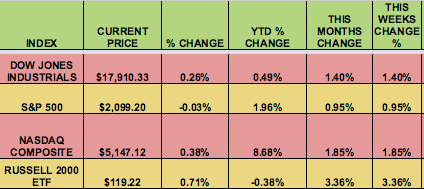

Markets: It was definitely back to “risk on” this week, as the Russell 2000 small caps greatly outpaced the other 3 indexes.

Volatility: After rising as high as $16.33 on Thursday, the VIX fell 5% this week, to end the week at $14.33.

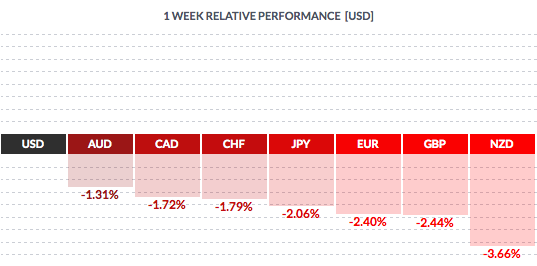

Currency: Prompted by Fed Chief Yellen’s hawkish comments concerning the possibility of a December rate hike, the dollar had major gains vs. most major currencies this week.

Market Breadth: 23 of the Dow 30 stocks rose this week, vs. 15 last week. 60% of the S&P 500 rose this week, vs. 51% last week.

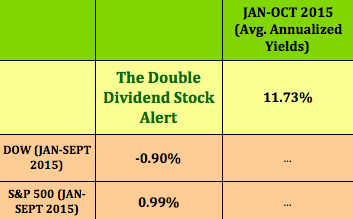

Dividend Stocks Update: High Dividend Stocks going ex-dividend next week include O:CLCT, N:FELP, N:RDSb, O:GAIN, O:GLAD, O:GOOD.

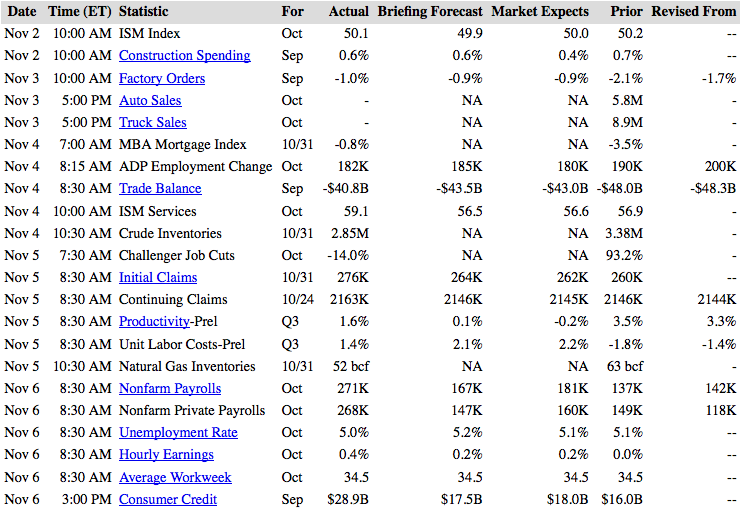

US Economic News: Total Non-Farm Employment rose by 271,000 jobs in October, the most since June. Gains occurred in professional and business services, healthcare, retail, services, and construction. Mining continued to trend down. The Unemployment rate inched down to 5%. Wages grew 2.5% in October from a year ago, the best increase since July 2009.

Week Ahead Highlights: With a strengthening labor market, retailers are set to report earnings next week and could help the consumer sector regain the leadership lost to technology in the latest market rally. Pricing power will likely pick the winners, analysts say. Several signs point to solid performance by the group as it heads into its strongest sales season. Consumers have cash to spend as wages rise, October posted the best print on monthly jobs creation this year, and gasoline prices remain low right before the start of the holiday shopping season. (Reuters)

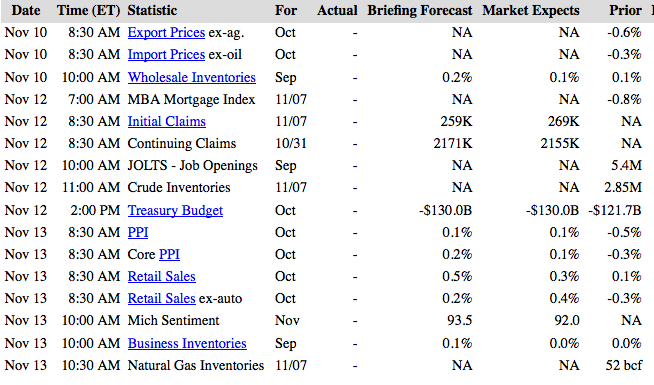

Next Week’s US Economic Reports:

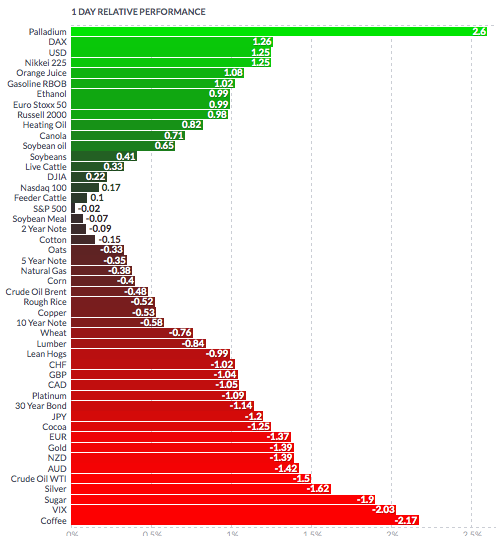

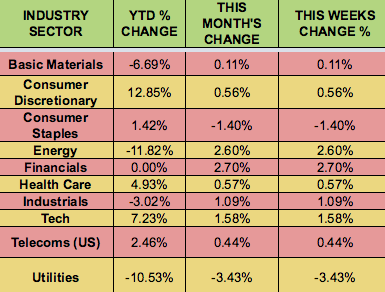

Sectors and Futures:

Financials and Energy led this week, as Utilities trailed.

Java lovers rejoice – coffee trailed, while palladium led this week: