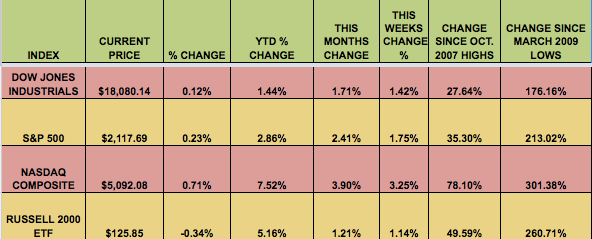

Markets:

The market gained solidly this past week, with the NASDAQ and the S&P hitting all-time highs. The NASDAQ had its biggest weekly gain since October 2014, helped by better than expected earnings reports.

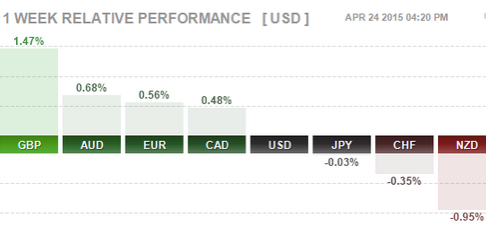

The US dollar had a mixed week, and fell vs. major currencies, except for the yen, Swiss franc, and New Zealand dollar:

Better Market Breadth: This week, 21 out of 30 DOW stocks rose, vs. 6 last week. 69% of the S&P 500 rose, vs. 26% last week.

US Economic News:

- Existing Home Sales jumped to 5.19M annualized, best since 2013

- New Home Sales fell to 481K, much lower than 520K forecast

- Durable Goods Ex-transport fell -.4%, vs prior -1.3%, but lower than 0.5% gain forecast

- Initial Claims rose 1K to 295K

- Continuing Claims rose 50K to 2325K

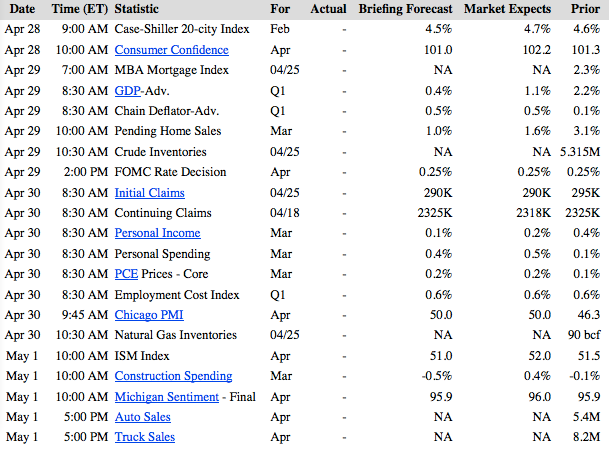

Week Ahead Highlights: Healthcare stocks will be in focus, with many top companies reporting first-quarter earnings, including Bristol-Myers Squibb Company (NYSE:BMY), Boston Scientific Corp (NYSE:BSX) , Merck & Co. (NYSE:MRK), Pfizer Inc (NYSE:PFE), Gilead Sciences Inc (NASDAQ:GILD) and Celgene Corp (NASDAQ:CELG). Apple (NASDAQ:AAPL) reports on Monday after the close…the Fed will issue a statement on Wednesday, after its 2-day meeting…Q1 GDP figures will also be issued on 4/29, and may move markets.

Next Week’s US Economic Reports:

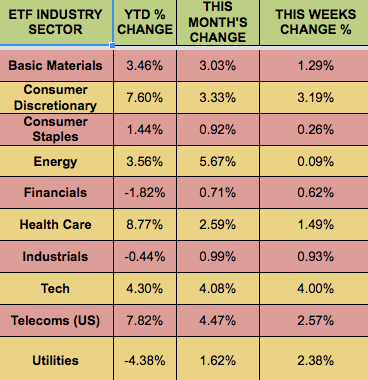

Sectors and Commodities:

Tech led this past week, led by Microsoft (NASDAQ:MSFT)’s post-earnings surge:

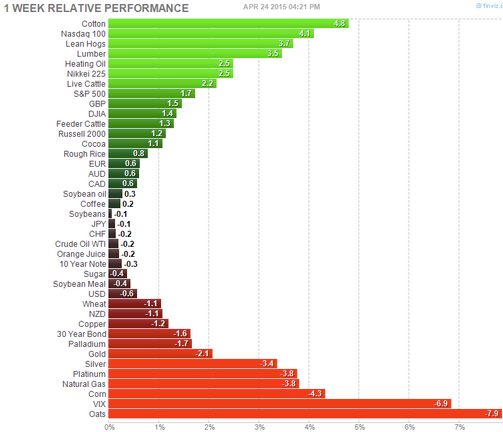

Cottonand Lumber futures gained this week, while WTI Crude had a slight loss:

Disclaimer: This article is written for informational purposes only, and isn’t intended as investment advice.

Disclosure: Author owned shares of CCLP at the time this article was published.