S&P 500 (SPY)

It was an uneventful day on December 24, most certainly not like the one last year. I went back and read my blog post from that day, and times have changed, and the markets appear to be in precisely the opposite position.

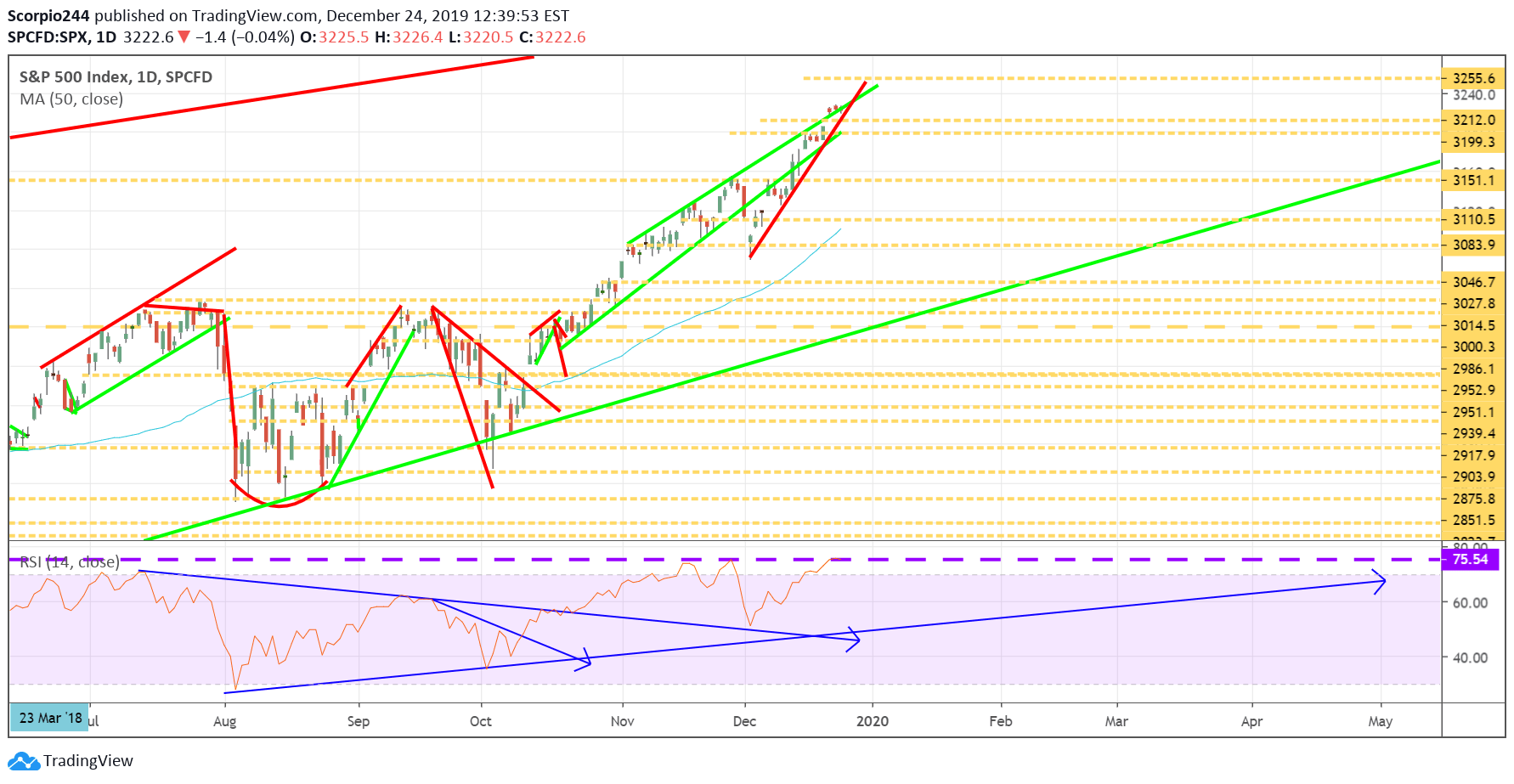

But that doesn’t mean we will continue to rise in a straight line, and signs are forming, which suggests we could be ready to see a minor pullback of perhaps 2% over the final four days of the year.

The RSI on the S&P 500 is overbought at 75.5 again, and that number needs to come down some. Based on the trends in the RSI, I would think back to around 60.

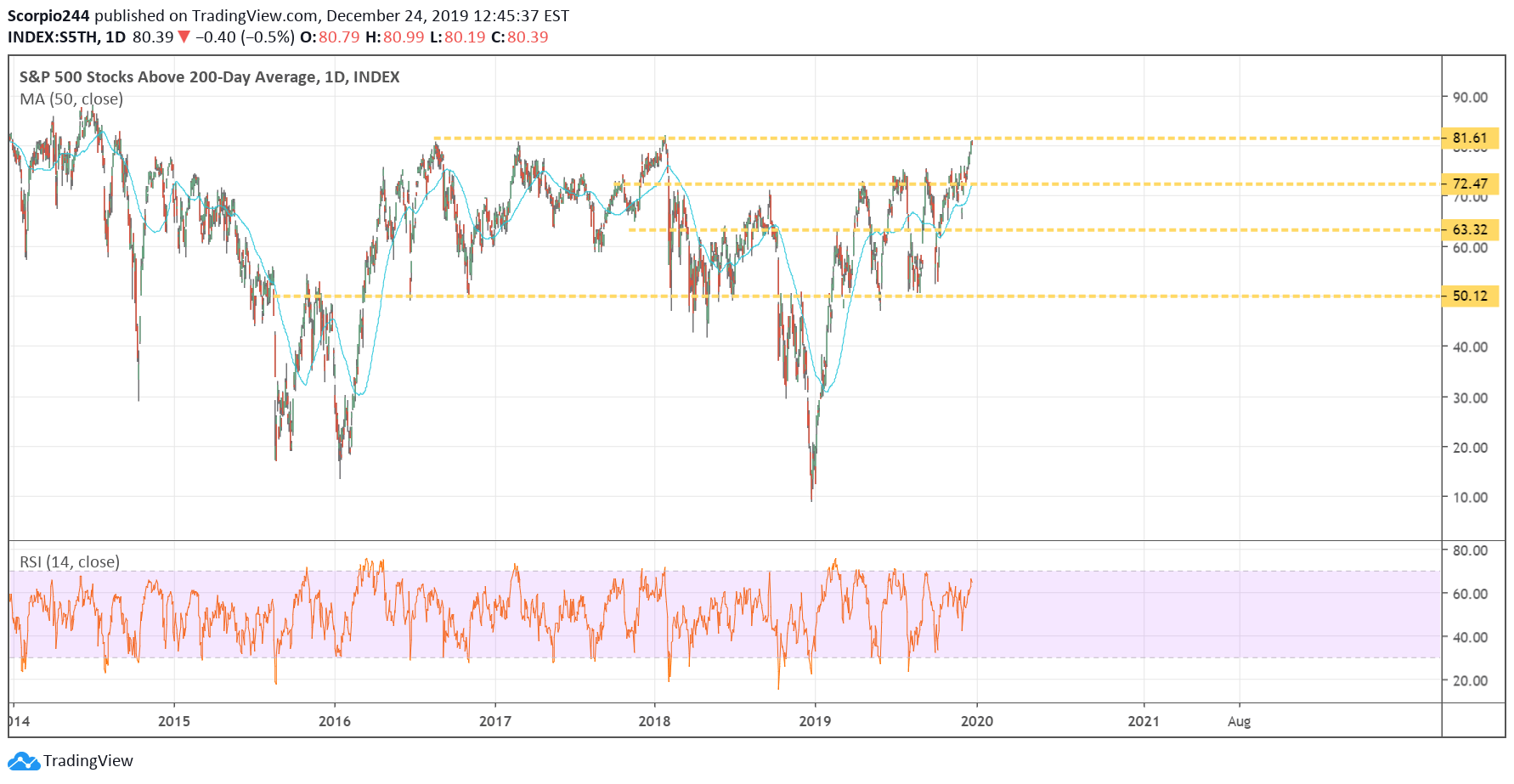

200-Day Moving Average

Meanwhile, the number of stocks in the S&P 500 trading above their 200-day moving average is at 81%, and that is the highest it has been since January 2018. Another sign of how far this market has come over a short period.

Additionally, the prior times the level got this high was in late August 2016 and March 2017. Both periods saw declines of about 3-5% that followed.

It suggest a pullback to around 3,175 to 3,200

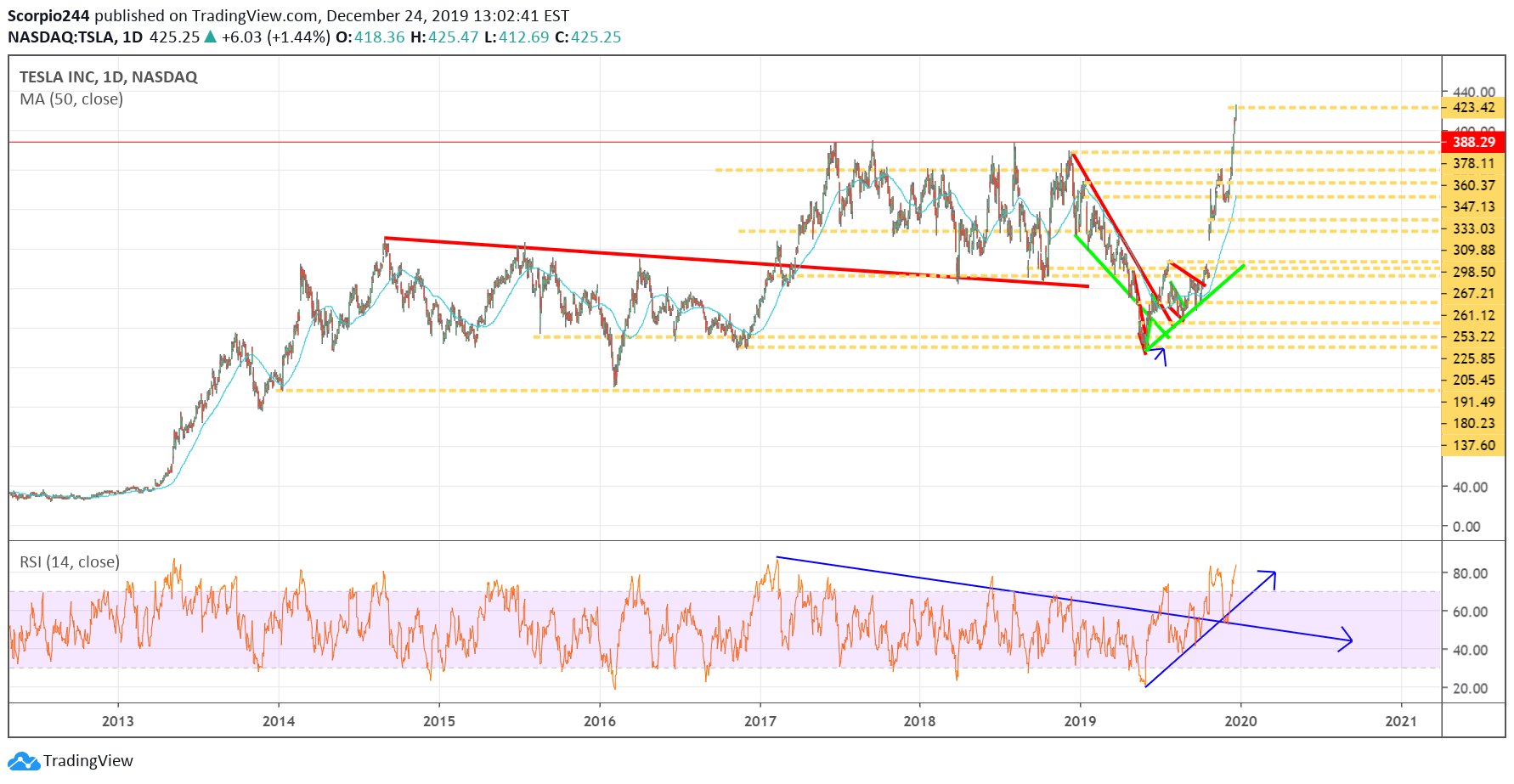

Tesla (TSLA)

Tesla (NASDAQ:TSLA) continues to rise, and at this point, logic would suggest the stock is getting overbought. But with Tesla, nothing is easy, and deciding if the stock can rise further is not easy. There have been no “leaked” emails yet about production and deliveries, either to consider.

The stock did something similar starting in December 2016 into June 201717. I have to think further on what happens from here regarding Tesla). I’m just not sure at this point.

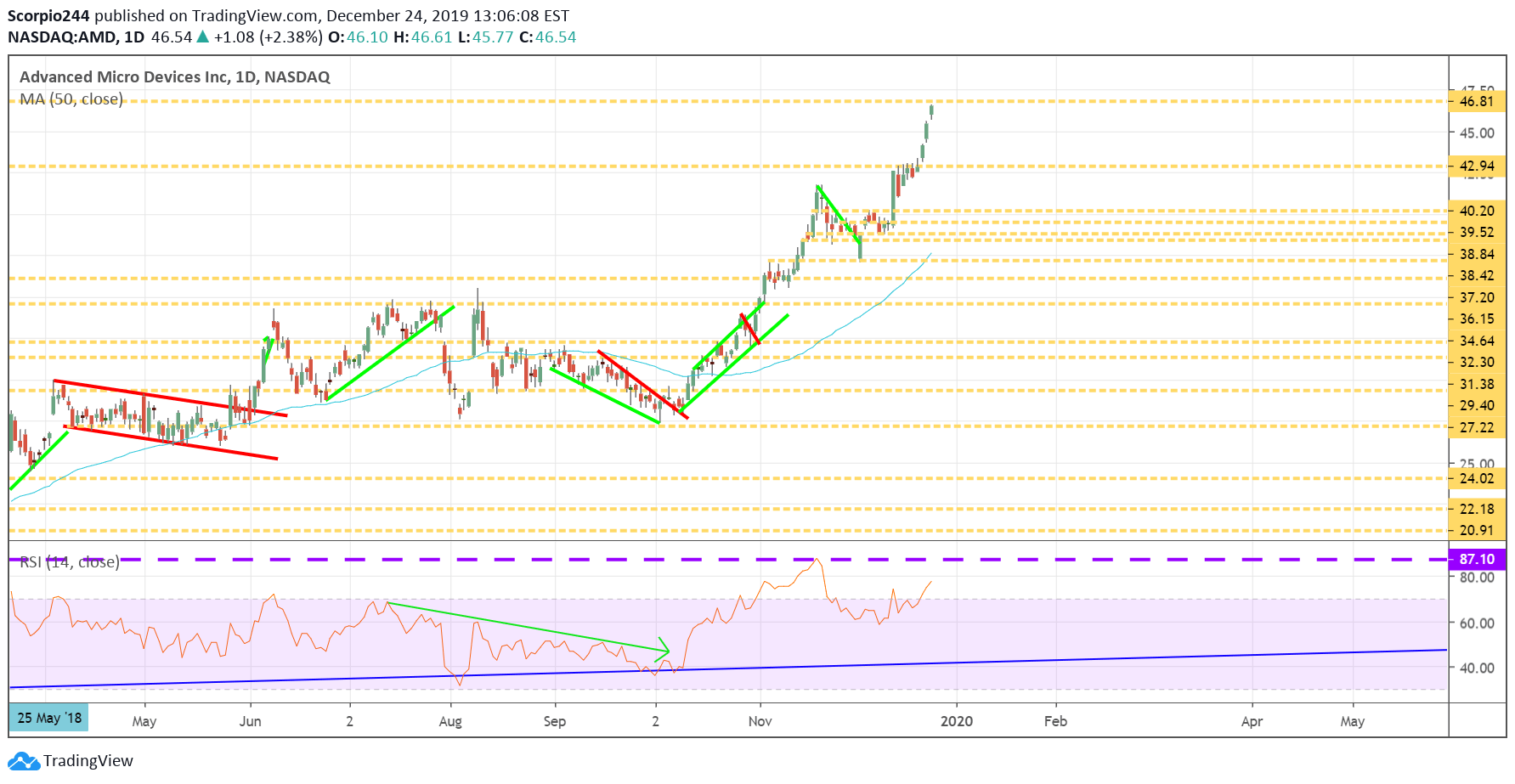

AMD (AMD)

Advanced Micro Devices (NASDAQ:AMD) also got up to our target of $46.80. This is also a stock that is due to pull back now, maybe back to $43. We can see the RSI failed to make a new, despite the price hitting a new high, a bearish divergence.

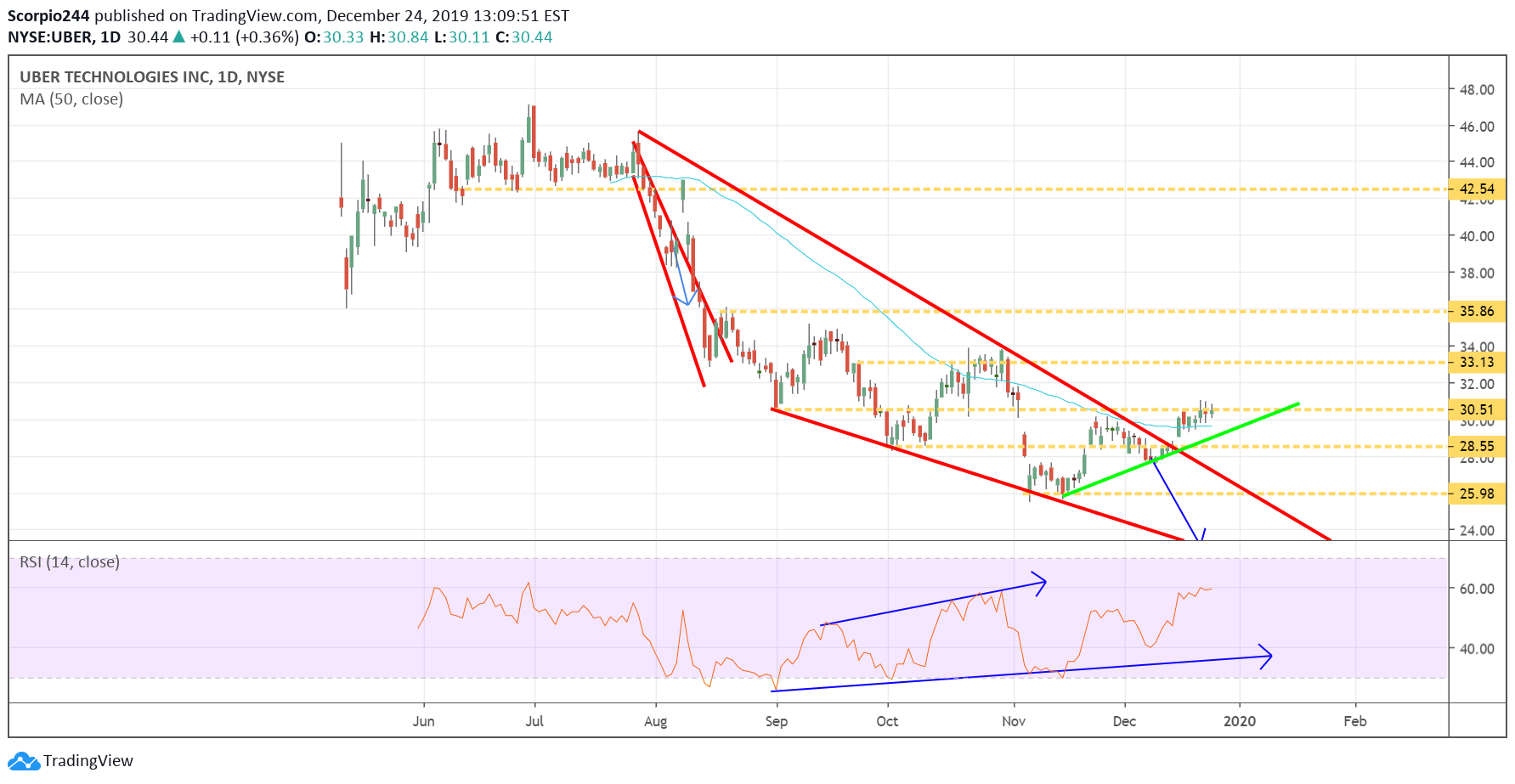

Uber (UBER)

It appears Uber (NYSE:UBER) may be setting up to take it’s next leg up to $33.13.

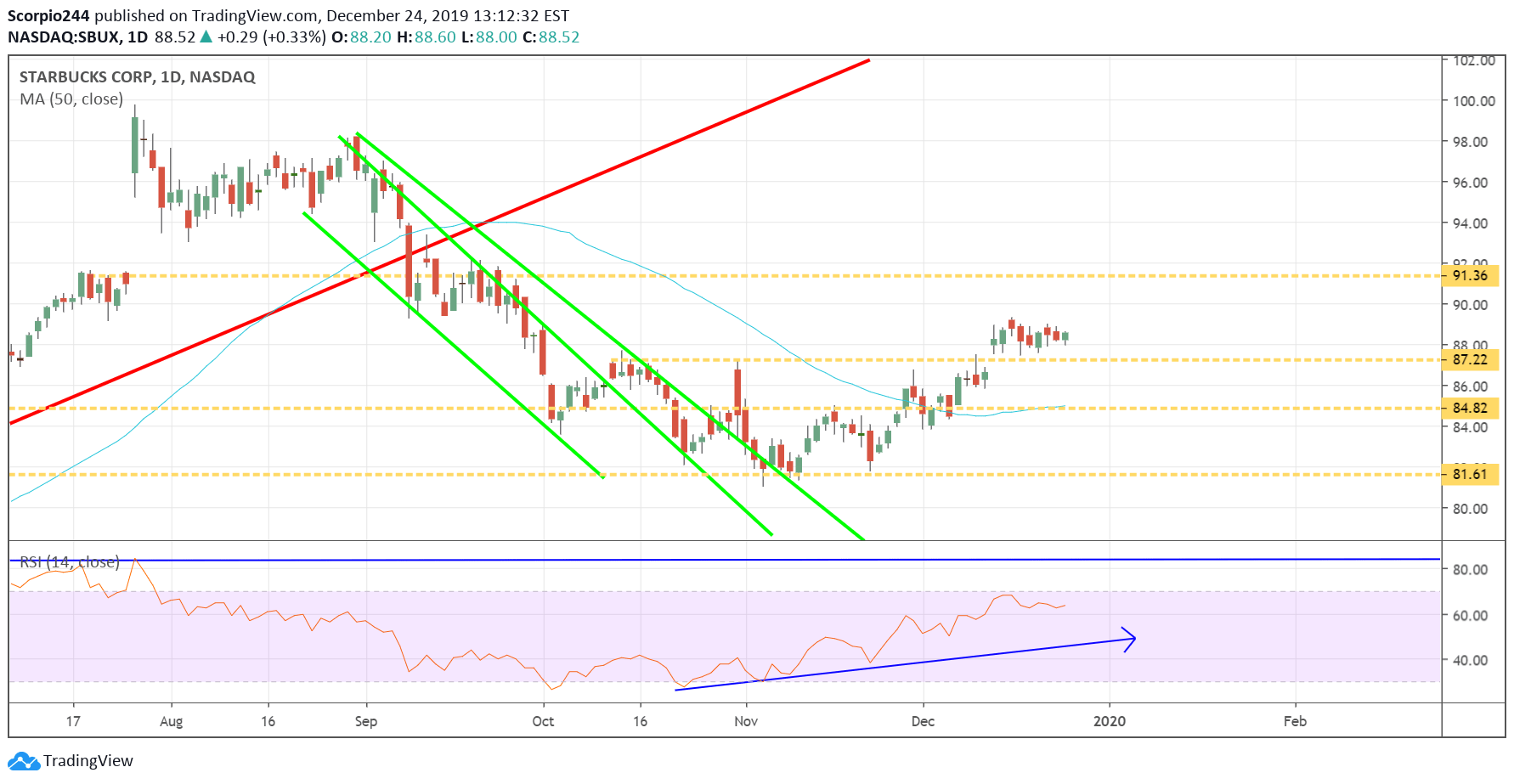

Starbucks (SBUX)

Starbucks (NASDAQ:SBUX) appears to be getting ready to move higher towards $91.35

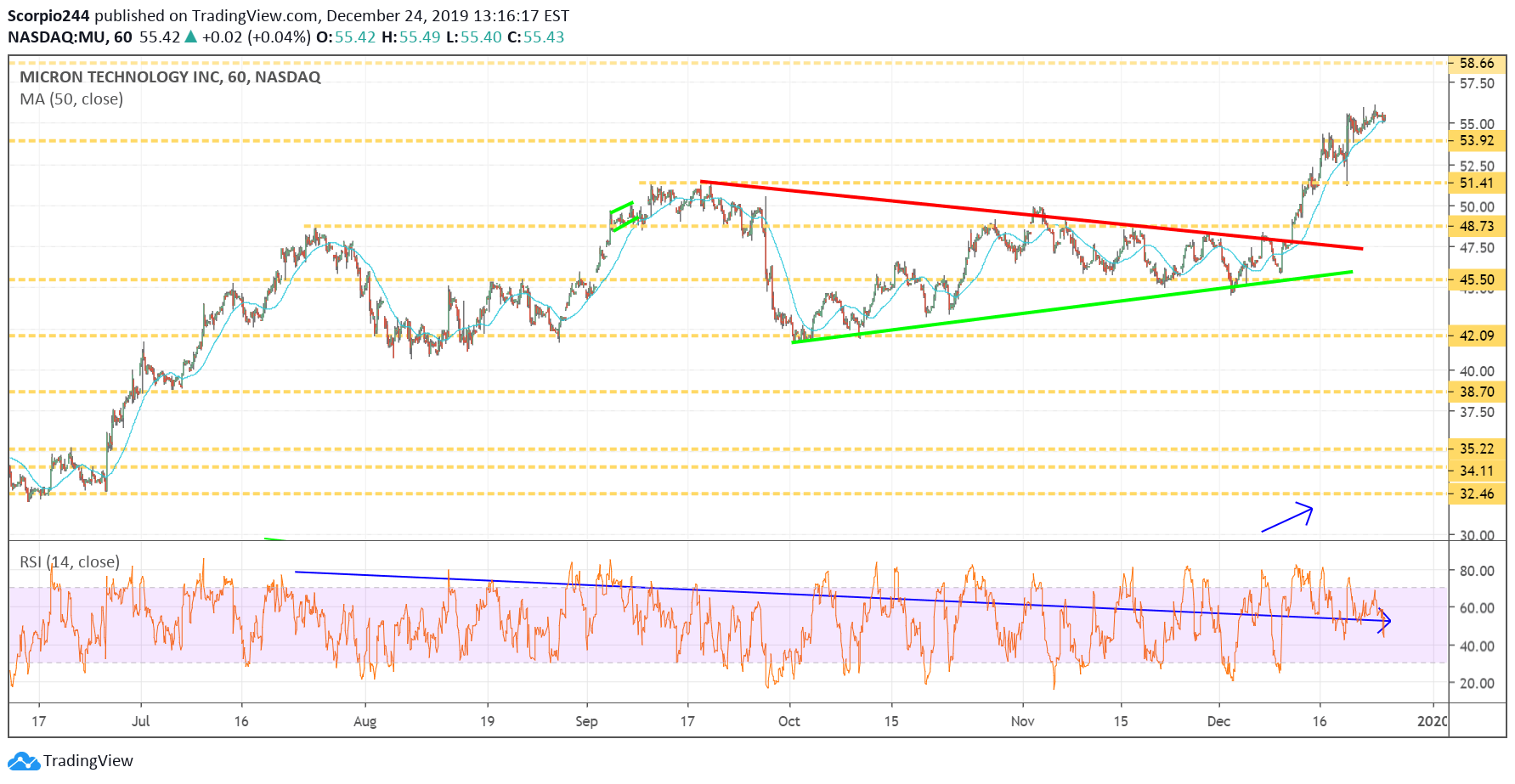

Micron (MU)

Micron (NASDAQ:MU) may be heading to around $58.