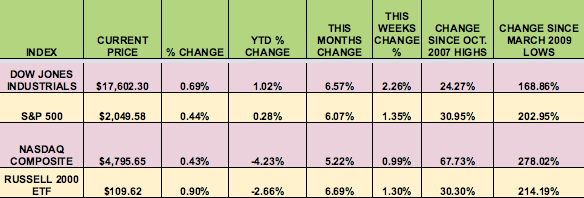

Markets: All 4 indexes had solid gains – the S&P 500 had its 5th week of 1%-plus gains, for the 1st time since April 2009, and pulled into positive territory for the year, along with the Dow. Crude Oil and Natural Gas had another good week, spurred on by the promise of an OPEC meeting on April 17th.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: NASDAQ:DSWL, NYSE:RY.

Volatility: The VIX fell 15% this week, finishing at $14.02, its lowest close since August 18th, before the late summer swoon.

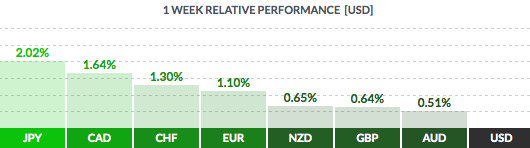

Currency: The US dollar fell vs. most major currencies this week, in the aftermath of a Fed decision not to raise the Fed Funds rate, and cut its forecast of rate hikes to just 2 for 2016, at this week’s meeting.

Market Breadth: 26 of the DOW 30 stocks rose this week, vs. 19 last week. 76% of the S&P 500 rose this week, vs. 71% last week.

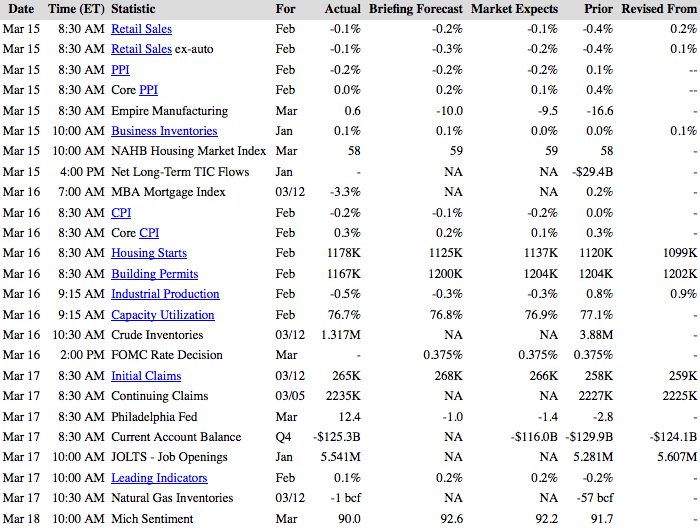

US Economic News: Housing Starts surprised to the upside, as did the Empire State Mfg. Index.

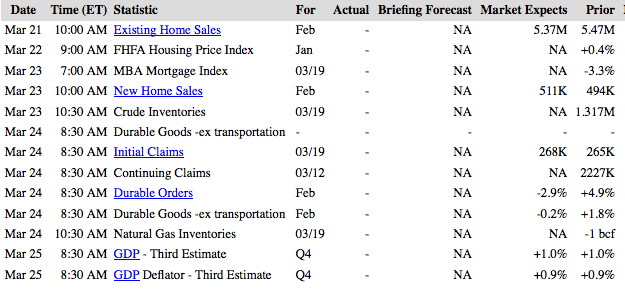

Week Ahead Highlights: It’ll be a short week, with US markets closed on Friday, in observance of Good Friday. Several Fed members will speak on Mon – Tues. Investors will be eyeing the US dollar, to see if it will continue to fall, which would help US firms’ overseas profitability and competitiveness. The final Q4 GDP number will come out on Friday.

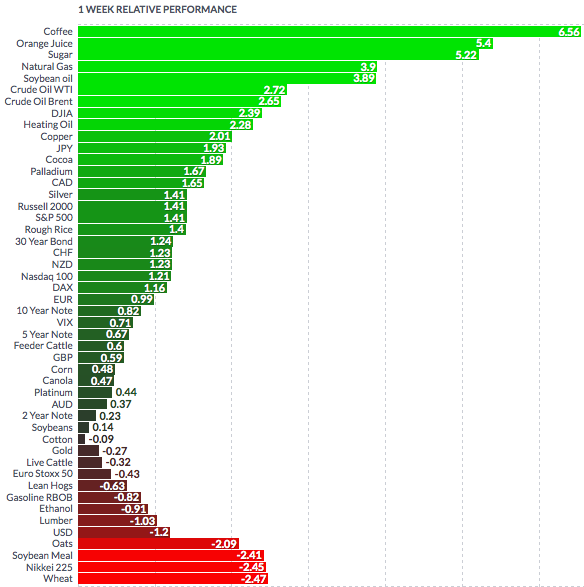

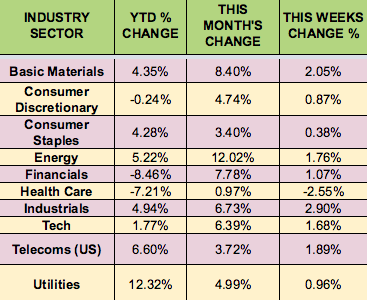

Sectors and Futures:

Industrials and Basic Materials led this week, as Health Care trailed. Basic Materials and Industrials were both aided by a weaker dollar.

Coffee futures led this week, with wheat trailing: