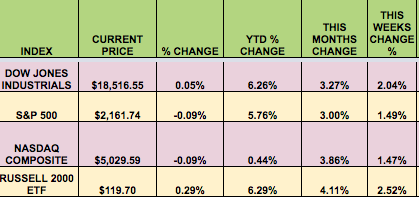

Markets: The Dow and the S&P 500 hit all-time highs this week, as the post-Brexit rally rolled on. This was the 3rd straight week of 1%-plus gains. The Dow posted 4 straight record closes this week, as markets were lifted by good economic news from China and the US, while Financials were buoyed by good earnings from JP Morgan Chase (NYSE:JPM).

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: PennantPark Floating Rate Capital Ltd (NASDAQ:PFLT), Compass Diversified Holdings (NYSE:CODI), Main Street Capital Corporation (NYSE:MAIN), Capitala Fi (NASDAQ:CPTA), Vermilion Energy Inc. (NYSE:VET).

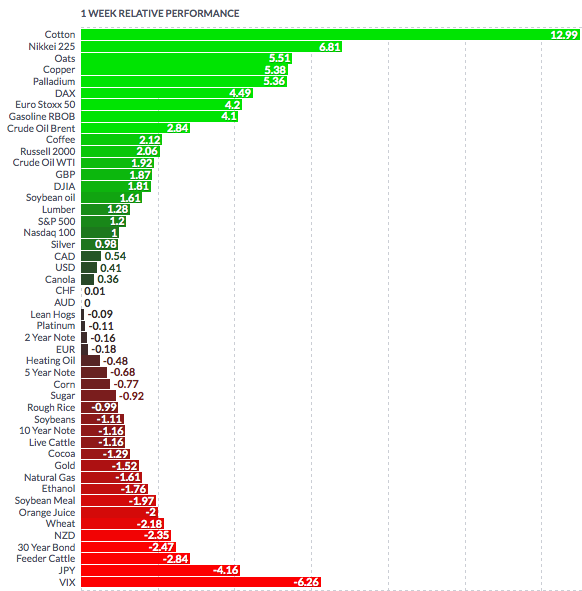

Volatility: The VIX fell 6.4% this week, finishing at $13.85.

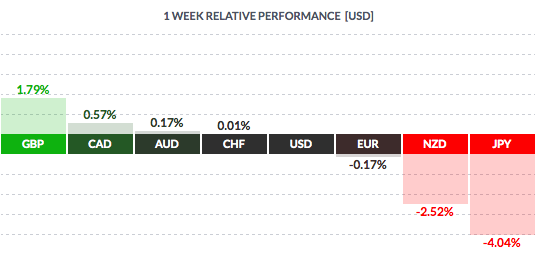

Currency: The dollar rose vs. the yen, the euro, and the NZ dollar this week.

Market Breadth: 28 of the Dow 30 stocks rose this week, vs. 26 last week. 74% of the S&P 500 rose this week, vs. 77% last week.

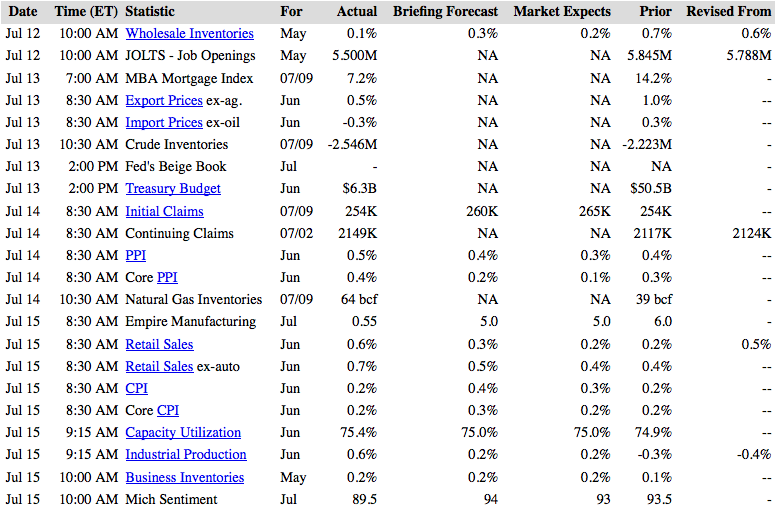

US Economic News: Industrial Production was more robust, +.6%, in June than forecasted. June Producer Prices overshot forecasts, but the Consumer Price Index underwhelmed.

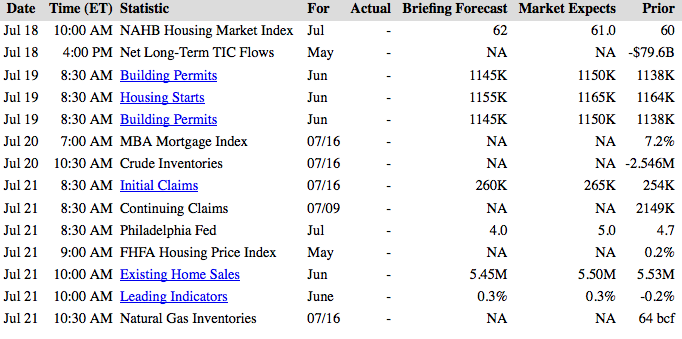

Week Ahead Highlights: Q2 earnings season revs up, with many top industrial and exporting companies report next week -International Business Machines (NYSE:IBM), Schlumberger (NYSE:SLB), Johnson Controls (NYSE:JCI), Johnson & Johnson (NYSE:JNJ), and others with more sales exposure to Europe than other companies. 11 of the 30 Dow stocks will report earnings, and 90 S&P 500 stocks will report. Housing will be in the spotlight next week, as several reports will be released on Mon-Wed. The Republican National Convention starts on Monday.

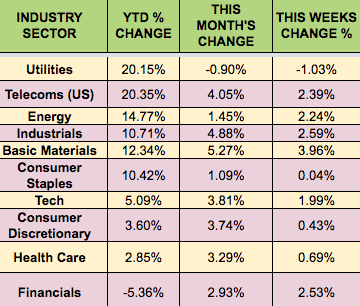

Sectors and Futures:

Basic Materials led this week, as Utilities trailed.

Cotton led this week, with cattle trailing: