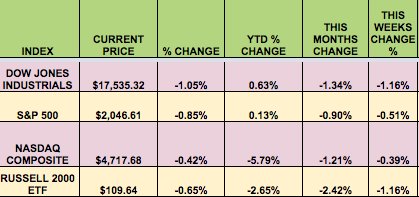

Markets: The market fell for the 3rd straight week, with only 7 Dow stocks rising for the week. In a bifurcated market, large caps and small caps both trailed the S&P and the NASDAQ. Even though the financial media has been warning of overheated Utility stocks, this defensive sector has once again outperformed so far in May, gaining 2%.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Collectors Universe(NASDAQ:CLCT), Telefonica (NYSE:TEF), Alon USA Energy (NYSE:ALJ), Crossamerica Partners LP (NYSE:CAPL), Gladstone Investment Corporation (NASDAQ:GAIN), Gladstone Capital Corporation (NASDAQ:GLAD), Gladstone Commercial Corporation (NASDAQ:GOOD), National CineMedia Inc (NASDAQ:NCMI), Southside Bancshares Inc (NASDAQ:SBSI), Solar Senior Capital Ltd (NASDAQ:SUNS), Apollo Globl Man (NYSE:APO), Main Street Capital Corporation (NYSE:MAIN), PennantPark Floating Rate Capital Ltd (NASDAQ:PFLT), Royal Dutch Shell A (NYSE:RDSa), Royal Dutch Shell B (NYSE:RDSb).

Volatility: The VIX rose $.15 this week, finishing at $15.90.

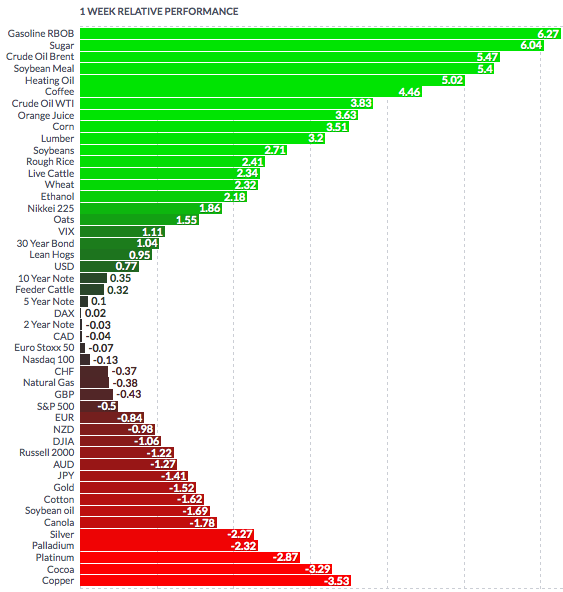

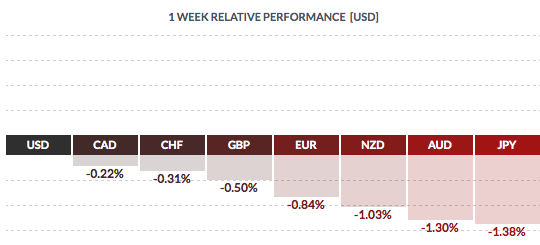

Currency: The USD rose vs. most major currencies this week, which put pressure on Basic Materials.

Market Breadth: 7 of the Dow 30 stocks rose this week, vs. 17 last week. 40% of the S&P 500 rose this week, vs. 46% last week.

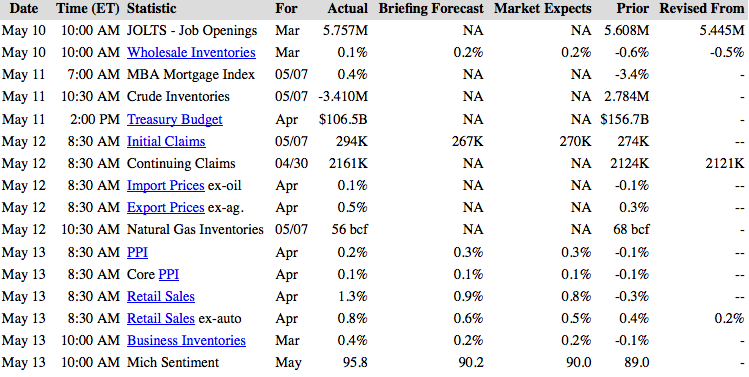

US Economic News: Initial Unemployment claims jumped to 294K, much higher than the 270K forecast, and the previous 274K. April Retail Sales were much better than forecast, rising .8%, as was Consumer Sentiment, which rose to 95.8. Retailers could definitely use a boost in the 2nd quarter, after disappointing Q1 earnings reports from Nordstrom Inc (NYSE:JWN) and Macy’s Inc (NYSE:M), among others.

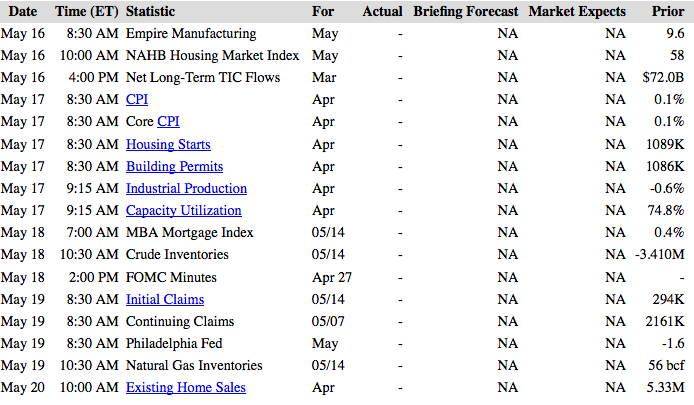

Week Ahead Highlights: The Housing Industry will be in the spotlight, with 3 Housing reports coming out. More retailers and Consumer stocks will report earnings – Walmart (NYSE:WMT), Target Corporation (NYSE:TGT), Staples Inc (NASDAQ:SPLS), TJX Companies Inc (NYSE:TJX), Ralph Lauren (NYSE:RL), Dollar Tree (NASDAQ:DLTR), Campbell Soup Company (NYSE:CPB), among others.

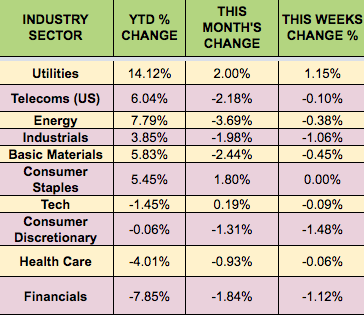

Sectors and Futures:

Utilities continued their winning ways this week, as Consumer Discretionary stocks trailed, in the wake of poor Q1 earnings reports.

Gasoline led this week, with Copper trailing: