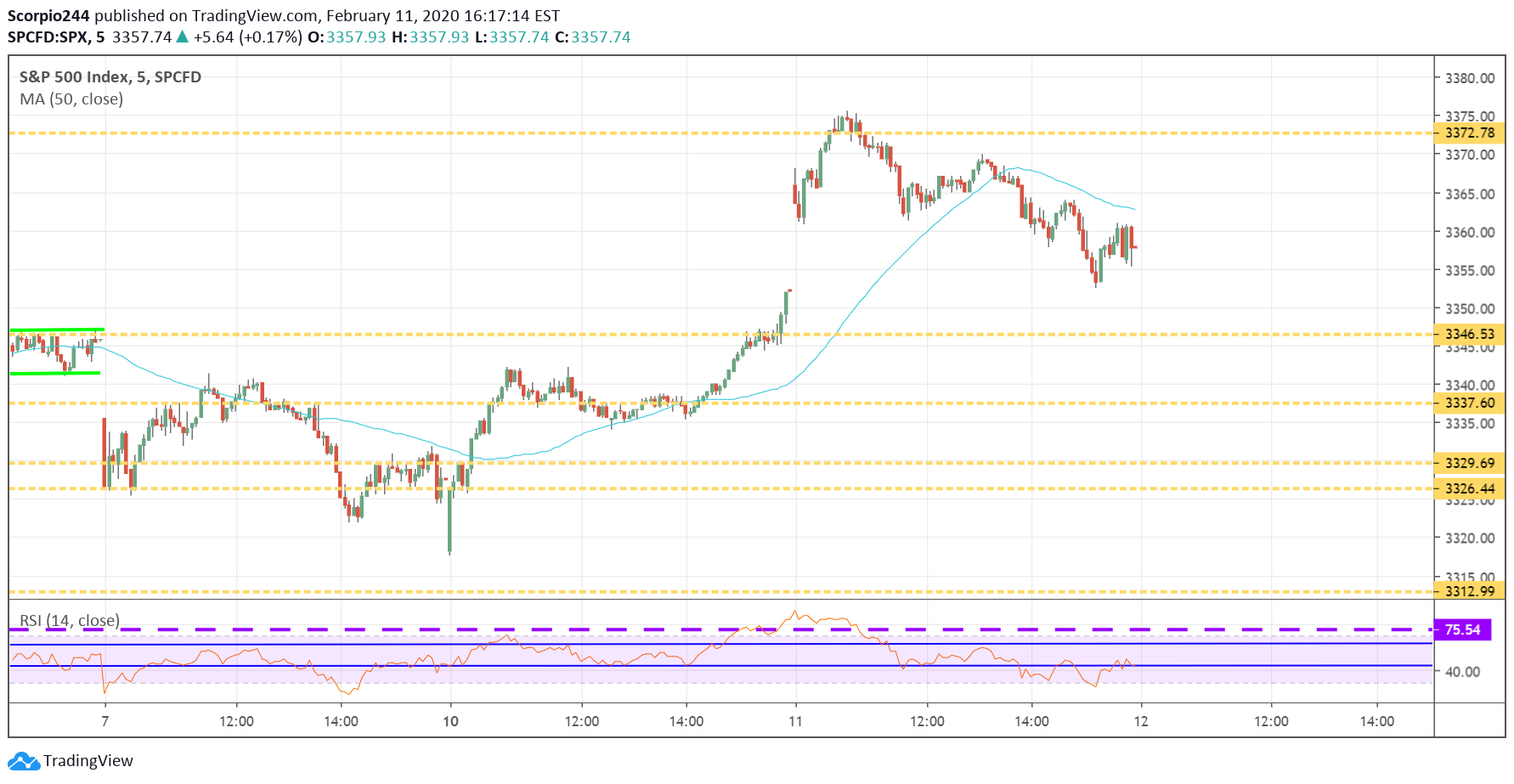

S&P 500 (SPY (NYSE:SPY))

Stocks gapped higher, and for a change, they decided to fill the gap, probably because I thought they wouldn’t fill the gap, but they did. No sweat. The good news is that the trend in the S&P 500 remains higher and that 3,346 has not been tested yet. It means that 3,372, for now, is the short-term resistance level, with room up to 3,400 still in place. Today’s price action changed nothing for me, except giving us a sense of where some resistance may lie

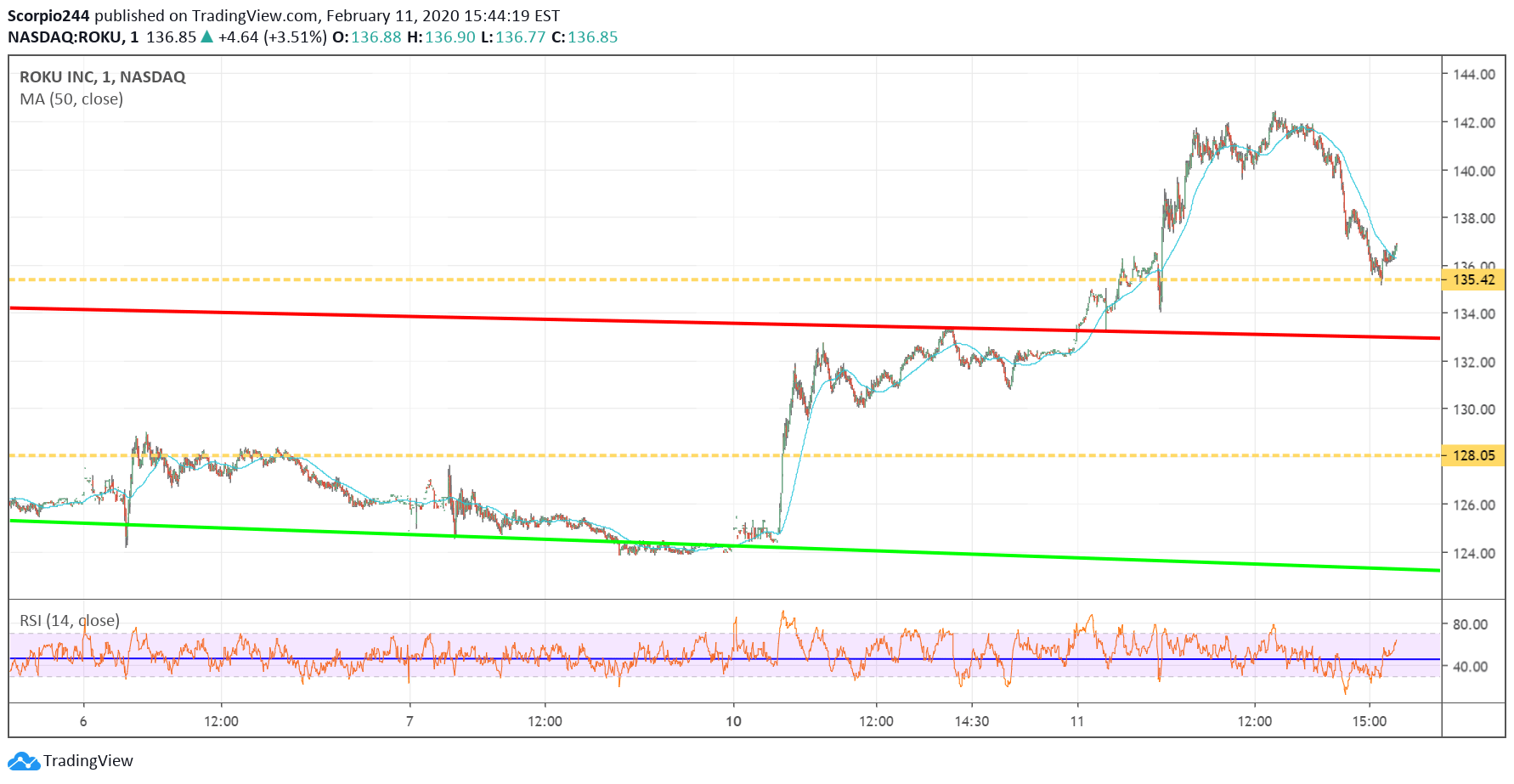

Roku (ROKU)

So let’s talk about Roku (NASDAQ:ROKU). Today I saw some bullish betting that made me do a 180 and go from bearish to bullish, plus the stock broke a downtrend. So, yeah, I hate switching my view two days before earnings, but I can’t go against the trend and activity I’m seeing.

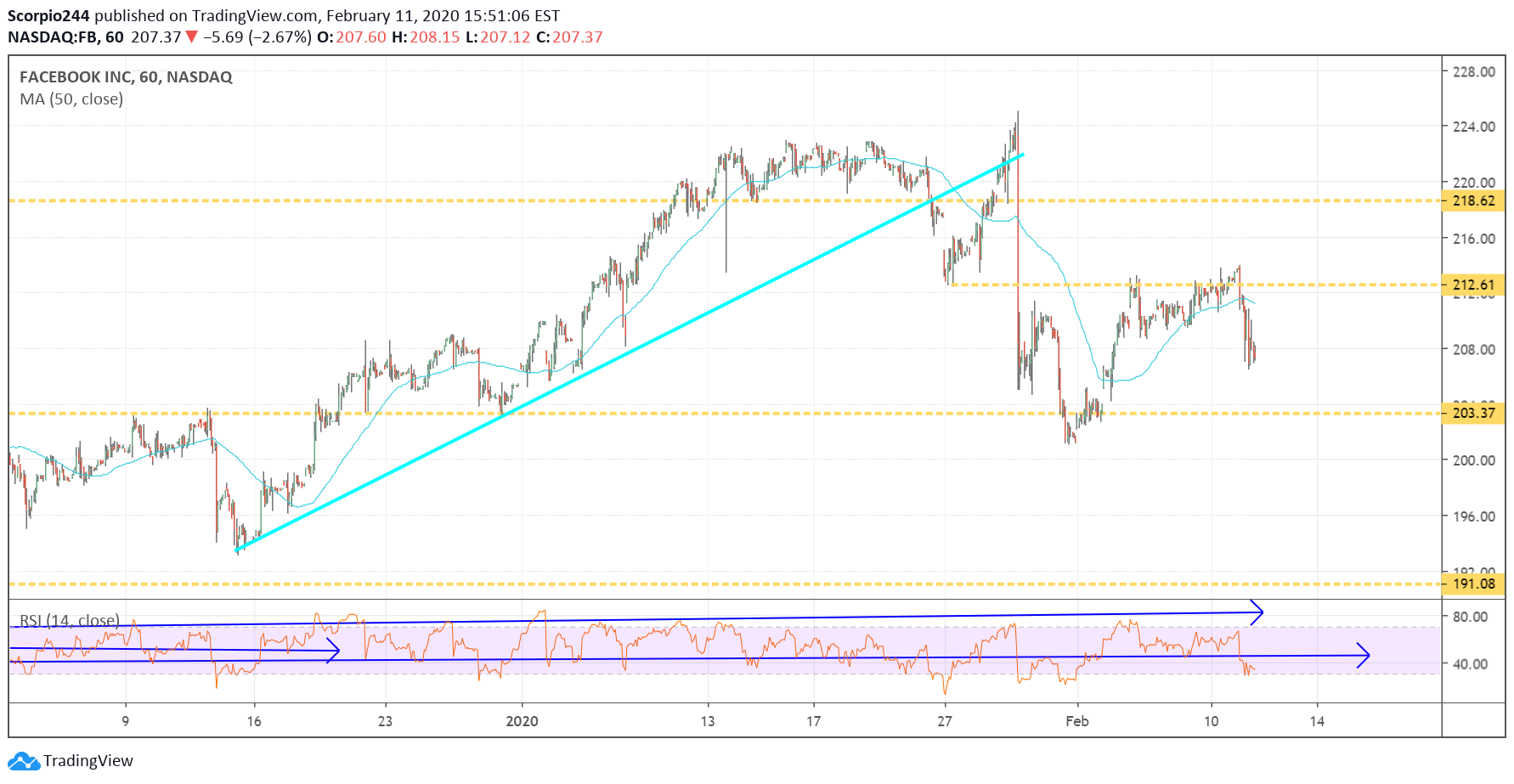

Facebook (NASDAQ:FB) fell today, as we noted the downgrade this morning, and it has now failed at resistance. Now $203 is the next level of support. Remember, I noted some bearish betting in this one late last week. Free story- Facebook Is Now An Aging Growth Story

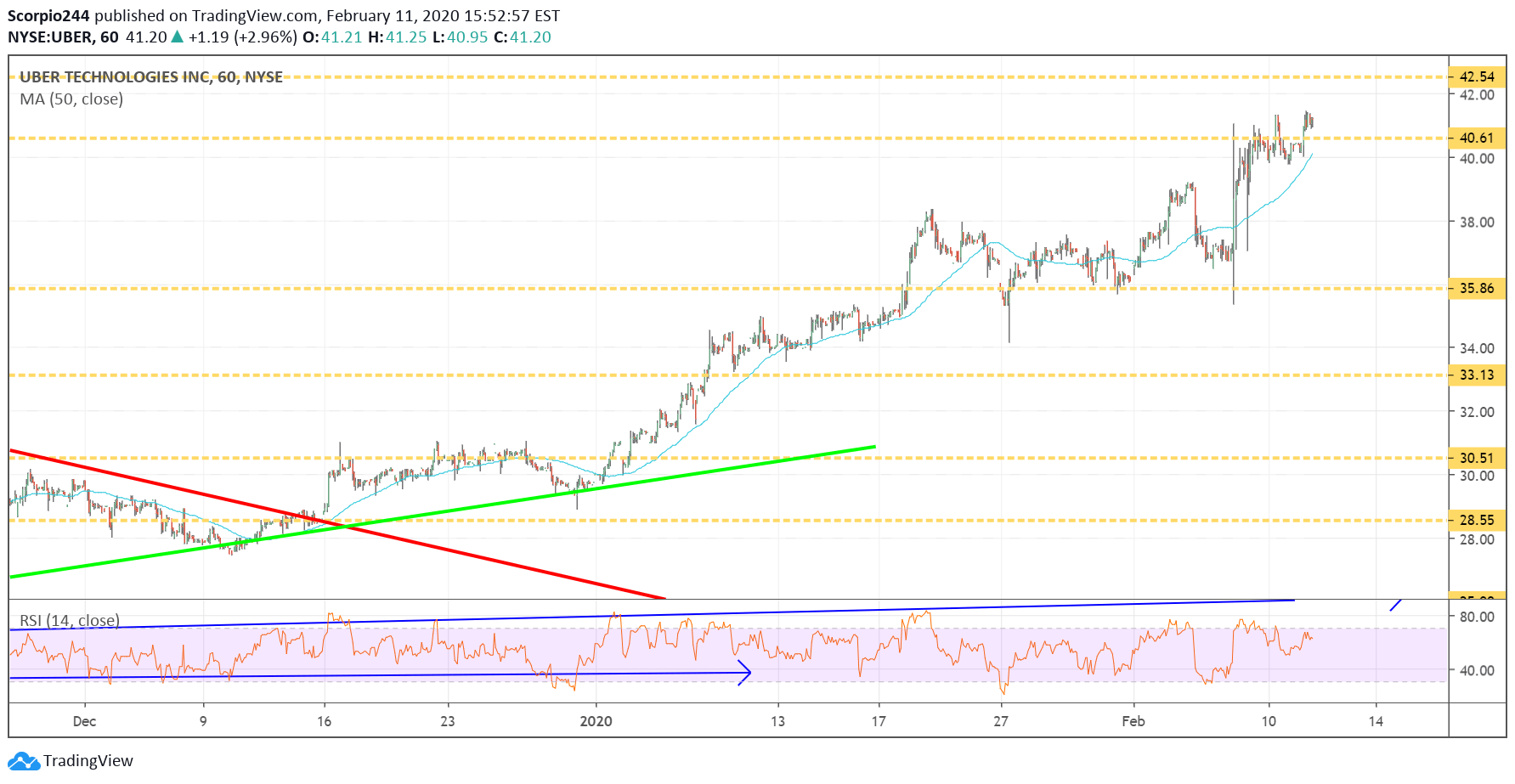

Uber

Uber (NYSE:UBER) continues to look strong post earnings and has crossed $40.60, with the next resistance level around $42.50.

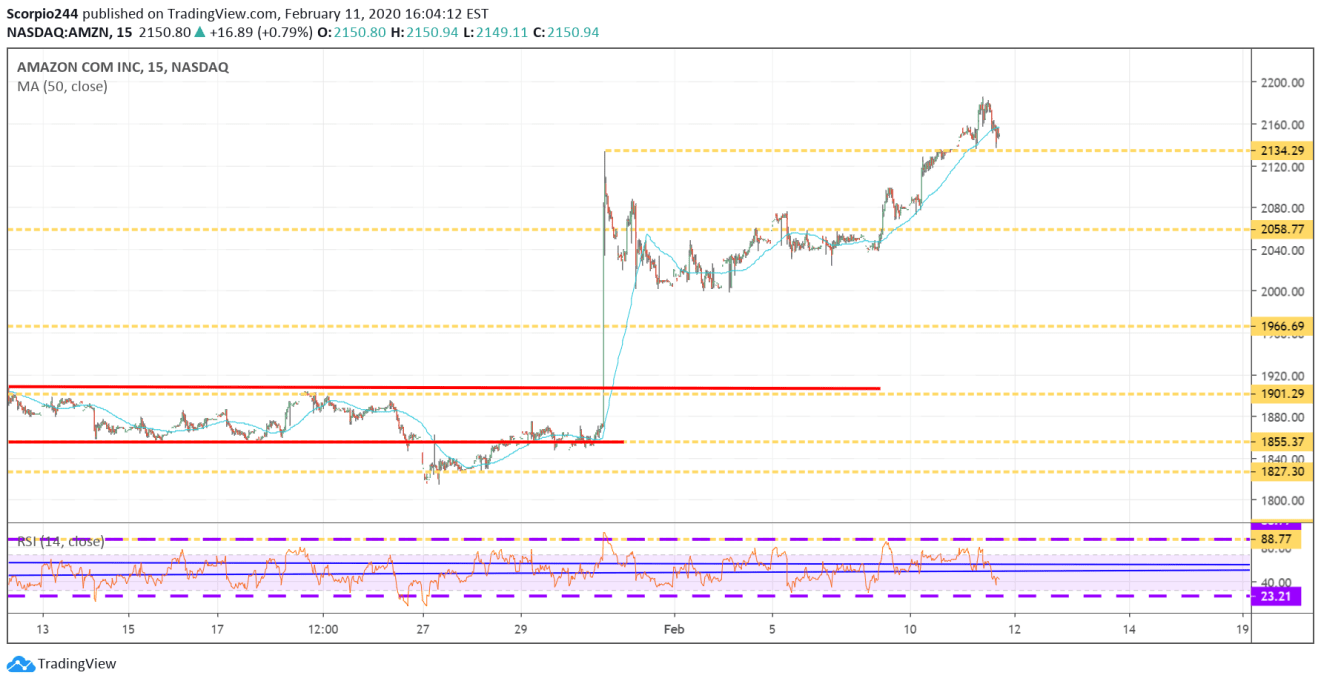

Amazon

Amazon (NASDAQ:AMZN) rose above 2,134 today, and now that level will become support, and sure enough, it held. I have been putting it off, but now I seriously have to sit down and figure out was this stock is going.

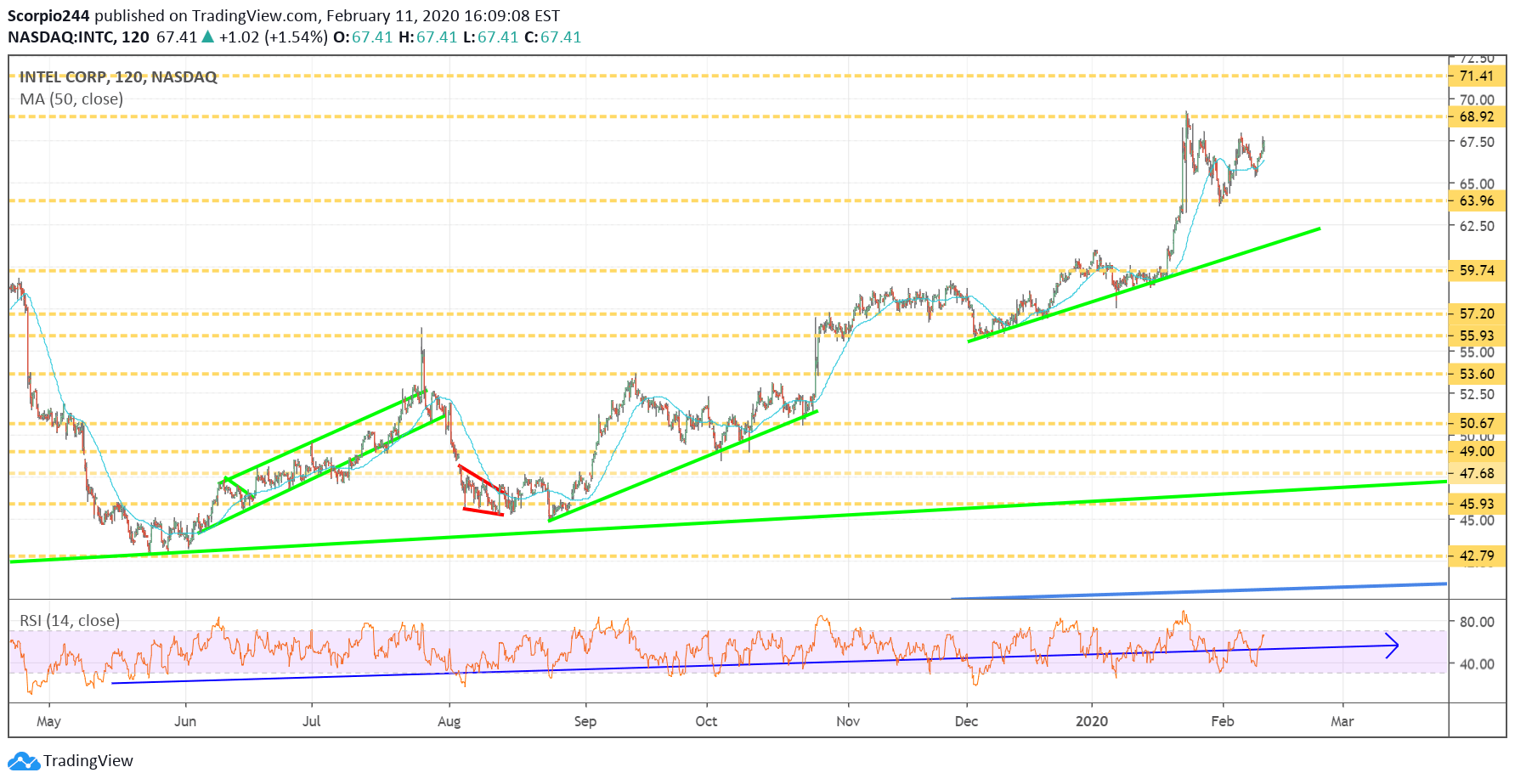

Intel

I noted some bullish betting in Intel (NASDAQ:INTC) today in this free article I wrote up; it seems like the same buyers I saw last week. If the stock can clear resistance at $69, it could push higher towards $71.40.