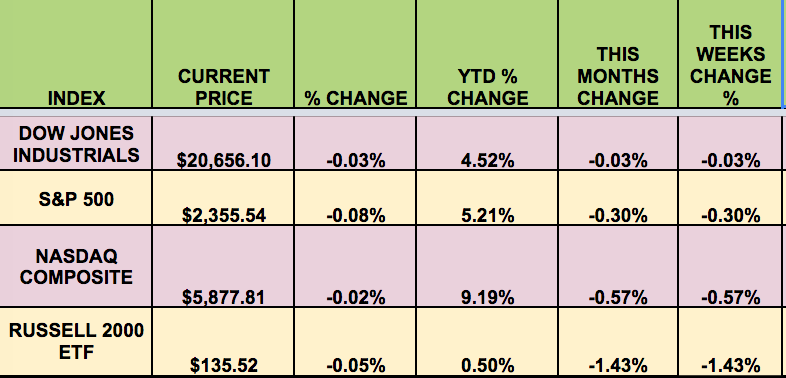

Markets: The market fell this week, hampered by geopolitical events in Syria, a weak March jobs report, and a Fed official’s comments about trimming the Fed’s balance sheet.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: ANTX (NYSE:ANTX), CNSL (NASDAQ:CNSL), EBF (NYSE:EBF), BAP (NYSE:BAP).

Volatility: The VIX rose 4% this week, finishing at $12.87.

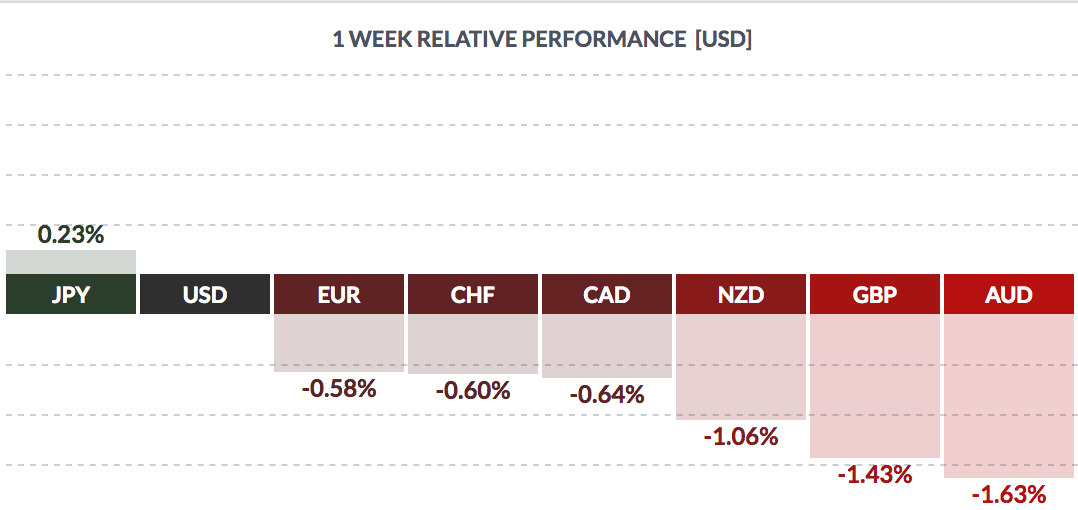

Currency: The dollar rose vs. most major currencies this week, except the yen.

Market Breadth: 11 of the DOW 30 stocks rose this week, and 42% of the S&P 500 rose.

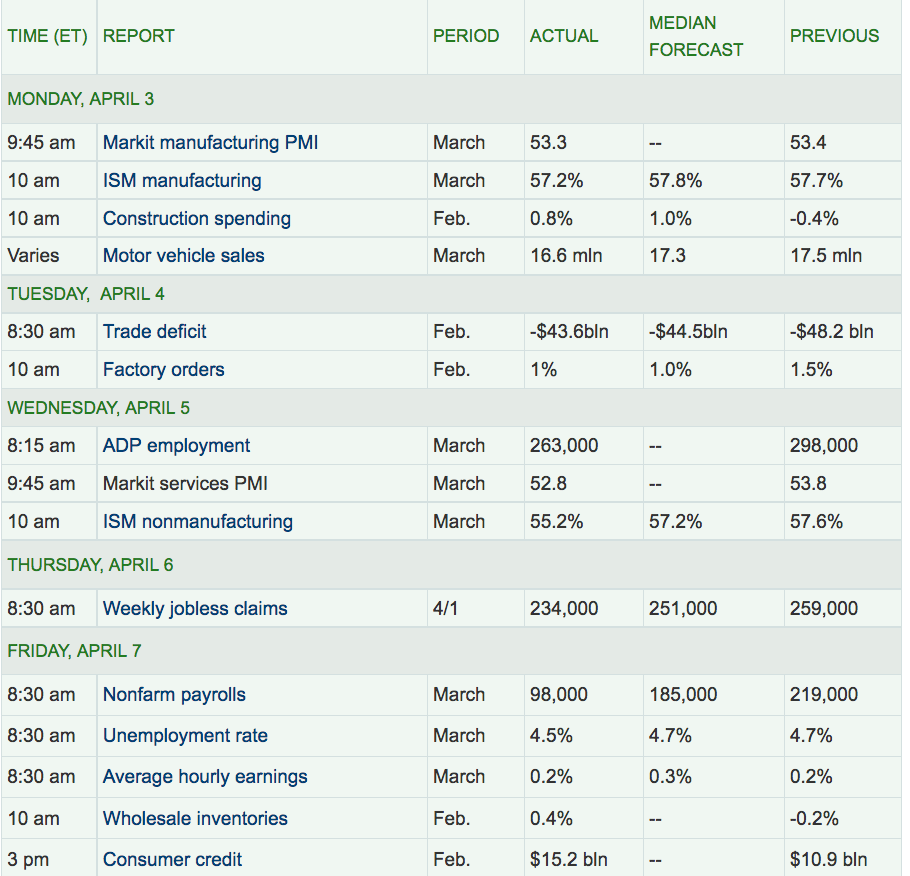

US Economic News: Non-Farm Payrolls sank in March to 98K, way below the 185K forecast. Jan. and Feb. Payrolls were revised downward by 38K. The Unemployment Rate fell to 4.5%, its lowest rate since 2007. Avg. hourly earnings have risen by 2.7% over the past year, signaling a tighter labor market.

Retail lost 30K jobs in March, and has declined by 89K jobs since reaching a high in Oct. 2016, as large retailers, such as Macy’s and Sears have announced layoffs. It’s questionable whether or not online retailing will pick up the slack – due to the automated nature of online sales.

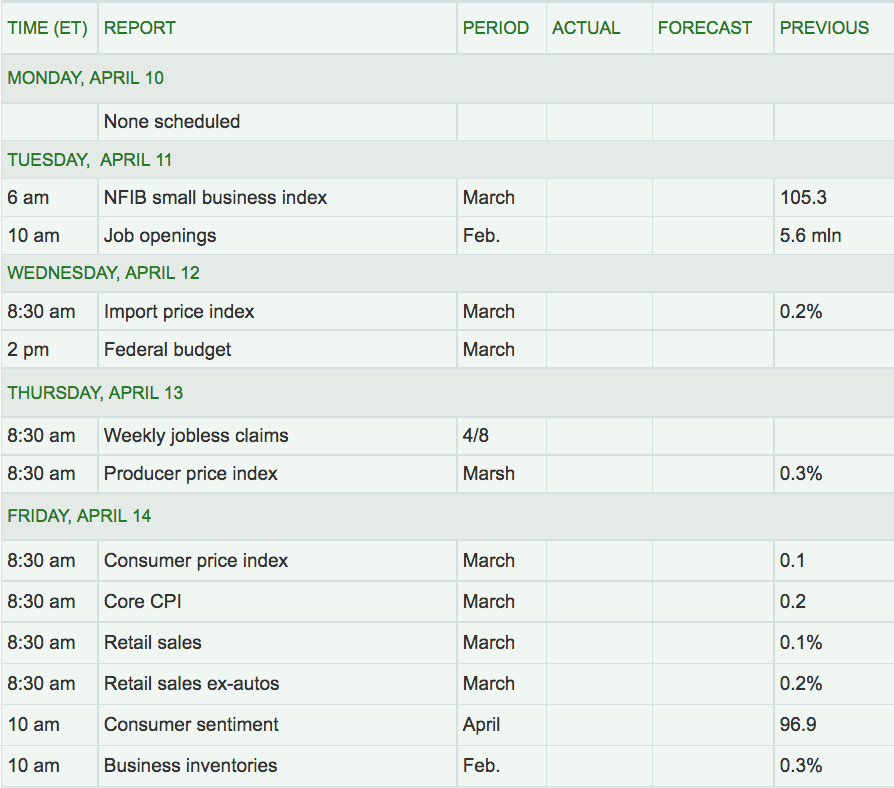

Week Ahead Highlights: The Q1 '17 earnings season kicks off, with some major banks reporting earnings – JP Morgan Chase (NYSE:JPM), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), and PNC (NYSE:PNC). Black Rock (AX:BKT) and Delta Airlines (NYSE:DAL) will also report. Next Friday’s economic data will focus on the US consumer, with several consumer-based reports due out.

Next Week’s US Economic Reports:

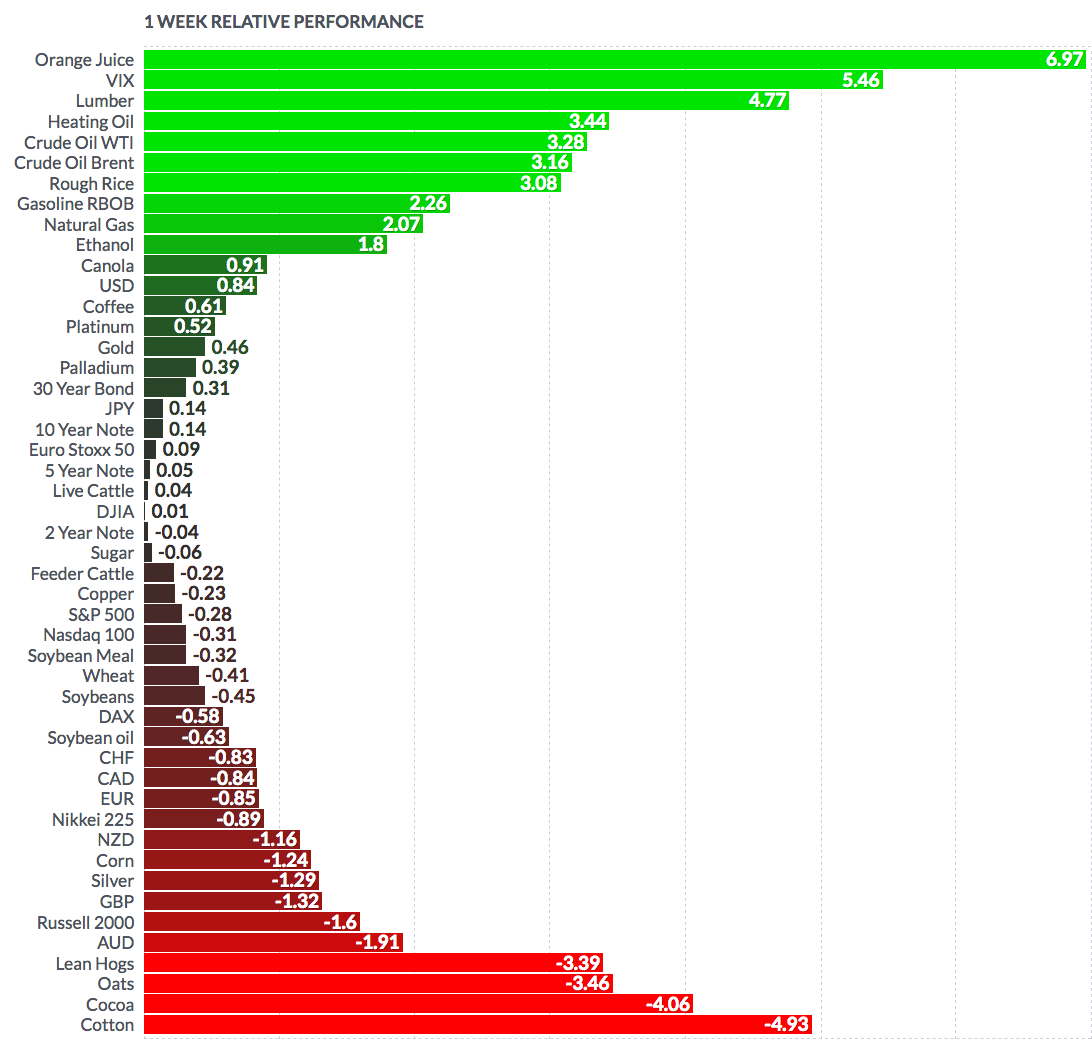

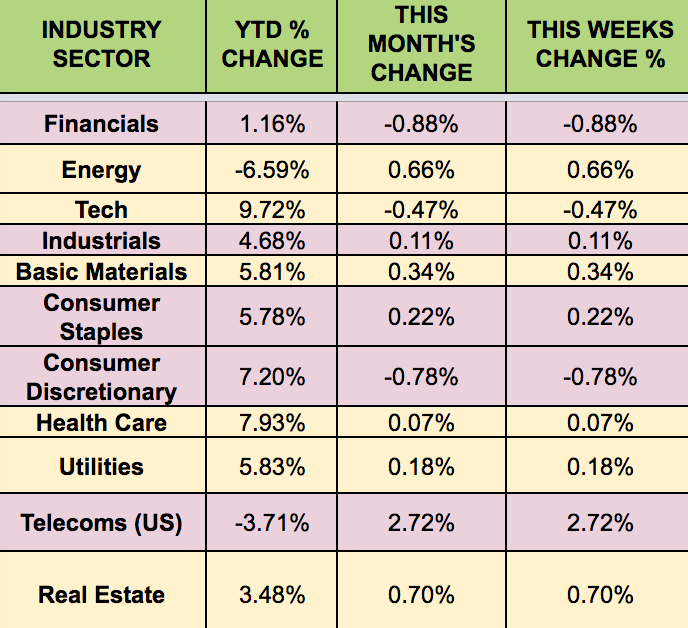

Sectors & Futures: Telecoms led this week, while Financials trailed.

OJ futures led this week, while cotton trailed. WTI Crude gained 3.28%, and natural gas gained 2.07%: