What should we make of the rally in stocks, world stocks, metals, materials, oil, junk bonds, and everything else that could be counted as an asset in the third week of February, 2016? Well, not much. When central banksters want a rally, we get a rally!

The stock rally can easily be explained through ‘calendar-ization’. This is a term that I coined a few years back so if you reuse it, send me some money. What it means is this. Every year, central bankers and their shills (Wall Street, bankers, financial media) goose asset prices in the fourth quarter so investors will get a pretty statement in January. Knowing that the next quarterly statement doesn’t get printed until April, these same manipulators take off the better part of January to rest and restock their inkjet money printers. Naturally, asset prices swoon. Realizing that most investors get monthly statements as well, these manipulators go into panic mode and begin to goose asset prices to mute the damage of January. If the selling in January is too brutal, as was the case this year (2016), the manipulators hold off until February. Then we get a rerun of the same movie.

All is well. The economy is recovering. Unemployment is falling. People are getting raises. Retail sales are increasing. We are all the best looking duck in the pond. Whatever it takes. The manipulators plow into stocks at least by mid-February so that investors don’t get spooked by a double digit stock loss in the first two months of the year. If that were to happen, investors and consumers might elect to withdraw from playing in the carnival anymore. So magically, we get a February rally. Yawn. We have seen this before.

Gasoline prices have fallen. Therefore, consumer spending should increase. Huh? We hear this all the time from the Wall Street cheerleading society. Let’s put a brain cell to work. If I have $100 dollars and gasoline costs me $20 dollars, I can spend the other $80 dollars on food, medicine, and clothes. If gasoline only cost me $10 dollars, I can spend $90 on that other stuff. However, the math does not change such that I can spend more. Regardless of what gasoline costs, I only have so much to spend in total. So, to think that lower gas prices leads to higher overall spending is mendaciously false.

Let’s look at the rally’s metamorphosis. 1/25/16: McDonald's (N:MCD) announces earnings. These are always fun. News articles written begin with the wonderful news that the burger chain was on the rebound with same-store sales increasing for the first time in two years. After all, McDonald’s is now a high priced Dow stock and manipulating the Dow higher means that McDonald’s has to lead the charge regardless of truth. Earnings and sales both beat ‘analyst projections’. Of course, writers these days always either omit the truth or wait until the end of the article. And there it is appearing as the last line in the article. Revenue for the company actually decreased by 3.5%. When we need a rally, all news is good!!!

Oh, I’m sure the rest of you have been worrying about this like I have but we can all rest easy now. JPMorgan (N:JPM) announced that CEO Jamie Dimon received a nice salary increase this year. They managed to bump him up from $20 million a year to $27 million a year. Wow! That’s a nice increase for a guy who ran his company into bankruptcy in 2008 only to be rescued by the Federal Reserve’s pilfering of the US Treasury. JP Morgan was given back all the money that they lost gambling on derivatives, Mr. Dimon got to keep his job, now he gets a fabulous raise up to $27 million a year, and the US tax payers get to pay more and more taxes to pay for the now $20 trillion in debt the government has racked up saving companies like JP Morgan so people like Jamie Dimon can make $27 million a year. I’m so happy for him! Who says the Federal Reserve Bank serves no purpose? And did any of the big banks lower any of the fees that they charge us for banking? Did any of them raise the interest rates that they pay us for our piddly savings accounts?

Johnson Controls (N:JCI) is buying Tyco (N:TYC) in another ‘tax inversion’ deal (like Pfizer (N:PFE)). Johnson is a large US based company and Tyco is based in Ireland with half the capitalization of their buyer. The company will technically move headquarters to Ireland thus saving some $150 million per year in corporate taxes. Would you move to Ireland for $150 million per year?

Stocks are rallying. Consumers are spending more and tooth fairies are leaving us all money under our pillows regardless of any extracted teeth. Unemployment is near zero and we are all getting raises. Ain’t it fabulous? Meanwhile, Walmart (N:WMT) is closing 154 stores in the US and Macy's (N:M) is closing 40. Oil producers are laying of tens of thousands but not to worry because they can all get jobs at america’s fastest growing job producer - bartenders and waiters.

2/22/16: Stocks rallied. How many of the indices of the world were in the green? All of them. How many of the 30 Dow stocks were in the green? All of them. So today, everything in every part of the world was a buy? Nothing was sold? Yeah, sounds like a real ‘market’ to me.

The Federal Reserve is busy buying every stock it can to drive up the Shanghai Composite stock index. Uh, I mean the PBOC is buying every stock it can to drive up the Dow. Wait, wait…, it’s the BOJ buying every stock in China. Hold on. Central bankers are all the same. It is so hard to tell the difference since formerly sovereign nations no longer control their sovereignty. Without central banker intervention on a daily basis in the capital markets, citizens would be free to realize price discovery on their own and Jamie Dimon would likely not be receiving a raise this year. Yes, while to White House purveyor of fantasy fiction purports positive economic statistics, we must understand the motive. These ‘statistics’ are solely for the purpose of our psychological manipulation. This is nothing new. Please review the NAZI party in 1930s Germany.

While central bankers everywhere report improving economics, we must understand their statistics are just lies. The stories they tell us are simply fantasy. Economic growth is simply fantasy. Economic failure now lies at the foot of the economic keepers - the central banks. They are directing sovereign policy. They are directing data, banking, and psychology. Economic failure now would require a regime change. Central bankers would be exposed for the thieving frauds that they are. Is it far fetched to think that the same central bankers control stock indices? After all, the PBOC, the BOJ, and ECB all admit to buying stocks. The FRB does not admit to buying stocks because they know the American audience is still too stupid and has not yet caught on.

So, let’s look at a few charts to see if we can recognize a pattern here.

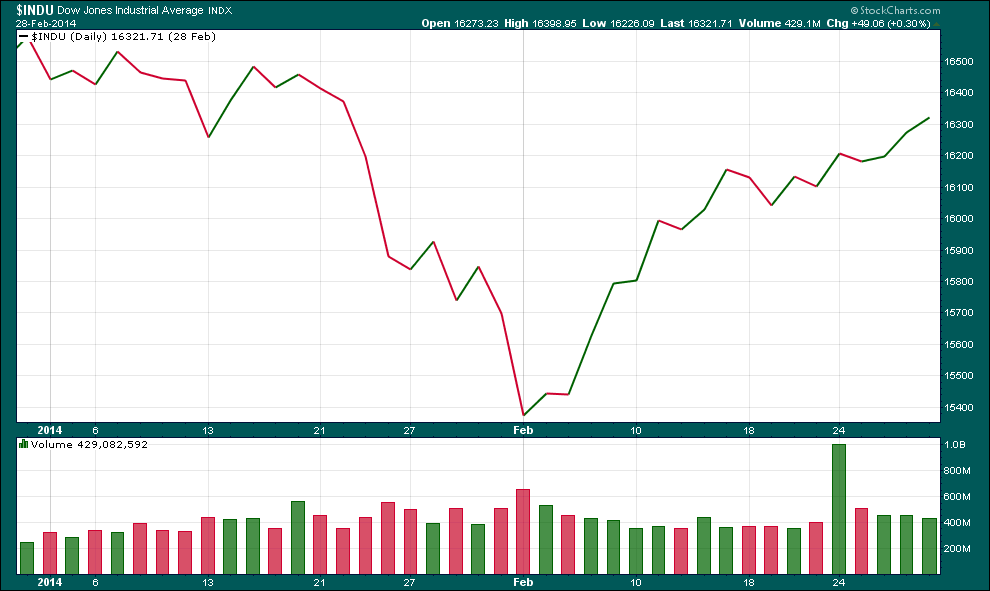

Again, for the last three years, the Fed’s stories about a ‘robust’ Christmas shopping season turned out to be lies and the 4th quarter rally based on fantasy faded to a January selloff. Central bankers rested in January only to come to work in February with a fist full of money meant to rally equities. Take a look at the two-month chart of 2014 below. January falls. February rises.

DJIA Jan. and Feb. 2014. Chart courtesy StockCharts.com

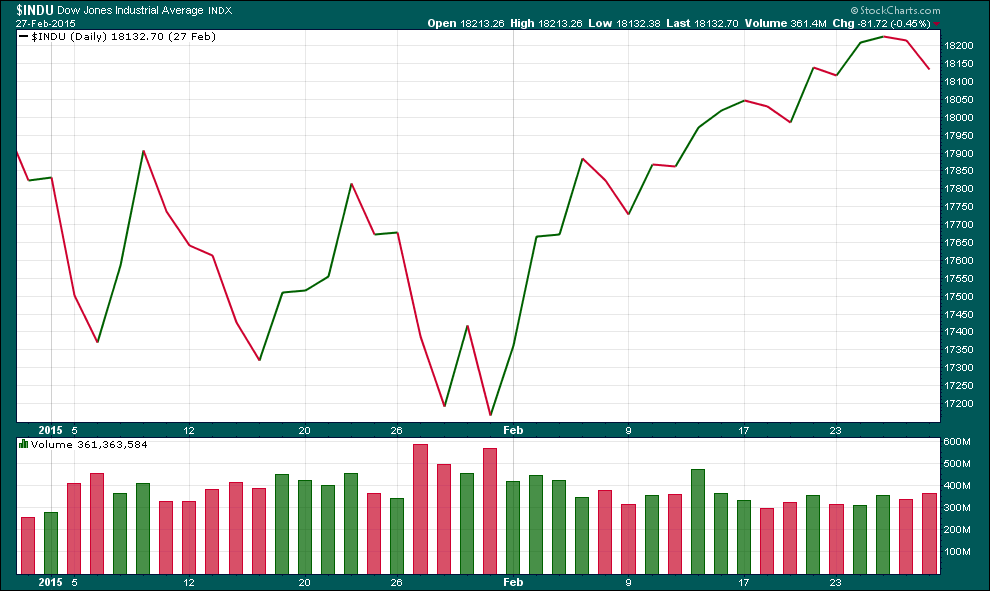

Now take a look at the same two months of 2015. Same movie.

DJIA Jan. and Feb. 2015. Chart courtesy StockCharts.com

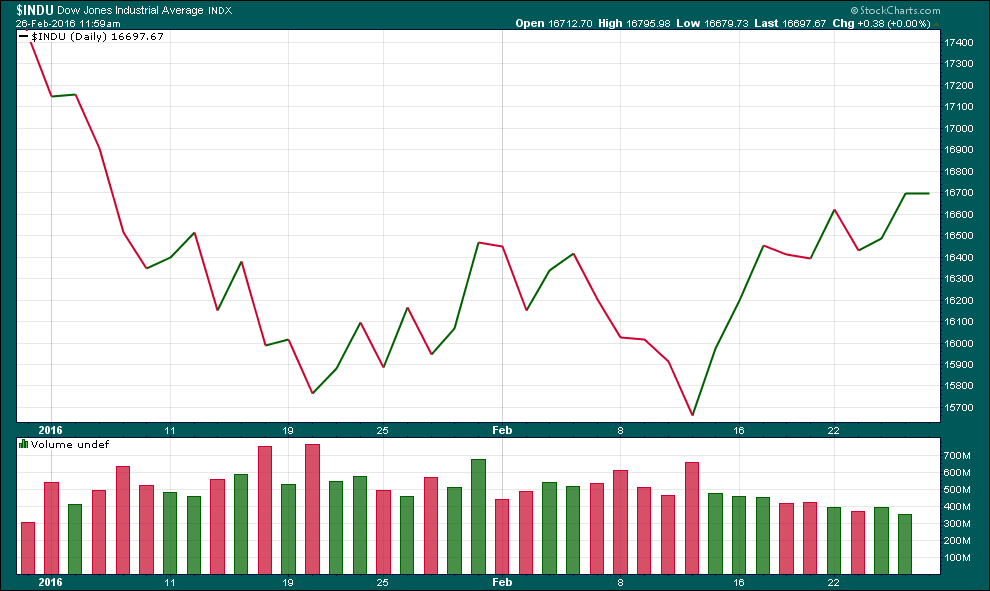

Now take a look at the same two months of 2016. Same movie.

DJIA Jan. and Feb. 2016. Chart courtesy StockCharts.com

So, kids, what have we learned?

One, stock prices always go up in the fourth quarter of the year. Lies, fantasy numbers, and the Fed will see to it. Yes, the stock carnival is rigged.

Two, stock prices always fall in January. The calendar dictates that when the Fed knows yearly statements are printed, they can take some time off from their busy schedule of manipulation.

Three, stock prices always go up in February because the Fed gets anxious about investors realizing that asset prices are in a bubble. Hope for an ‘improving’ economy joins lies and fantasy to support the Fed rally attack.

The question now is what happens in March. This outcome is not so certain. One thing is certain. These serial manipulators hate negative quarterly statements so with indices still down for the year, March might again see a rally. Central bankers are not so much interested in a prolonged rally as much as they are the day-to-day manipulation of our psychology. Or, more accurately, the calendar-ization of monthly investor statements is now the lone function of the most fraudulent, corrupt, mendacious, nefarious group on the planet - the central banksters. Bear market? What bear market? Stock index correction? What correction? Nothing to see here. See, indexes only went into ‘correction’ territory for one day. And then, ssssccchhhwwwwiiiiing!!!! Weeeeeee!!! Right back up we go. See, everything changes in a day. It is all in the calendar.

Disclaimer: The views discussed in this article are solely the opinion of the writer and have been presented for educational purposes. They are not meant to serve as individual investment advice and should not be taken as such. This is not a solicitation to buy or sell anything. Readers should consult their registered financial representative to determine the suitability of any investment strategies undertaken or implemented. BMF Investments, Inc. assumes no liability nor credit for any actions taken based on this article.