**NEW** As part of the ongoing process to offer new and up-to-date information regarding seasonal and technical investing, we are adding a section to the daily reports that details the stocks that are entering their period of seasonal strength, based on average historical start dates. Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

-

No stocks identified for today

The Markets

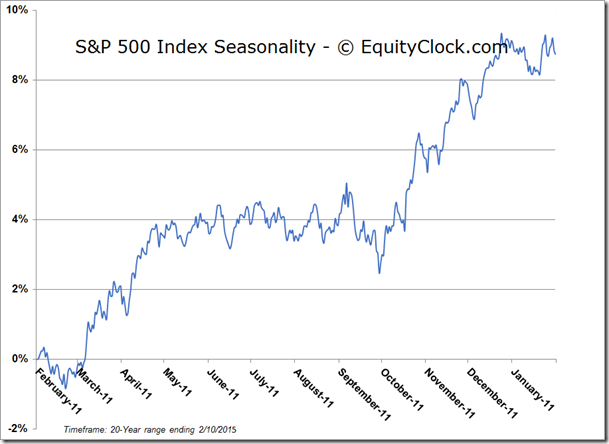

Stocks ended higher on Tuesday in hopes that Greece would strike a deal with its creditors, thereby averting a crisis that could roil equity markets around the globe. The Greece ETF Global X FTSE Greece 20 (NYSE:GREK) jumped 7.62%, neutralizing the loss recorded during Monday’s session as investors place bets ahead of the country’s meeting with creditors on Wednesday. Despite the uncertainty that remains regarding the fate of Greece, investors in the US didn’t hold back, pushing major benchmarks through short-term resistance. The S&P 500 Index closed above the upper limit of its short-term range at 2064, increasing the probability of another run towards the all-time high of 2093.55. Similar breakouts were recorded on the NASDAQ Composite and NYSE Composite. Seasonally, we are reaching the time of year when investors have fully digested earnings, leaving stocks free to trade higher based on the uptick in economic activity into the spring months; once overhanging macroeconomic issues, such as Greece, are resolved, equities have the momentum behind them for a move higher.

Meanwhile, jumping ahead, this coming Monday is Presidents’ Day in the US, which will close equity markets in both New York and Toronto (Family Day holiday in Ontario), giving investors a three-day weekend. While investors may be looking forward to the event, they may not be too excited about the equity market tendencies ahead of the long weekend. On the Friday before Presidents’ Day, the S&P 500 Index has traded lower 72% of the time since 1990. Average loss during this session is 0.39%. The loss can be attributed to investors limiting their exposure to stocks ahead of the holiday, thereby reducing the risk of showing up on Tuesday to a negative lead from markets overseas. Something to be mindful of in the days ahead.

| Presidents’ Day | S&P 500 Index return during the Friday prior to the holiday |

| 2/17/14 | 0.48% |

| 2/18/13 | -0.10% |

| 2/20/12 | 0.23% |

| 2/21/11 | 0.19% |

| 2/15/10 | -0.27% |

| 2/16/09 | -1.00% |

| 2/18/08 | 0.08% |

| 2/19/07 | -0.09% |

| 2/20/06 | -0.17% |

| 2/21/05 | 0.07% |

| 2/16/04 | -0.55% |

| 2/17/03 | 2.14% |

| 2/18/02 | -1.10% |

| 2/19/01 | -1.89% |

| 2/21/00 | -3.04% |

| 2/15/99 | -1.91% |

| 2/16/98 | -0.40% |

| 2/17/97 | -0.41% |

| 2/19/96 | -0.51% |

| 2/20/95 | -0.67% |

| 2/21/94 | -0.56% |

| 2/15/93 | -0.69% |

| 2/17/92 | -0.29% |

| 2/18/91 | 1.33% |

| 2/19/90 | -0.65% |

| Average | -0.39% |

| Loss Frequency | 72.00% |

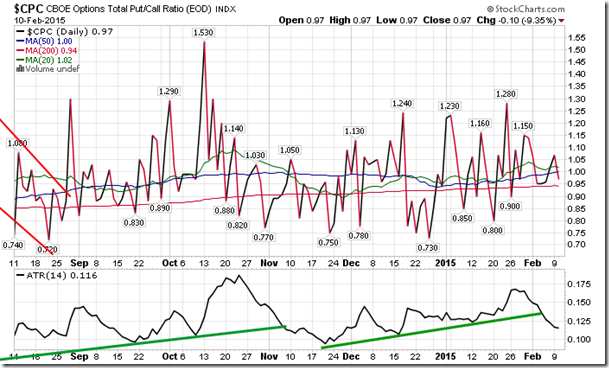

Sentiment on Tuesday, as gauged by the put-call ratio, ended close to neutral at 0.97.

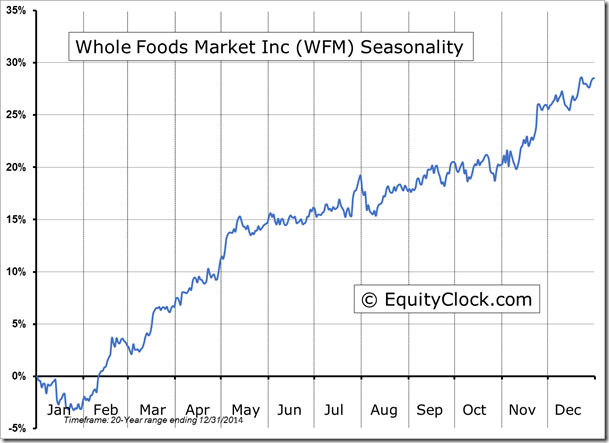

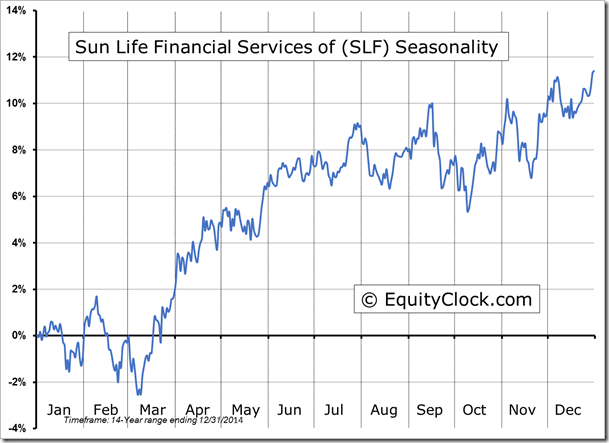

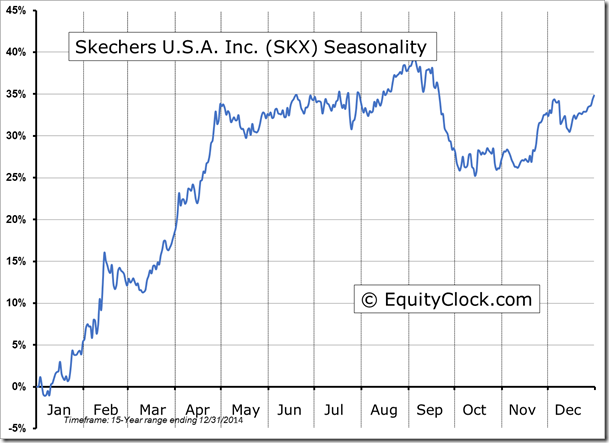

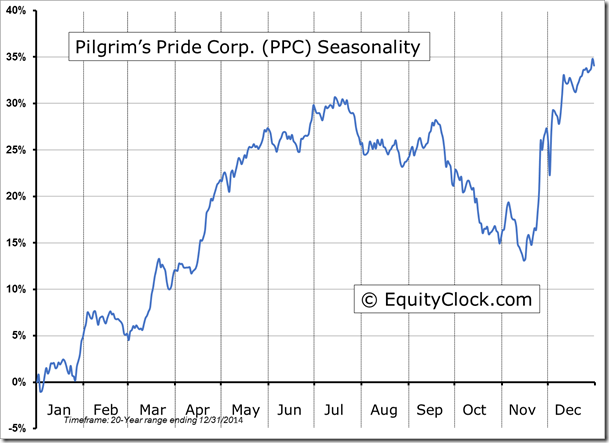

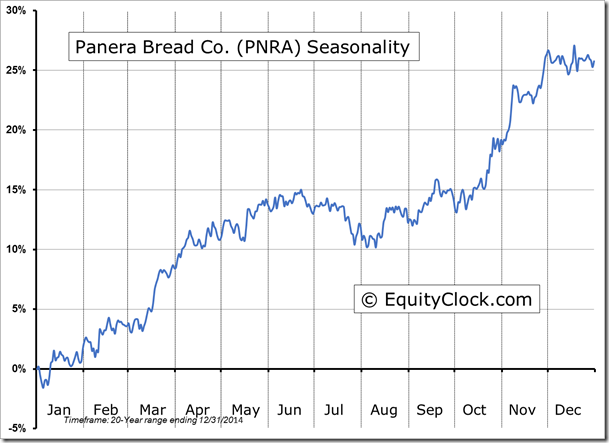

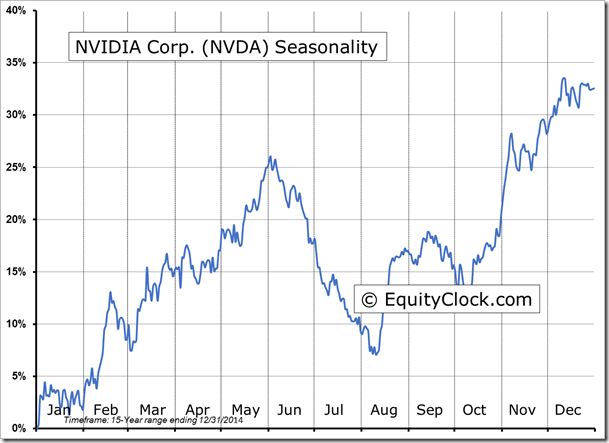

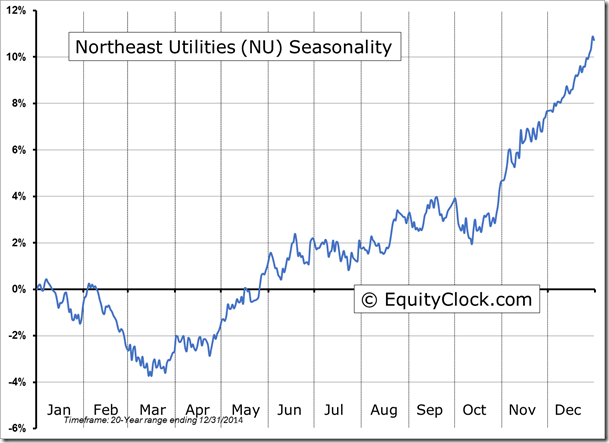

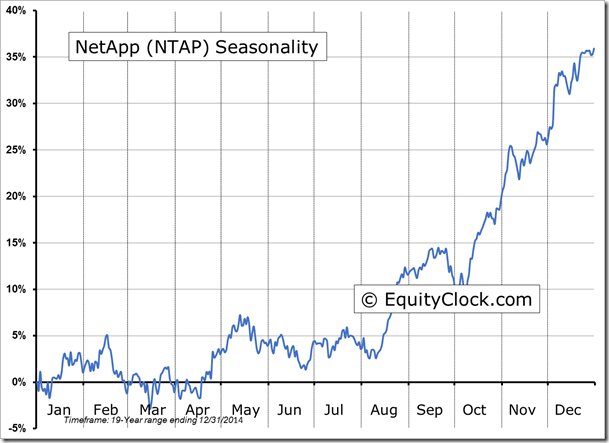

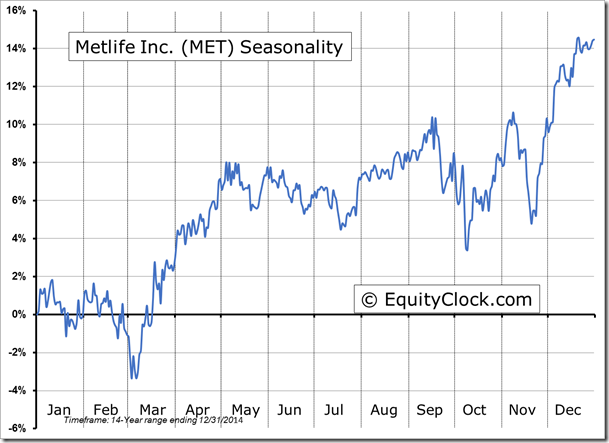

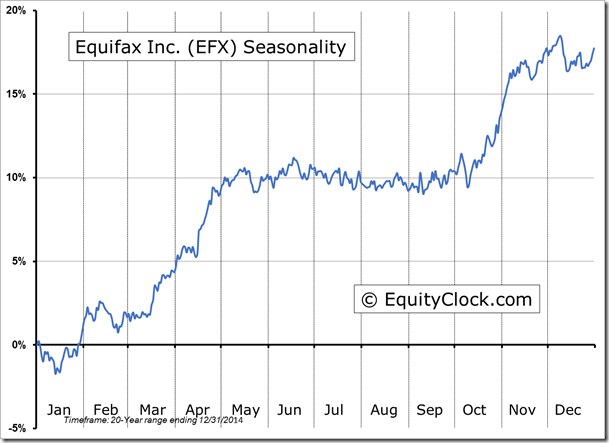

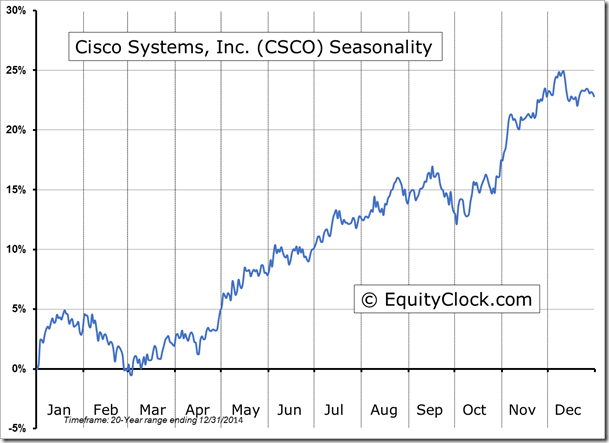

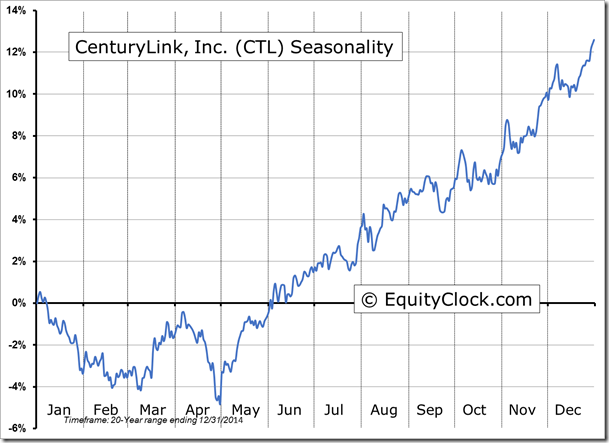

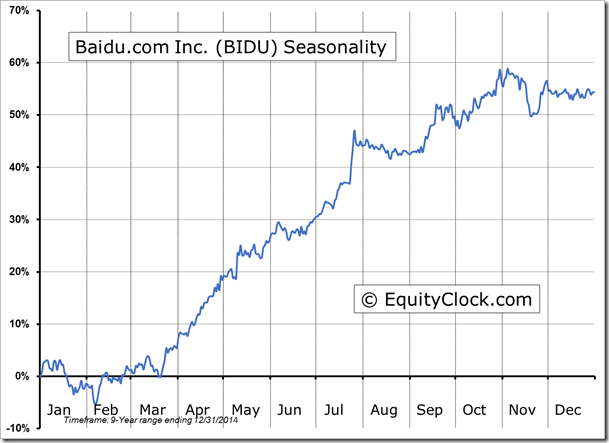

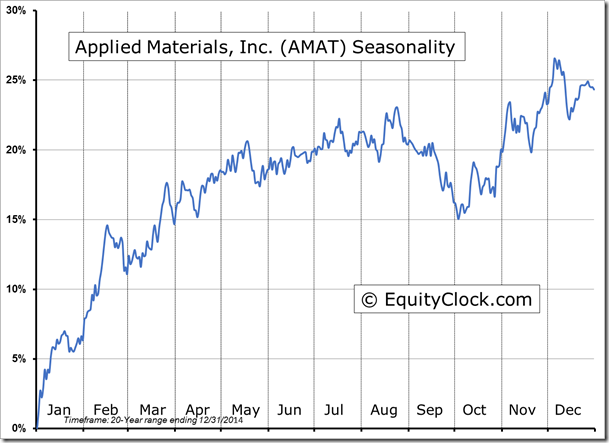

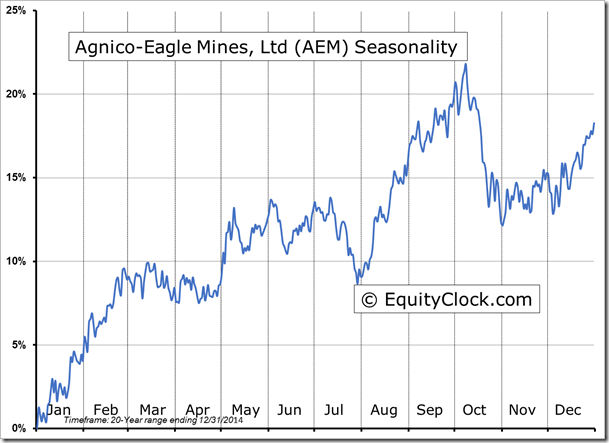

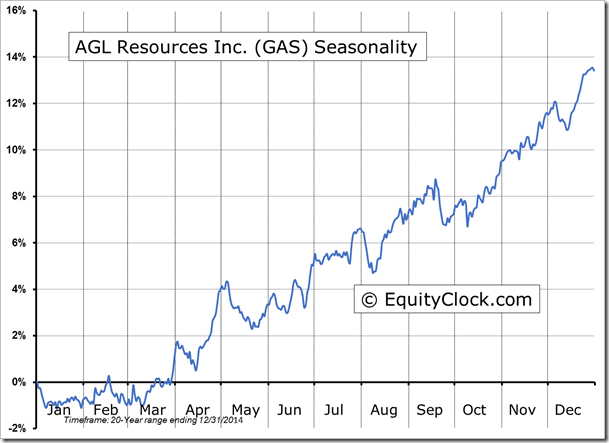

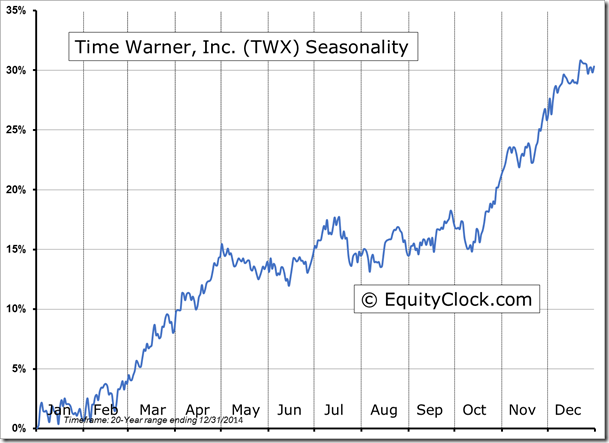

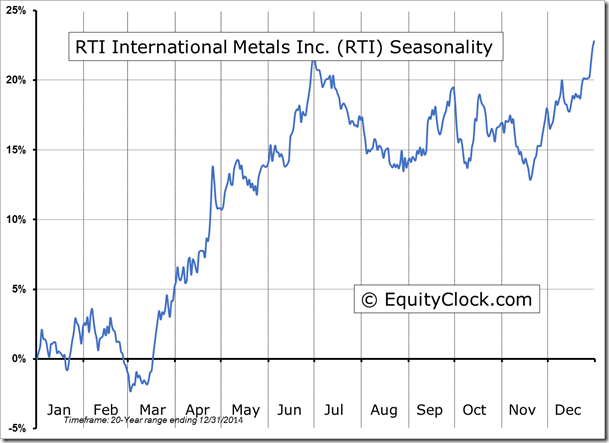

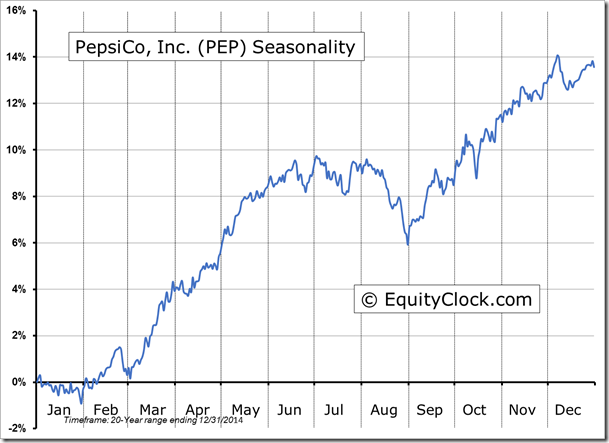

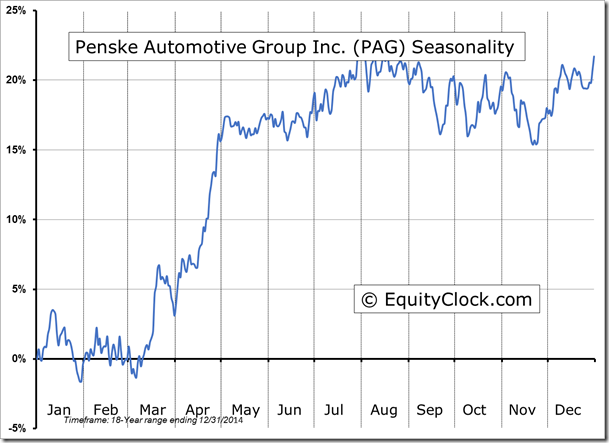

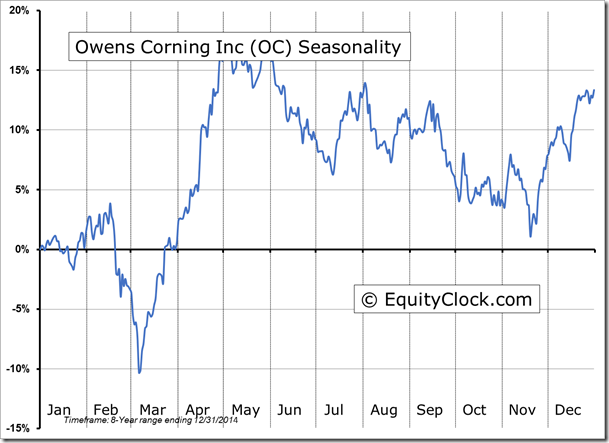

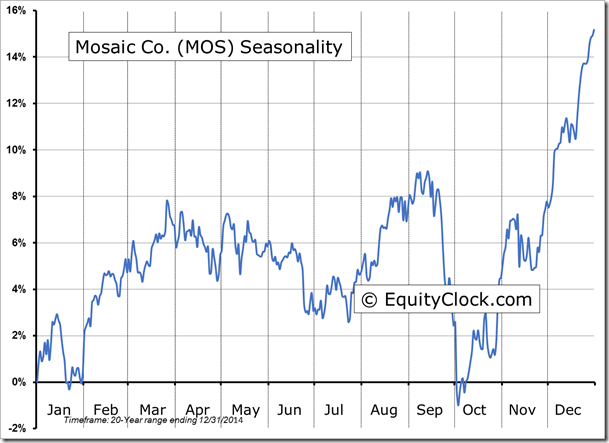

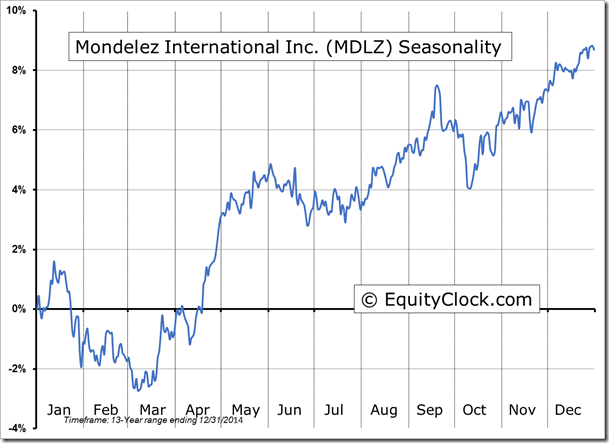

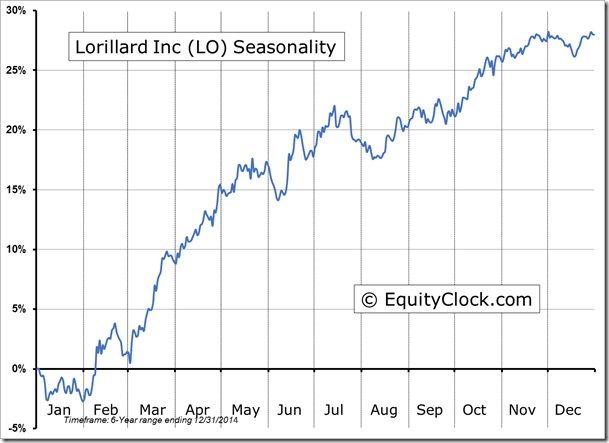

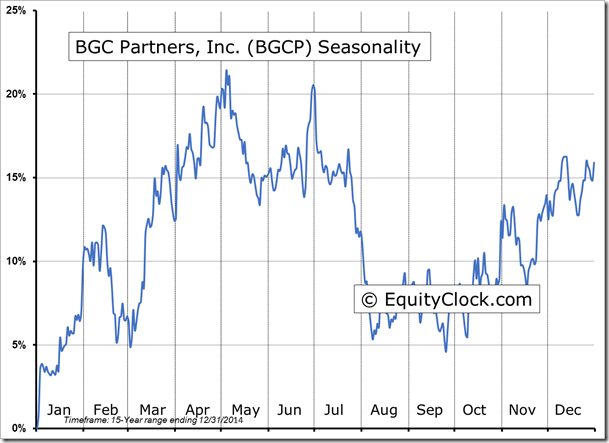

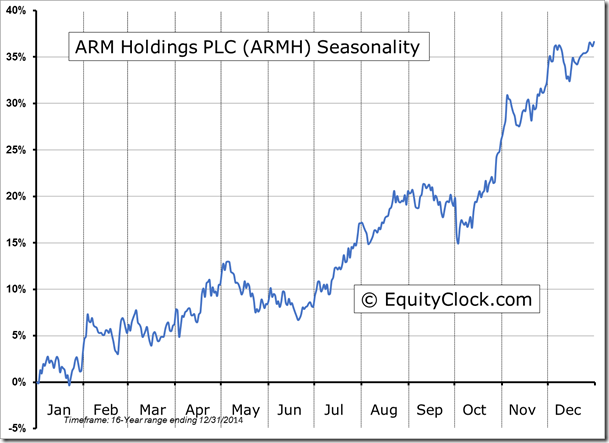

Seasonal charts of companies reporting earnings today:

S&P 500 Index

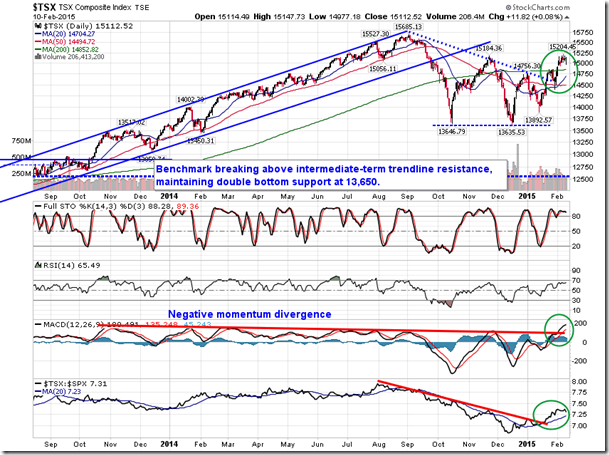

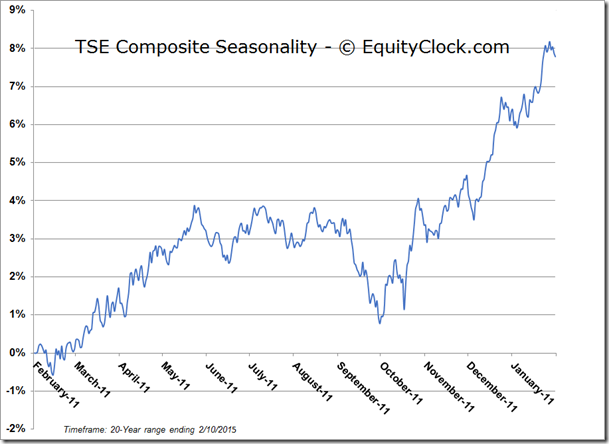

TSE Composite

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $15.94 (up 0.50%)

- Closing NAV/Unit: $15.92 (up 0.30%)

Performance*

| 2015 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 5.22% | 59.2% |

* performance calculated on Closing NAV/Unit as provided by custodian