- S&P 500 expected to remain stuck in a tighter range due to macroeconomic risks even as short-term volatility is likely to decrease

- In that scenario, stock picking is the best and safest way to score above-average profits in the coming months

- Applied Materials and Accenture could be market winners based on their financial health, undervaluation, and positive market trends

As the Fed approaches what is likely to be the final rate hike of this cycle, investors are increasingly wondering if the market will return to a similar pattern as the one seen in the aftermath of the COVID crash.

But while greater stability on the capital-cost side will most likely lead to lower short-term volatility, which is usually positive for markets, too many macroeconomic risks remain in place in order for markets to rally like there's no tomorrow.

As I wrote in early January, this conundrum suggests that the S&P 500 will most likely remain stuck in a tighter range that we have gotten used to in the last decade. And while recent data have indicated an (expected) improvement both from the inflation and the economic resilience sides, I still see 4,300-4,400 as a very strong resistance for the S&P 500 in the next few months.

The downside risk, however, has improved in my view. While earnings season is just about to give us further clues about the current state of American companies, only a very negative surprise would take us down below the 3,700-3,800 level.

In fact, given that the market is already expecting an earnings recession (i.e., two straight quarters of negative earnings growth for the S&P 500), I wouldn't be surprised if the general picture ended up being better than expected once again, which, should, in turn, do just enough to keep prices stable in the short term.

As we noted in December and January (that is, before the SVB debacle), the joker on the deck is the banking sector, particularly smaller and regional U.S. banks. Despite the situation being perceived as stable by the general market, the lag effect of higher volatility in the bond market could still be a problem once the Fed's Bank Term Funding Program (BTFP) runs out. On the positive side, though, recent data indicates that banks borrowing from the BTFP is easing week by week. Still, investors that want to assess the market direction should keep a close eye on the sector's situation.

Against this backdrop, I see two ways to score above-average profits in the next few months:

- Active index trading (risky). Those looking to beat the market could take advantage of the strong support and resistance levels cited above, as well as moving averages, and trade both sides of the market accordingly. I advise traders that take such a route to hedge their positions according to their active assessment of the general macro risks (i.e., never position yourself 100% bullish or 100% bearish. Instead, do anywhere between 90%-10% to 60%-40%).

- Stock Picking (less risky). While the general market appears likely to remain within range, the same does not apply to individual stocks. Therefore, investors looking to beat the market should keep a close watch on the fundamental aspects of companies and make their decisions accordingly. InvestingPro is currently the best tool in the market for that, as it gives you all the information you need to make better and well-funded decisions that are very likely to beat the market in the upcoming months.

Based on InvestingPro data, here are two stocks that I have acquired recently and that I believe to be market winners for this year:

1. Applied Materials

After tanking nearly 35% last year (via the sector's leading ETF, SMH), semiconductors have rebounded sharply this year, up nearly 25% YTD. There are a few reasons for that, but the main ones are the broad tech resurgence, as investors look favorably to stocks that were unfairly punished during last year's selloff, the reopening of the Chinese economy, and the lowering expectations regarding the depth of a probable global recession later this year.

Furthermore, as China doubles down on its threats of invading Taiwan — one of the world's largest producers of semiconductors — investors are progressively flocking to U.S.-based competitors. Such was the argument made by Warren Buffett when selling Taiwan-based Taiwan Semiconductor Manufacturing (NYSE:TSM) last week.

Against this backdrop, Santa Clara, California-based Applied Materials (NASDAQ:AMAT) is an excellent option. The leading provider of manufacturing equipment, services, and software for the semiconductor industry, as well as display and related industries, has several reasons that should propel its stock higher in the mid-term, according to InvestingPro. Such as:

- Management has been aggressively buying back shares

- Cash flows can sufficiently cover interest payments

- Large price uptick over the last six months

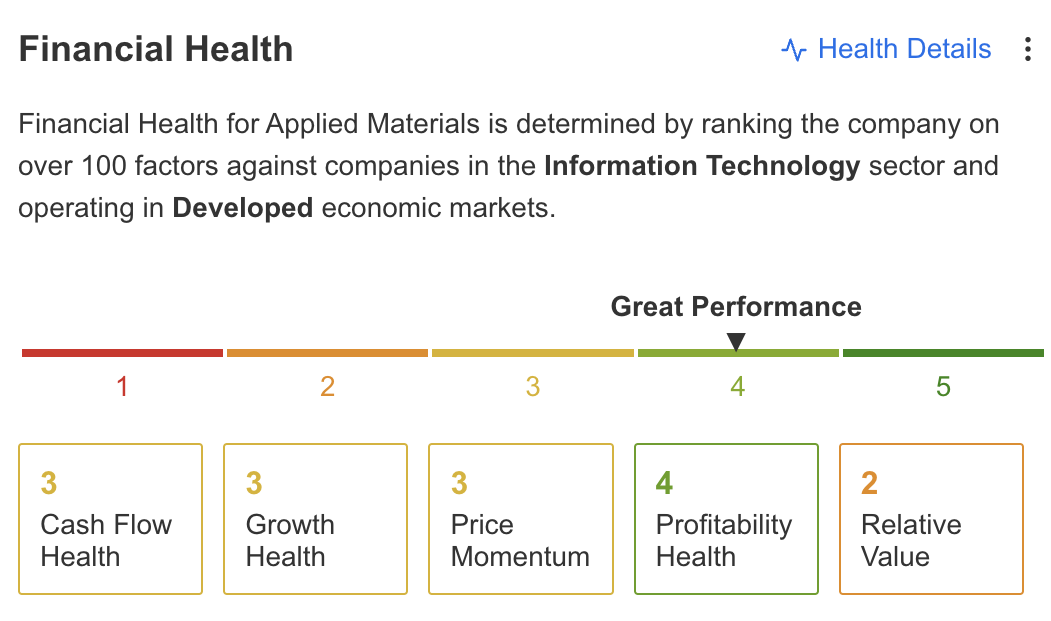

AMAT also has a great financial health score, according to InvestingPro.

Source: InvestingPro

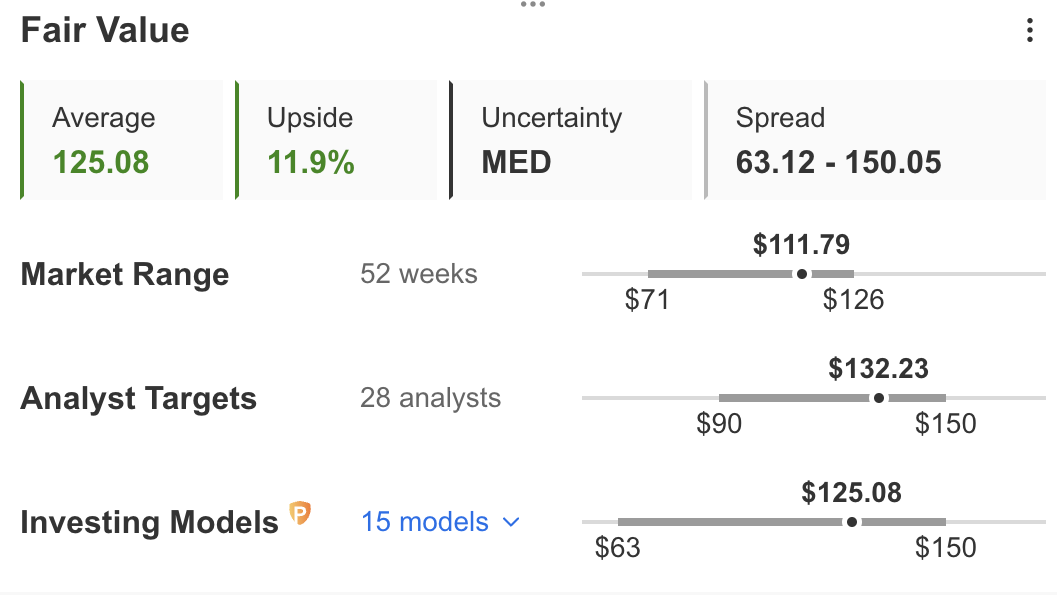

The company, which operates through three segments - Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets - is also significantly undervalued according to the quantitative models in InvestingPro and could see an upside of roughly 12% over the next 12 months to its fair value of $125.08/share.

Source: InvestingPro

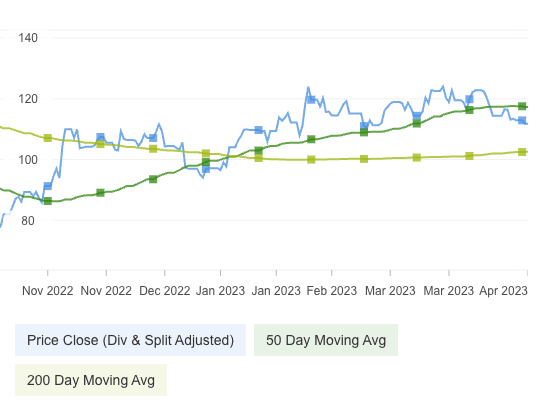

On the technical side, AMAT is still trading below its 50-day Moving Average, and a breakout above would most likely send the stock soaring.

Source: InvestingPro

The company will report earnings one month from now, on May 18, so it's likely to keep up the good performance, at least until then.

2. Accenture

While I don't see Accenture (NYSE:ACN) as the new Tesla (NASDAQ:TSLA) (at least not in the short term), the Dublin, Ireland-based professional services and HR company has everything it takes to safely outperform the market for the next few months.

On top of the current market trend pointing to a resurgence in growth stocks as inflation ticks progressively lower, the still resilient U.S. labor market is also a major tailwind for Accenture, keeping demand for the company's services significantly high.

That's the main reason why — contrary to the general U.S. stock market — Accenture is expected to post solid earnings growth when it reports financial results in June. While analysts have reduced the company's earnings expectations by 7% over the last 12 months, ACN's EPS is still expected to come in at 2.98 — significantly higher than last quarter's 2.39.

Source: InvestingPro

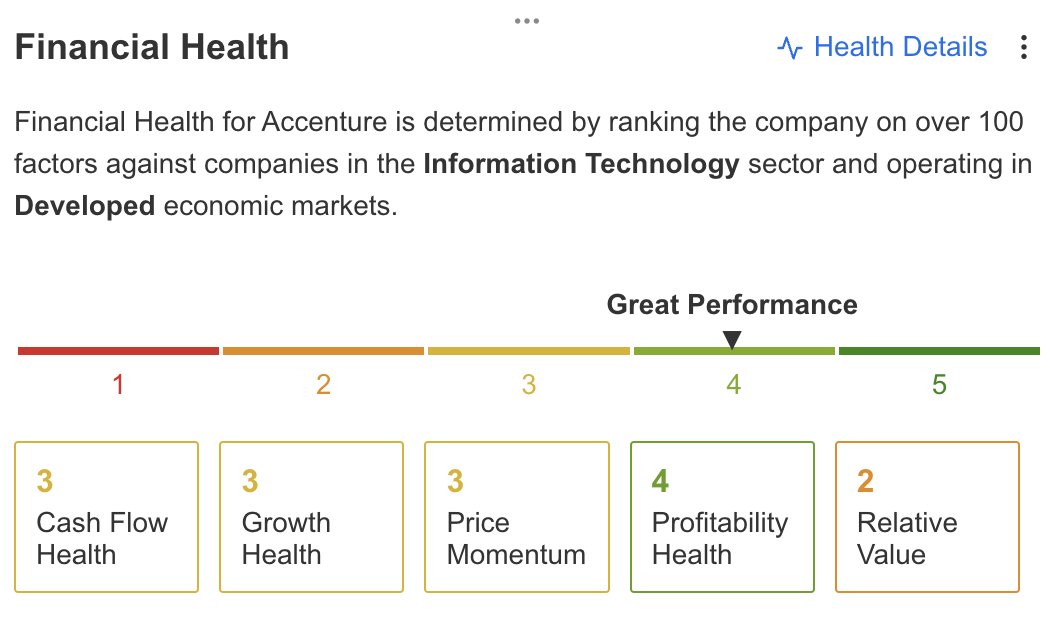

That's also why ACN has an excellent Financial Health Score, according to InvestingPro.

Source: InvestingPro

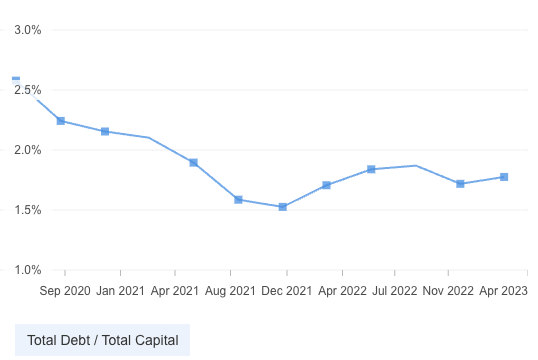

Furthermore, the company's solid balance sheet puts it in a perfect position to ride the AI trend without being overly exposed to larger sector risks, such as higher capital costs, as its cash flows can sufficiently cover interest payments. As InvestingPro graphically shows, Accenture's debt and financial leverage are still at solid levels (below 2%), making the company more resilient than its peers when faced with a challenging macro scenario.

Source: InvestingPro

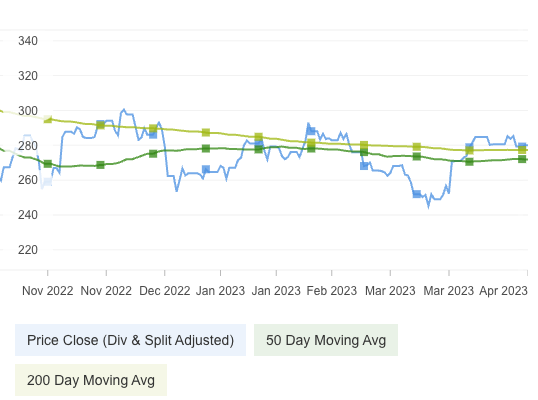

On the technical side, ACN is trading just above its 50-day Moving Average. A brief move below that level could signal a buying opportunity, so watch out for the $275-$270 levels.

Source: InvestingPro

Disclosure: I'm long on both stocks cited in this article and hold a few short positions in the Nasdaq Composite to hedge volatility risks.