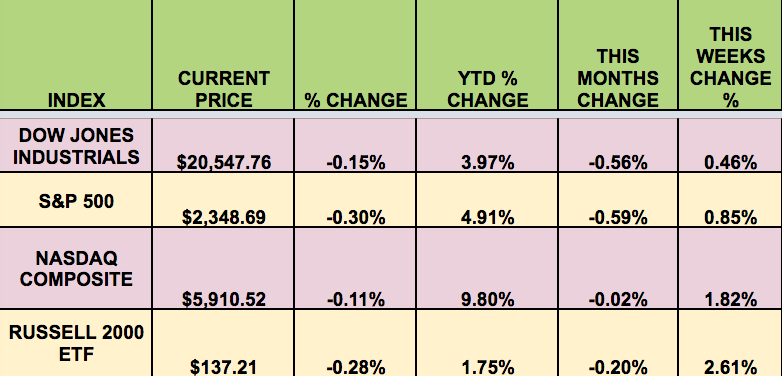

Markets: The market had a topsy turvy week – up 2 days, down 3, but broke its 2-week slump with an up week. Investor tax reform enthusiasm faded on Friday, in the face of worries over this weekend’s elections in France.

Small Caps led this week, regaining some of their luster, and the NASDAQ hit a new all-time high on Thursday.

Barrons reported today that “the 10 largest stocks in the S&P 500 accounted for 39% of the market’s gains during the first quarter of the year, according to Birinyi Associates data.Investors have flocked to bonds—sending yields on 10-year Treasuries to the lowest levels since the election—and to gold, which is up 12% this year.

S&P 500 companies are reporting an 11% rise in first-quarter profits, the headiest showing in years, thanks to the big year-over-year jump in energy prices”. (Source: Barrons)

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: GEC (NASDAQ:GEC), CLDT (NYSE:CLDT), GEL (NYSE:GEL), KNOP (NYSE:KNOP), PSEC (NASDAQ:PSEC), STAG (NYSE:STAG), STB (NASDAQ:STB).

Volatility: The VIX fell 8.3% this week, finishing at $14.63.

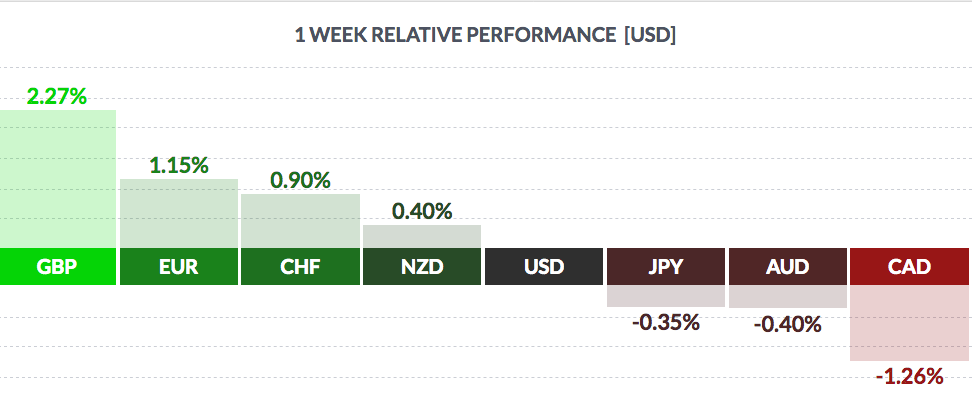

Currency: The USD fell vs. most major currencies this week, except the loonie, Aussie, and the yen.

Market Breadth: 19 of the DOW 30 stocks rose this week,vs. 7 last week and 74% of the S&P 500 rose, vs. 28% last week.

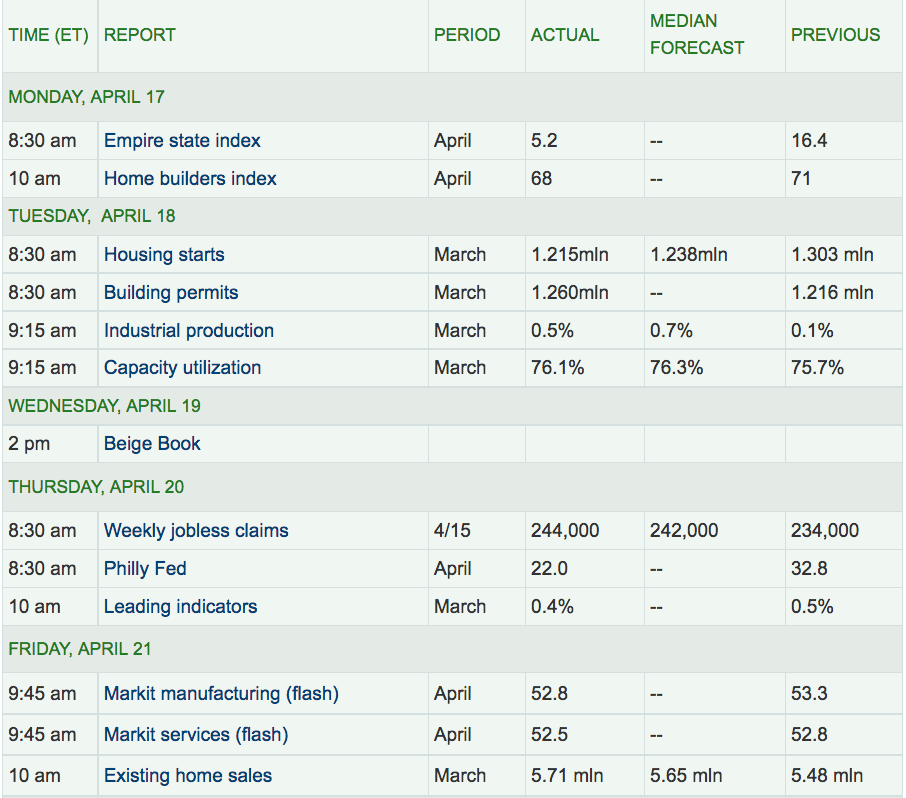

US Economic News: Existing home sales rose 4.4% month over month, and 5.9% year over year, to an annualized rate of 5.71M, but Housing starts dropped 6.8% – a 1.22M annualized rate. Unemployment Claims’ 4-week avg. moved lower for the 3rd straight week.

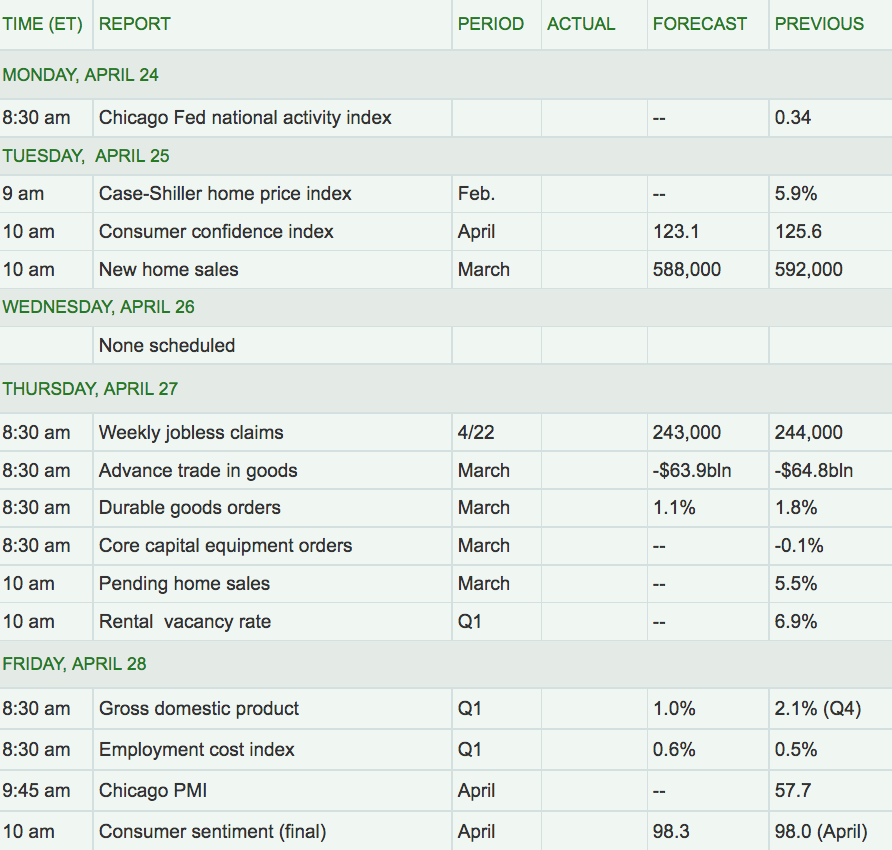

Week Ahead Highlights: The Q1 ’17 earnings season rolls on, with DuPont (NYSE:DD), Coke (NASDAQ:COKE), McDonald’s (NYSE:MCD), P&G (NYSE:PG), Microsoft (NASDAQ:MSFT), Boeing (NYSE:BA), and ExxonMobil (NYSE:XOM) reporting, among many other major firms.

French elections are in the spotlight this weekend, which should decide who will face Marine Le Pen—either conservative François Fillon or centrist Emmanuel Macron or leftist Jean-Luc Mélenchon. A Mélenchon-Le Pen runoff could pump up market volatility, since both candidates are anti-euro and anti-free trade.

We’ll get another look in the rear view mirror, for Q1 GDP, which economists estimate grew at a ho-hum 1% rate.

Next Week’s US Economic Reports:

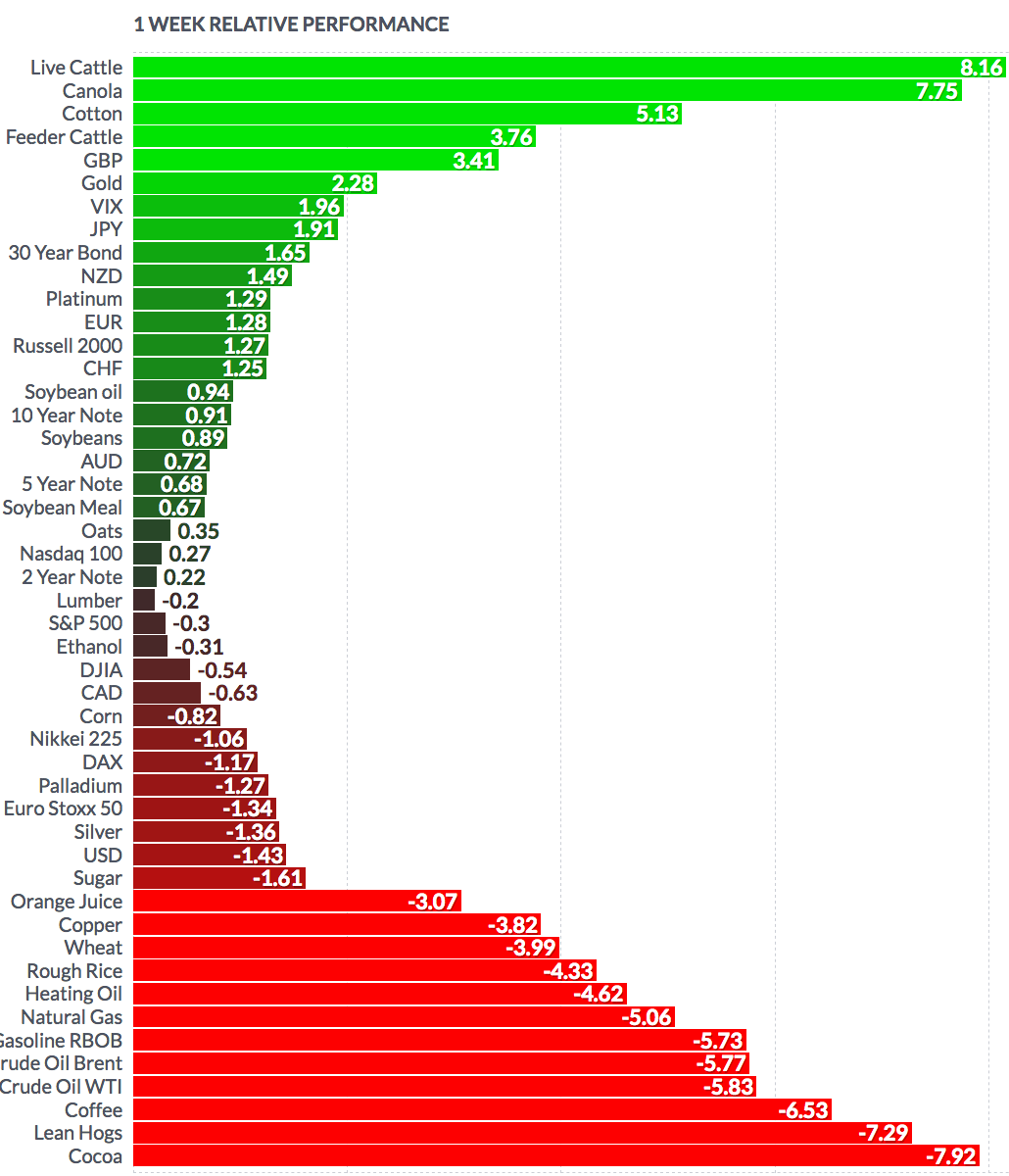

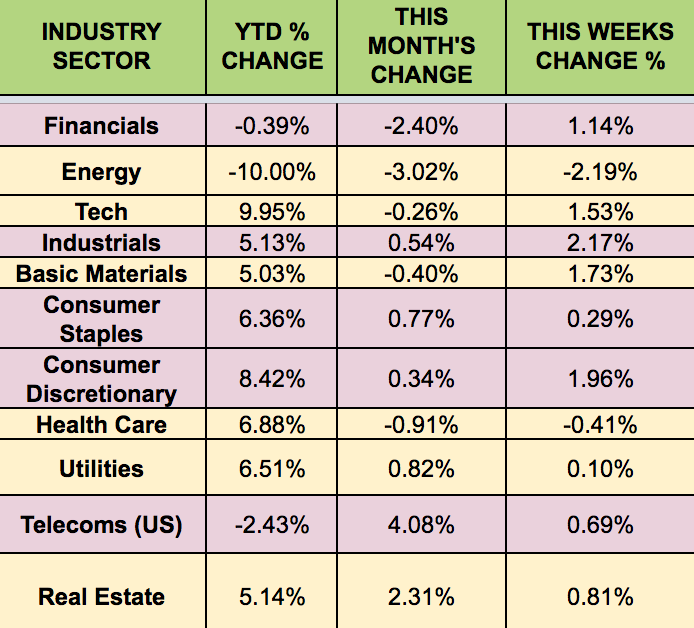

Sectors & Futures: Industrials led this week, while Energy trailed.

Crude oil and natural gas futures both fell this week. live cattle led while cocoa trailed.