- Stocks are under pressure but the dollar fails to make gains

- ECB meets today, unlikely to produce a dovish shift

- The pound ignores data; the yen continues to rally against the dollar

Stock Markets Under Pressure; Feels Like 2007 Again

Following last weekend’s events, the market is probably paying more attention to Donald Trump’s economic plan.

Speculation about increased tariffs on Chinese goods, including high-technology products, was probably one of the causes of the Nasdaq experiencing yesterday its weakest trading session since mid-December 2022.

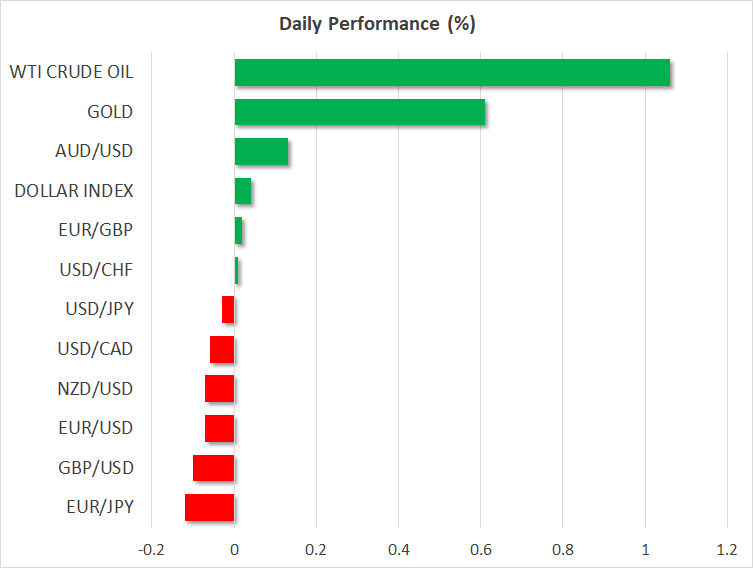

Interestingly, the US dollar continues its muted weakening, which could quickly reverse if US stock indices continue to trade in red.

Interestingly, the current situation resembles the period prior to the September 2007 Fed rate cut. If history repeats itself, then the S&P 500 index could experience a correction towards the 5,100 level while dollar/yen could drop to the 148-yen area, possibly assisted by repeated BoJ interventions.

Unsurprisingly, the 10-year US Treasury yield tends to decrease ahead of the first-rate cut gathering. The downward yield move that started in early July could push it down to the 3.70% area.

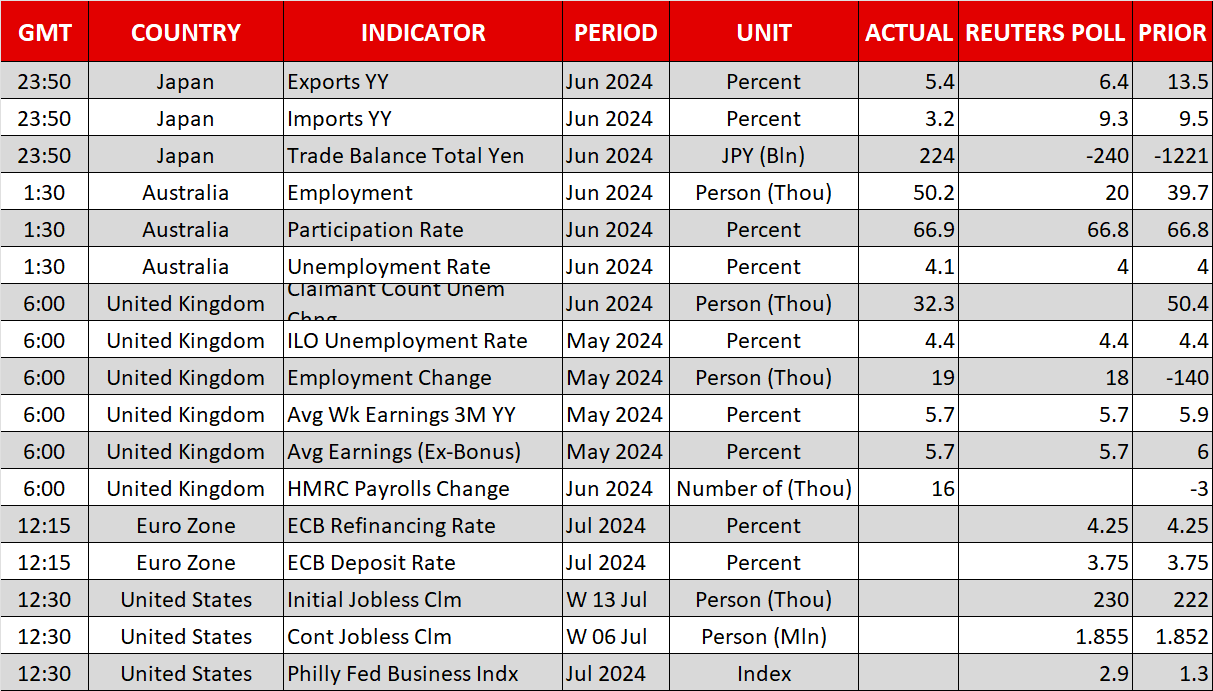

With the Fed's Beige Book yesterday revealing an increased possibility of a soft landing, today’s US calendar remains relatively light. Both the weekly unemployment claims and the Philadelphia Fed manufacturing survey will most likely be ignored unless they produce a surprise.

More interestingly, Fed members Logan, Daly and Bowman will be on the wires later, but only Bowman is a 2025 voter. She is also a known hawk and hence a dovish shift could cement the mood change inside the Federal Reserve Board.

ECB Meets Today, No Surprises Expected

The ECB meets today and the chances of a surprise rate cut are close to nil as the rift between the hawks and the doves continues.

The market is currently pricing in an 80% probability of a September rate cut but it looks unlikely that President Lagarde will pre-commit today to such a move.

Apart from drawing the ire of the ECB hawks, it is probably too risky to pre-commit to an event that is almost two months away.

In addition, by early September, the Fed’s rate-cut intention will be clear, making it easier for the ECB to formulate its strategy

Pound Ignores the Weaker UK Data

Expectations of an August 1 rate cut by the BoE have been significantly dented this week, as following yesterday’s decent CPI report, the labor market data today failed to produce a significant downside surprise.

With the average earnings indicators remaining elevated and the economy potentially performing better in the past two months, the focus understandably turns to the September BoE gathering.

Yen Rally Continues; Post-Plenary Press Conference Scheduled in China

The yen remains on the front foot against the dollar as the BoJ is assumed to intervene almost daily. Japanese Vice Finance Minister Masato Kanda's comment that "if speculators cause excessive moves, we have no choice but to respond appropriately" possibly points to a strategy change from Japanese authorities compared to the end-April interventions.

Only time will tell if this change proves more effective, but it is evident that a sustainable yen appreciation is dependent on the BoJ becoming more hawkish and the Fed starting its rate-cutting cycle.

In the meantime, the Chinese Communist Party has called for a press conference on July 19 following the completion of the Third Plenum.

There has been some speculation about further support measures for the housing sector being announced, but the market is not really holding its breath.