Markets both in the US and Europe saw a solid start to the week. On Wall Street, the S&P and the NASDAQ closed at a record-high. Coronavirus vaccine and treatment developments hopes of additional monetary stimulus as we look towards the Jackson Hole symposium and strong demand for US big tech stocks drove markets higher.

Overnight, encouraging news flow surrounding US – Sino trade talks has helped to keep the mood buoyant. Chinese and US officials have seen progress on the Phase 1 trade deal boosting Asian stocks and setting European bourses up for a stronger start.

German GDP -9.7% QoQ In Q2

Adding to the upbeat mood, data revealed that the German economy performed better in the April – June period than initially thought. The German GDP data saw an upward revision to -9.7% QoQ contraction, from an initial -10.1% record-breaking contraction.

All in all, Germany has fared the COVID significantly better than many other countries. With 9,276 deaths compared to the UK’s 40,000 plus, GDP of -9.7% compared to the UK’s -20.2%. These figures speak for themselves.

German business outlook to improve

What’s more interesting for traders is how the German economy has been performing over more recent months and how German businesses see the outlook. The German IFO Business Climate Survey is likely to offer some insight here.

The German IFO Business Climate is expected to continue rising in August to 92, up from 90.5 in July as the recovery from April’s 74.5 remains intact. Concerns over a second wave will be unnerving businesses and this could prevent the index from reaching pre-pandemic mid to high 90’s.

US consumer confidence

Looking ahead attention will turn towards US consumer confidence data. We saw a sharp drop in morale in July after the Conference Board’s consumer confidence index slumped to 92.6, down from 98.5 in June as concerns over the second wave of COVID dented confidence. With coronavirus statistics improving and the reopening of the economy continuing confidence is expected to improve mildly again in August to 93. However, the reality is that this could go either way, particularly given the expiry of the additional $600 unemployment benefit and Congress’ failure to agree to a new rescue package.

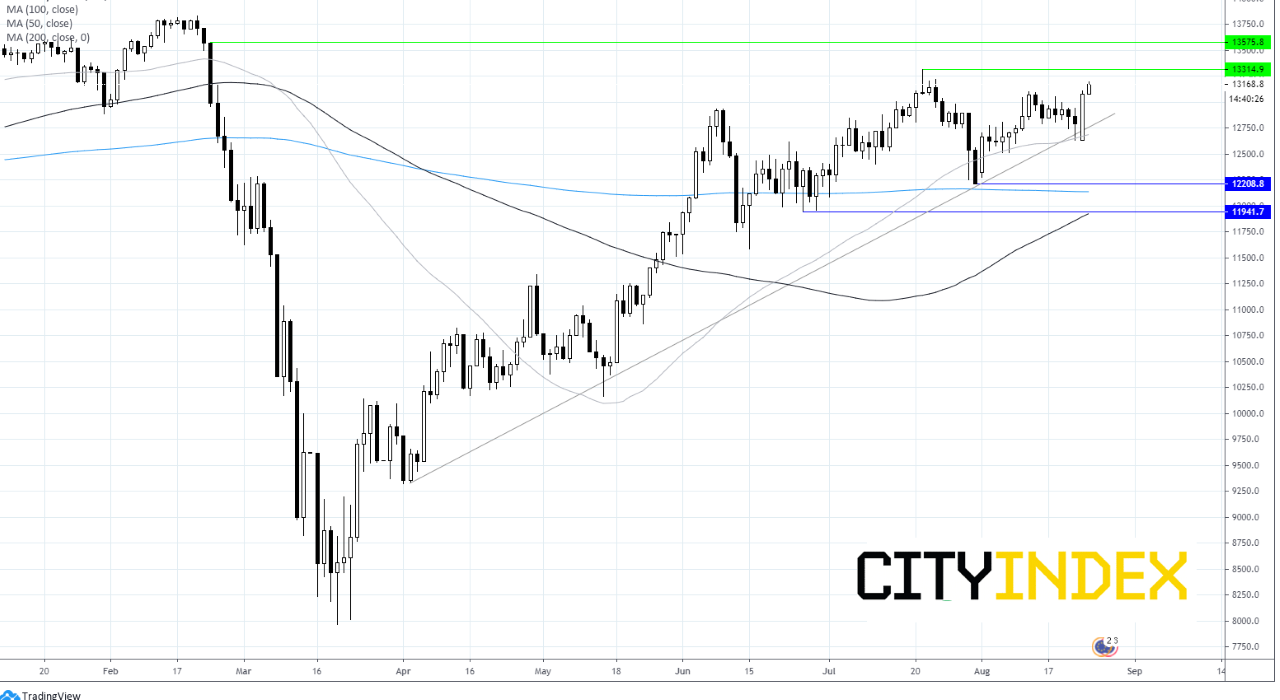

DAX Chart