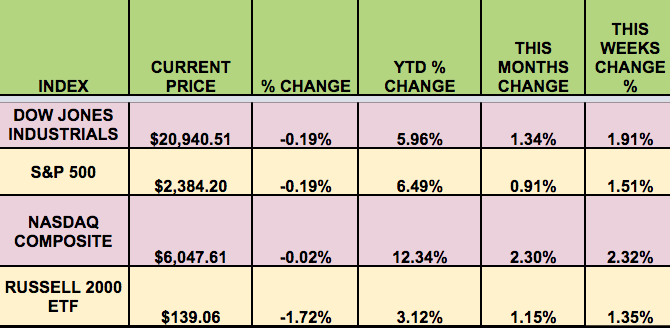

Markets: The market rallied this week, with all 4 indexes rising, as investors reacted positively to new tax plan highlights offered by the new administration. The NASDAQ led, hitting an all-time high.

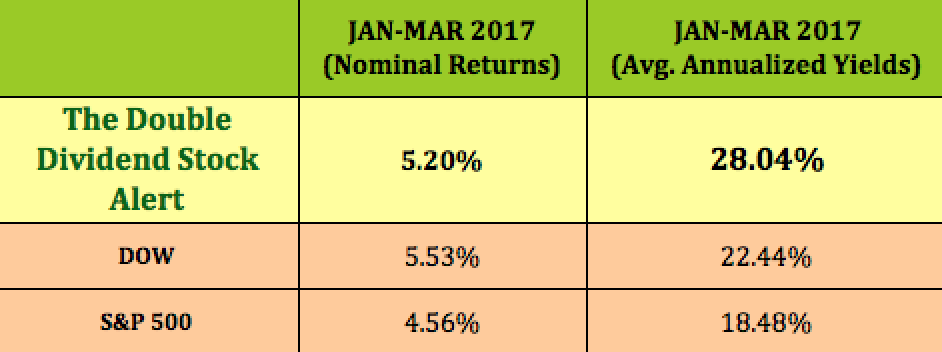

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: WSR (NYSE:WSR), TOO (NYSE:TOO), GLOP (NYSE:GLOP).

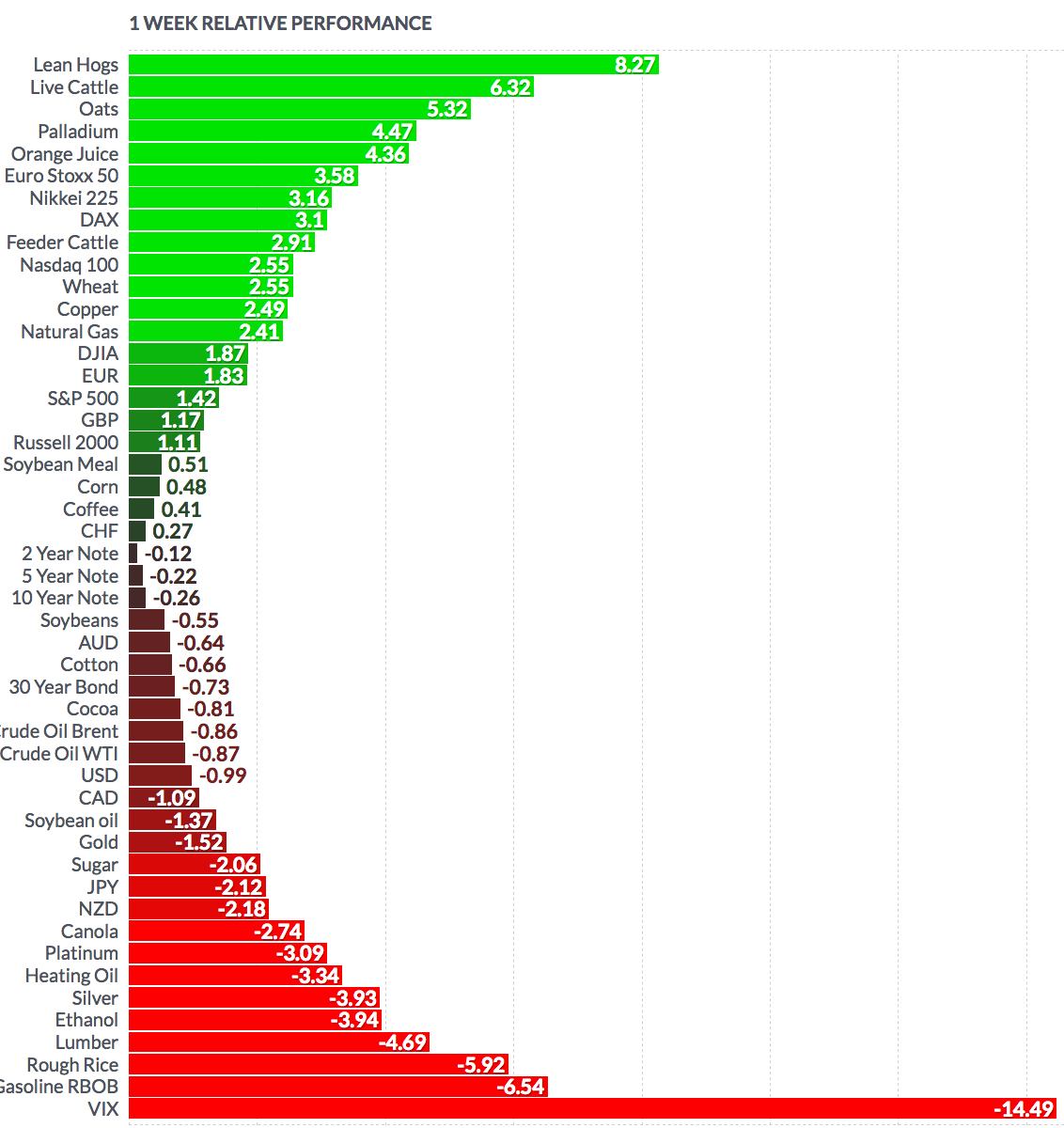

Volatility: The VIX fell 26% this week, finishing at $10.82, Its lowest close Jan. 27th.

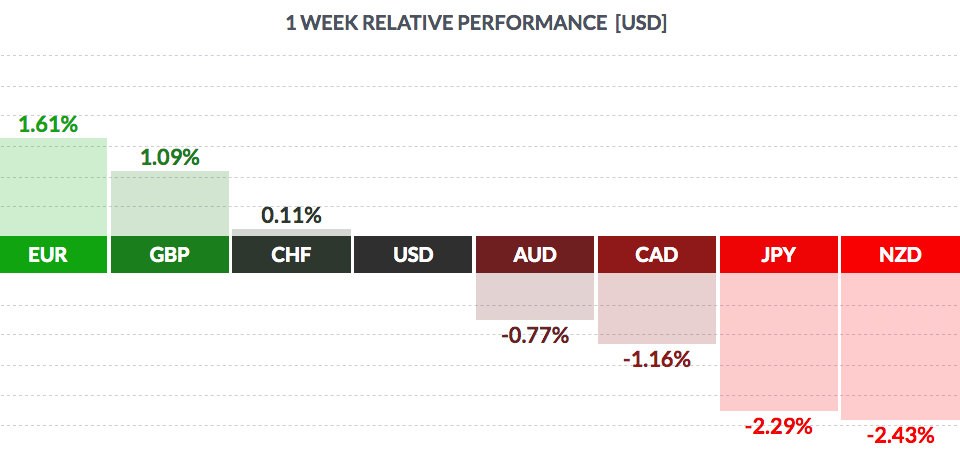

Currency: The USD rose vs. most major currencies this week, except the euro and the pound.

Market Breadth: 23 of the DOW 30 stocks rose this week, vs. 19 last week, and 67% of the S&P 500 rose, vs. 28% last week.

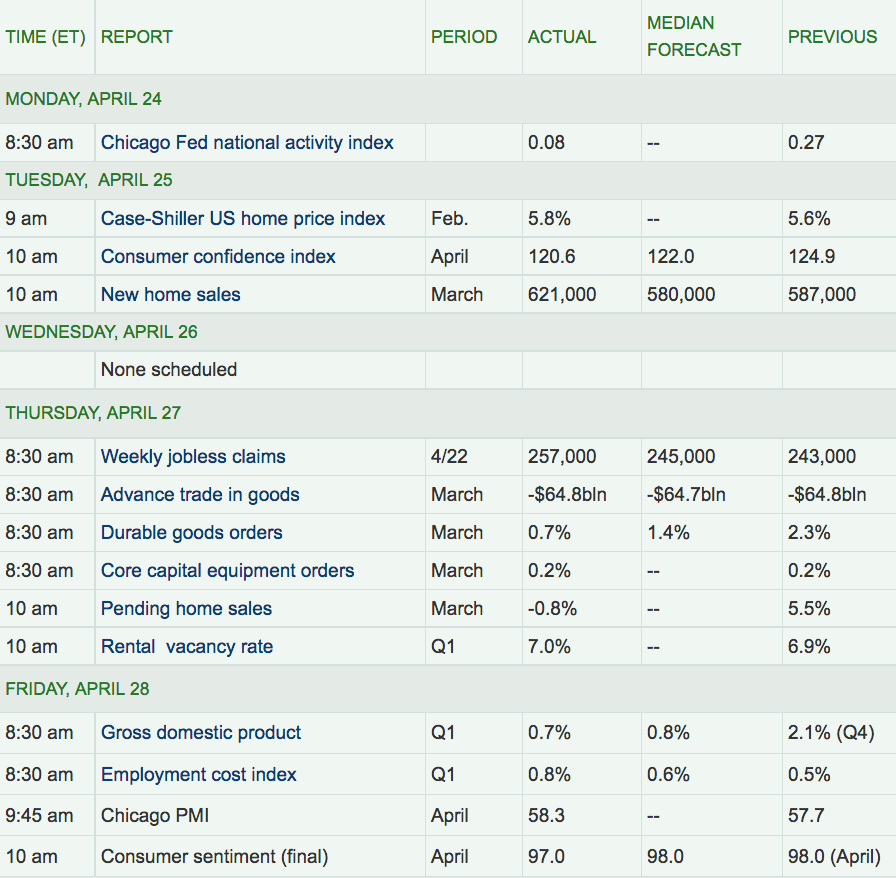

US Economic News: Q1 GDP growth disappointed, rising only .07%, vs. 1% forecast. Consumer Confidence remained strong at 120, but Consumer Spending rose just .03%, lowest since 2009. New Home sales rose to 621K, beating the 587K forecast. Congress kicked the government funding can down the road for 1 week, passing a 1-week extension on Friday, in order to avoid a government shutdown.

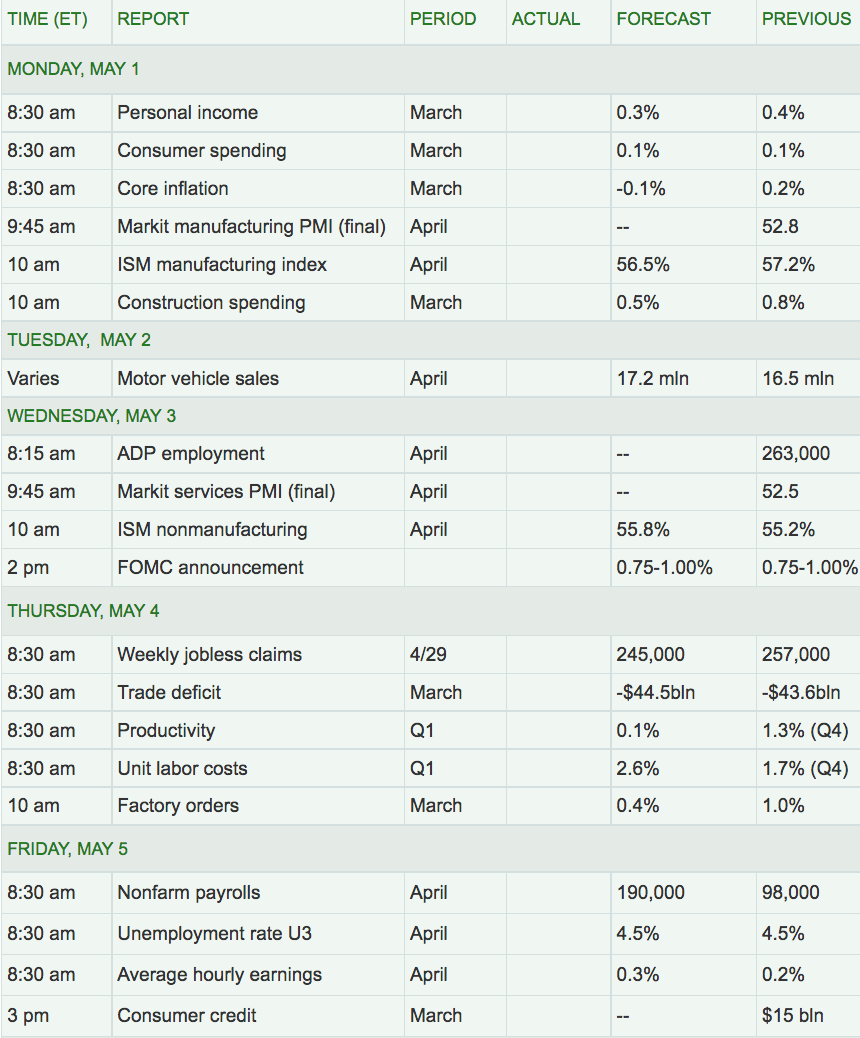

Week Ahead Highlights: It’ll be a heavy data week, with the ADP Payrolls report, the Non-Farm Payrolls Report, the Unemployment report, and an Inflation report all due out, in addition to more Q1 ’17 earnings reports.

Next Week’s US Economic Reports:

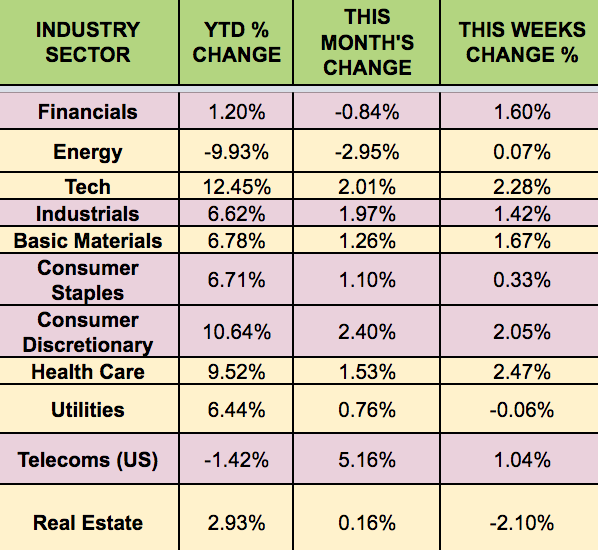

Sectors & Futures: Tech and Consumer Discretionary led this week, while Real Estate trailed. Telecoms and Consumer Discretionary led in April, with Energy trailing. Tech leads year-to-date, with Energy trailing.

Lean hogs futures led this week, while gasoline RBOB trailed. WTI crude fell .87%, and natural gas rose 2.41%. NatGas was flat in April, while WTI Crude futures gained .74%.

Year-to-date, WTI Crude is down 12%, while NatGas is down 19%.