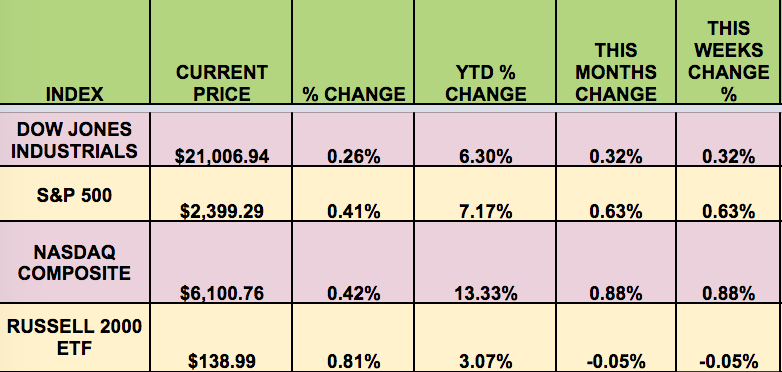

Markets: The market rose this week, led again by the NASDAQ, which closed at another all-time high. Friday’s positive Non-Farm Payrolls report spurred the market on, capturing most of the indexes’ gains for the week.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: APU (NYSE:APU), AHC (NYSE:AHC), AJX (NYSE:AJX), ARR (NYSE:ARR), NEWM (NYSE:NEWM), ECC (NYSE:ECC).

Volatility: The VIX fell 4.5% this week, finishing at $10.11, maintaining very low values all week.

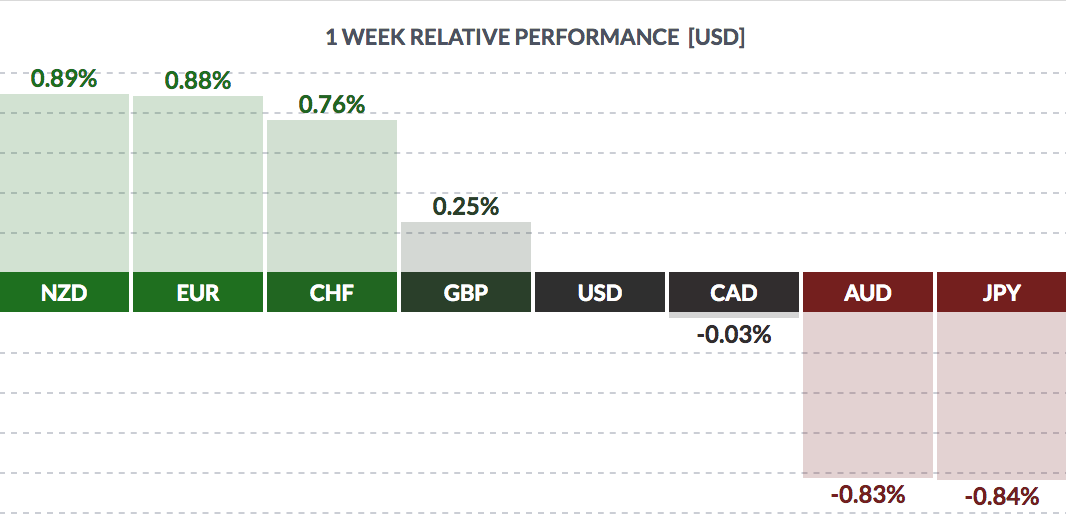

Currency: The dollar fell vs. most major currencies this week, except the Aussie dollar and the yen.

Market Breadth: 19 of the Dow Jones stocks rose this week, vs. 23 last week; and 60% of the S&P 500 rose, vs. 67% last week.

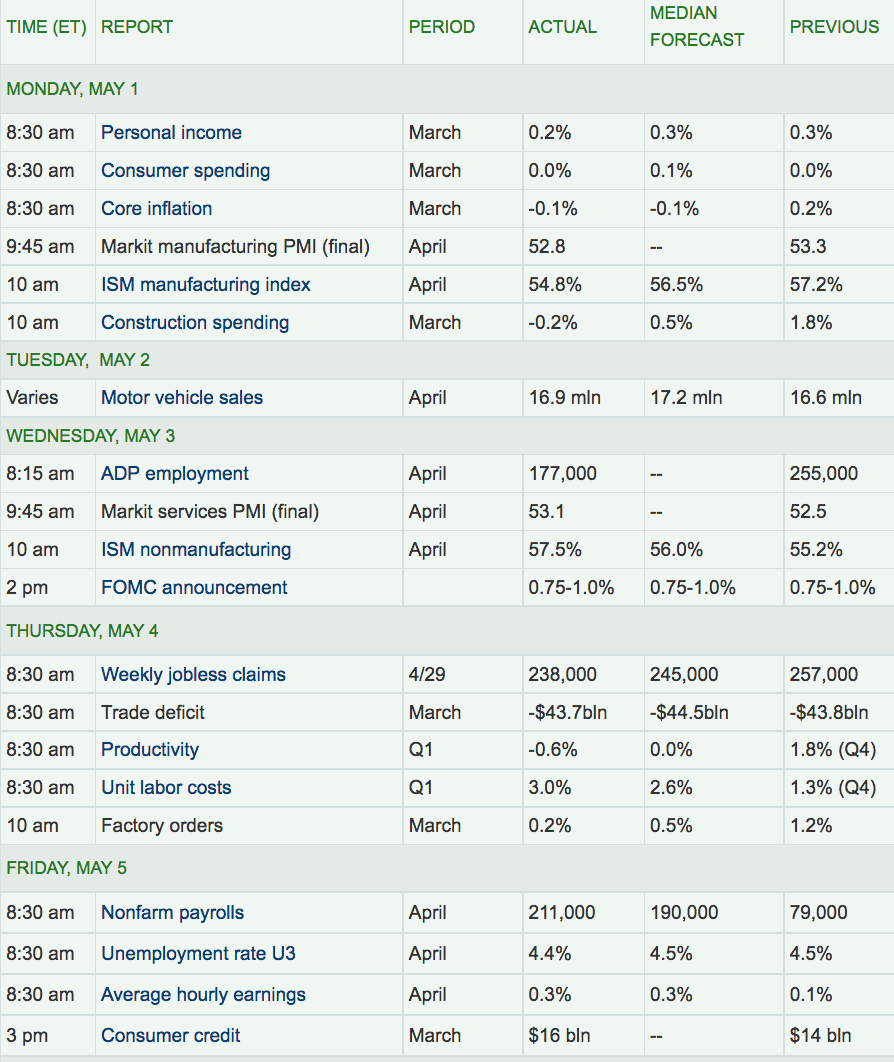

US Economic News: Non-Farm Payrolls rose 211K in April, surpassing the 190K estimate, after falling to 79K in March. The Unemployment Rate fell to 4.4%, lowest since 2001. There were large gains in leisure and hospitality, healthcare and social assistance as well as business and professional services payrolls.

PMI Mfg. hit a 7-month low, Consumer Spending was flat. The Fed left rates unchanged, but voted unanimously to leave a June rate hike on the table.

The Fed didn’t signal any change to its balance sheet policy. It is discussing how to begin shrinking its $4.5 trillion in holdings, and officials have said they hope to release a plan this year. They may start unwinding by the end of 2017, though that hinges on economic conditions. (Source: Bloomberg)

Markets are pricing in an 83% chance of a .25% Fed rate hike in June.

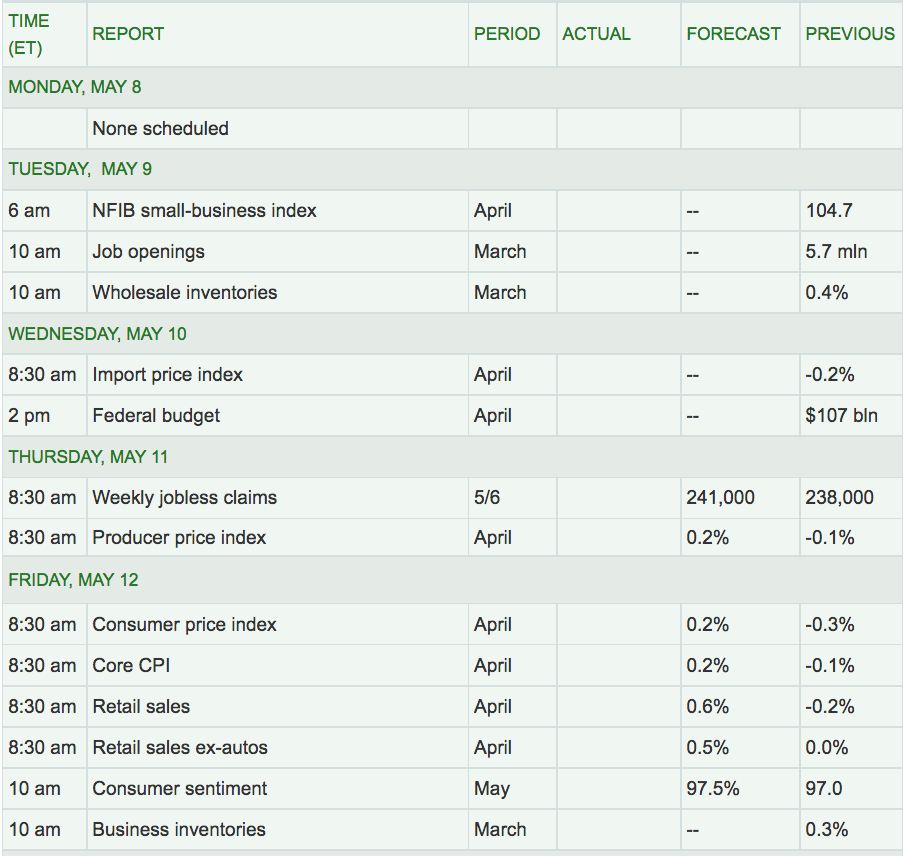

Week Ahead Highlights: It’ll be a light data week, with a focus on the Consumer, with 3 consumer-based reports due out next Friday. The Q1 ’17 earnings season continues, with brick and mortar retailers Macy’s (NYSE:M), Nordstrom (NYSE:JWN), Kohl’s (NYSE:KSS), and JC Penney (NYSE:JCP) all reporting – the market has no great growth expectations for these firms, but rather is waiting to see if turnaround plans have come to fruition yet. Disney, Costco (NASDAQ:COST), Home Depot (NYSE:HD), and Walmart (NYSE:WMT) will also report, among many other major firms.

Next Week’s US Economic Reports:

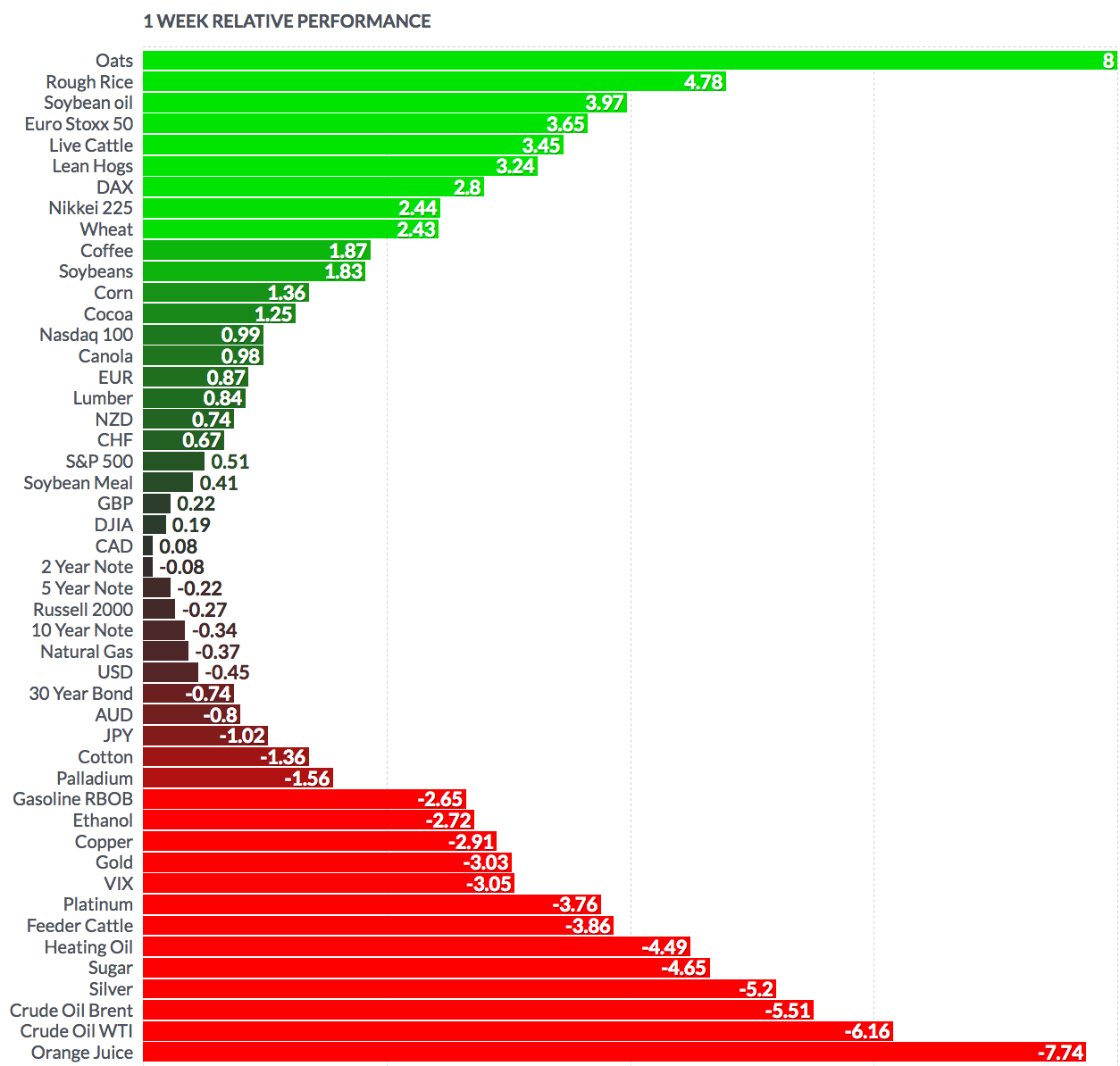

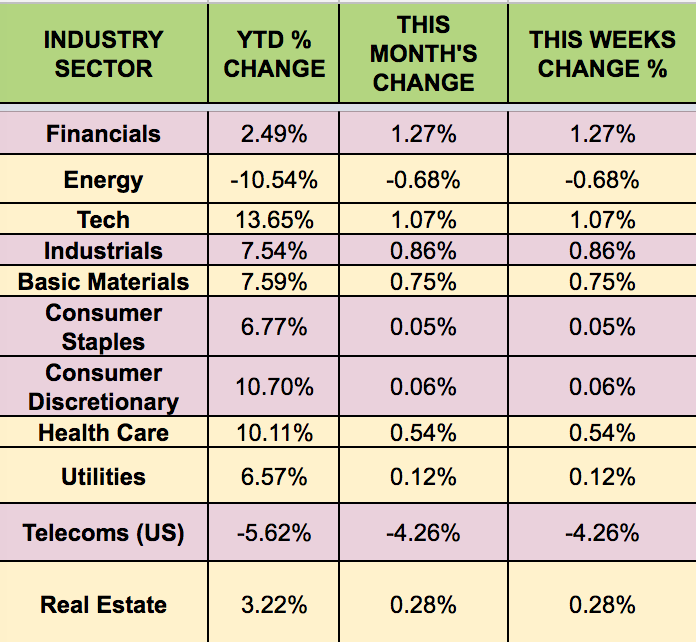

Sectors & Futures: Tech led this week, while Telecoms trailed.

Oats Futures led this week, while OJ trailed. WTI Crude fell 6%, and Natural Gas fell .37%: