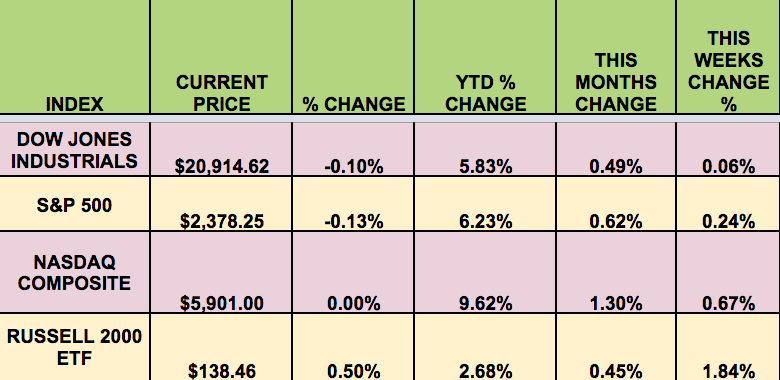

Markets: The market reverted to “risk on” this week, with small caps and the NASDAQ leading, after the Federal Reserve disappointed traders this week with its failure to make more aggressive forecasts for rate increases. Financials, which are thought to benefit from higher rates, lagged all other sectors, due to lower inflation expectations shown in a Consumer survey. This was the markets’ 7th gain in 8 weeks.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: GAIN (NASDAQ:GAIN), GLAD (NASDAQ:GLAD), GOOD (NASDAQ:GOOD), STX (NASDAQ:STX), LVS (NYSE:LVS), NRZ (NYSE:NRZ).

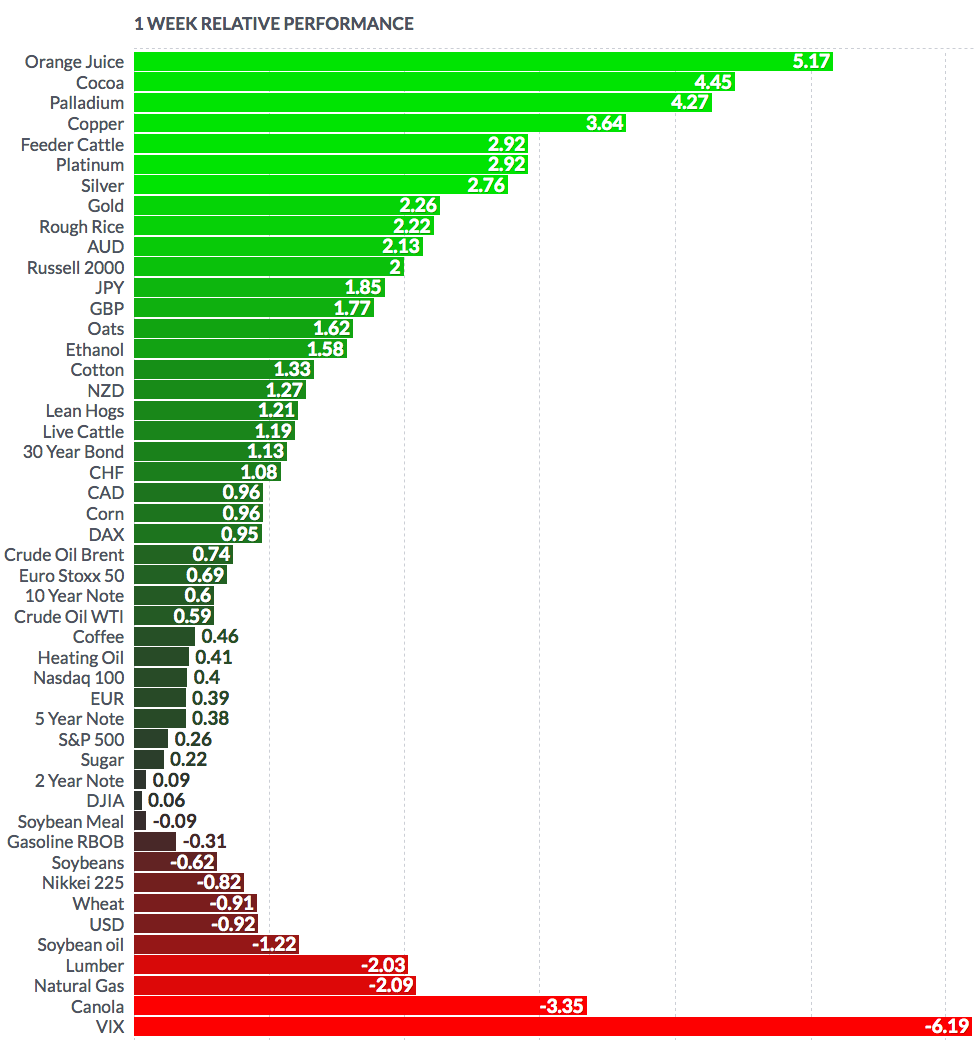

Volatility: The VIX fell 3.3% this week, finishing at $11.28.

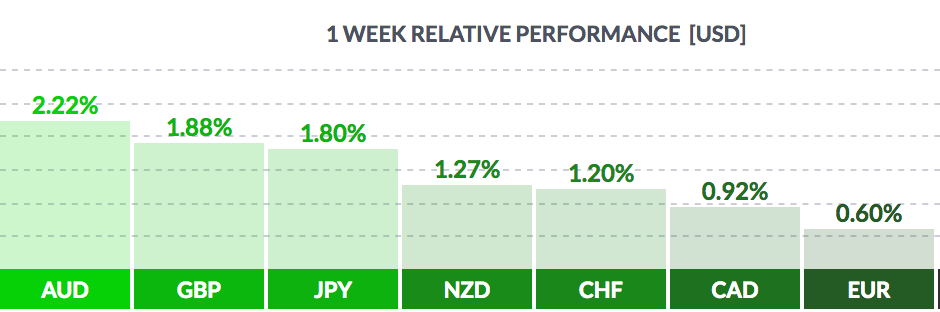

Currency: The dollar fell vs. most major currencies, as currency traders sold on the news of the Fed rate hike. With a populist party’s loss in the Dutch election, European political risk is seen to be fading, which strengthened the euro vs. the dollar. The dollar also lost ground this week on a less hawkish rate forecast from the Fed, and lessened long-term inflation expectations:

Market Breadth: 23 of the DOW 30 stocks rose this week, vs. 7 last week. 74% of the S&P 500 rose, vs. 35% last week.

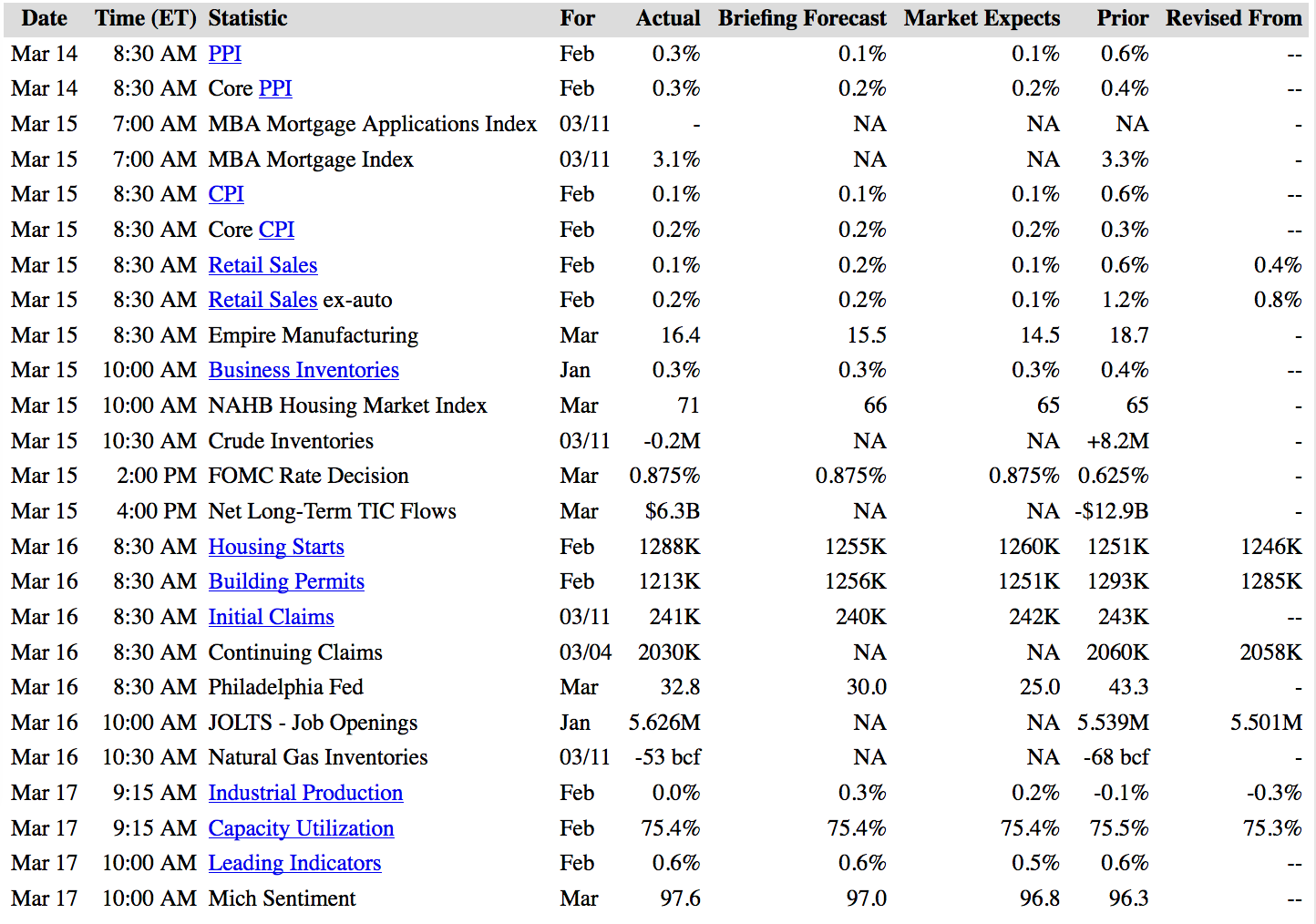

US Economic News: Consumer prices rose 2.7% year-over-year, the biggest increase in nearly 5 years. Consumer Sentiment remained high, at 97.6. Empire Mfg. remains robust.

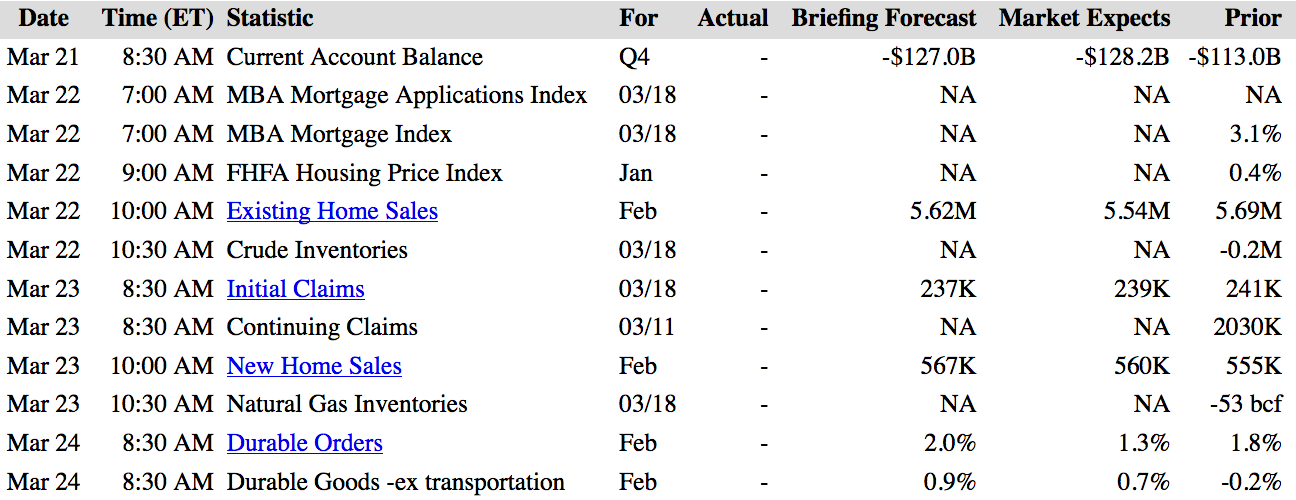

Week Ahead Highlights: It’ll be a light data week, with few economic reports due out. There will also be little in the way of earnings reports over the next few weeks, until we head into the Q1 earnings report season.

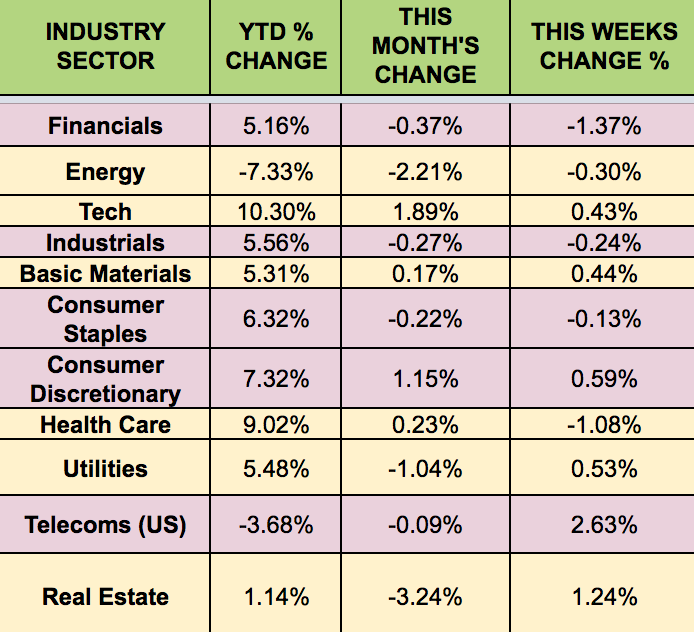

Sectors & Futures: Telecoms led this week, with Financials trailing.

Natural gas futures fell over -2% this week, while WTI crude gained .59%, OJ led, gaining 5%-plus: