Stocks are falling on May 4, with the S&P 500 ETFs suggesting a drop of 1%. Selling overseas is a bit worse, but then again, their markets were closed on Friday, so those markets are playing a game of catchup.

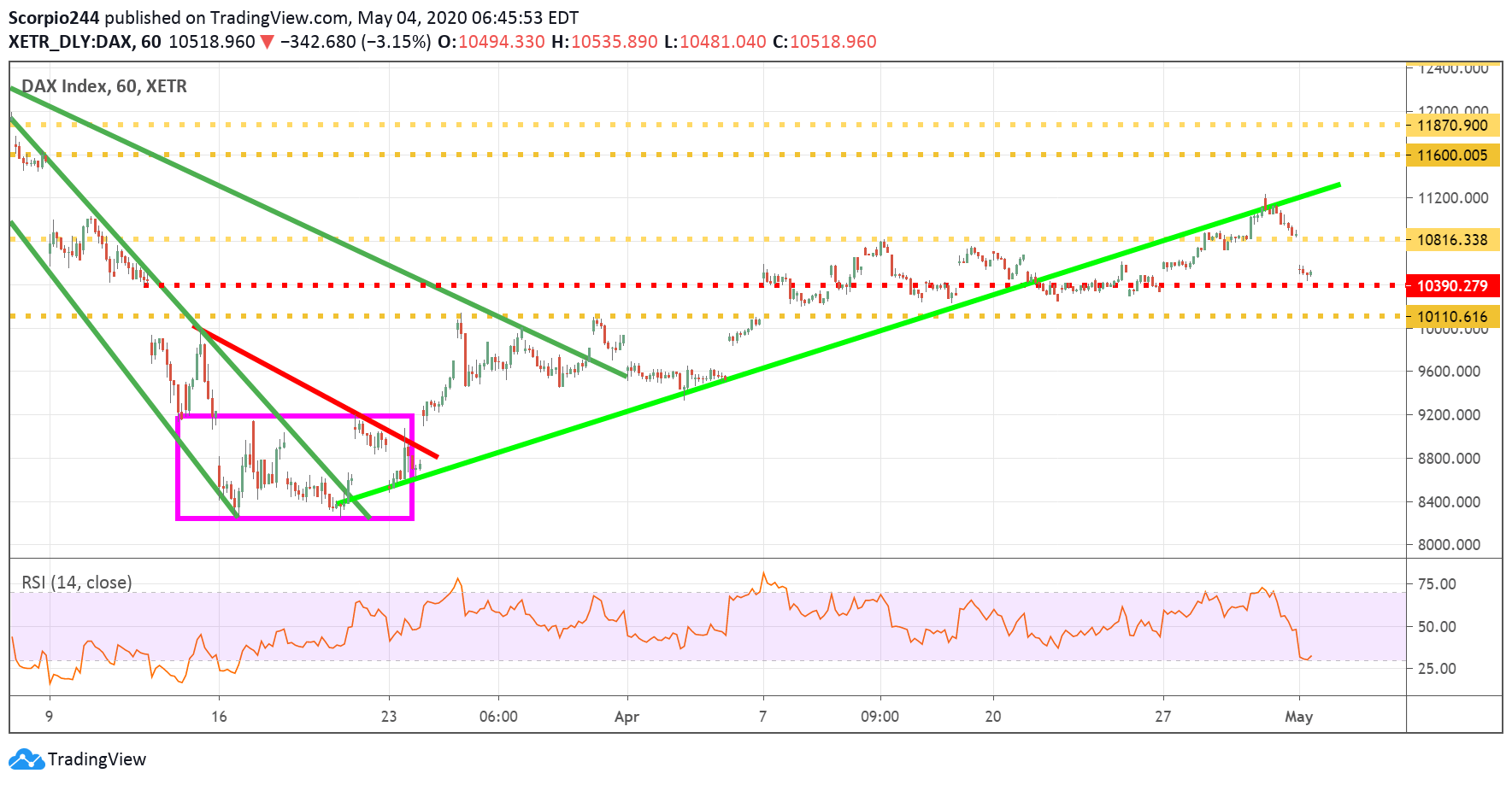

Germany (DAX)

At the moment, Germany is holding a critical level of support round 10,390.

