It was a pretty crazy day of trading on Friday (Mar.5), with the S&P 500 jumping by 2% after plunging more than 1% to start the day. Friday was more about volatility levels imploding and short-covering than I think a real rally driven by true buying.

But the NASDAQ was where most of the action was, and we can see that Qs hit support at $297 and managed to bounce nicely off it, rising back to resistance around $310.

It seems entirely possible that the NASDAQ will continue the strength seen Friday, rising back to the downtrend around $316, or perhaps even to $319.50. I’m not sure that changes much though over the next couple of weeks. The November and March uptrends are broken on the Qs, and that is not ideally what one wants to see. It seems that any rallies are likely to be still sold, and the trend is still lower for now.

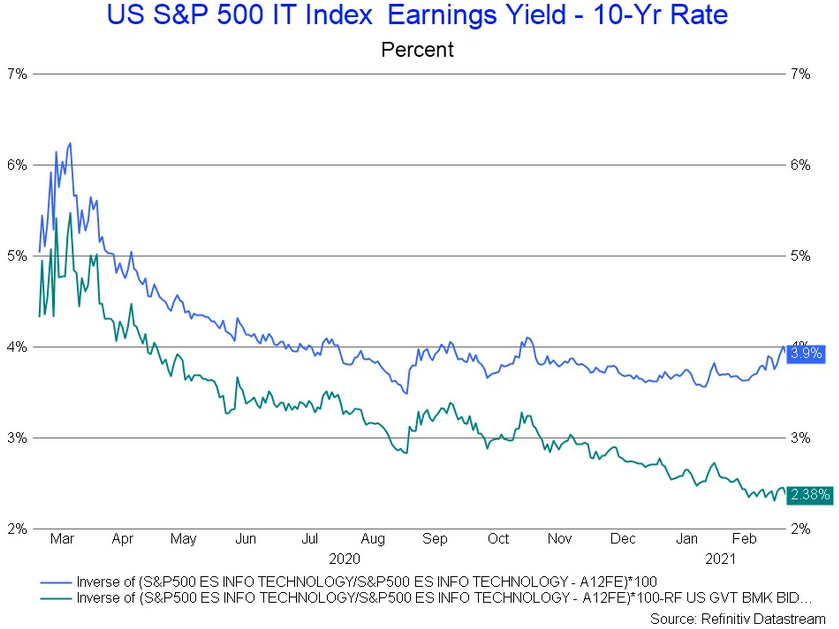

Additionally, despite the rough drawdown in technology, the sector made no headway against the 10-year Treasury. The S&P 500 IT sector’s earnings yield rose this week to 3.9%, but the premium over the 10-year remained around 2.40%.

Yields stalled out on Friday around 1.6%, and they were really getting overbought here. Could they go higher? Yes, much higher. A pullback to 1.5% or even 1.3% isn’t out of the realm of possibility. It could even help provide the equity market a boost, as I mentioned above.

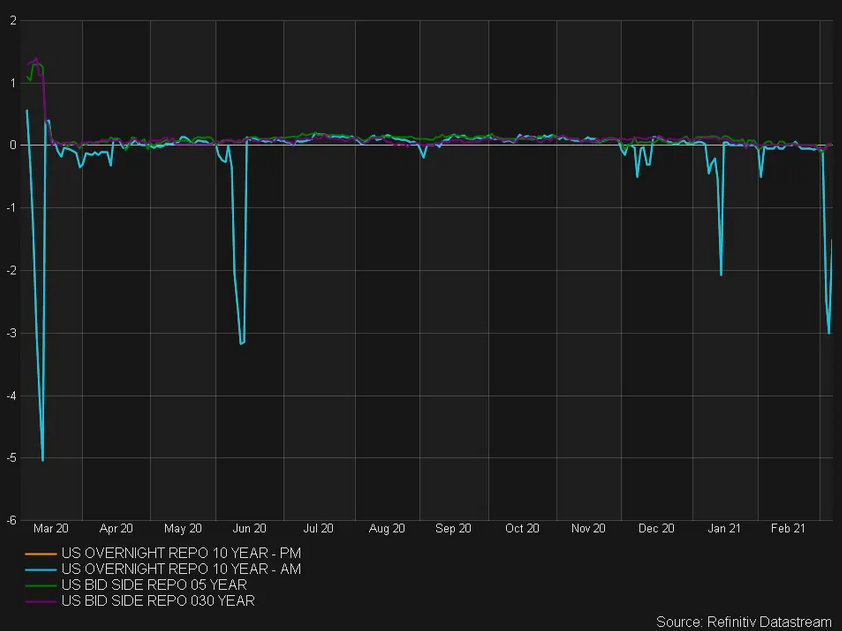

But there are still plenty of people looking to short the 10-year, with Thursday's overnight repo rate negative. It is telling us a lot of people are looking to borrow the 10-year to go short. So that means for now, the pain trade likely means yields move higher.

Anyway, more after the weekend.