By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Between the Senate’s tax-bill vote and the Flynn-Trump-Russia confusion, the U.S. dollar should be trading sharply higher. Instead, the greenback failed to extend its gains during Monday's NY trading session even as it managed to end the day in positive territory against all of the major currencies. The lack of continuation during U.S. trading hours is a sign of the selling pressure surrounding the greenback. U.S. stocks hit a record high Monday and 10-year Treasury yields ticked up. But with USD/JPY and the Dollar Index knocking against key resistance, there was not enough momentum to keep USD/JPY above 113 and take the Dollar Index to 93.50. The setback had nothing to do with data as factory orders beat expectations. Investors are still worried that tax reform will be a drawn out process – reconciliation of the House and Senate bills is the next step and while there are vast differences, leaders of both houses are highly motivated to get a deal done, so we believe it is only be a matter of time before a final proposal is reached and passed on to the White House for President Trump’s signature. It is for this reason that we think pullbacks in the dollar will be shallow. The most important event risk for the dollar this week will be Friday’s nonfarm payrolls report. With only 7 working days to go before the December FOMC meeting, this report could have a major impact on market expectations. Payrolls are expected to rise by 200K, but average hourly earnings and the unemployment rate should determine the dollar’s reaction and the market’s expectations for the Fed’s forward guidance. In the meantime, if USD/JPY dips to 112, it could be an interesting place to reestablish longs.

With UK Prime Minister May meeting with European Commission President Juncker, it was no surprise to see the big moves in sterling on Monday. GBP/USD raced to a high of 1.3539 at the start of the NY trading session but lost more than 100 pips in a matter of minutes after BBC revealed that no deal was reached. May was supposed to present her best offer to Juncker in hopes of moving Brexit negotiations to the next phase but she failed to close the deal due to a last-minute divide on the Irish border. She had to back off after the leader of Northern Ireland’s leading political party said “Northern Ireland must leave the European Union on the same terms as the rest of the United Kingdom. We will not accept any form of regulatory difference which separates Northern Ireland politically or economically from the rest of the U.K.” Both Juncker and May described the talks as constructive and while this setback has been difficult to overcome, as negotiations continue this week, investors remain optimistic that a deal could still be reached. May and Juncker are planning to reconvene before the end of the week. If Tuesday’s UK PMI services and composite index show the same improvements that we have seen in the manufacturing and construction sectors, we could see GBP/USD recapture 1.35.

In contrast, it was a quiet day for the euro, which traded in a relatively narrow 55 pip range against the U.S. dollar. The single currency was supported by the 10-year German–U.S. yield spread, which moved in favor of EUR/USD despite the rise in U.S. rates. Data continues to be firm with Eurozone producer prices rising more than expected in October. Unfortunately, Tuesday’s Eurozone retail sales report is not expected to be as friendly to the currency as the sharp drop in consumption in Germany weighs on the broader regional index. There’s been no progress on Angela Merkel’s coalition talks so for the time being in this U.S. data heavy week, the direction of the euro will most likely be driven by the market’s appetite for U.S. dollars.

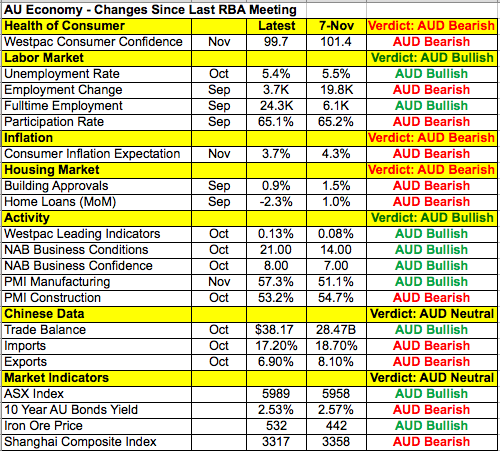

The Australian dollar was in Monday night ahead of service-sector activity, retail sales and the Reserve Bank of Australia’s monetary policy announcement. We are looking for slightly stronger data and unchanged policy guidance but that may not do much for the currency. Taking a look at how Australia’s economy performed since the last meeting, first and foremost, there were fewer than usual economic reports released between monetary policy announcements. Retail sales, the trade balance and Q3 GDP, for example, won’t be shared until the day of, or after, the RBA rate decision. Since the November meeting, consumer confidence has fallen, inflation expectations have declined and housing activity has slowed. Labor-market indicators were mixed but for the most part the RBA is happy with the jobs market. Business confidence and manufacturing activity also improved as iron ore prices rocketed higher. These improvements will encourage the RBA to maintain its neutral policy stance while preserving its view that inflation will remain low for some time. Since we don’t expect anything new from the central bank, the impact on AUD should be limited. AUD/USD is still in a downtrend but we don’t believe that the RBA announcement will take the pair out of its .7532 to .7660 range – the catalyst will either be Australian data (retail sales and GDP) or U.S. data.

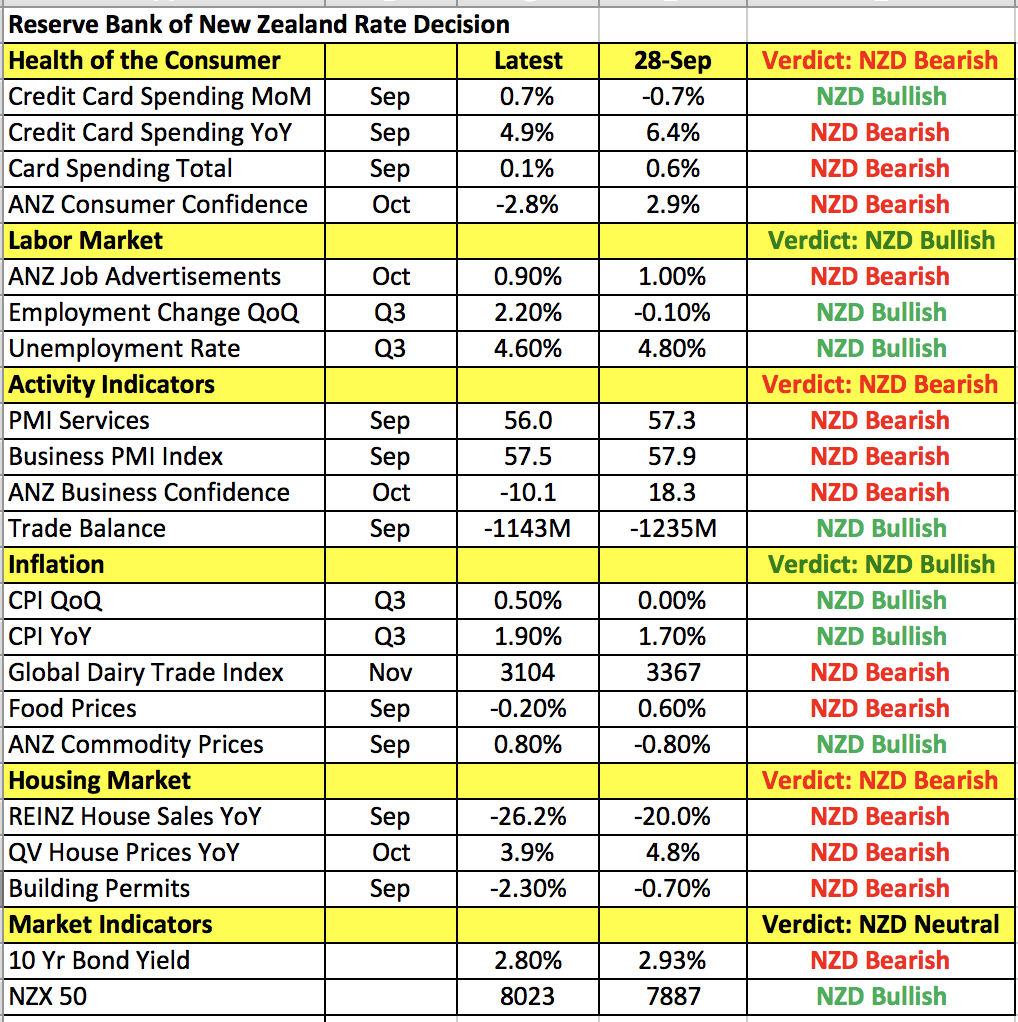

Like AUD, the Canadian and New Zealand dollars traded lower with NZD leading the slide. No major economic reports were released from New Zealand but investors are worried that Tuesday’s dairy auction could show another decline that spells trouble not only for the country’s dairy farmers but for the RBNZ and the New Zealand dollar. Despite last week’s strong Canadian data and Monday’s rise in Canadian bond yields, the loonie failed to extend its slide as the U.S. dollar rebounded and oil prices fell 1.5%. We are still looking for further weakness going into Wednesday’s Bank of Canada monetary policy announcement but the best place to sell may be closer to 1.2750.