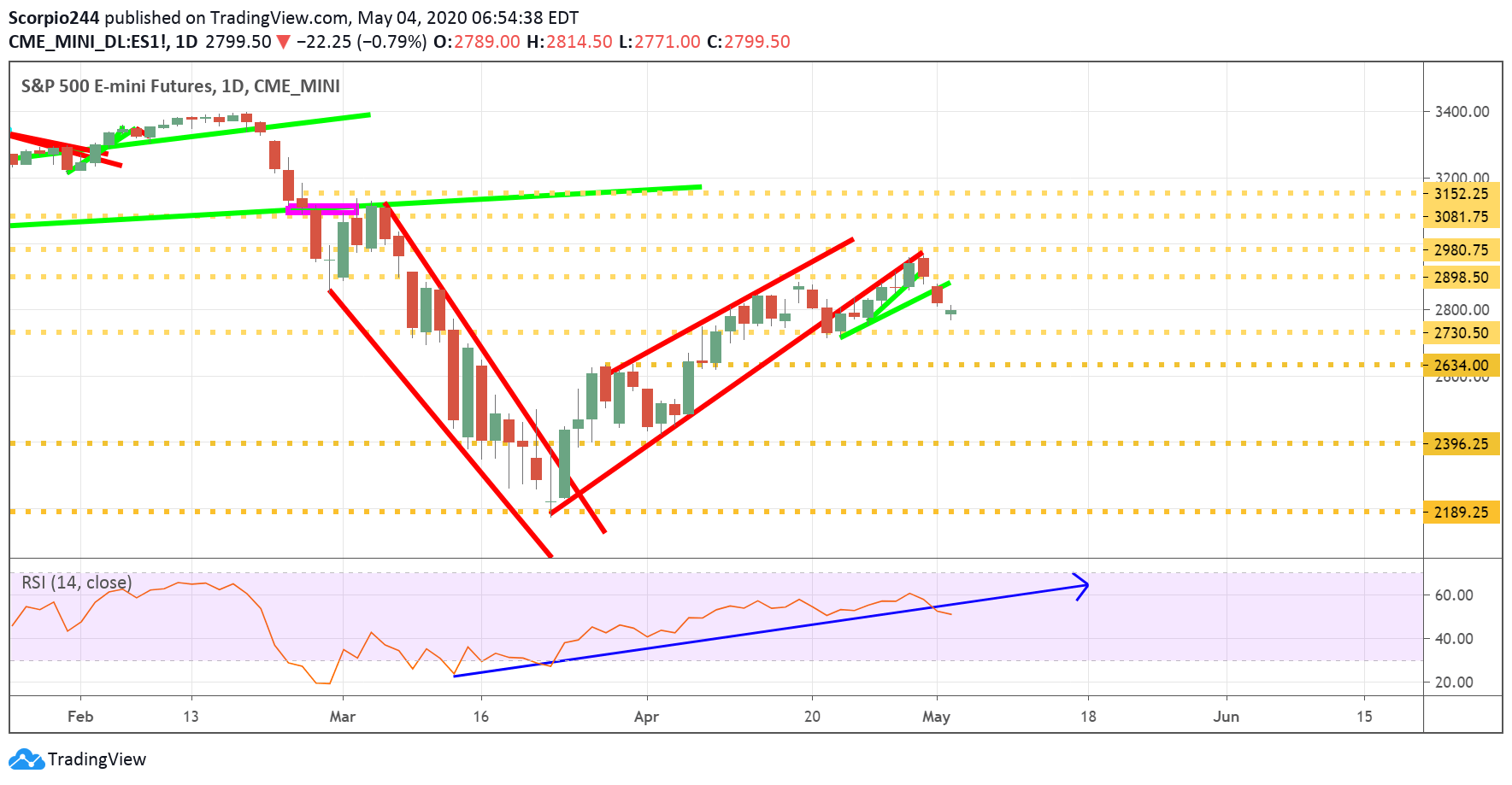

S&P 500 Futures (NYSE:SPY)

S&P 500 futures are falling, and currently trading around 2,800. This is a pretty significant level based on options positioning. It also means that there is a great deal of risk here, with the next significant level of support coming around 2,730. Additionally, the uptrend in the RSI has been broken at this point, and it suggests that the bullish momentum we have seen has shifted back to being bearish.

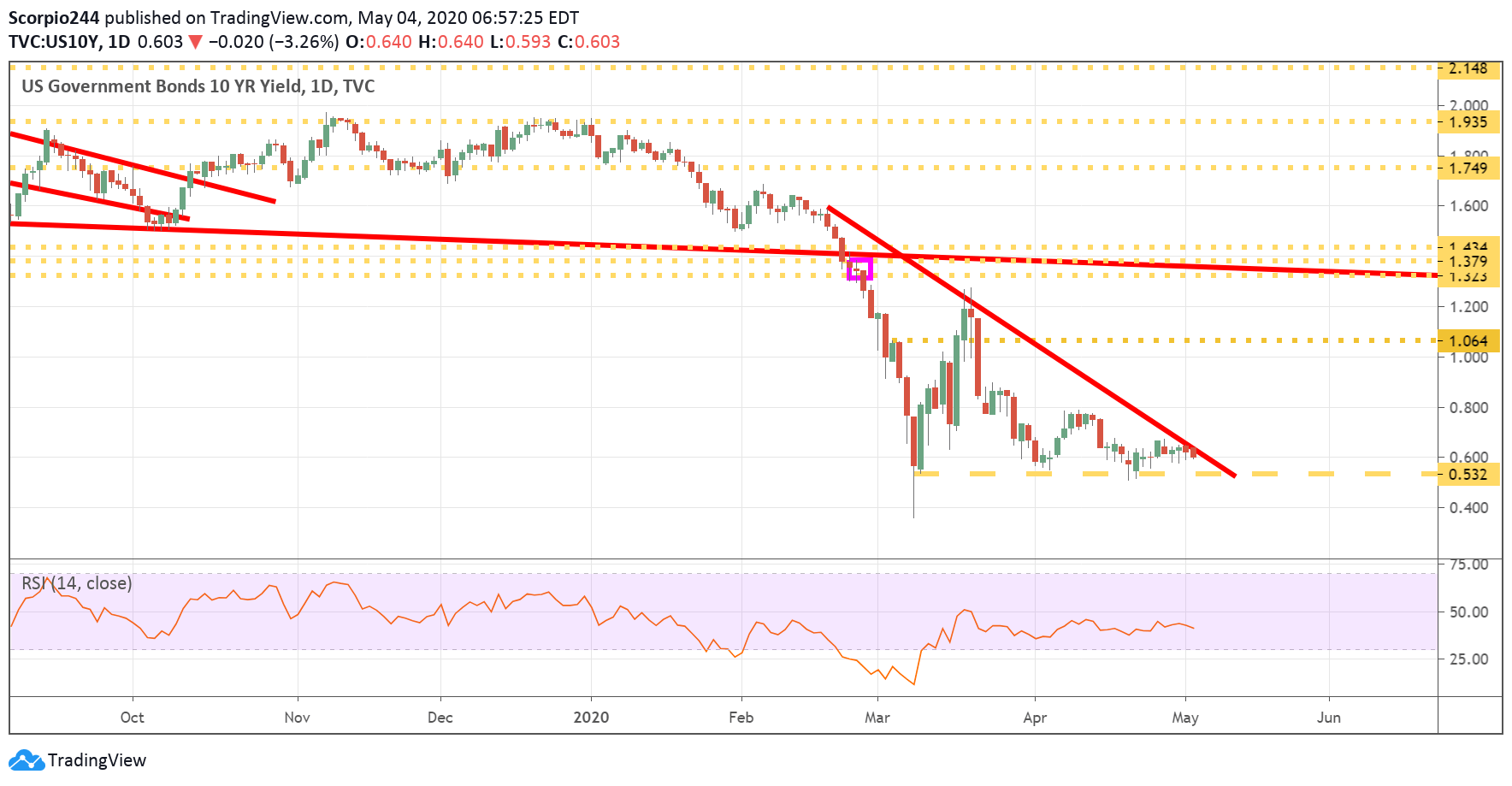

US 10-Year

Again, I have now said several times; I have a great deal of concern over what the 10-Year Treasury is suggesting.

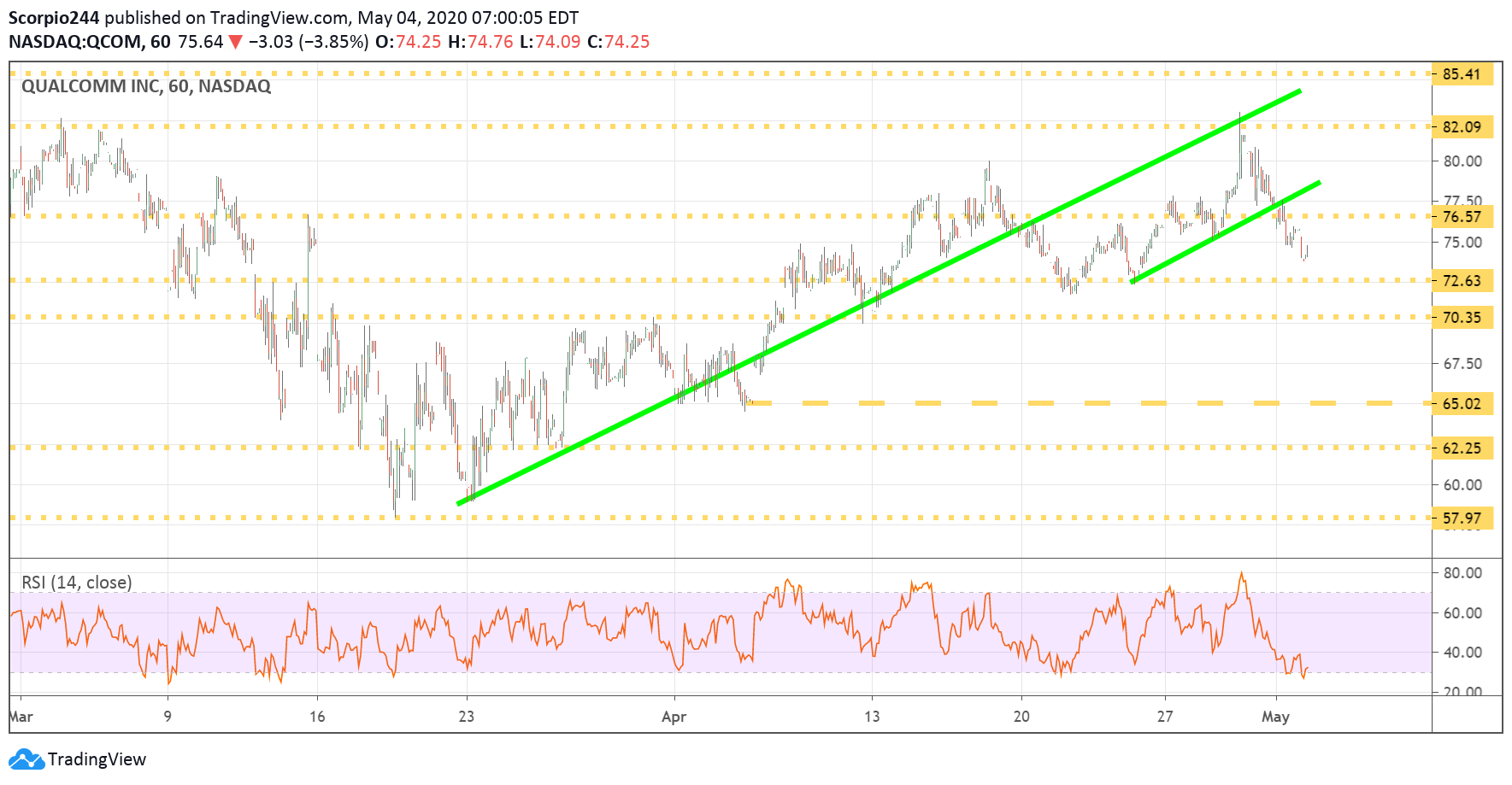

Qualcomm

Qualcomm (NASDAQ:QCOM) was initiated today by Wells Fargo with an underweight rating and a $70 price target. Again, nothing has changed here in my view, and I continue to think shares fall to around $65.

