I have not been satisfied with many of the narratives that are floating around the market, from low rates to M2 money supply and equity risk premium. They do not work. But finally, it seems to all come together in a rather fantastic way, and perhaps I wasn’t too far off when I started focusing on gamma exposure in the options market more.

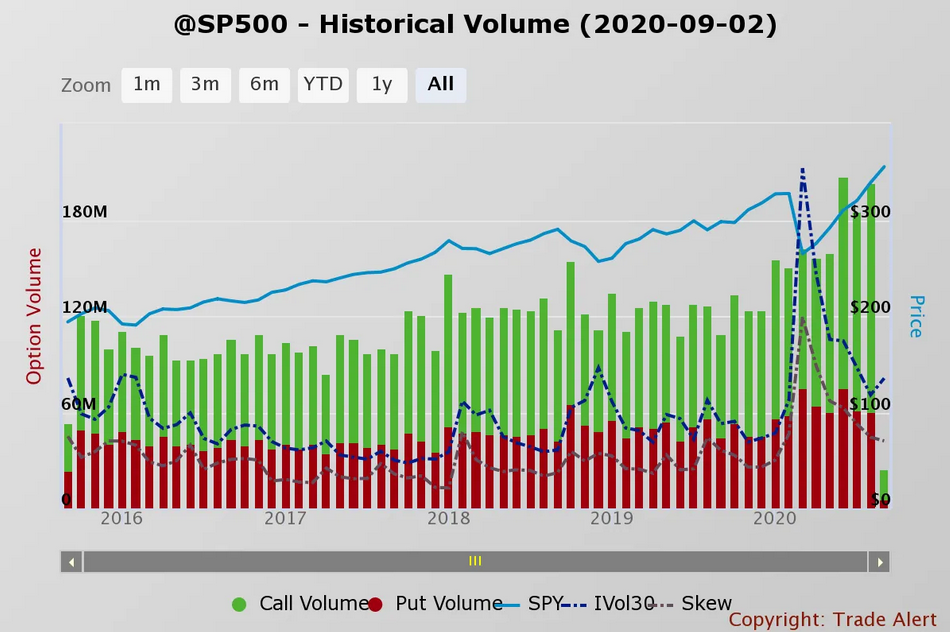

The truth is, at this very moment, I believe the equity is something of a self-fulfilling prophecy. The higher it goes, the more it goes up. My old boss always used to say buyers are higher, and sellers are lower. The chart below shows how call volumes have exploded in recent months, well above historical levels.

Now, the more that calls are bought, the more the dealers are short calls. To hedge their positions, dealers need to buy the stock. That pushes the price of the stock up, which, in turn, helps to bring in more call buyers and more hedging. At some point, dealers will get long to much of one stock and perhaps look to diversify that risk across a basket like the NASDAQ 100 or S&P 500. So again, now buying futures of the index sends the entire index higher.

Now I don’t think it started this way, but this what this has become over the past few weeks. So, taking on more risk means higher options pricing, which comes in the form of higher implied volatility. We could see that the VIX index has been trending higher in recent days.

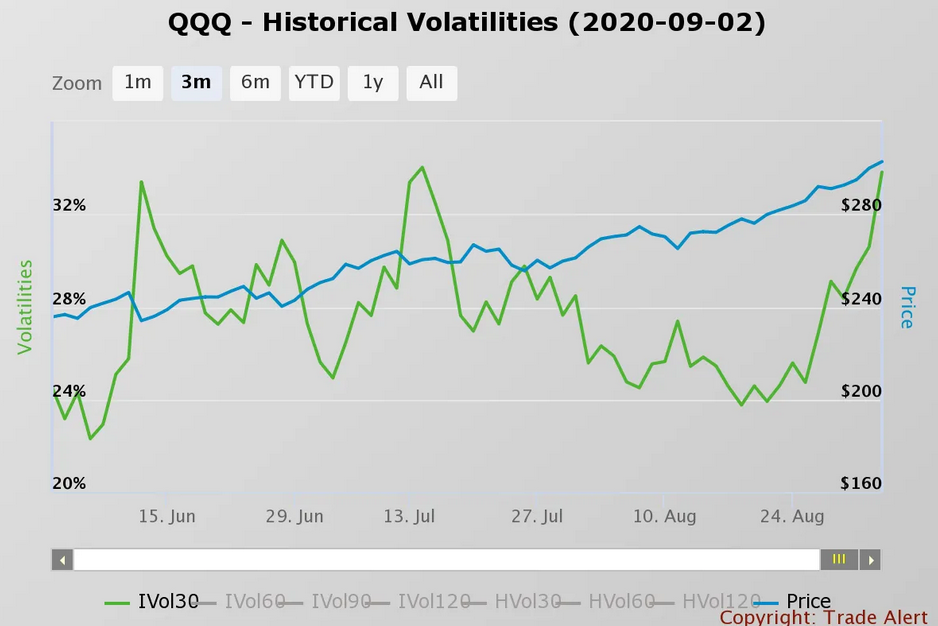

The VXN, which is the NASDAQ 100 VIX, is rising even faster.

Implied 30-day volatility levels for the Qs have risen from 23.9% on August 20, to 33.8% on September 2.

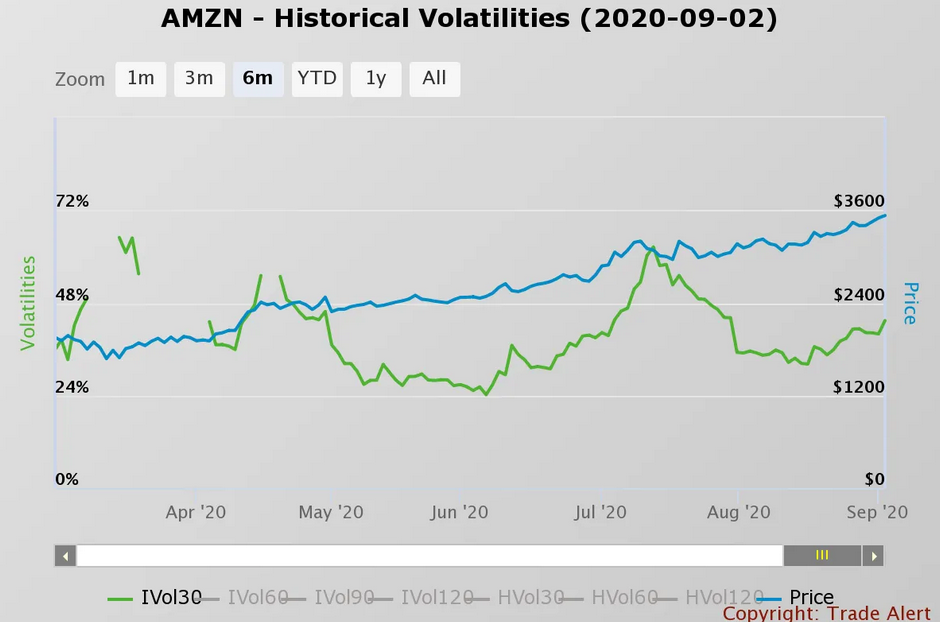

The IVOL in Amazon.com (NASDAQ:AMZN) has risen from 32.1% on August 17 to 43.4% yesterday. You’d think Amazon’s stock was crashing.

So when will the music stop? When the implied volatility levels reach a point that options pricing no longer makes sense and traders stop buying calls. That will cause dealers to have too many long positions on their books, and result in a significant reversal.

The QQQs did hit the upper end of the trading range to around $302. It is impossible to know how much higher they go, but you have an RSI over 81 and is at the top of a channel. It should result in some mean reversion.

Right now, the S&P 500 is still on track to hit 3,590. Haven’t thought about what happens next. Again, it is positioned like the QQQ.