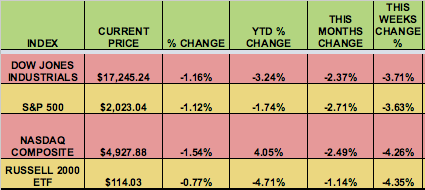

Markets: The market had its worst week since August, with all 4 indexes falling 3% to over 4%. Tech shares sold off Thursday-Friday, and department stores also got hit, on worries about the coming holiday shopping season.

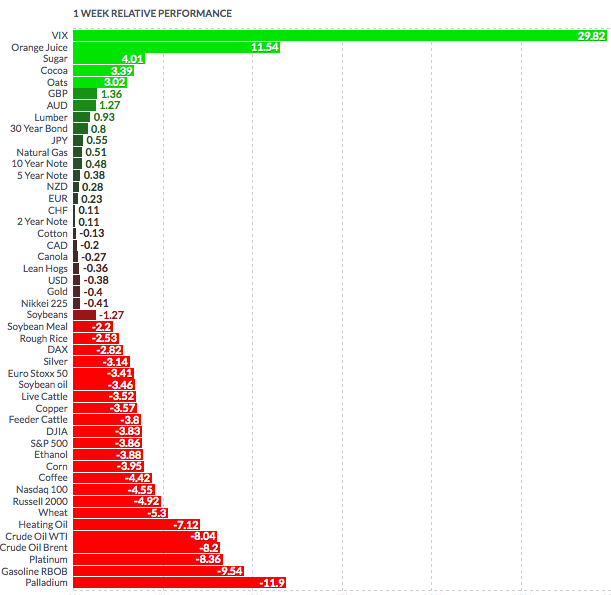

Volatility: The VIX surged 40% vs. last week’s close, ending the week at $20.08, its highest close since Oct. 2nd.

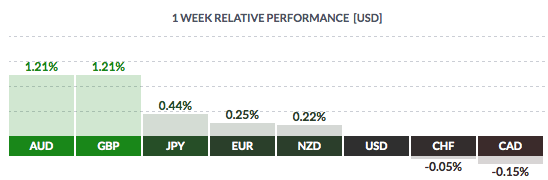

Currency: The dollar fell vs. most major currencies, except the Swiss franc and the loonie.

Market Breadth: 2 of the DOW 30 stocks rose this week, vs. 23 last week. 10% of the S&P 500 rose this week, vs. 60% last week.

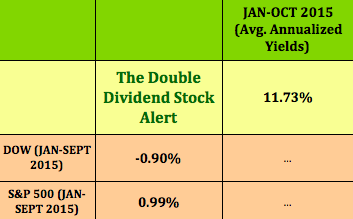

Dividend Stocks Update: These high dividend stocks are going ex-dividend this coming week – N:ALDW, N:ABR, N:CAPL, N:CDI, O:HRZN, O:PFLT, N:PSF, O:SUNS, O:BGCP, O:HCAP, N:LTC, N:MAIN, N:TGH.

Dividends are going to set a record this year, says Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. Silverblatt expects dividends paid by companies in the S&P 500 to total $382 billion at year-end.

Goldman (N:GS) predicts dividend payouts will rise 7% next year, to $432 billion, or $46 a share, helped by strong corporate balance sheets. As of Nov. 12, 313 companies in the S&P 500 had unveiled dividend hikes in 2015, versus 15 decreases, half of which were energy companies, according to S&P Dow Jones Indices. (Source: Barrons)

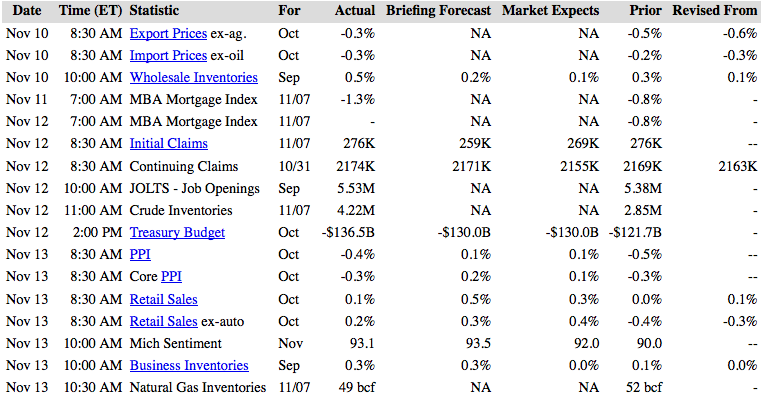

US Economic News: The Producer Price Index has fallen -1.6% over the past year, a new record. Sept. Job Openings were the 2nd best since December 2000.

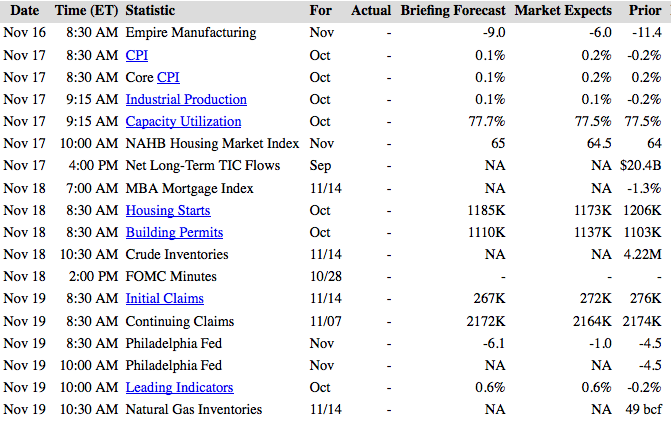

Week Ahead Highlights: The minutes from the Fed’s October meeting will be released on Wednesday. Square, an IPO started by Twitter (N:TWTR) founder Jack Dorsey, will price its shares. Several Fed members will be giving speeches – (on Tues, Wed, and Friday). Housing data comes out on Tues – Wed.

Next Week’s US Economic Reports:

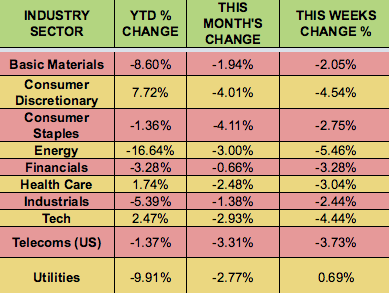

Sectors and Futures:

Utilities led this week, as Energy trailed.