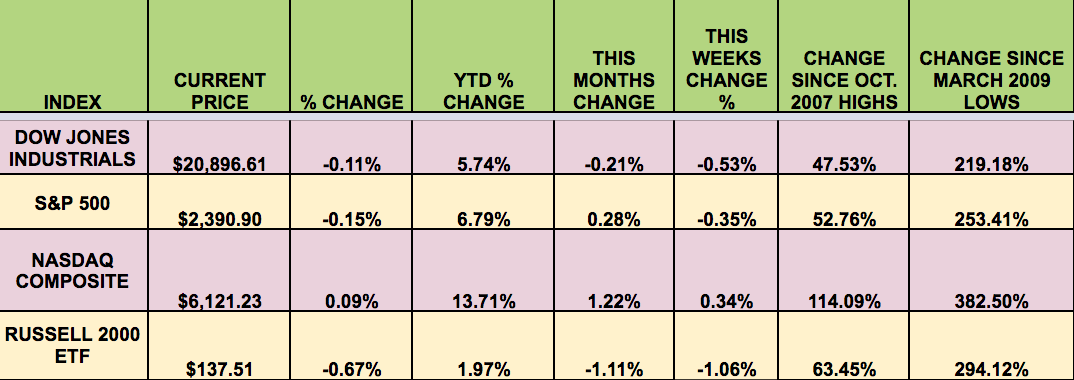

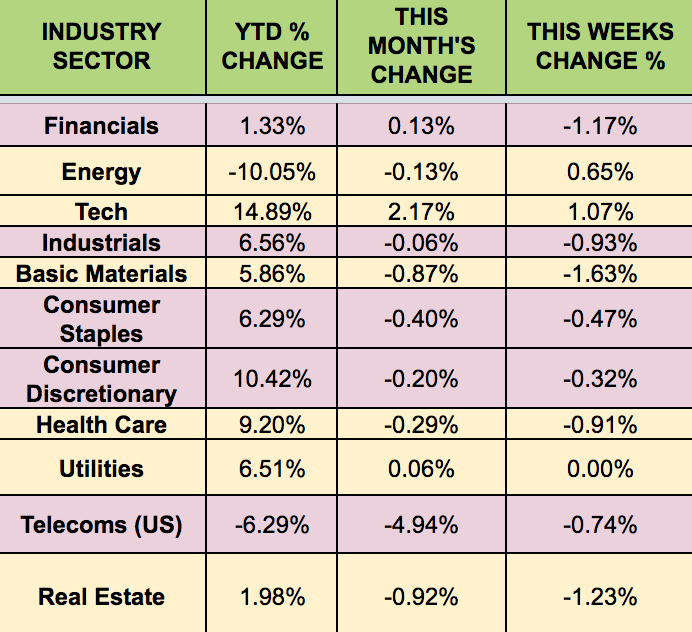

Markets: The market fell this week, reacting to an uncertain US political environment, after the firing of FBI director Comey. Brick & Mortar Retail stocks slid, led down by JC Penney (NYSE:JCP), which reported mixed results. Retail Sales rose .4% in April, below the .4% forecast.

The NASDAQ was the sole gainer, and leads the other indexes by a wide margin year-to-date, buoyed by resurgent Tech firms.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: GLAD (NASDAQ:GLAD), GOOD (NASDAQ:GOOD), GAIN (NASDAQ:GAIN), HRZN (NASDAQ:HRZN), MAT (NASDAQ:MAT), NAT, CPTA (NASDAQ:CPTA).

Volatility: After hitting its lowest point in decades on Monday, the VIX rose 2.8% this week, finishing at $10.38.

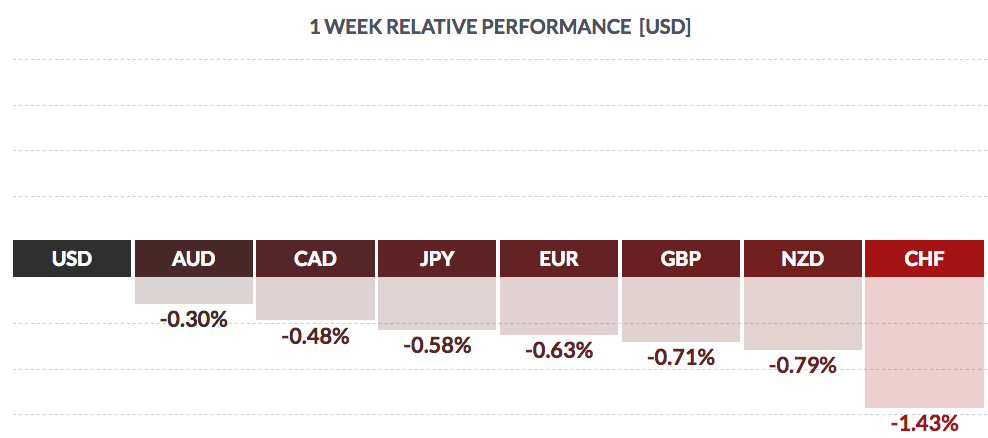

Currency: The dollar rose vs. most major currencies this week. The British pound pulled back, in the wake of a decreased 2017 GDP forecast for the UK.

Market Breadth: 14 of the Dow Jones stocks rose this week, vs. 19 last week, and 52% of the S&P 500 rose, vs. 60% last week.

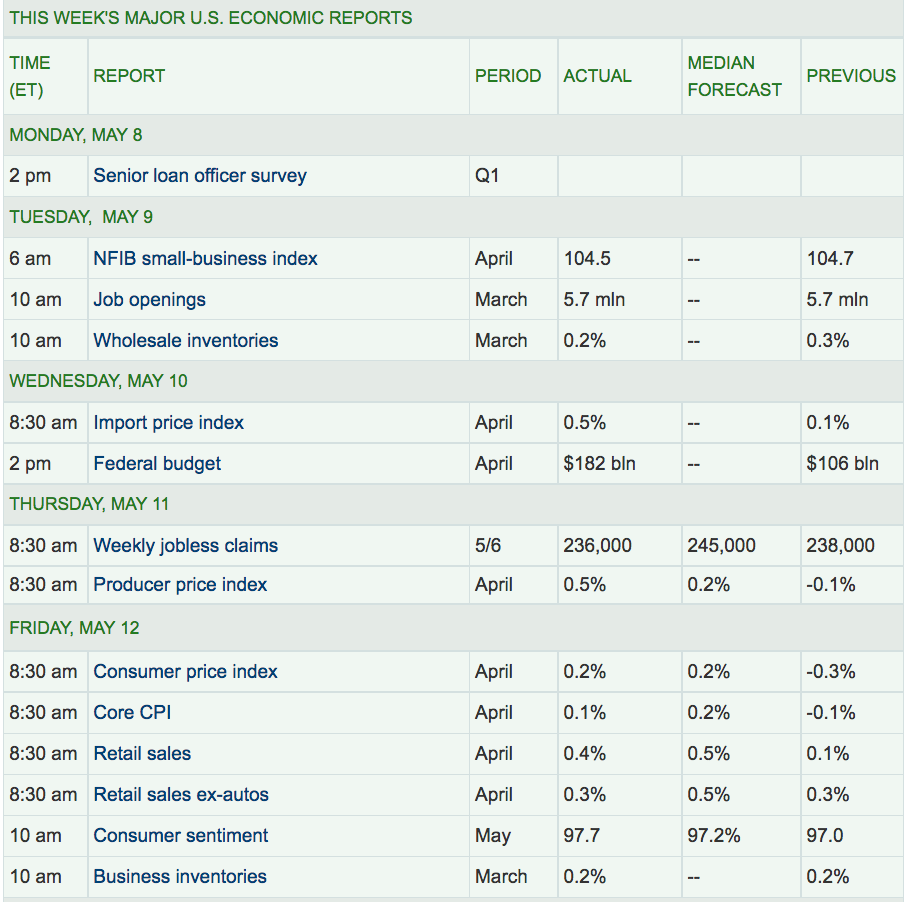

US Economic News: The Consumer Price Index rose .2% in April, with the Core CPI rising .1%. The Producer Price Index jumped .5% in April, more than the .2% forecast.

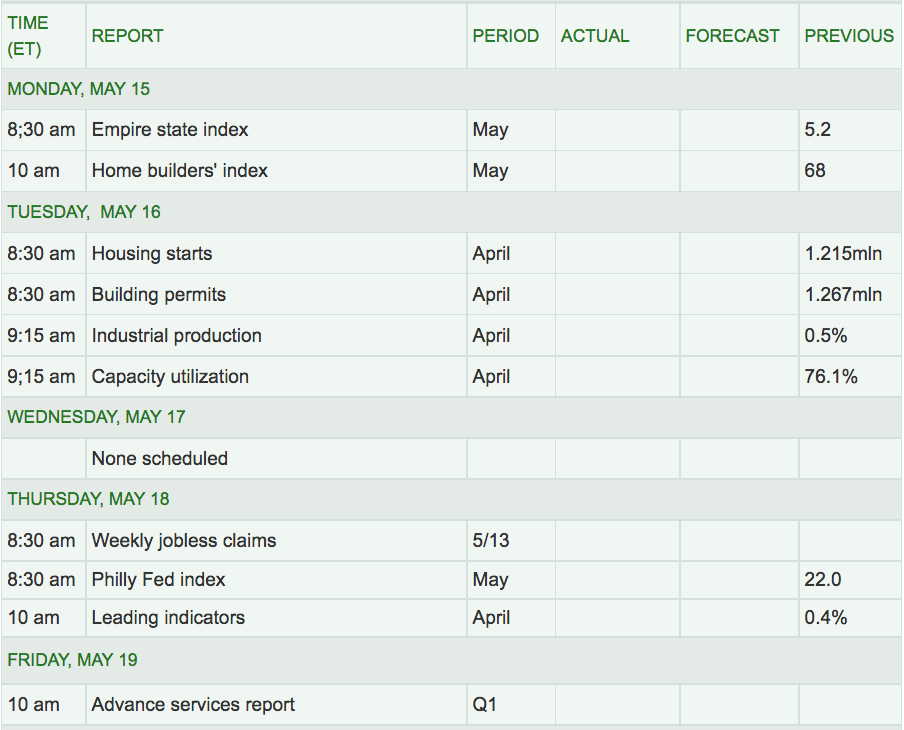

Week Ahead Highlights: The Q1 ’17 earnings season continues, with Home Depot (NYSE:HD), Cisco, and Walmart (NYSE:WMT) reporting, among many other major firms. More retailers will report, such as TJX (NYSE:TJX), LB (NYSE:LB), ROST (NASDAQ:ROST), and FL (NYSE:FL).

We’ll also get a look at Housing data, with the Housing Starts and Building Permits reports for April due out on Tuesday.

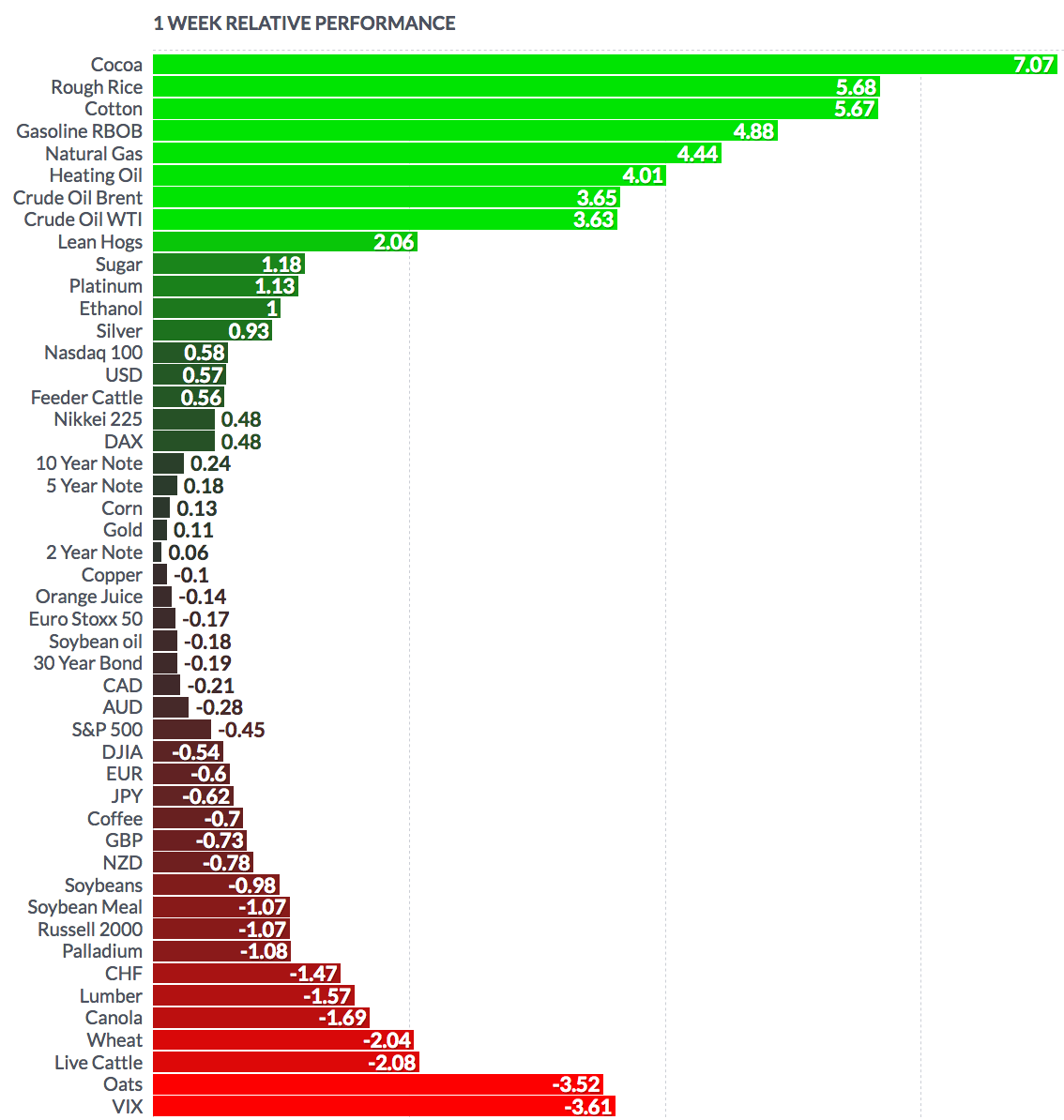

Sectors & Futures: Tech led again this week, on the back of Apple’s 5% gain, while Basic Materials trailed.

Cocoa futures led this week, while oats trailed. WTI Crude gained 3.6%, its 1st gain in a month, on hopes that OPEC will extend its production cuts. Natural Gas rose 4.4%: