Stocks finished the day mostly lower, with the S&P 500 falling by six bps and the Qs finishing lower by 1.3%. It was a reversal day with markets opening decidedly higher and then turning sharply lower following the weaker than expected ISM Manufacturing PMI.

Additionally, there was an article in the Wall Street Journal, in what appears to have been floated as a trial balloon, about when the Fed might start running off the balance sheet. Obviously, this is something that will be a topic in the upcoming release of the Fed minutes, and they want the market to be “prepared.”

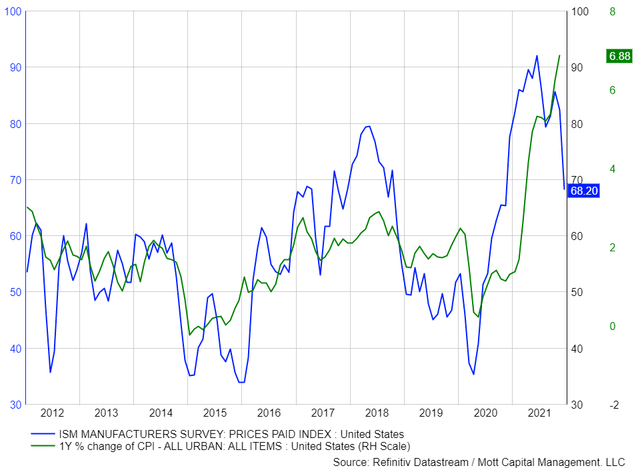

Still, it was sort of a tough day with a lot of stuff going on, following a much weaker than expected Prices Paid Index from the ISM report. Overall, the survey leaves me to believe that we are now seeing weaker inflationary pressure that is likely to spill over into the CPI reading. An indication that inflation has probably peaked, and now we could be facing disinflationary tailwinds or inflation rates rising at a much slower pace.

It does not mean that the rise in prices witnessed will disappear; it just means that the pace at which they rise will begin to head back towards the Fed’s 2% target. How long it takes for that to happen is critical and will depend on how much commodity prices like oil rise or fall.

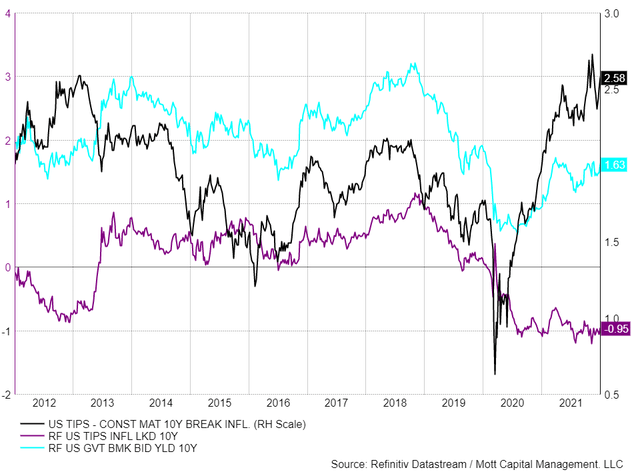

As you can see from the chart above, it would be highly unlikely to see CPI at a higher level than what was witnessed in November, given the ISM Prices Paid Index drop. So if that is the case, we could probably argue that market-based inflation expectations are too high, and if those are too high, then TIP rates are probably too low. If real yields start to rise, well then, that isn’t good for the long duration technology/growth trade, and thus the NASDAQ Composite dropped 1.3%.

NASDAQ

Last week I warned there was a good chance a double bottom was not forming in the NASDAQ Composite, despite its appearance. Now the pattern isn’t complete yet, but it looks like there is substantial resistance at 15,850, while there is support around the 50-day moving average and around 15,520. However, I don’t think that the support region will hold, and we are very likely to see the index drop back to the recent lows of around 14,900.

Adobe

After hours, Adobe Systems (NASDAQ:ADBE) got a pretty significant downgrade by UBS, with a price target reduction to $575 from $635, on slowing growth concerns.

I get the feeling we are going to be hearing a lot more of these types of downgrades over the next three weeks as we prepare for earnings season. Adobe is one of the biggest software companies around, and if they have slowing growth concerns, they all will. There is a good chance this falls to about $500.

Salesforce

UBS wasted no time because they also cut Salesforce.coms (NYSE:CRM) price target to $265 from $315 and downgraded the stock to neutral from buy. It will need to hold support at $240.