That wasn’t fun. The S&P 500 fell by 3.5% yesterday, and the Nasdaq 100 fell over 5%. It always amazes me how much faster markets can fall than they can rise. Yesterday's price action took six days of gains away from the market.

I’m sure the big question on everyone’s mind is what happens next. It depends. The chart of the S&P 500 looks pretty bad to be honest. Yesterday's action left the index sitting right on its uptrend from early April. It is too close to say it is officially broken, but it is not a spot you want to be. There is a chance this could turn into the pullback I have feared might happen, dragging us back to that 2,860 level. That’s how vital this uptrend is.

The good news is that the Qs (NASDAQ:QQQ) have not yet come close to their uptrend.

At this point, all I can say is we have to wait and see. We can’t say that the market is breaking down yet, but at the same time, we don’t know if this is a one day wonder. Given how overbought this market was, I doubt this is over, and I think there is still further to fall.

The NASDAQ 100 VIX closed above 40, which is certainly not good.

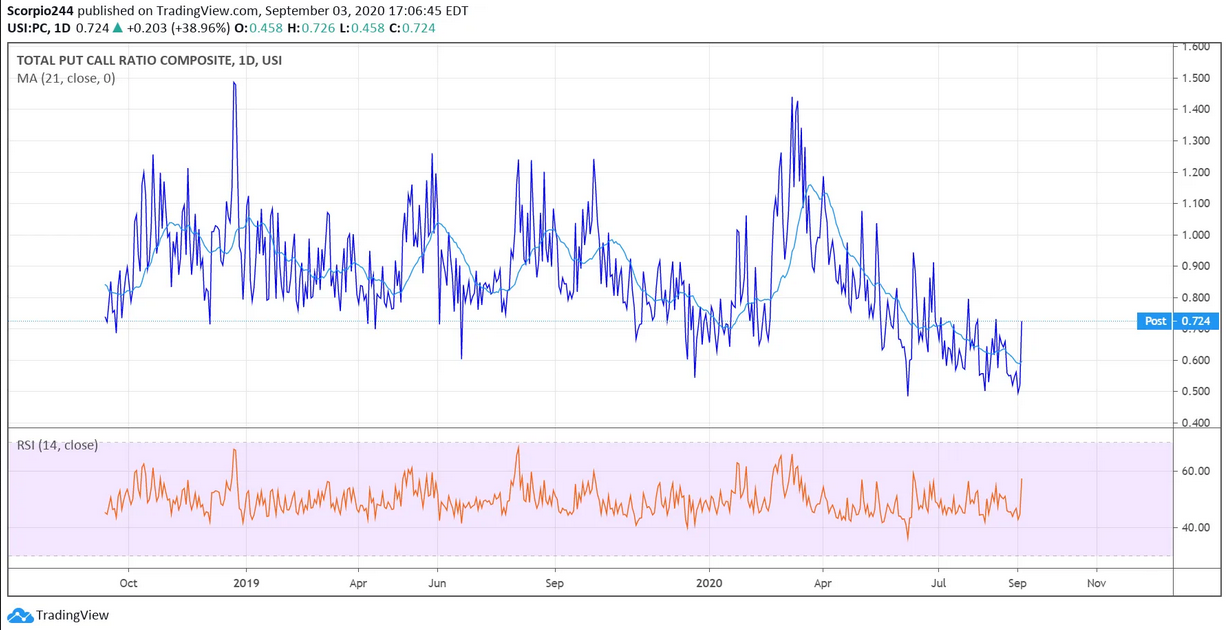

The put to call ratio did rise, on sightly higher put activity and slightly lower call activity. But an amount that makes me think the mentality of the options market has not changed in a meaningful way.

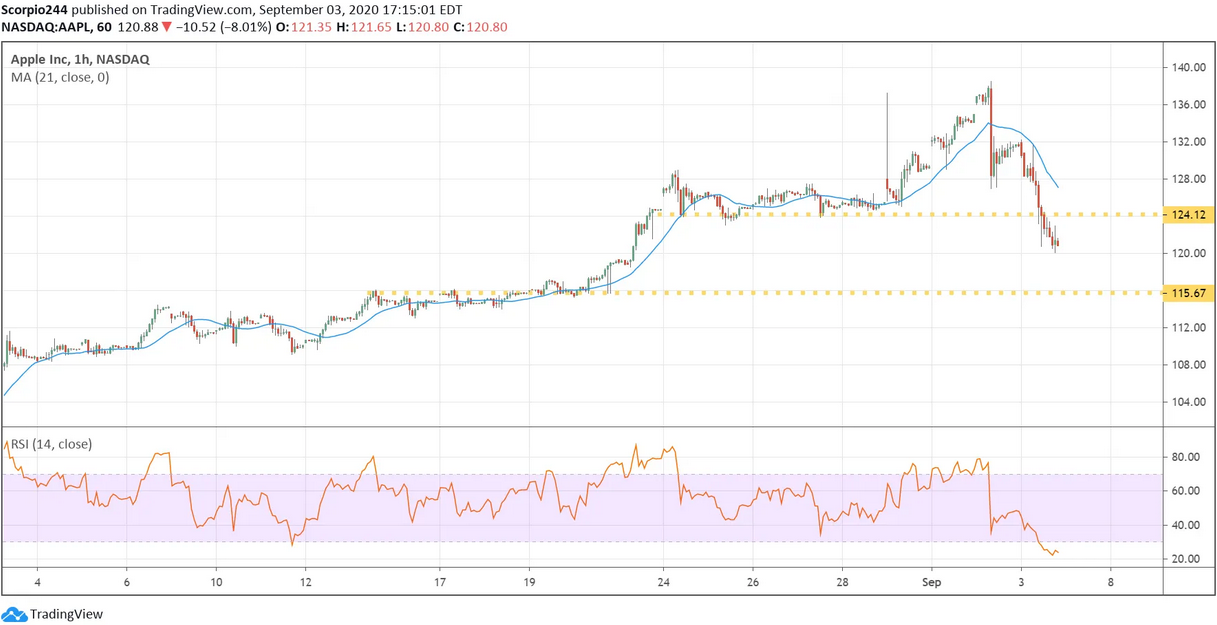

Apple

Apple (NASDAQ:AAPL) fell below support yesterday at $124 and is likely not finished falling, with the next level of support at $115.

Nvidia

NVIDIA (NASDAQ:NVDA) fell to support around $511 yesterday, with a drop below that support sending the shares lower to $463.

Square

Square (NYSE:SQ) broke one uptrend yesterday, with the next uptrend around $140.

Tesla

Tesla (NASDAQ:TSLA) has a pretty significant level of support, around $380 to $390. That is a considerable level that needs to hold, with the potential for shares to drop to $330 otherwise.