Markets are pointing to a lower opening around the globe after Apple (NASDAQ:AAPL) warned it would miss fiscal second-quarter revenue estimates due to the coronavirus. While everyone can note that they aren’t surprised, I think the more significant issue is that the company didn’t give a revised guidance range, it would suggest that Apple likely has limited visibility.

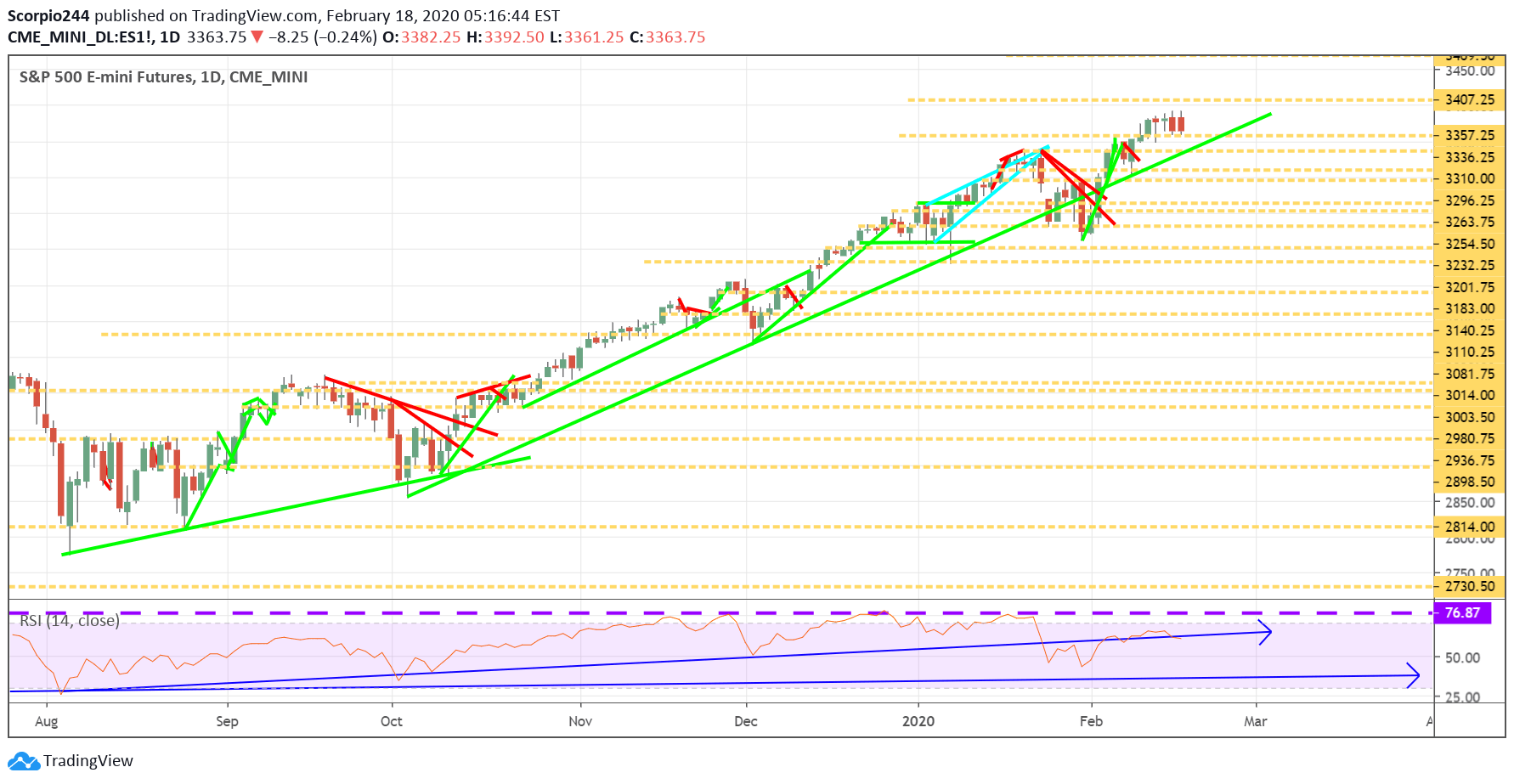

S&P 500 (SPY)

However, at this point, the damage seems contained with the futures down about 11 points on the S&P 500, which is essentially nothing. Markets in Europe are all down less than 1%, while most major markets in Asia were down by 1.5%.

Overall, I think this is likely to be looked through by the market as a short-term event. Any pullback is likely to be short-term in nature, with the general trends in the S&P 500 unchanged, which is for the market to move higher.

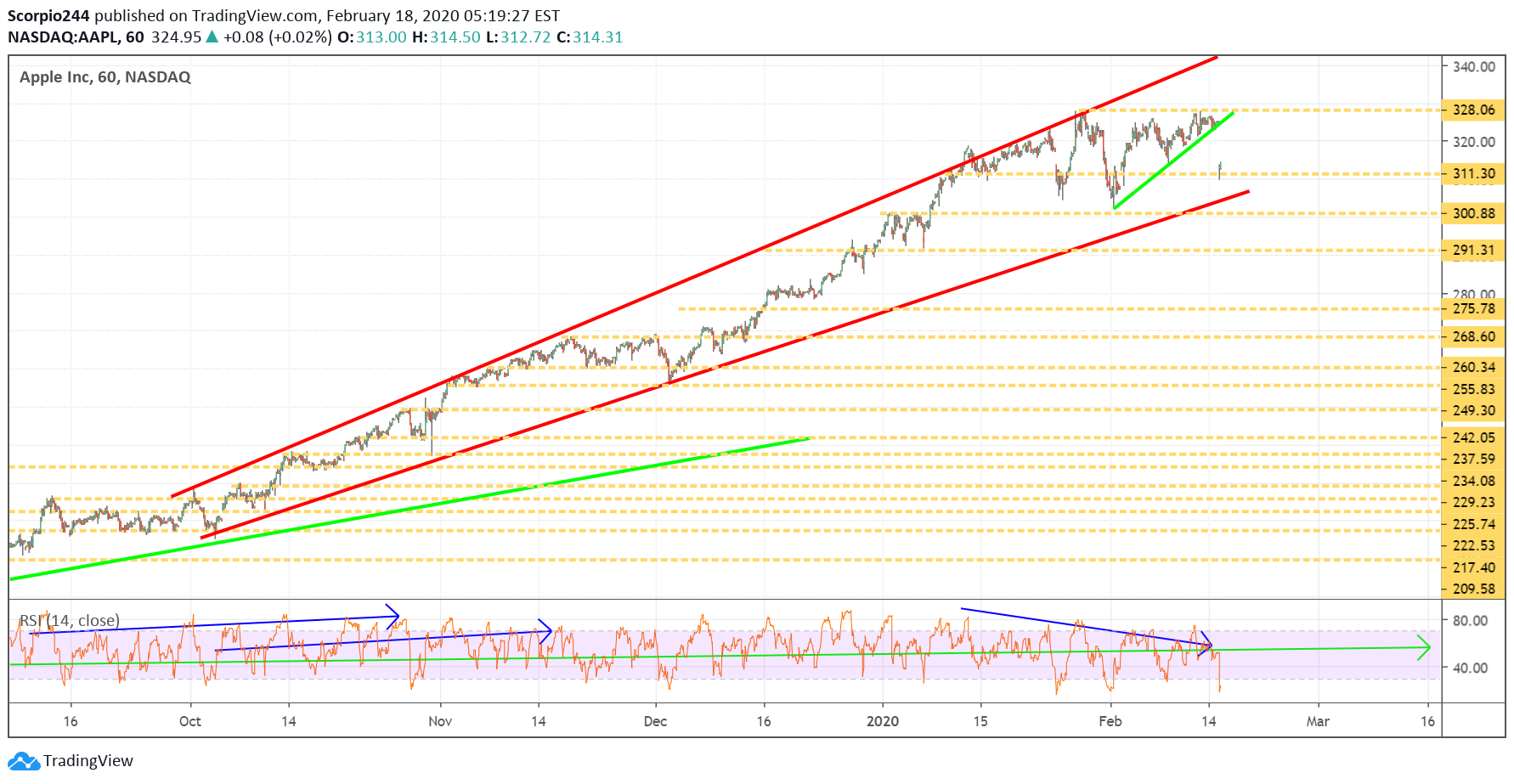

Apple (AAPL)

Apple (NASDAQ:AAPL) is falling as expected, but again it seems relatively contained around $313. At this point, the stock is holding support around $311; after that, the next level comes around $300, which is where the stock fell to in late January. I don’t expect any pullback to be long-lasting. I noted this last night, in my premium room updates.

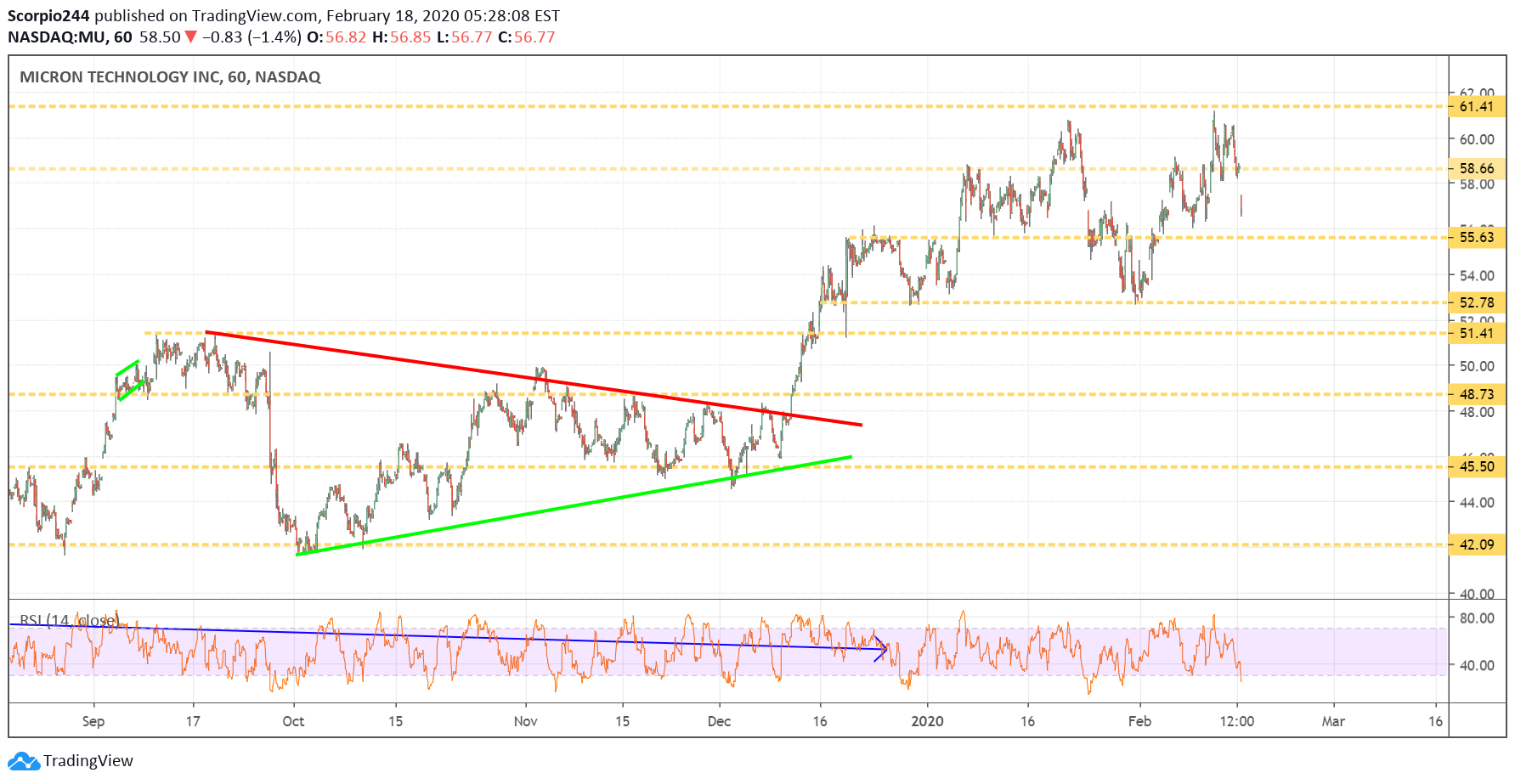

Micron (MU)

Micron (NASDAQ:MU) has struggled around resistance in the $60 region. Today shares are pointing to a lower opening, and we will have to see if the stock can bounce back and get back above $58.65. If not, then it probably moves lower to $52.75, creating a potential double top. We will need to keep an eye on this one.

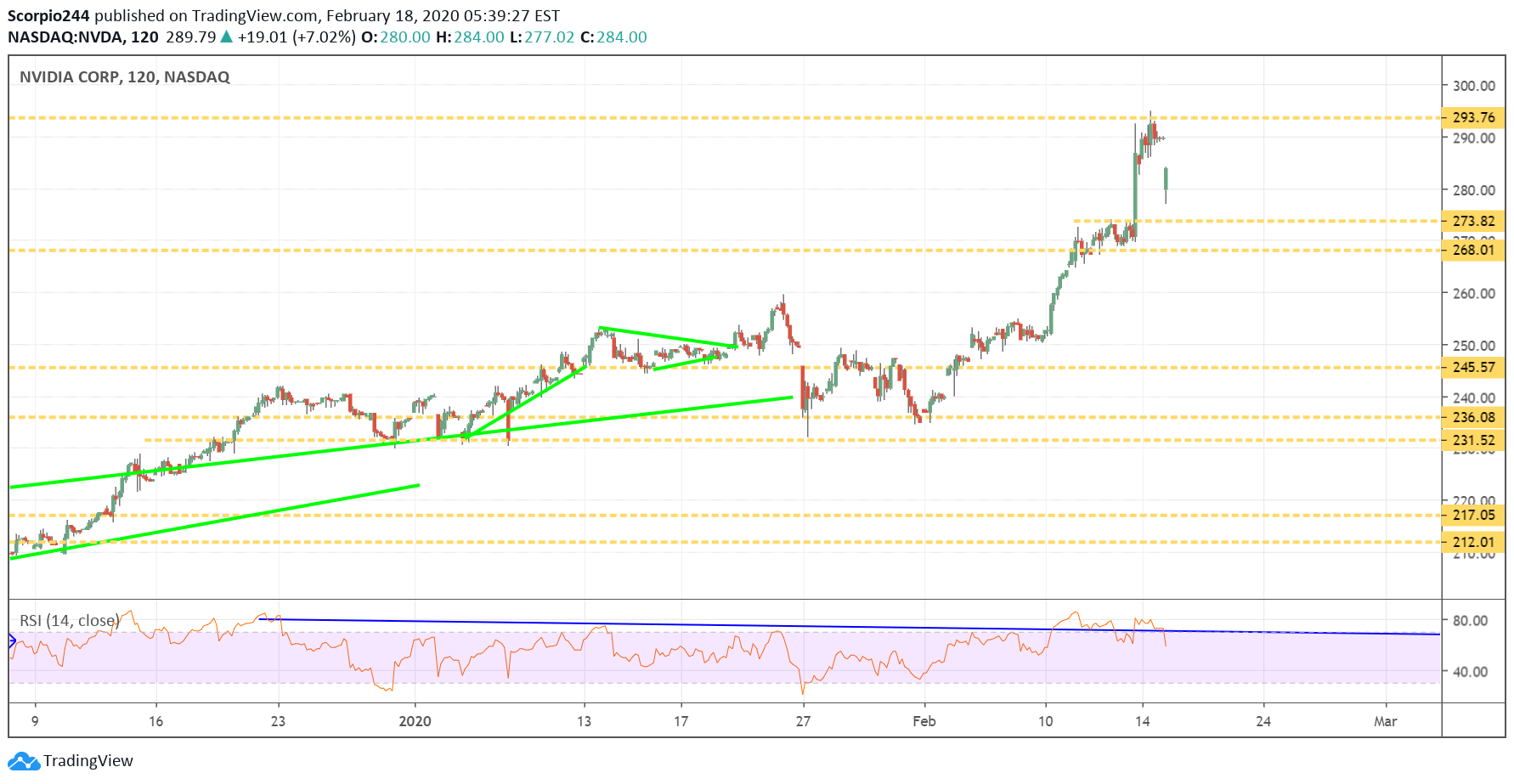

Nvidia (NVDA)

Nvidia is falling some today, and downside risk seems moderate potentially to that gap fill at $272.

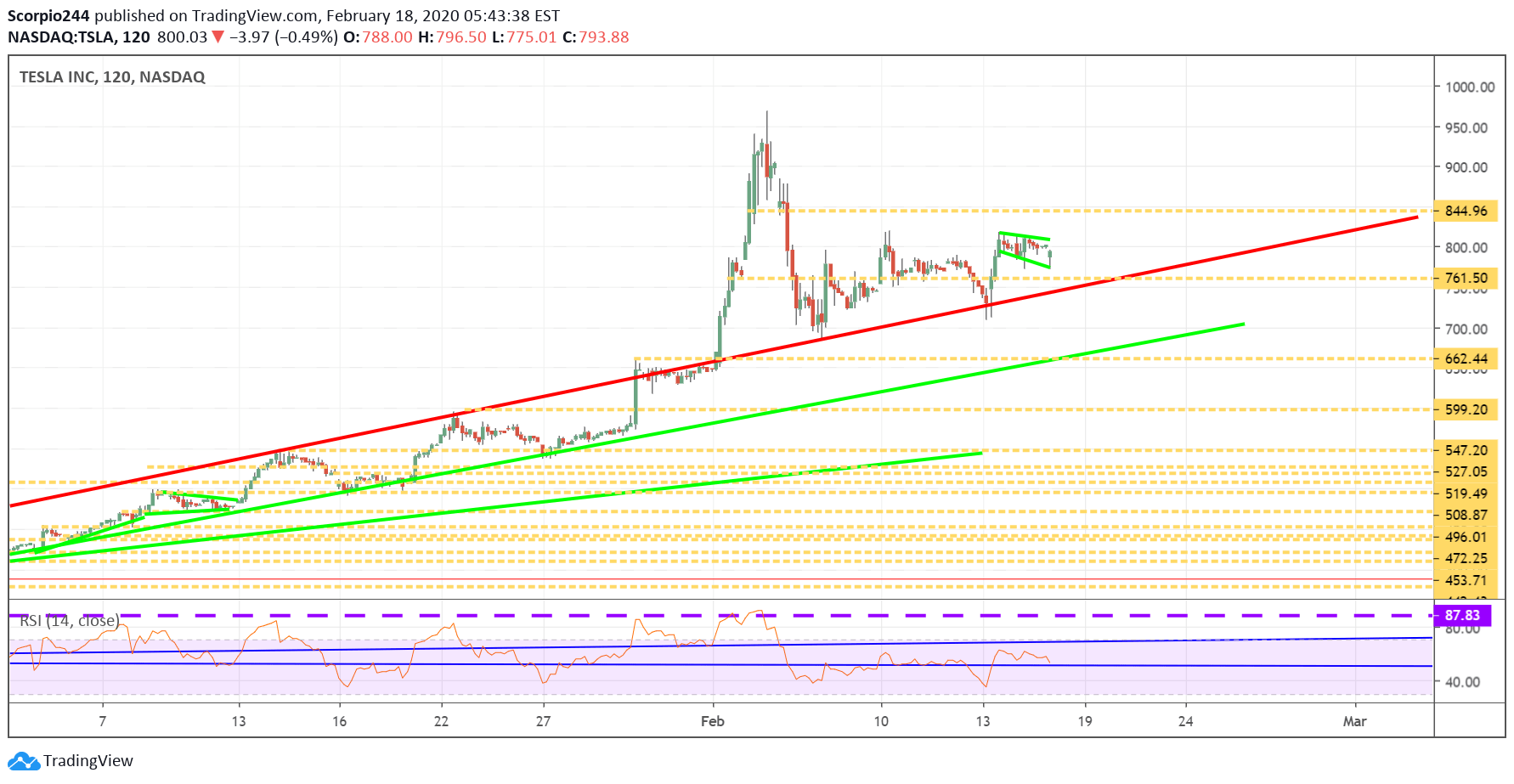

Tesla (TSLA)

Tesla (NASDAQ:TSLA) is trading relatively unchanged today, and after the pricing of the offering last and the significant volume the stock has been trading, I find it hard to believe the stock has much downside risk ahead of it over the short-term, the considerable risk is for shares to rise towards $850.

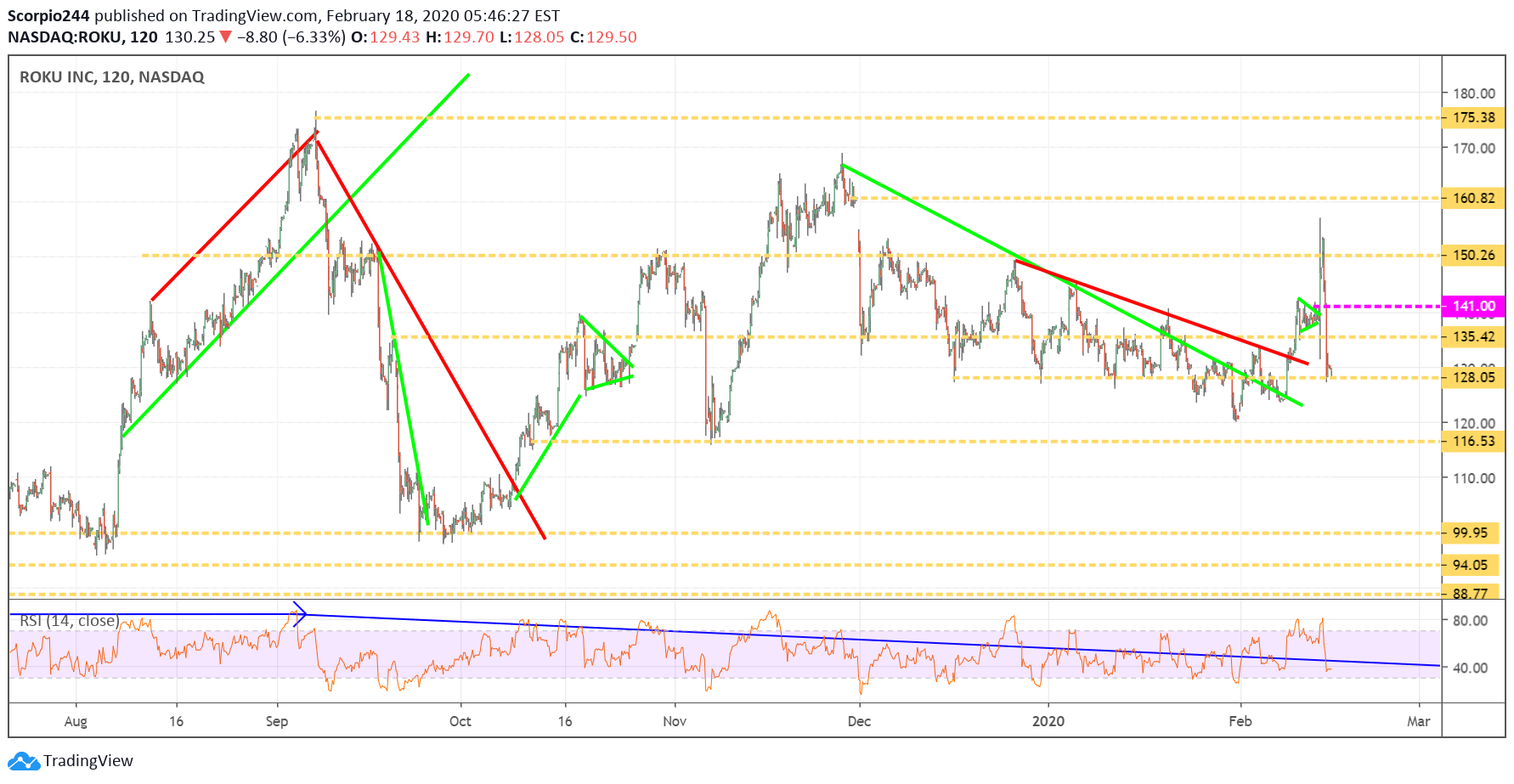

Roku (ROKU)

So far, Roku (NASDAQ:ROKU) has been able to hold the $128 region time and time again. So as long as that region holds, the stock will be fine and will likely bounce — this is the must-watch region for the shares.