- The stock market's performance so far this year has been very positive

- Tech giants are driving S&P 500 gains, while small caps are languishing

- But, the real buying opportunity could be in streaming stocks as they may be undervalued and on the rise

How's the stock market performing so far this year?

Well, it depends on the index we're considering. If we're talking about the Nasdaq, things look pretty good, with the index up 37% so far this year. But when we dig a bit deeper, we uncover a different story altogether.

A comparison between the S&P 500 Equal Weight ETF (NYSE:RSP) and the market-cap-weighted S&P 500 tells the story. It shows that the market is retracing to 2020 lows.

In fact, the so-called "Magnificent 7" – Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Nvidia (NASDAQ:NVDA), Alphabet (NASDAQ:GOOGL), Meta (NASDAQ:META), Amazon (NASDAQ:AMZN), and Tesla (NASDAQ:TSLA) – are responsible for most of the S&P 500's positive performance this year.

The next chart shows the Russell 1000 Large-Cap versus the Russell 2000 Small-Cap.

After spending more than two decades in a prolonged consolidation phase, the scale has started tipping in favor of large-cap stocks in the past two years. If this trend from last year continues, it's quite possible that we'll see more robust performance from the usual suspects like Google, Meta, Nvidia, and other aforementioned companies in the near future.

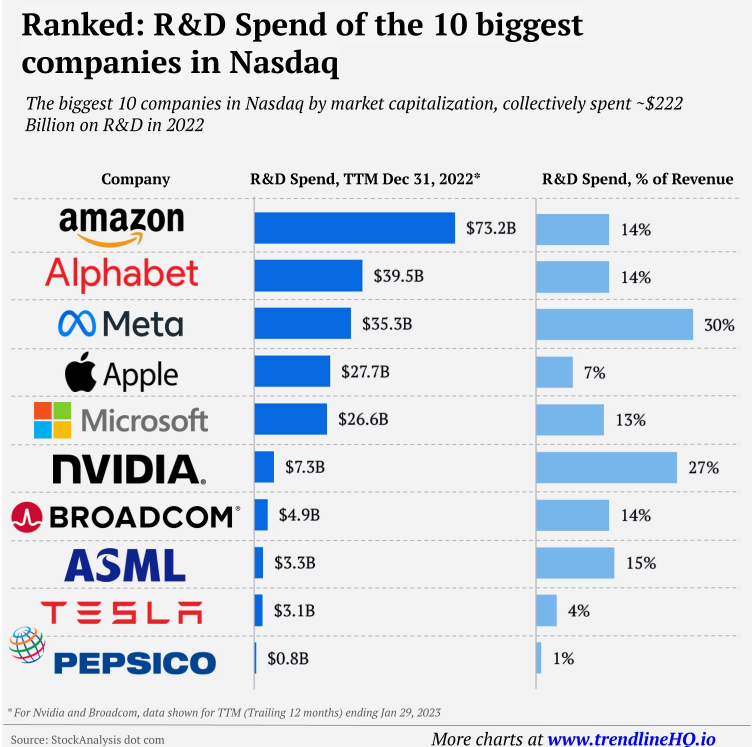

Over the last few decades, Apple and other tech giants have been heavily investing in research and development. This is especially crucial as technologies like artificial intelligence become increasingly integrated into our daily lives. Visual Capitalist's chart illustrates the substantial scale of spending by the 10 largest Nasdaq-listed companies: they shelled out more than $200 billion in 2022 alone.

Source: StockAnalysis

Apart from the major players, numerous companies are ramping up their investments in research and development to stay competitive in the ever-evolving tech landscape. Take China's largest electric vehicle manufacturer, BYD (OTC:BYDDY), for instance. They've increased their investment by an impressive 133% over the past year.

Are Streaming Stocks Currently Undervalued?

Another burgeoning sector to keep an eye on is streaming. This has much to do with the technological advancements that have become integral to our daily lives. Just think about how far we've come – from limited cable TV channels to the abundance of options available today.

Watching movies or shows on regular TV often feels like a waste of time, thanks to the endless commercials. And let's not forget the Blockbuster era, where you'd hope they had a copy of the movie you wanted to rent. Fast forward to today, and we have a multitude of streaming platforms offering hundreds of shows and movies. We can enjoy every season of our favorite series on our smart TV, iPad, desktop, or iPhone, ready to watch and rewatch with just a click.

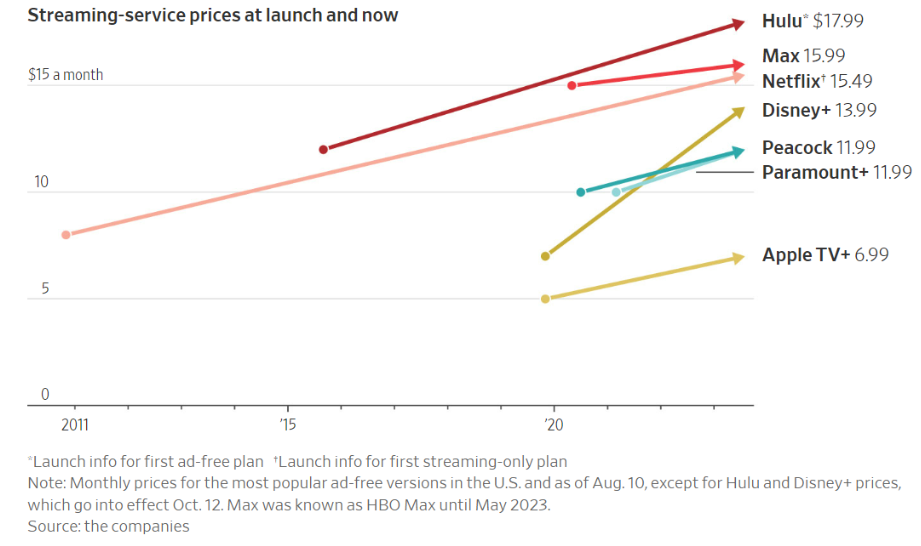

Source: The Companies

Streaming platforms are banking on ad-free subscriptions despite an upcoming nearly 25% increase in average costs over the next year. Surprisingly, companies like Disney and Netflix (NASDAQ:NFLX) have found that ad-supported versions actually generate more revenue per user than their premium ad-free counterparts. This boost in pricing is attributed to the growing viewership of streaming services, with the U.S. witnessing a 38.7% increase in recent months, while traditional TV fell below 50%t for the first time.

In Italy, 72% of all viewers watched streaming content at least once in 2022, with nearly half of them dedicating up to 2 hours daily to their favorite shows on these platforms. Netflix, the streaming behemoth, has started cracking down on password sharing, prompting many to opt for increased monthly subscriptions rather than sharing accounts.

David Zaslav, CEO of Warner Bros Discovery (NASDAQ:WBD), believes most streaming services are undervalued given the substantial content investments. Whether this holds true remains to be seen. In the meantime, expect more ad-supported offerings from platforms and price hikes for their ad-free versions, all aimed at boosting revenues.

Drop in Disney, Netflix Stock Prices a Buying Opportunity?

It's worth noting that some of the best returns often follow periods of decline. Companies like Netflix, currently down 48% from all-time highs, and Disney, with over a 55% drop and trading around the key level of $84, could potentially present attractive long-term investment opportunities in these lower price zones.

Conclusion

The average target, between the two stocks, reported by analysts indicates an upside of 30% from current prices, suggesting how they are currently undervalued. As for InvestingPro's Fair Value, the picture is slightly more positive: Netflix has a potential upside of 38% with a target of $493 while Disney remains at previous levels (30%), with an average degree of uncertainty, with a target of $109.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.