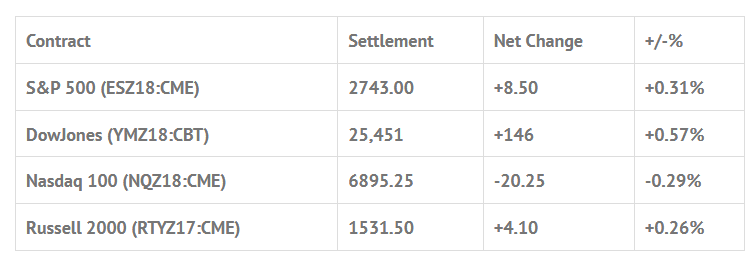

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed higher: Shanghai Comp +0.91%, Hang Seng +0.72%, Nikkei +0.65%

- In Europe 9 out of 13 markets are trading higher: CAC +0.09%, DAX -0.03%, FTSE +0.70%

- Fair Value: S&P +1.04, NASDAQ +9.23, Dow -6.87

- Total Volume: 1.86mil ESZ & 970 SPZ traded in the pit

As of 8:00 AM EST

Today’s Economic Calendar:

Today’s economic calendar includes John Williams (NYSE:WMB) Speaks 9:40 AM ET, Housing Market Index 10:00 AM ET, E-Commerce Retail Sales 10:00 AM ET, and John Williams Speaks 10:45 AM ET and 3:15 PM ET.

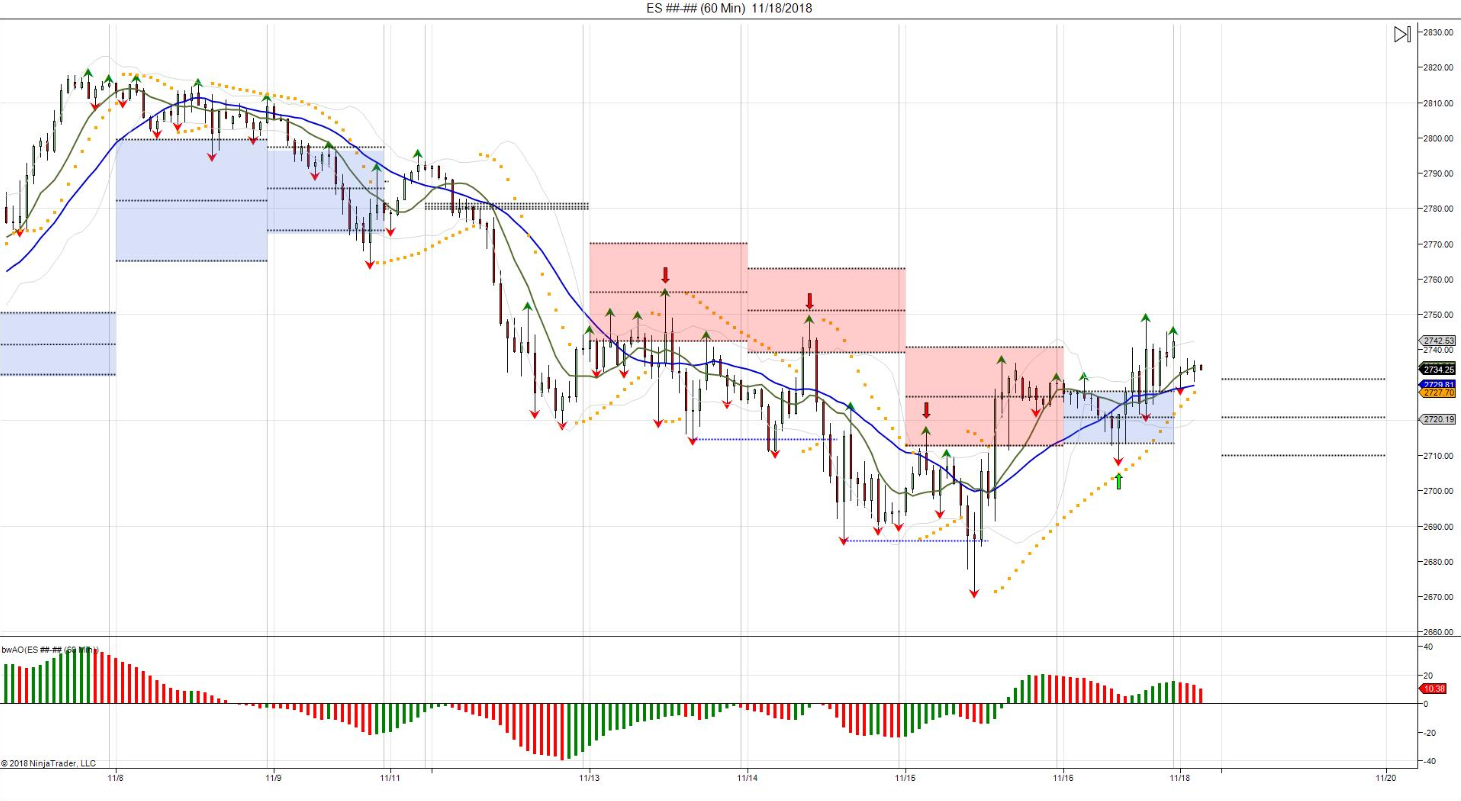

S&P 500 Futures: Volatility Surge Continues

Chart courtesy of @Chicagostock

– $ES_F Rejected its 3D pivot everyday last week, except for Friday, holding above to force shorts to cover into the weekend. Headfake? or change in momentum? Keep eye for possible headfake as Monday’s pivots below where buyers forced to defend. Failure =opp to retest Thurs trap.

With increased volatility, stocks posted another losing week. After popping up on Thursday afternoon, the S&P 500 futures gapped lower on Globex, and traded down to 2708.75 early Friday morning. The first print off the 8:30 futures open was 2720.50. From there, the ES rallied a few handles, up to 2722.25, sold off down to 2713.00 seven minutes after the open, and by 9:40 am had traded up to 2740.50, up 6.00 handles on the day.

Like all the recent trading days, the ES quickly sold back off below the vwap, made two separate lows at 2721.50 and 2721.25 at 11:00, and 18 minutes later made a new high at 2749.00. After the high the ES lost its footing, as the Nasdaq weakened, and traded down below the vwap at 2724.25. Finally, the futures did a little ‘back and fill’ before trading up to a lower high at 2745.00, and then broke back down to 2735.25. The last move was a pop back up to 2745.00 to close out the week.

In the end Friday capped off another very volatile week for the S&P 500 futures. In terms of the markets overall tone, it seemed like things improved. In terms of the days overall trade, volume was lower, but pretty much in line with the recent surge in volatility.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.