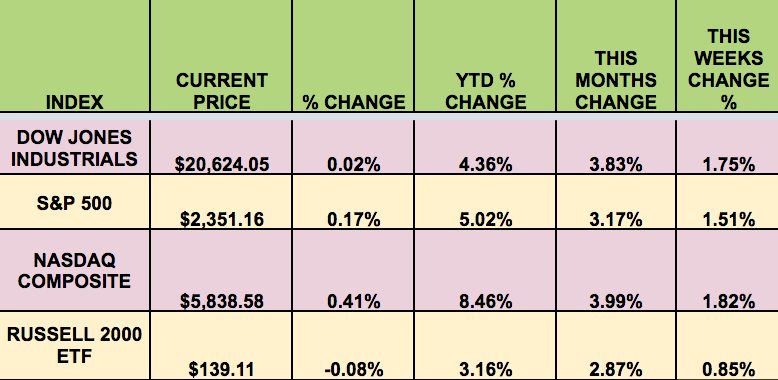

Markets: The market had good gains for the week again, with the Dow, S&P 500 and NASDAQ all hitting all-time highs once again, in spite of Fed Chief Yellen’s testimony to Congress, that the Fed may possibly raise rates in March. Banks had another good week, with the promise of higher rates and political jawboning about rolling back Dodd-Frank pushed big bank stocks higher.

The zeitgeist has shifted in 2017 – over the past few years, any talk of a rate hike would send markets down. In 2017, however, the market sees this as constructive for banks. Of course, the talk about easing financial regulations is very supportive of banks as well.

But wait a minute, weren’t those regulations passed to protect US consumers and the US economy from the reckless behavior of banks, which threw the US into the Great Recession? Yes they were, but investors seem to have forgotten the reason that these regulations were passed.

The rationale for rolling back bank regulations that’s being offered up by the current regime is specious – insisting that “banks aren’t lending to business” is totally incorrect. While some banking regulations may be dampening small community banks profitability, there’s absolutely no proof that big banks aren’t lending to businesses.

Want proof? Check out the many data points and graphs in this Market Watch article by Rex Nutting, which clearly illustrates that there is no business credit squeeze in the US.

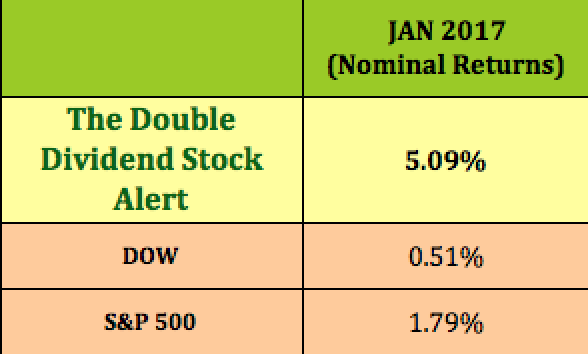

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: BEP (NYSE:BEP), CLDT (NYSE:CLDT), PSEC (NASDAQ:PSEC), STB (NASDAQ:STB).

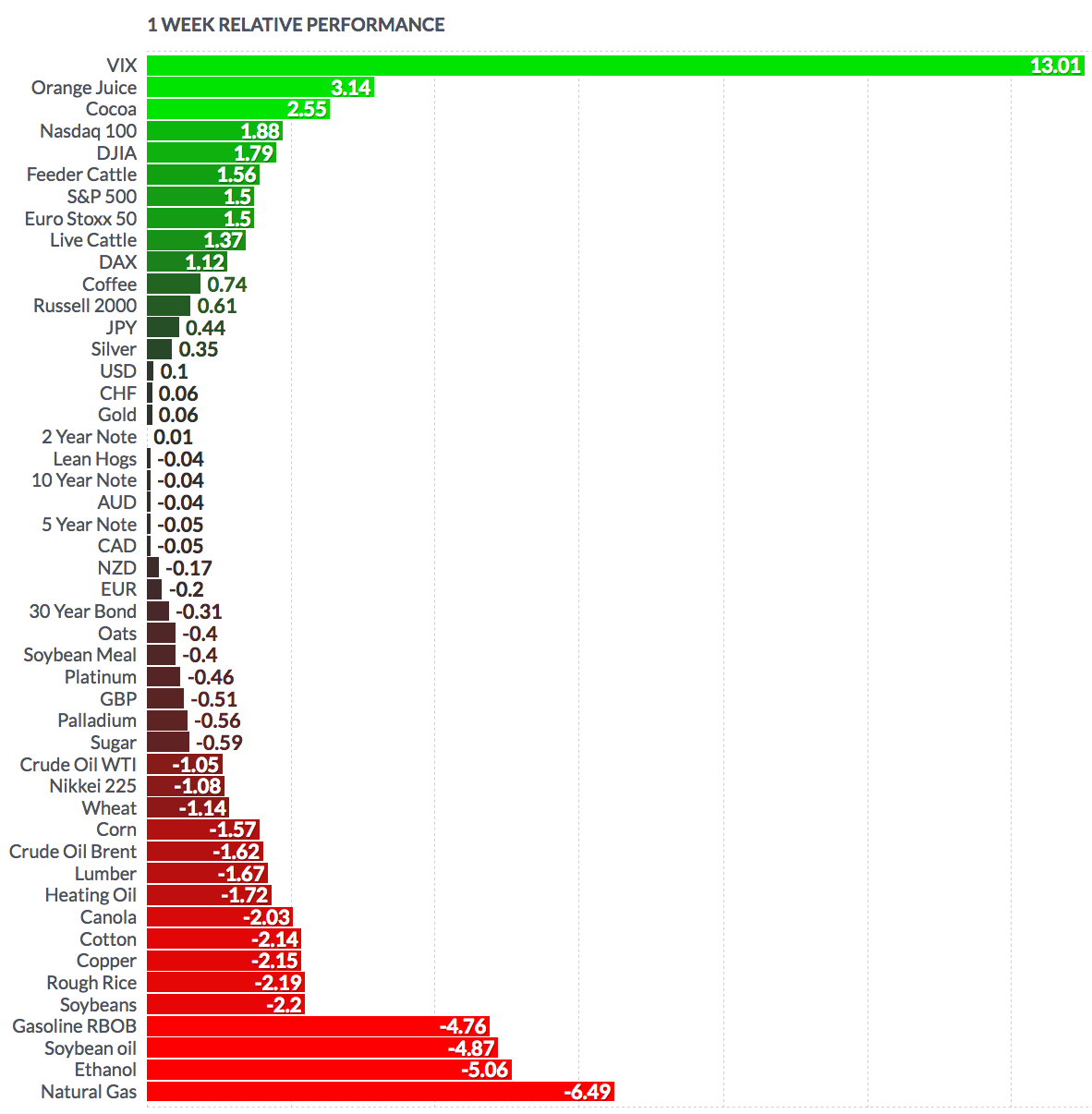

Volatility: The VIX rose 5.9% this week, finishing at $11.49, but still remains at a very low level.

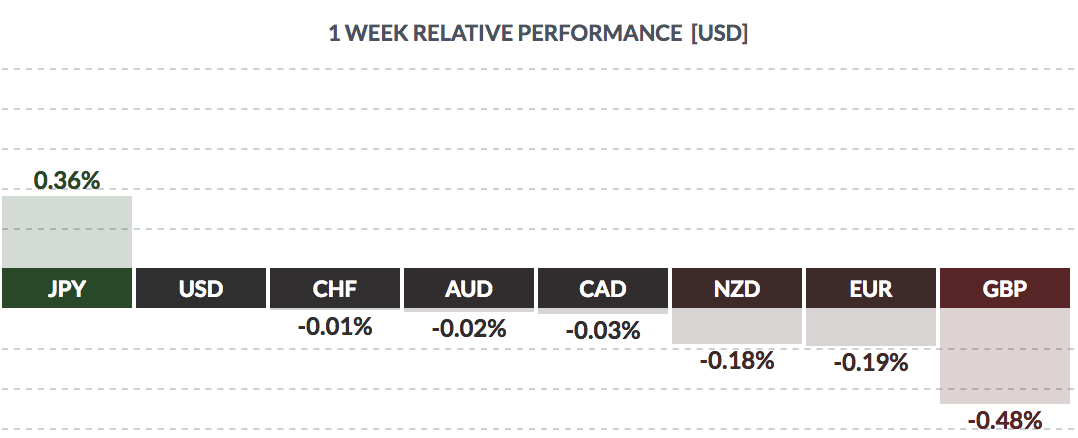

Currency: The USD rose vs. most major currencies, except the yen:

Market Breadth: 27 of the DOW 30 stocks rose this week, vs. 21 last week. 72% of the S&P 500 rose, vs. 69% last week.

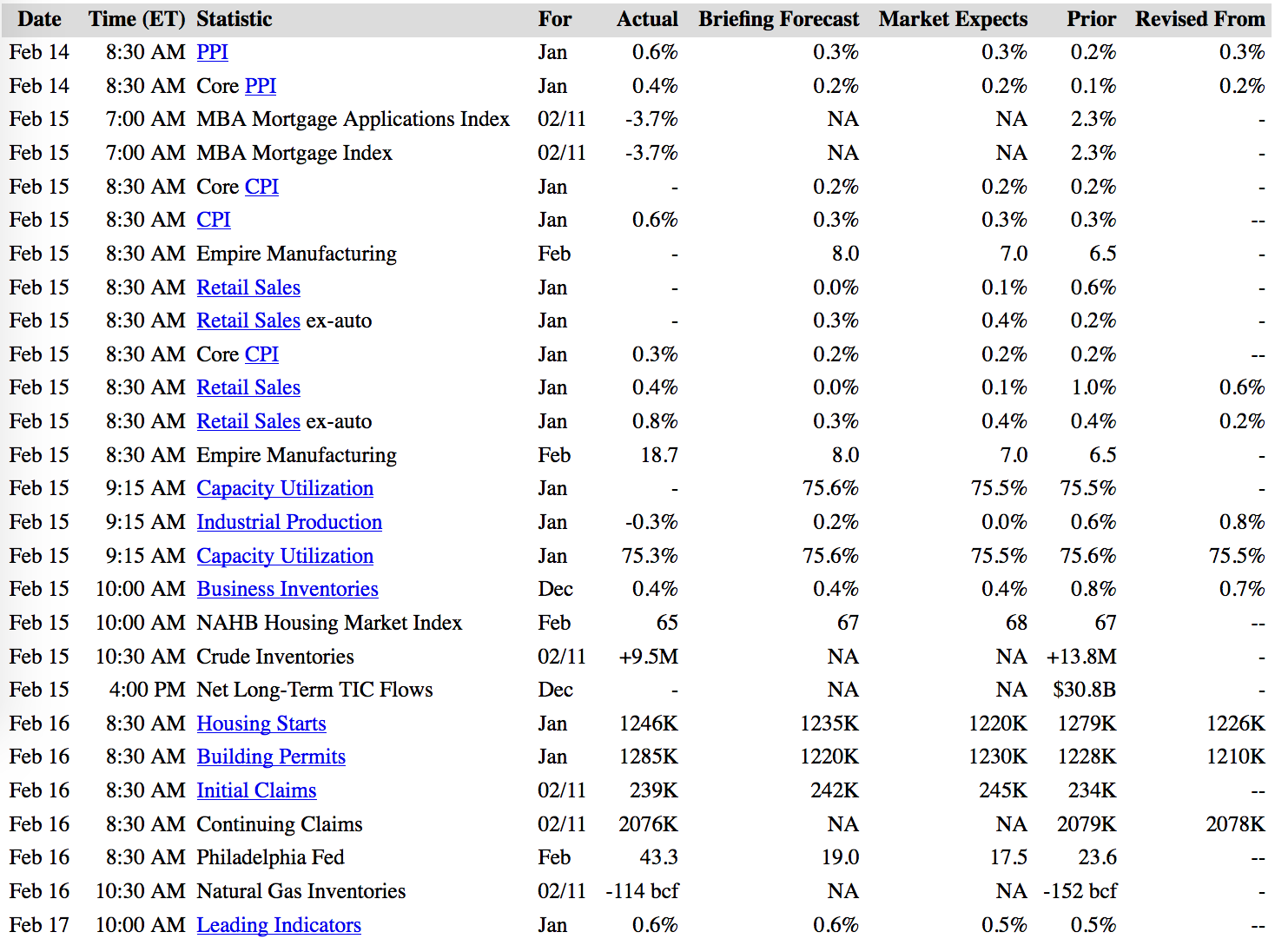

US Economic News: Inflation showed signs of life, with CPI rising 0.6% in Jan, the highest in 4 years, due in part to rising gas prices. Retail Sales jumped in Jan., rising 0.8%. Housing Permits and Building Permits, both Leading Indicators, surprised to the upside.

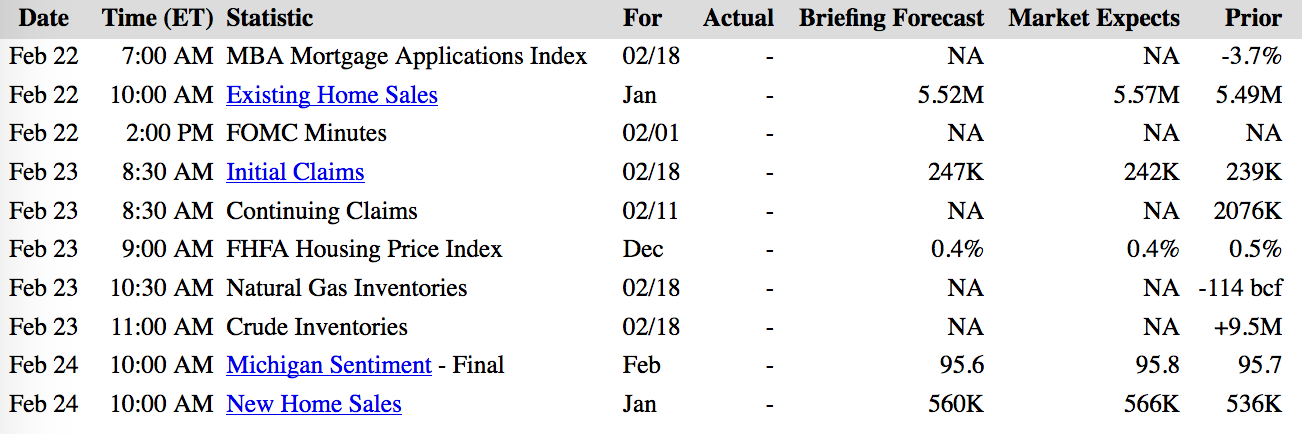

Week Ahead Highlights: It’ll be a shortened week, with markets closed Monday for the President’s Day holiday. There’s not a lot of economic data coming out, but we’ll get a peek into Fed thinking with the Fed minutes release. Existing and New Home Sales reports also come out – will they beat to the upside, in spite of higher rates? The Consumer Sentiment report should give us more clues into Consumers' psyches on Friday.

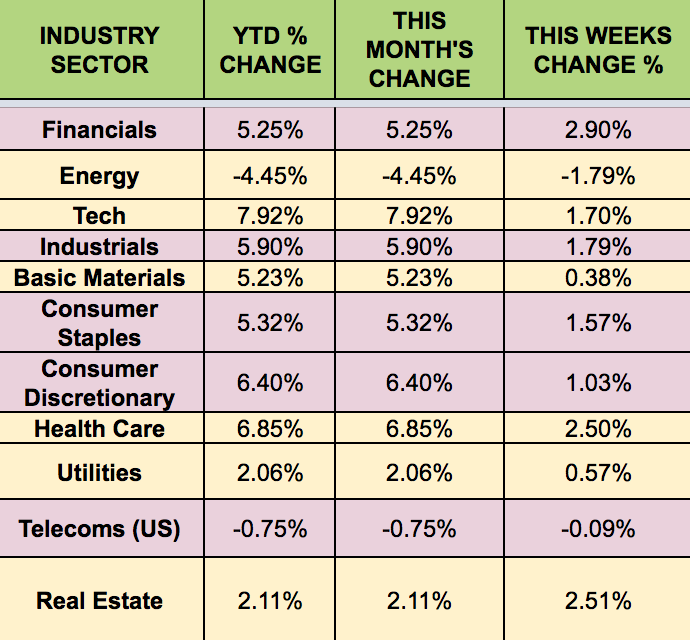

Sectors & Futures: Financials, Real Estate and Healthcare led, while Energy trailed, as Crude slipped 1%.

OJ futures led this week, while Natural gas trailed. WTI crude futures also lost -1% this week: