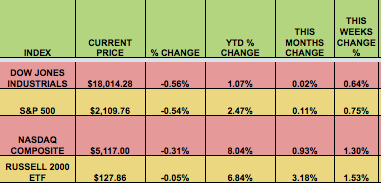

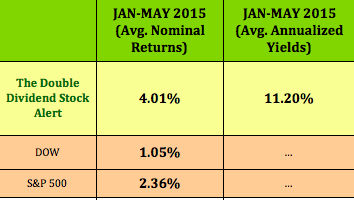

Markets: Markets put together an up week, the best since April, in spite of Friday’s down day, which was inspired by the continued uncertainty about Greece, ahead of the Monday pm Eurozone meeting, which aims to come up with a last-ditch bailout plan for Greece. Investors were cheered by no rate hike moves by the Fed. The NASDAQ hit a new high, and the Russell Small Caps had yet another up week, and continue to lead the DOW and S&P 500 large caps year-to-date by a wide margin.

Market Breadth: 20 DOW stocks rose this week, vs. 18 last week. 66% of all S&P 500 stocks rose this week, vs. 53% last week.

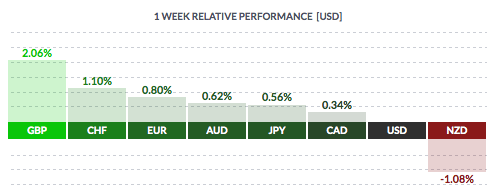

Currency: The US dollar fell again vs. most other currencies, except the NZ dollar.

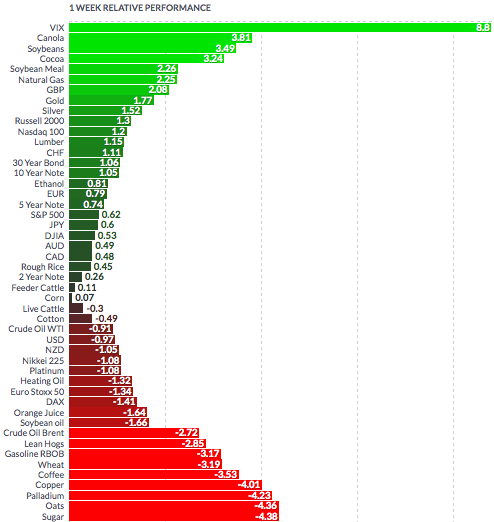

Volatility: After reaching as high as 15.62 mid-week, the VIX rose 5% for the week, ending at 13.96.

US Economic News: As expected, the Fed kept its rate at .25%.

FED Statement excerpt:

“Economic activity has been expanding moderately after having changed little during the first quarter. The pace of job gains picked up while the unemployment rate remained steady. On balance, a range of labor market indicators suggests that underutilization of labor resources diminished somewhat.

Growth in household spending has been moderate and the housing sector has shown some improvement; however, business fixed investment and net exports stayed soft. Inflation continued to run below the Committee’s longer-run objective, partly reflecting earlier declines in energy prices and decreasing prices of non-energy imports; energy prices appear to have stabilized. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations have remained stable.”

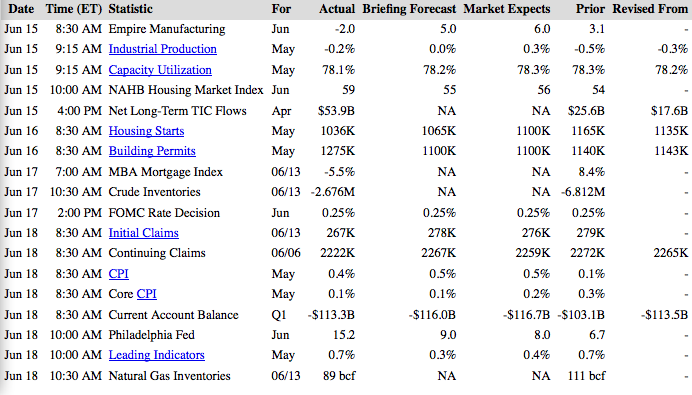

Consumer Prices rose in May, the most in 2 years, due to rising gasoline prices…Core CPI only rose .1%, less than forecast…Building Permits rose nearly 12%, best since 2007…Housing Starts underwhelmed again…Homebuilder Sentiment rose to 59, beating forecasts…Initial Claims were 12K below estimates…

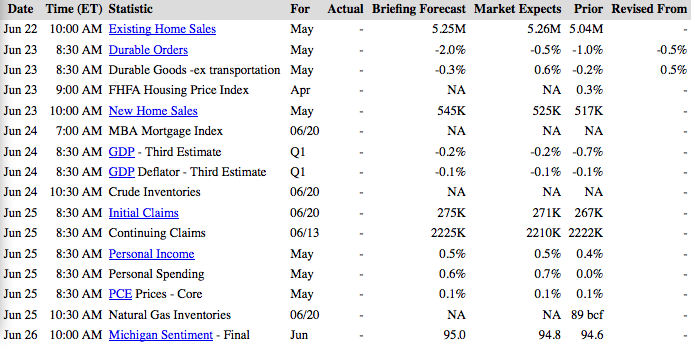

Week Ahead Highlights: The Greek debt talks, with an emergency meeting scheduled for Mon. pm, may continue to weigh on markets at the top of the week. Homebuilders will be in the spotlight early in the week, with the Existing and New Home Sales reports due out, while Consumer data comes out late week – Spending and Consumer Sentiment.

Next Week’s US Economic Reports:

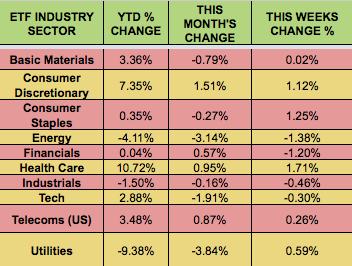

Sectors and Commodities:

Healthcare led this week, while energy lagged.

Canola oil led this week, while sugar lagged.