Investing.com’s stocks of the week

Bulls are starting to put a bit of distance on the prior consolidation of early November and this will only make it easier to extend gains when Santa comes to town. As it stands, all bar the Russell 2000 are at multi-year (10-year+) highs.

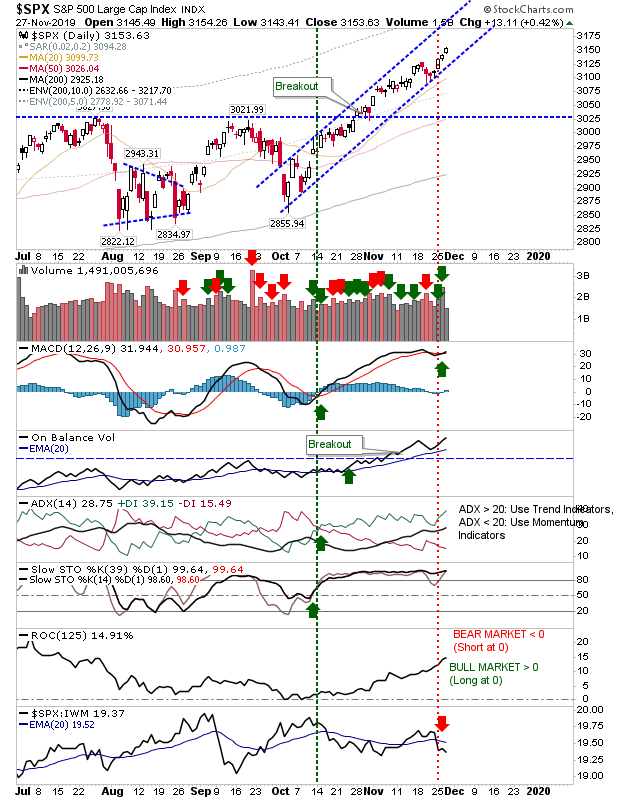

The S&P 500 is running inside a rising channel with well defined support and resistance. It's still underperforming against the Russell 2000, but other technicals have returned net positive.

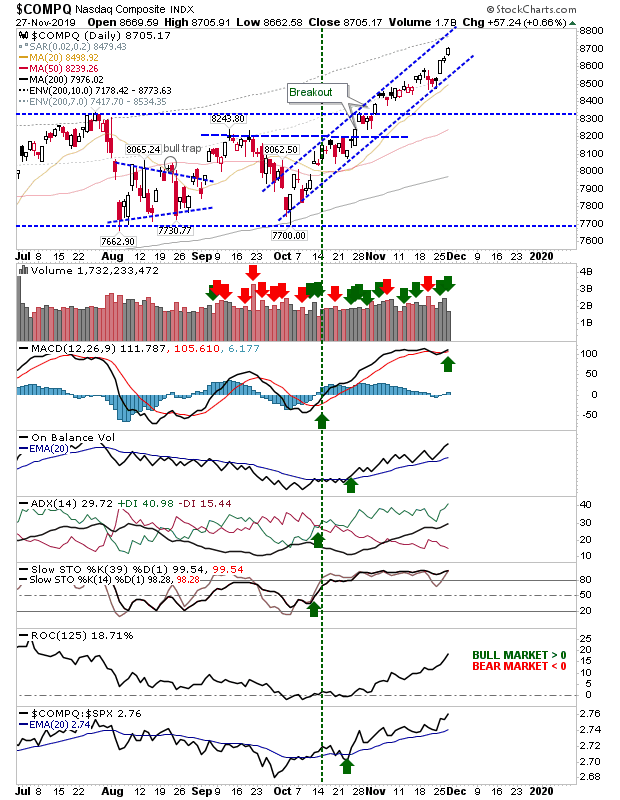

The NASDAQ Composite also has a well defined rising channel and a new MACD trigger 'buy' to go with it. Relative performance against the S&P has also surpassed the July swing high - meaning more money is flowing into this more speculative index as have at any time over the past 6 months.

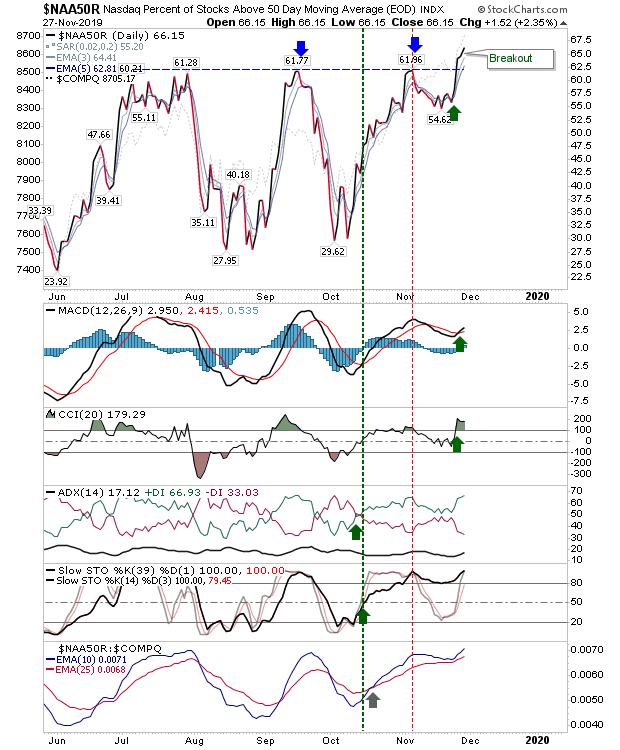

Meanwhile, breadth metrics for the NASDAQ have delivered a significant breakthrough with a new swing highs for the Percentage of Stocks above the 50-day MA.

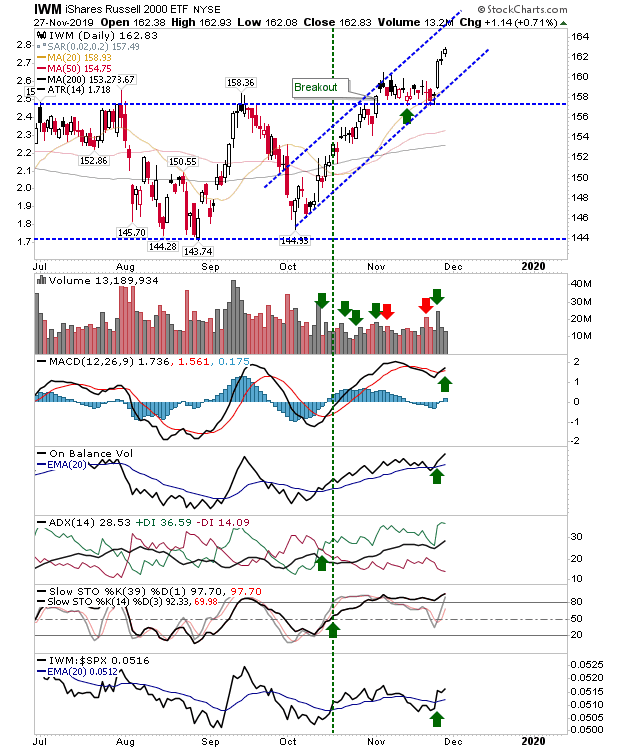

The Russell 2000 has managed to retain the big gain from Tuesday and is the index with the biggest relative gain; for secular (and cyclical) bulls this is a key advantage.

For Friday, the plan is clear and as long as there isn't a big sell off then bulls have little reason for pessimism; more gains would be welcome but a small loss would be tolerable.