Stocks Battle Out Bore Draw:

“How many times can you buy support before you get burned?”

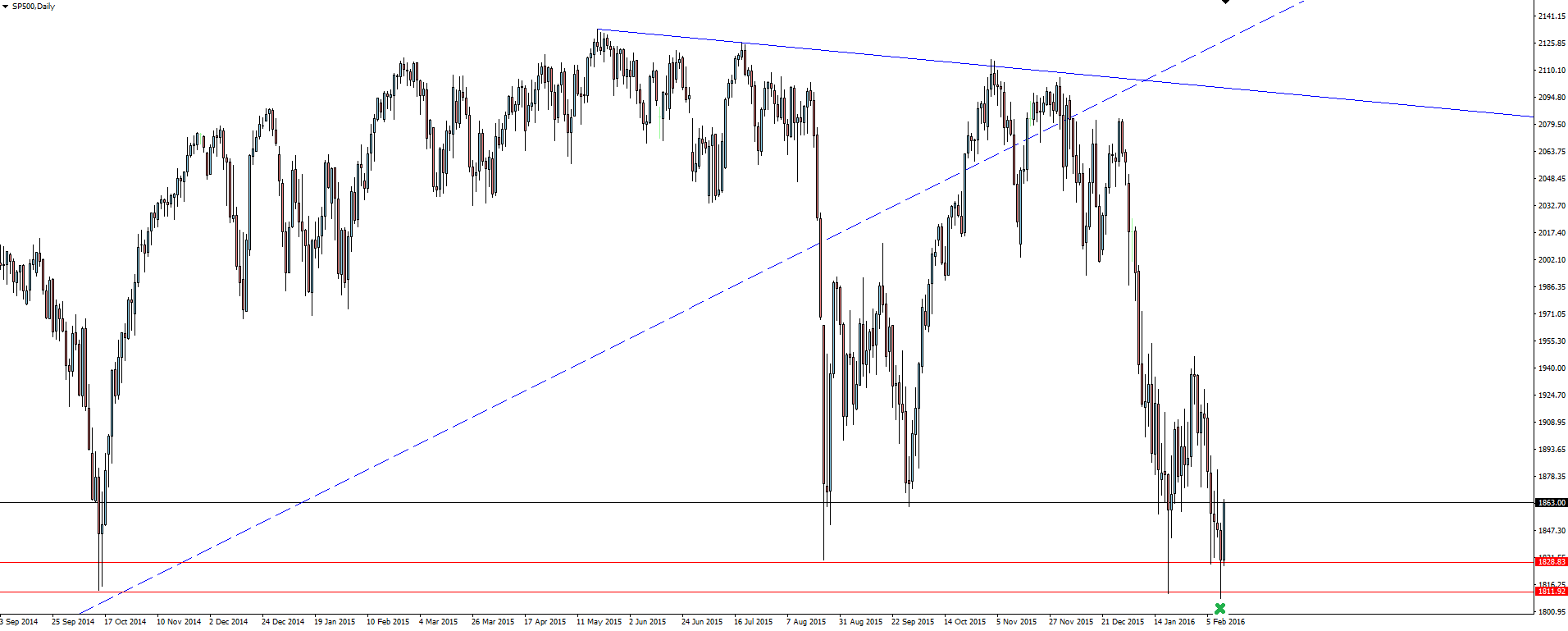

S&P 500 Daily:

Well, it would seem at least once more…

I had high expectations for breakouts across Indices markets on Friday, but with strength coming out of the S&P 500 support level in the chart above, it just wasn’t to be.

With US markets closed tonight for Presidents Day, tonight isn’t the night. I set the week up for a big finale to the major trend line support across indices narrative that I’ve been running on the blog, and it just didn’t happen. Take a deep breath and respect the major levels.

Speaking of not respecting levels, Chinese markets will open Monday after a week long holiday in celebration of the Lunar New Year. Markets are bracing for what’s being described as a ‘catch up sell off’ on the open, as China will most likely be forced to follow it’s Asian market counterparts down.

The Nikkei's fall has been well publicised, slumping 11% last week, while Hong Kong’s Hang Seng (who only received a 3 day break) dropped nearly 4%. The volatility dynamic that Chinese stocks bring to world Indices could well be the key that we’ve been waiting to have turned.

Another story to watch as China comes back online this week is the depreciation of the yuan. Governor of the People’s Bank of China Zhou Xiaochuan, has printed headlines as we move toward the re-open with the following comments:

“There’s no basis for continued depreciation of the yuan because the balance of payments is good, capital outflows are normal and the exchange rate is basically stable against a basket of currencies.”

With foreign exchange reserves shrinking according to Bloomberg, this is the PBOC reassuring us that they are in no way ready to give up on defending the currency with a bit of jaw-boning with the aim of stability.

Chart of the Day:

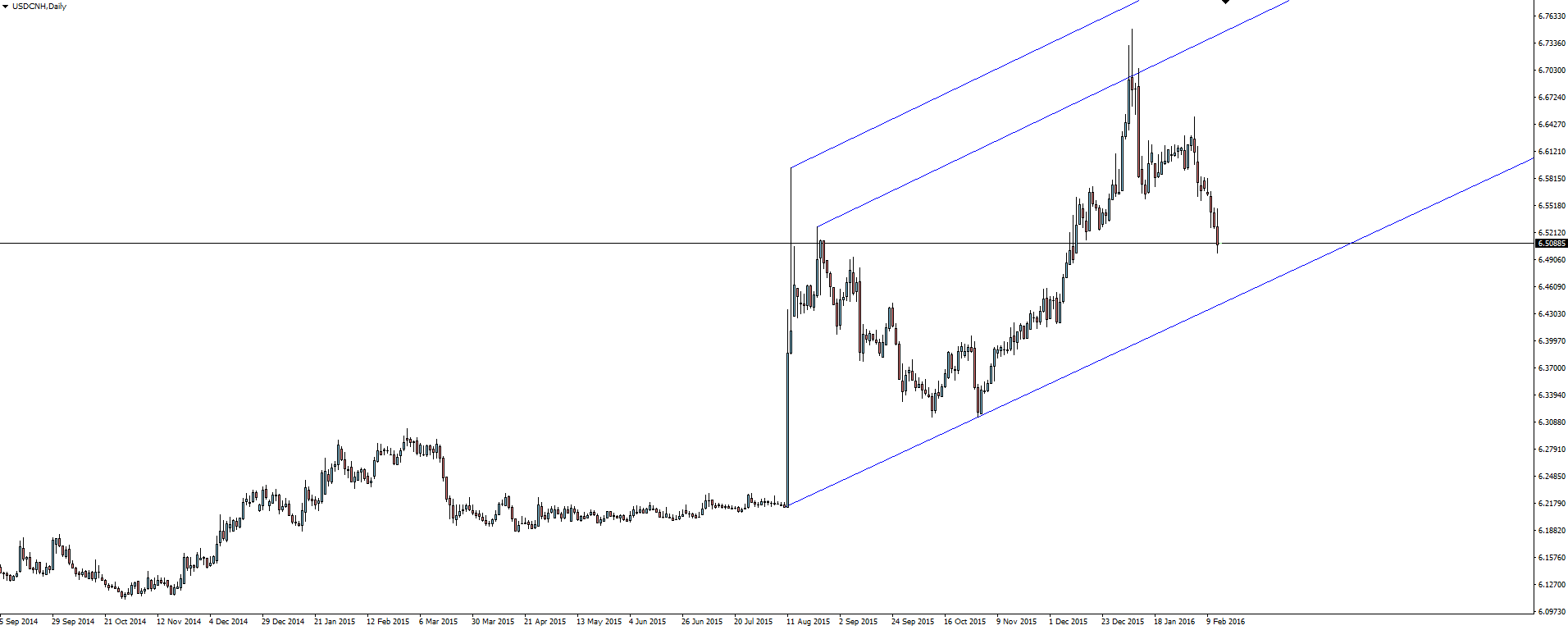

USD/CNH Daily:

The offshore USD/CNH chart is a wild one, but the drop out of the parallel channel top shows that the market respects technical zones as well as any of the forex pairs on the Vantage FX MT4 platform.

With price heading back to channel support, how do you see the above comments from Zhou Xiaochuan affecting the pair?

On the Calendar Monday:

JPY Prelim GDP q/q

CNY Trade Balance

USD Bank Holiday

EUR ECB President Draghi Speaks

“Washington’s Birthday is a United States federal holiday celebrated on the third Monday of February, meaning it can occur the 15th through the 21st inclusive, in honour of George Washington, the first President of the United States, who was born on February 22, 1732.

Colloquially, it is widely known as Presidents Day and is often an occasion to remember all the presidents. The term “Presidents Day” was coined in a deliberate attempt to change the holiday into one honouring multiple presidents.“

Do you see opportunity trading Chinese markets?

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our Forex account prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this Forex blog service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.