Major indices ended on a weak note with the Russell 2000 iShares Russell 2000 ETF (NYSE:IWM) and the NASDAQ 100 Invesco QQQ Trust (NASDAQ:QQQ) closing down 1.5%.

With that said, gold via SPDR® Gold Shares (NYSE:GLD) and silver via iShares Silver Trust (NYSE:SLV) while down half a percent, were holding a strong uptrend over their 10-Day moving average.

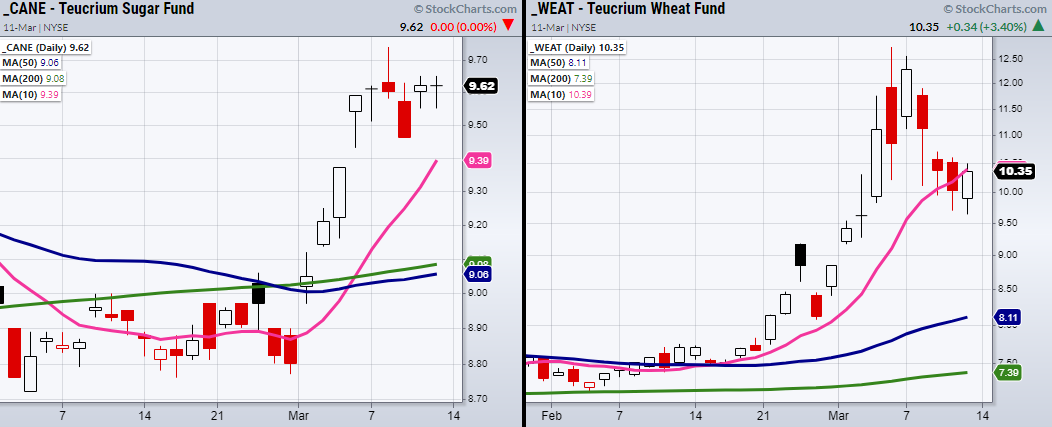

Soft commodities were also sitting in an uptrend compared to the overall stock market. Therefore, with the indices moving closer to their pivotal support levels, we should keep watch for trade setups in the commodities space.

The above chart of the small-cap index (IWM) and the NASDAQ 100 (QQQ) both have main support from 2/24. (Black Lines) $318 for the QQQ and $188 for IWM.

While we have seen large price runs in the precious metals, soft commodities such as Sugar (NYSE:CANE), Wheat (NYSE:WEAT) made large moves last week and have now put in some consolidative price action.

CANE is especially interesting if it can clear its recent high at $9.74 as it has stayed in a tight range over the past 6 trading days. On the other hand, WEAT is teetering near its 10-DMA at $10.39 and could use more time before it's ready to push higher. If WEAT can hold over $10, next we can watch for it to clear through last Wednesday’s high of $10.70.

ETF Summary

- S&P 500 (SPY) 410-415 support.

- Russell 2000 (IWM) 193 support.

- Dow (DIA) 322-326 support.

- NASDAQ (QQQ) 318 support.

- KRE (Regional Banks) Needs to hold over 69 the 200-DMA.

- SMH (Semiconductors) 239 next support.

- IYT (Transportation) 243-245 support area. Resistance 264.

- IBB (Biotechnology) 118 support.

- XRT (Retail) 78 resistance. 72 to hold.

- Junk Bonds (JNK) Watching to find support.

- SLV (Silver) 23.63 the 10-DMA to hold.

- USO (US Oil Fund) Inside day.

- TLT (iShares 20+ Year Bonds) 134.50 pivotal.

- DBA (Agriculture) Like DBA to clear and hold over 21.90.