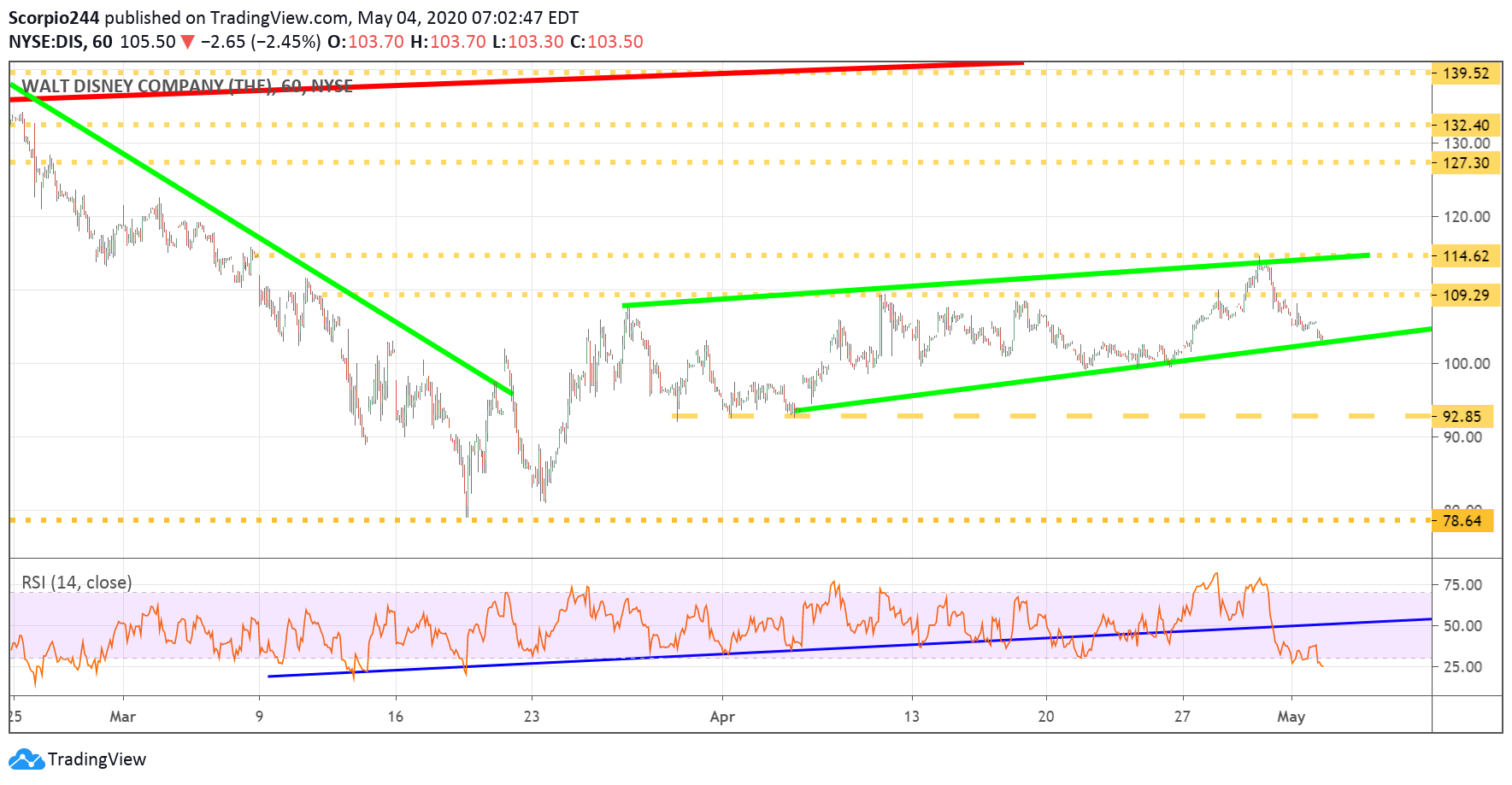

Disney

Disney (NYSE:DIS) was downgraded by Moffett Nathanson with a $112 price target. Again, I think this one still falls further to $92.85.

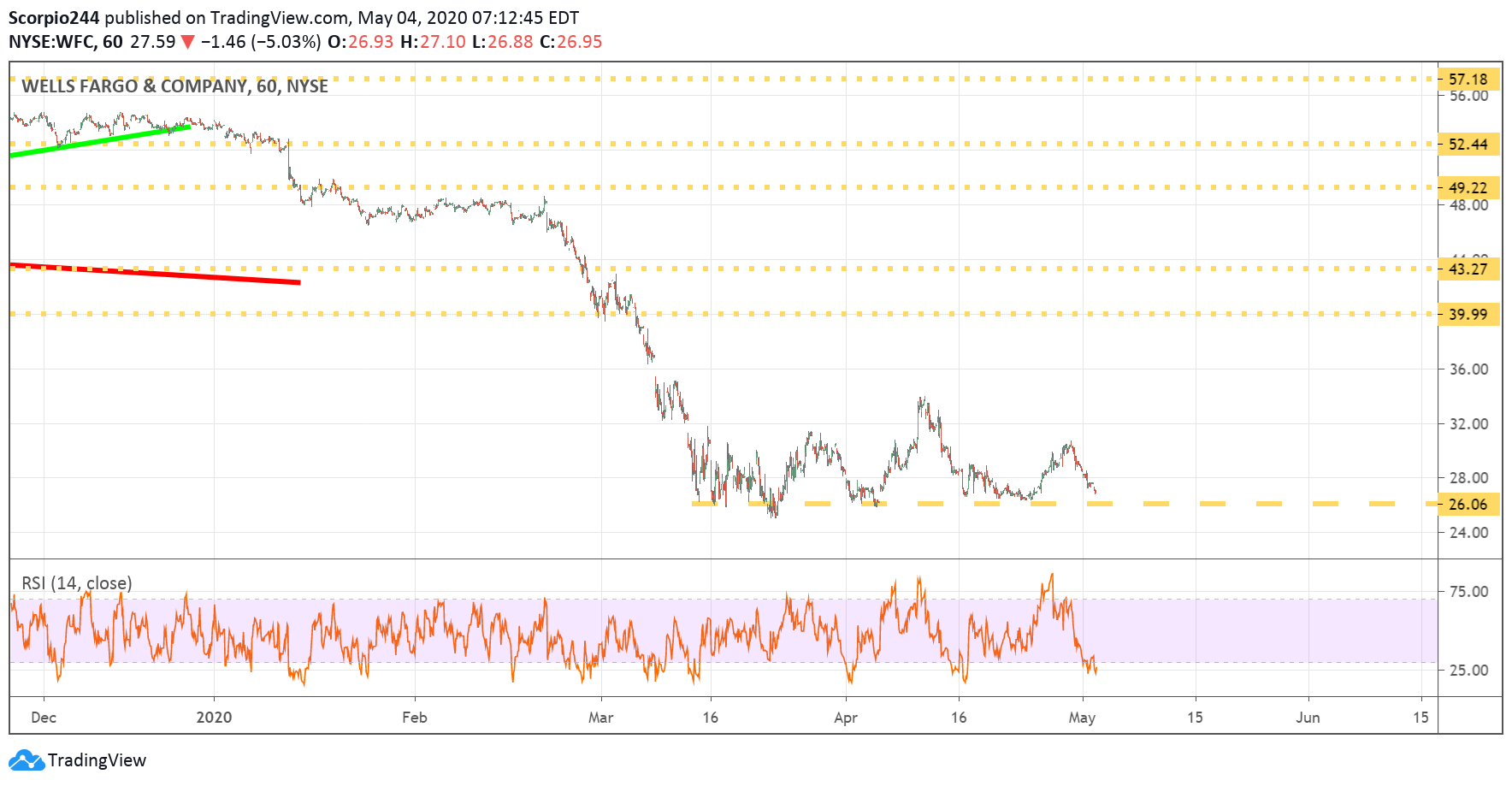

Wells Fargo

Wells Fargo (NYSE:WFC) was downgraded to Sell from Neutral at UBS. The price target was also trimmed to $19 from $21. The pattern in Wells is very bearish, with the drop below $26.00 trigger a very sharp sell-off.

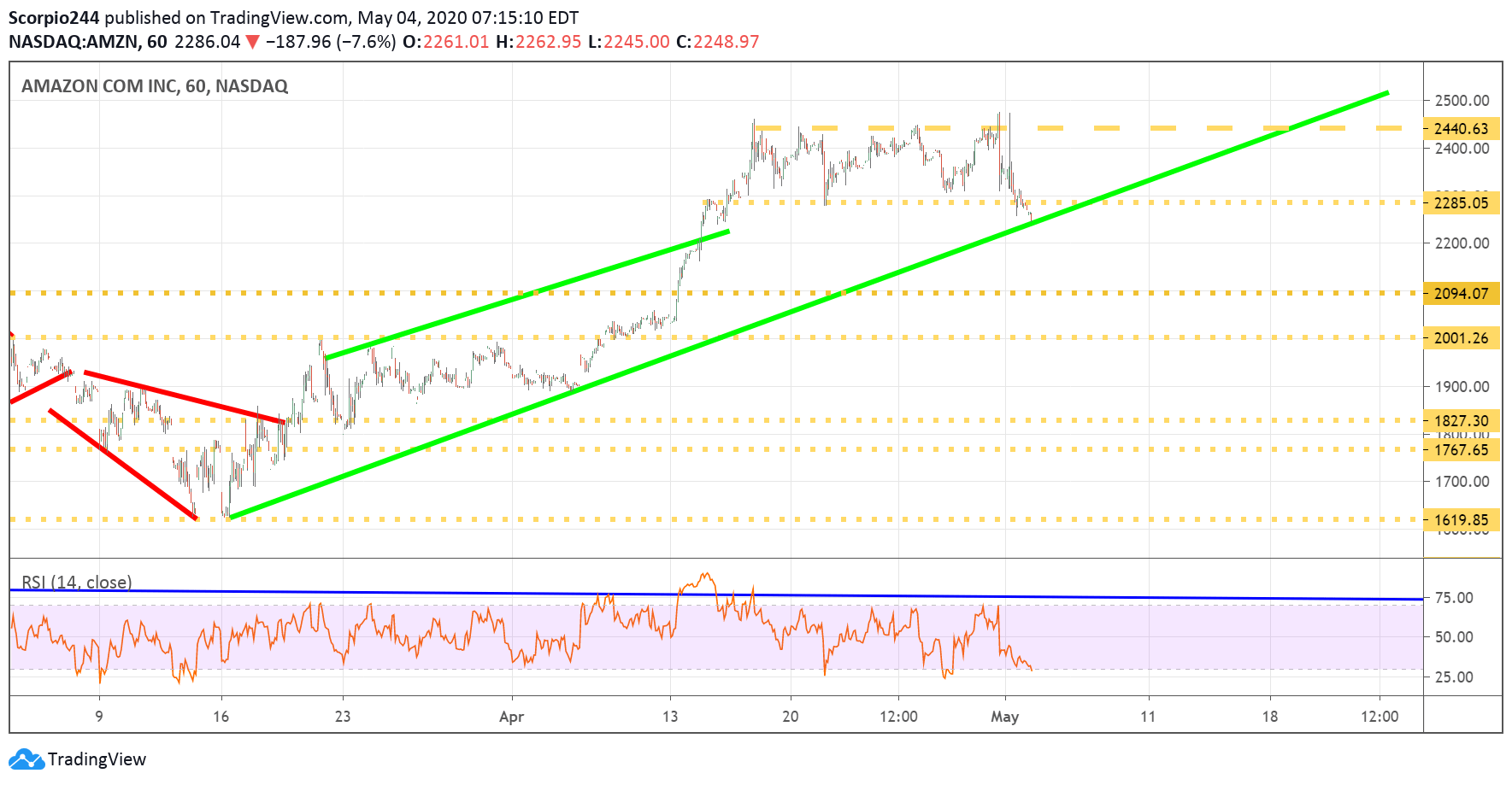

Amazon

Amazon (NASDAQ:AMZN) is testing the uptrend this morning with a break sending the stock back to $2,090.

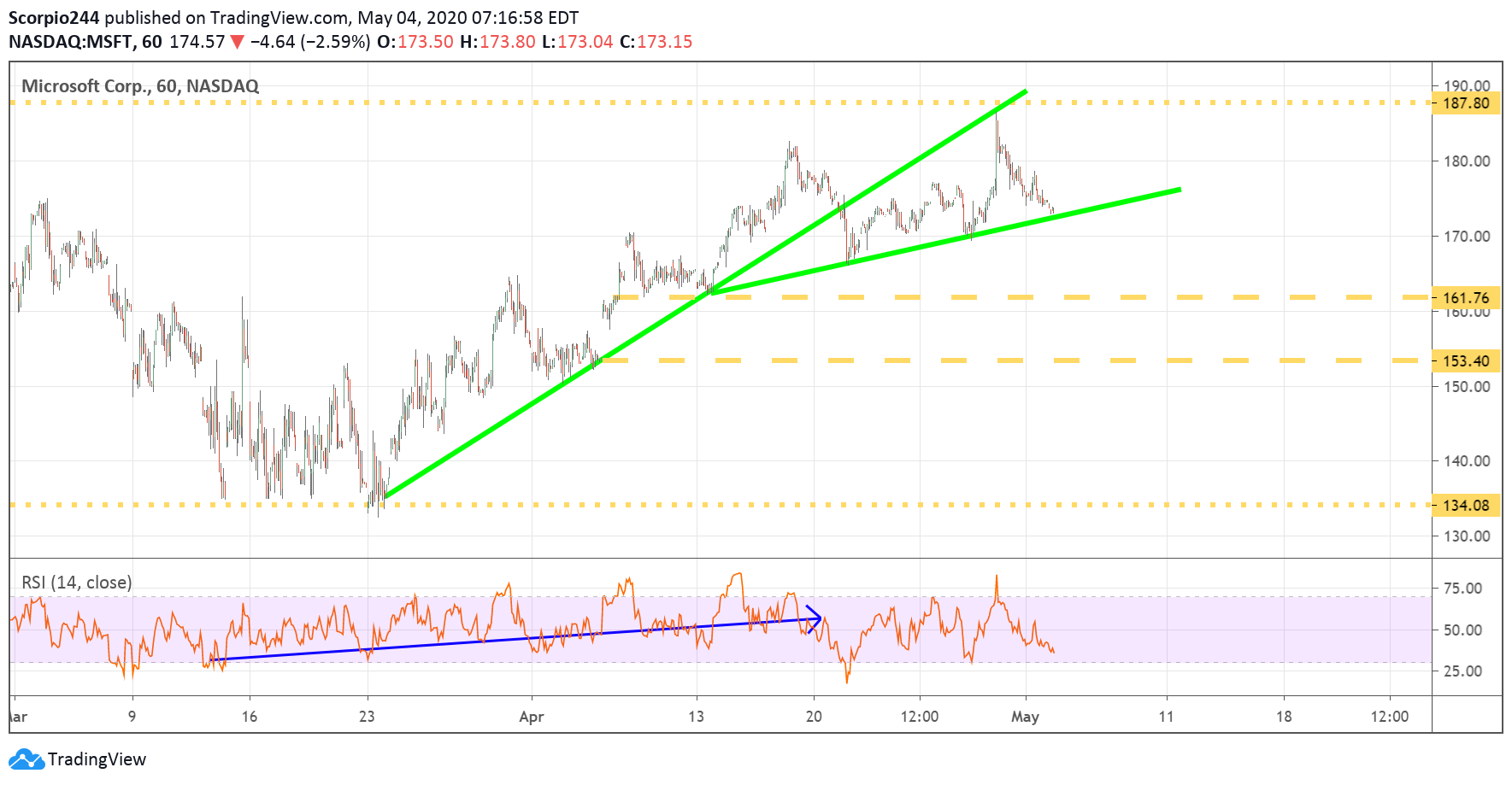

Microsoft

Again, I continue to think Microsoft (NASDAQ:MSFT) goes back to $161.