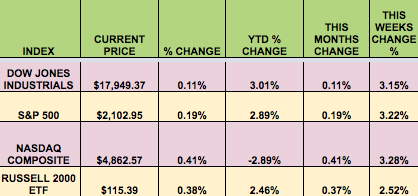

Markets: After the wild post-Brexit pullback on Monday, US indices staged a big rally, with 3 out of 4 notching 3%-plus gains. This was the market’s 1st up week in 3 weeks, no doubt aided by the fact that forecasters are now placing more chance of a Fed rate cut, than any rate hikes in 2016.

Financials remain the weakest sector year-to-date, with no rate hike in sight. The Financial sector will also lose some important window dressing in September, when Standard & Poors breaks out Real Estate REIT’s into a new sector – REIT’s had been propping up the Financial sector’s dividend yield, in addition to adding to earnings.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: City Office (NYSE:CIO), Deswell Industries Inc (NASDAQ:DSWL), KCAP Financial Inc (NASDAQ:KCAP), Manhattan Bridge Capital Inc (NASDAQ:LOAN), RAIT Financial Trust (NYSE:RAS), Waddell & Reed Financial Inc (NYSE:WDR), Potash Corporation of Saskatchewan (NYSE:POT)

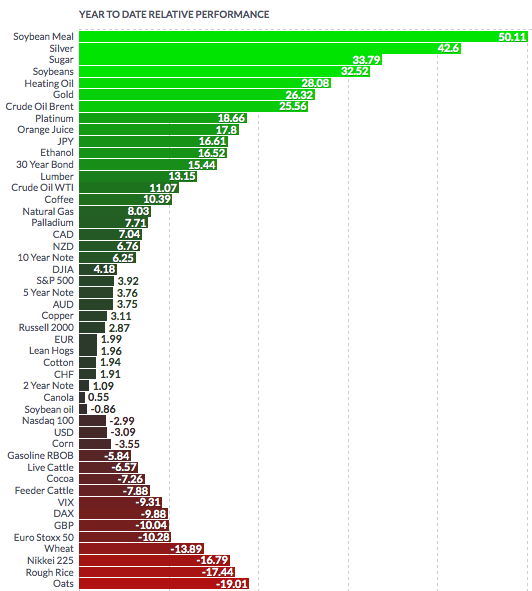

Volatility: The VIX fell 39% this week, finishing at $14.77. Volatility had quite a wild ride in June, but is down YTD, as you can see from this YTD chart:

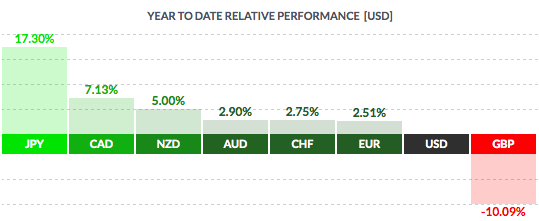

Currency: Japan’s Finance minister must be ready to tear his hair out – after all of that QE, the yen still gained over 17% vs. the dollar, hurting Japanese exporters. The Canadian loonie has regained some of its luster in 2016, rising over 7% vs. the dollar. And look at tiny New Zealand, its currency is up 5% vs. the US dollar.

Meanwhile the Brexit has sent the pound down to levels not seen since the ’80s – it closed the week at $1.32. However, there may be a silver lining – that suddenly cheaper currency should help out UK exporters quite a bit, by making their goods cheaper in the US. The UK tourism industry may see a bounce also, with more Americans taking UK vacations, to take advantage of our suddenly increased purchasing power vs. the pound.

Market Breadth: 28 of the DOW 30 stocks rose this week, vs. 5 last week. 87% of the S&P 500 rose this week, vs. 25% last week.

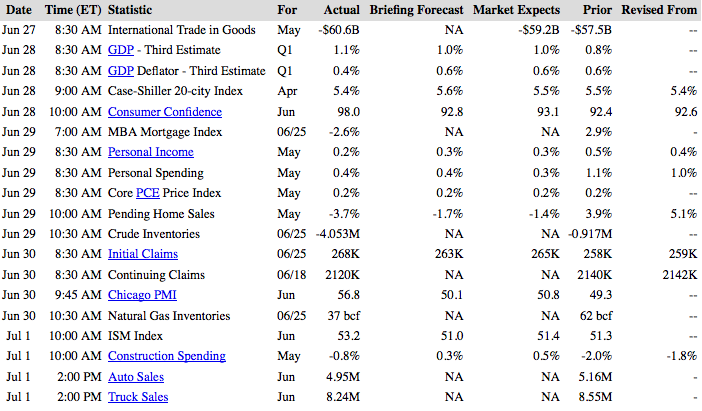

US Economic News: Mortgage refinance applications rose over 60%, in response to rates dropping to 3.75%. Personal Spending inched up to .4% in May, ahead of forecasts.

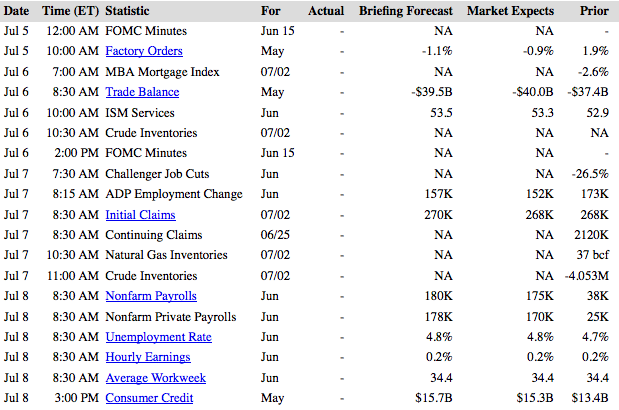

Week Ahead Highlights: It will be a short trading week, with US markets closed Monday for July 4th. On Friday, we’ll get the Non-Farm Payroll Reports for June, and the Unemployment Rate. Forecasters are expecting a big bounce back from May’s very low 38,000 figure. Another very disappointing report may fuel recession fears. Q2 Earnings season will start in 2 weeks, with several big banks reporting.

Next Week’s US Economic Reports:

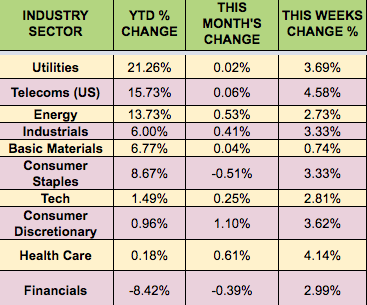

Sectors and Futures:

Anyone who still thinks Utilities are stodgy, better take a hard look at this table – Utilities have thumped the market in 2016, rising over 21%. Meanwhile, Financials have faltered, in the wake of no rate hikes, and global growth concerns. Energy has come back, rising over 13%, thanks to a huge rebound in the price of crude oil from its February lows.

Value hunters take note – look at how Healthcare is flat year to date. Does that make sense, with 10,000 Boomers turning 65 daily in the US? Is the potential political fallout really going to squash profits that much? Probably not.

Soybean meal, silver, and sugar have had a huge gains so far in 2016…oats, not so much.