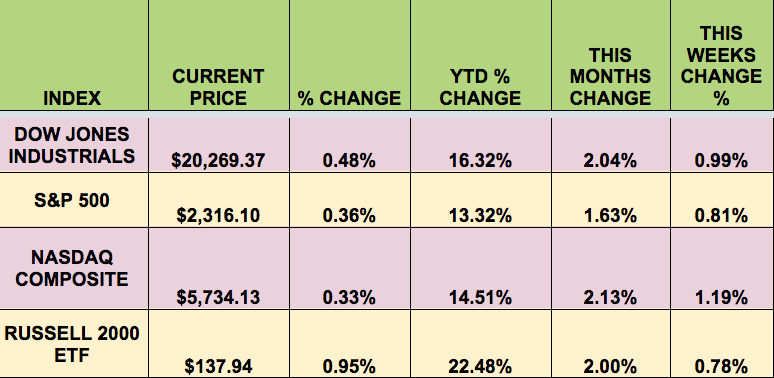

Markets: The market had good gains for the week, with the Dow, S&P 500 and NASDAQ all hitting all-time highs, with big banks getting a boost from promises of future deregulation.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: ARR (NYSE:ARR), CLCT (NASDAQ:CLCT), EVA (NYSE:EVA), OAKS (NYSE:OAKS), TESS (NASDAQ:TESS), GAIN (NASDAQ:GAIN), GLAD (NASDAQ:GLAD), GOOD (NASDAQ:GOOD), HCAP (NASDAQ:HCAP), EXCU (NYSE:EXCU), LTC (NYSE:LTC), MAIN (NYSE:MAIN).

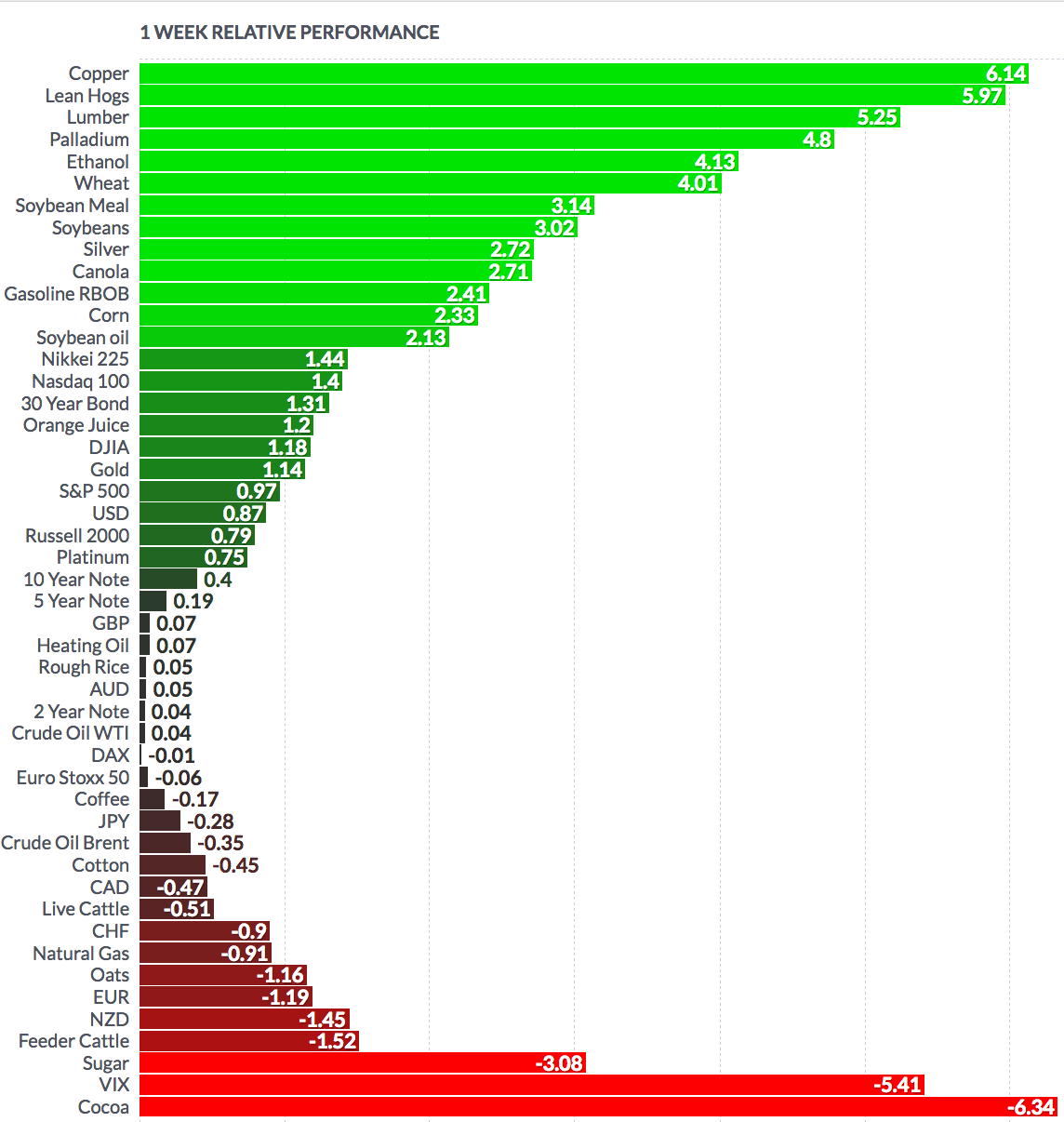

Volatility: The VIX was flat this week, down 1%, finishing at $10.85, still at a very low point.

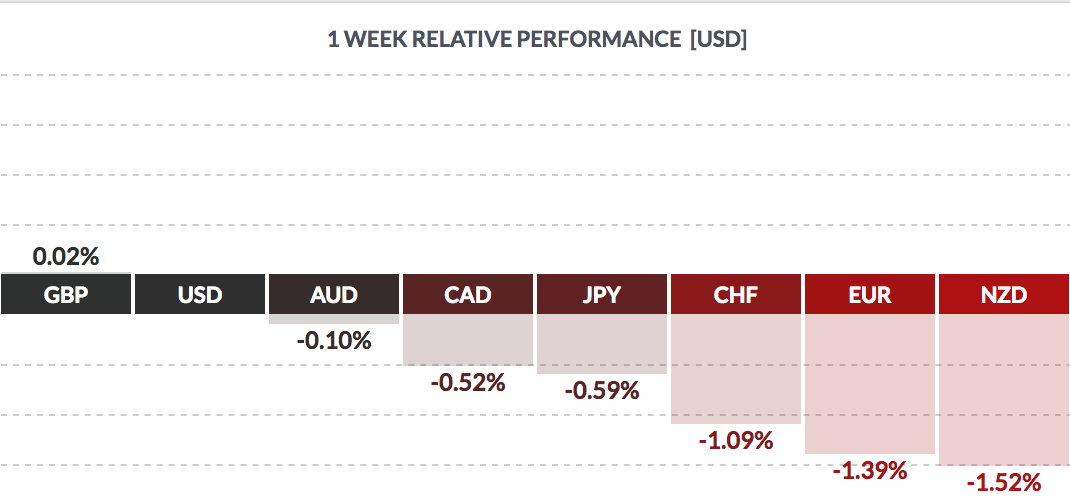

Currency: The USD rose vs. most major currencies, except the pound:

Market Breadth: 21 of the DOW 30 stocks rose this week, vs. 14 last week. 69% of the S&P 500 rose, vs. 58% last week.

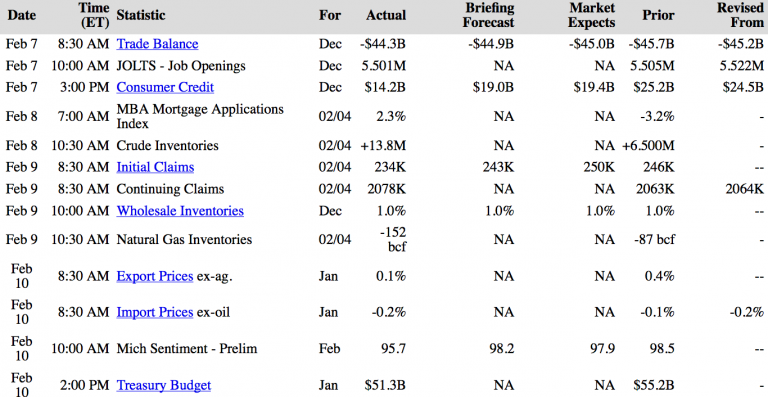

US Economic News: Consumer Confidence came in lower than expected. Mortgage Refi’s fell to their lowest since 2009. Consumer daily spending averaged $88, the highest avg. for January since 2008.

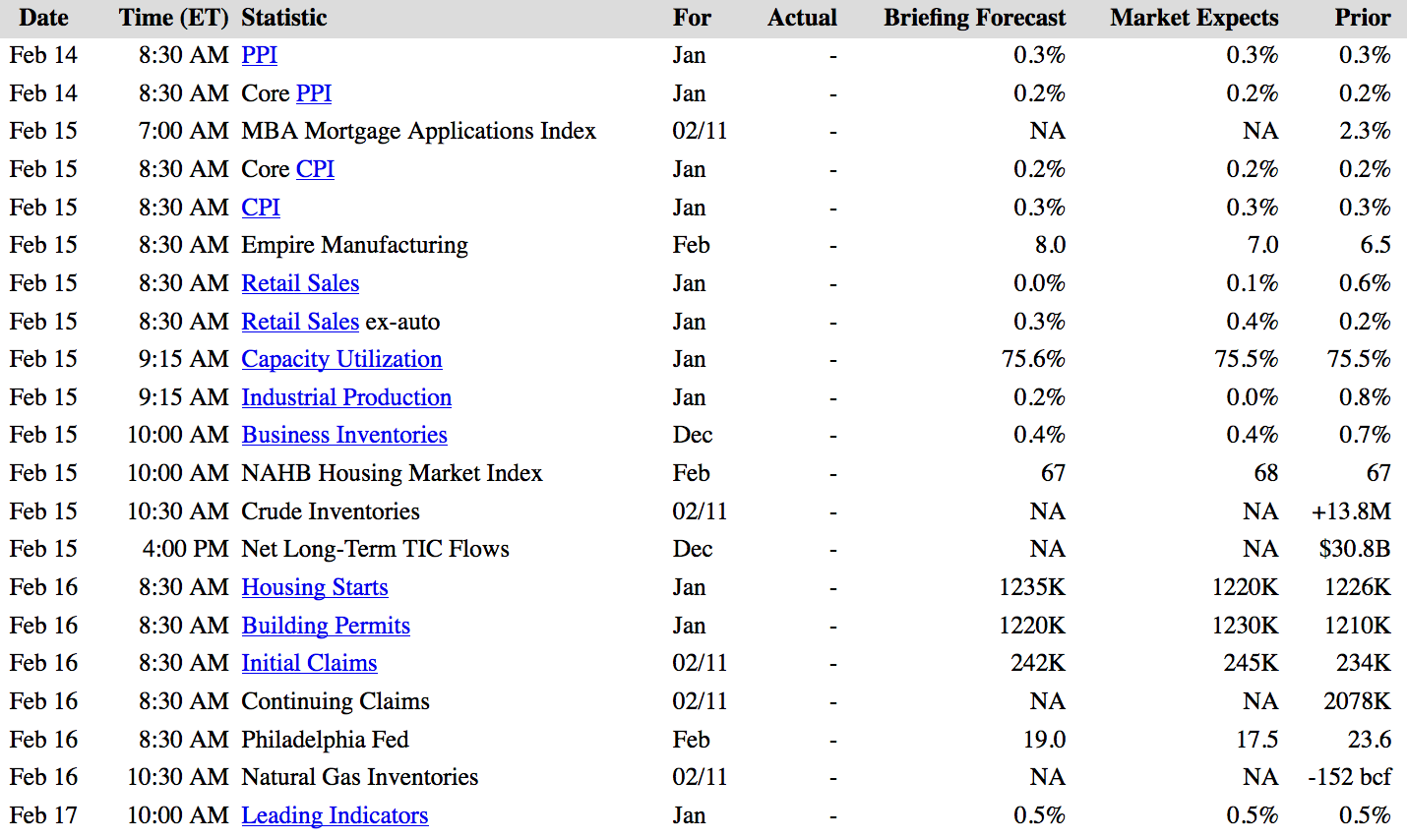

Week Ahead Highlights: Fed Chair Janet Yellen testifies before Senate and House committees on the economy and Fed policy. Earnings season continues, with many healthcare firms reporting, such as Ventas (NYSE:VTR), Express Scripts (NASDAQ:ESRX), HCI (NYSE:HCI), and Mylan (NASDAQ:MYL).

Over 175 Basic Materials firms will be reporting also. 65% of reporting companies have beaten analysts’ EPS estimates, and 56% have beaten revenue estimates. Consumers will be highlighted next week, with Retail Sales and Housing reports due out. We’ll also get the latest inflation data.

Next Week’s US Economic Reports:

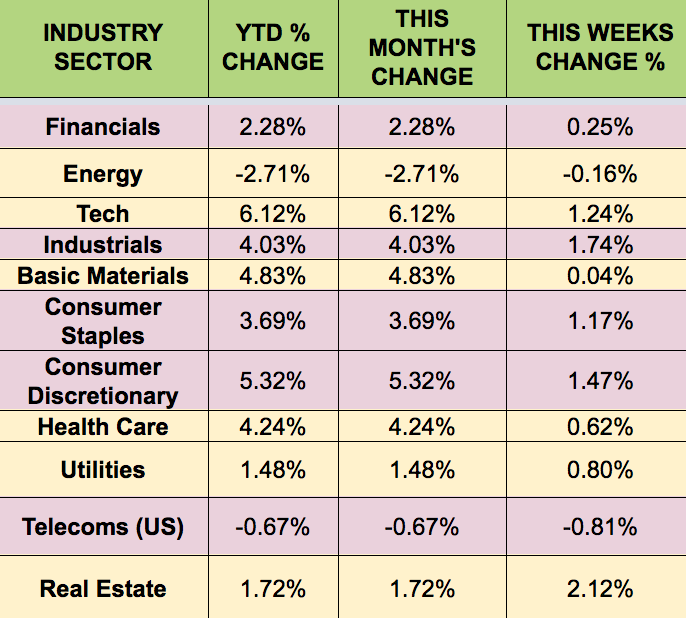

Sectors & Futures: Real Estate and Industrials led, while Telecoms and Energy trailed, as crude was flat.

Copper futures led this week, while cocoa trailed: