Does Your Portfolio Need More Protection In This Volatile Market?

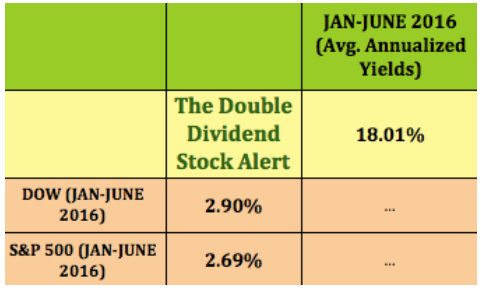

Check out our returns in 2016:

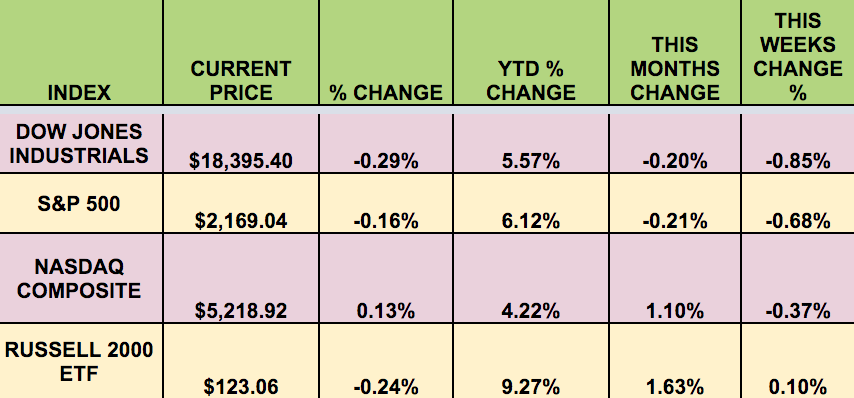

Markets: The market had a down week, as investors cautiously took some profits. Only the Russell small caps managed to eke out a tiny gain. The S&P 500 fell for the 5th time in the last 6 sessions, but is still just 1% below its all-time high.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: American Capital Agency Corp (NASDAQ:AGNC), Chatham Lodging Trust REIT (NYSE:CLDT), Exelon Corp (NYSE:EXC) Unit (NYSE:EXCU), IRT, NDRO, PSEC, STB, TPVG, Wheeler RE Investment Trust (NASDAQ:WHLR), EFC, RELM Wireless Corporation (NYSE:RWC), WSR, Apple (NASDAQ:AAPL) Hospitality REIT Inc (NYSE:APLE), GBDC, Kronos Worldwide Inc (NYSE:KRO), GHL.

Volatility: The VIX rose 3% this week, finishing at $15.15.

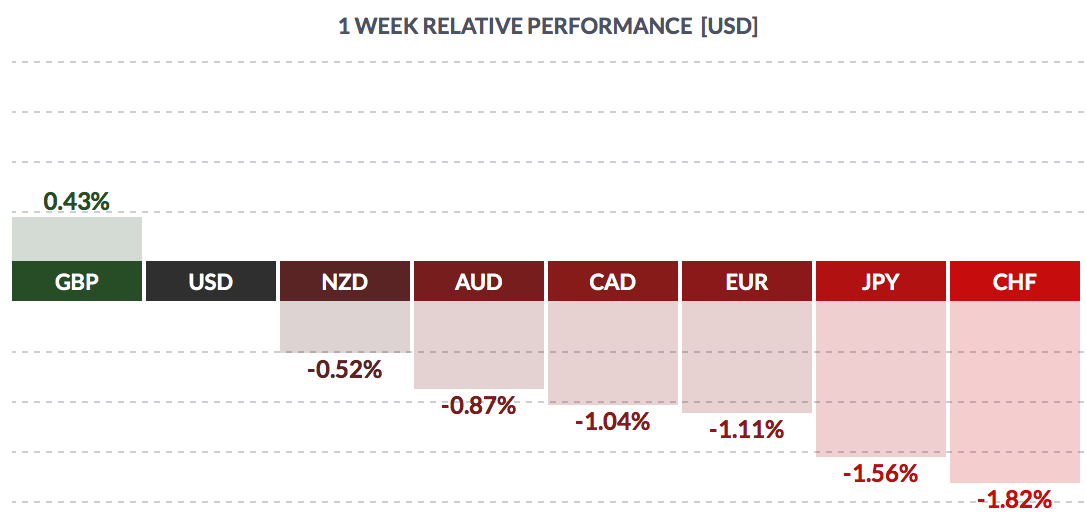

Currency: The US Dollar Index rose vs. most currencies, except the Pound, as Yellen’s speech fanned rate hike fears.

Market Breadth: 7 of the DOW 30 stocks rose this week, vs. 18 last week. 36% of the S&P 500 rose this week, vs. 55% last week.

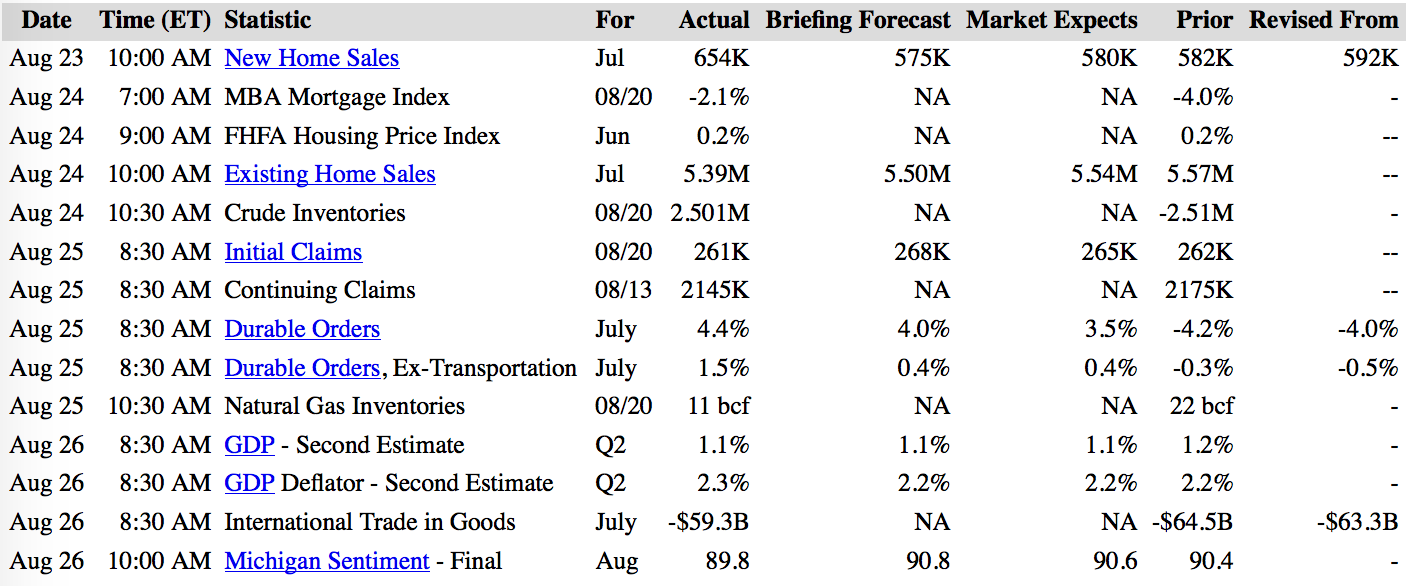

US Economic News: Fed chief Yellen paved the way for future rate hikes in her Jackson Hole speech Friday:

“I believe the case for an increase in the federal funds rate has strengthened in recent months,” Yellen said in a speech at the Fed’s annual monetary policy conference in Jackson Hole, Wyoming.

Yellen said the Fed already thinks it is close to meeting its goals of maximum employment and stable prices, and she described consumer spending as “solid” while noting business investment was weak and exports had been hurt by a strong U.S. dollar. New Home Sales hit their highest mark since 2007, up 12% to 654K, while Existing Home Sales underwhelmed. GDP rose 1.1% i Q2, but consumer spending outpaced, rising 4.4%.

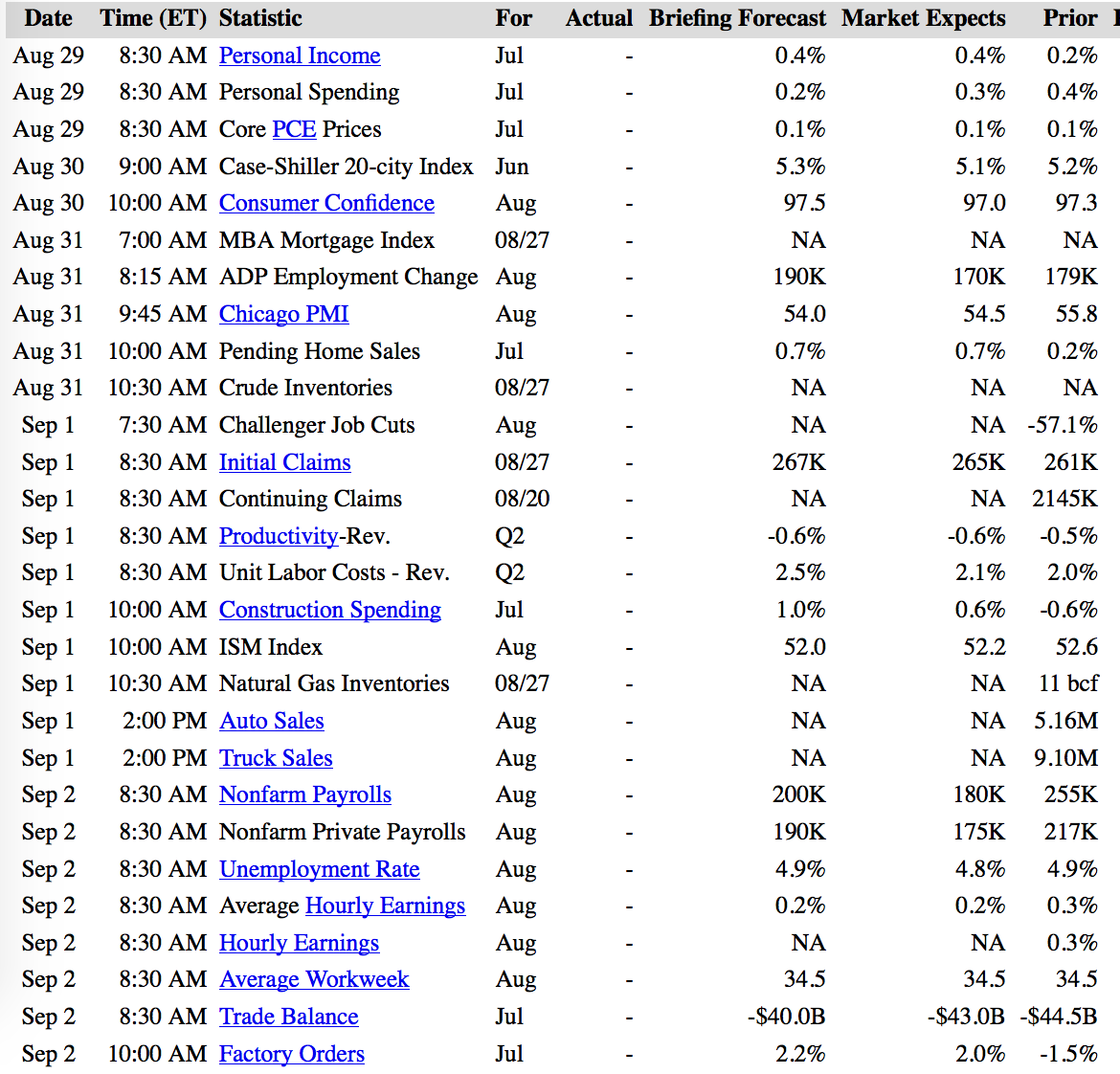

Week Ahead Highlights: Next Friday’s NonFarm Payrolls report now looms very large, after Fed chief Yellen’s more hawkish Jackson Hole speech. The market expects a 180K jobs number for August. We may return to the “good news is bad news” syndrome we had in 2015, in which strong payroll reports prompted selloffs, due to rate hike fears. Keep an eye on Wednesday’s ADP Employment Change report, which often predicts how the Non-Farm Payroll report will go.

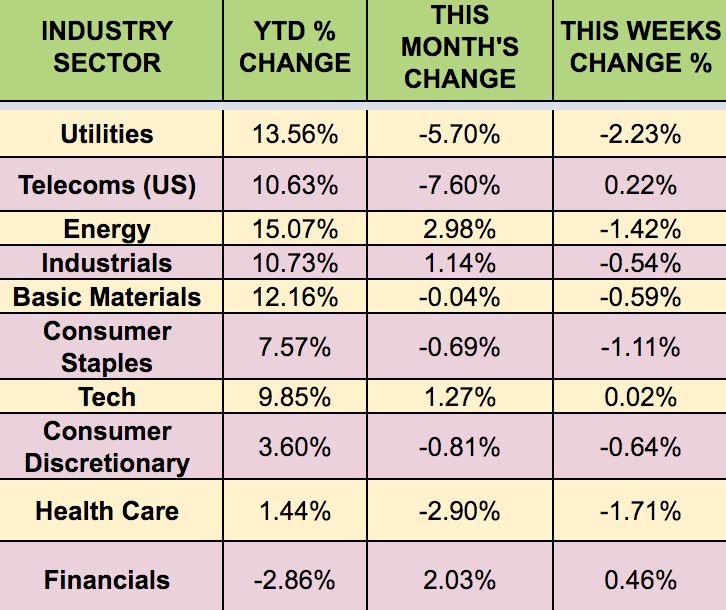

Sectors & Futures:

The Financial sector led this week, reacting to rate hike speeches from Fed members, while rate-sensitive Utilities lagged.

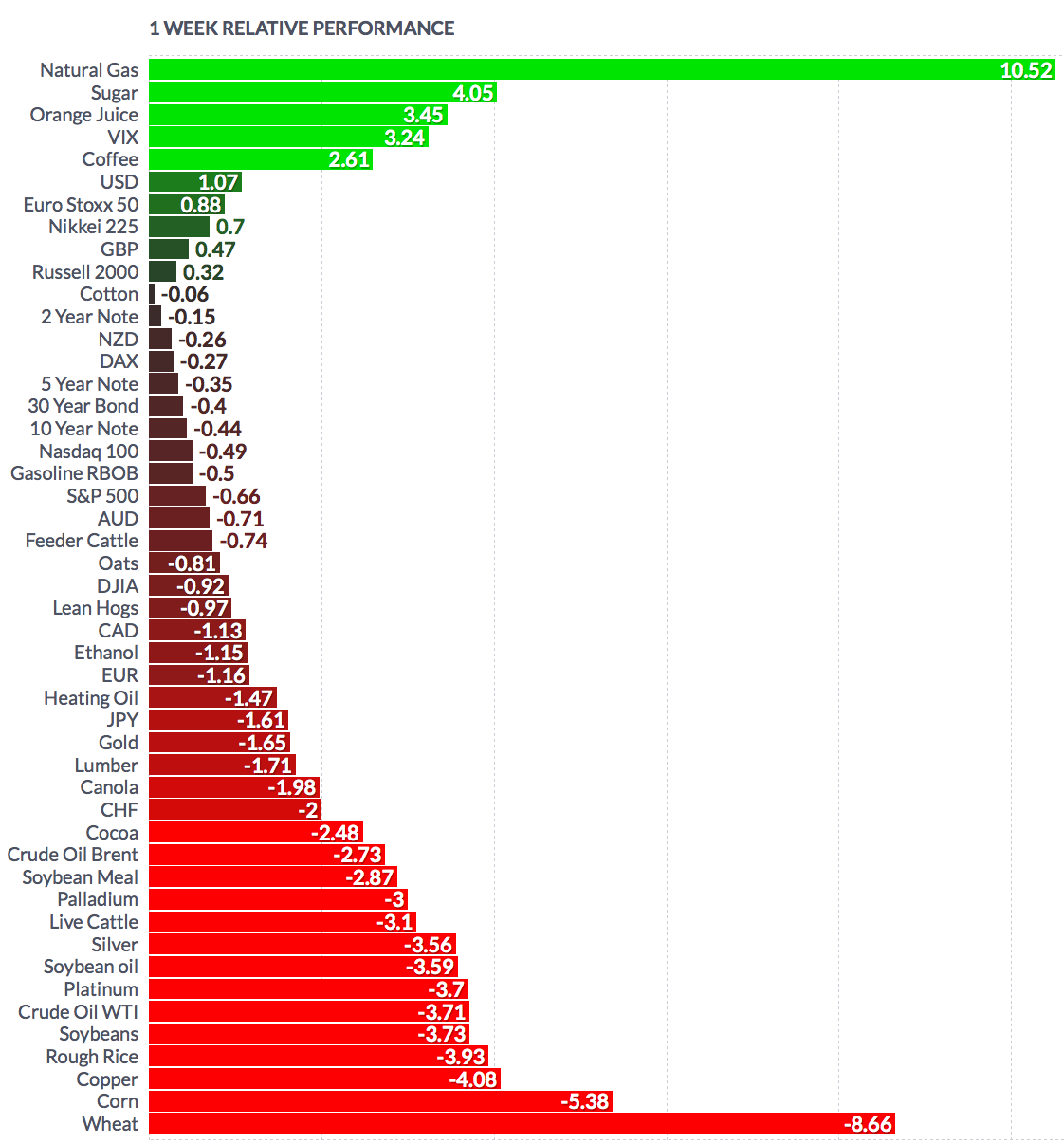

Natural Gas led this week, while wheat lagged: