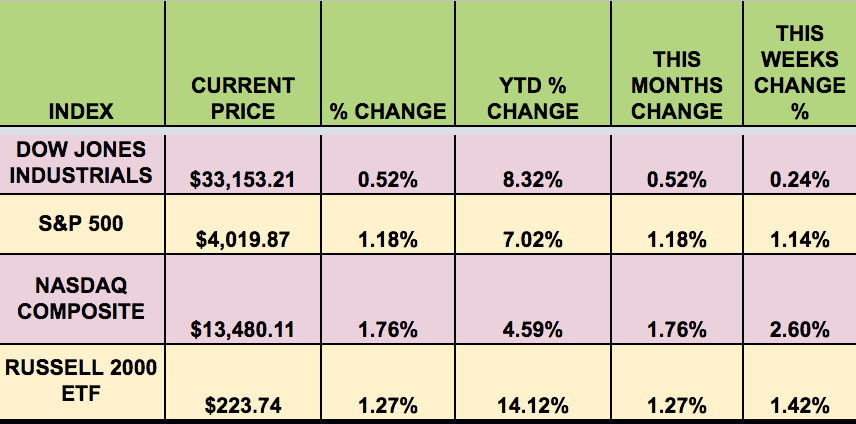

Market Indexes: The market was up in a shortened week, with all 4 indexes making gains. The NASDAQ led, followed by the Russell small caps. The S&P 500 hit 4,000 for the first time on Thursday and closed the week up 1.18% at 4,019.87, pushing the benchmark index’s gain to nearly 80% from the March 2020 lows.

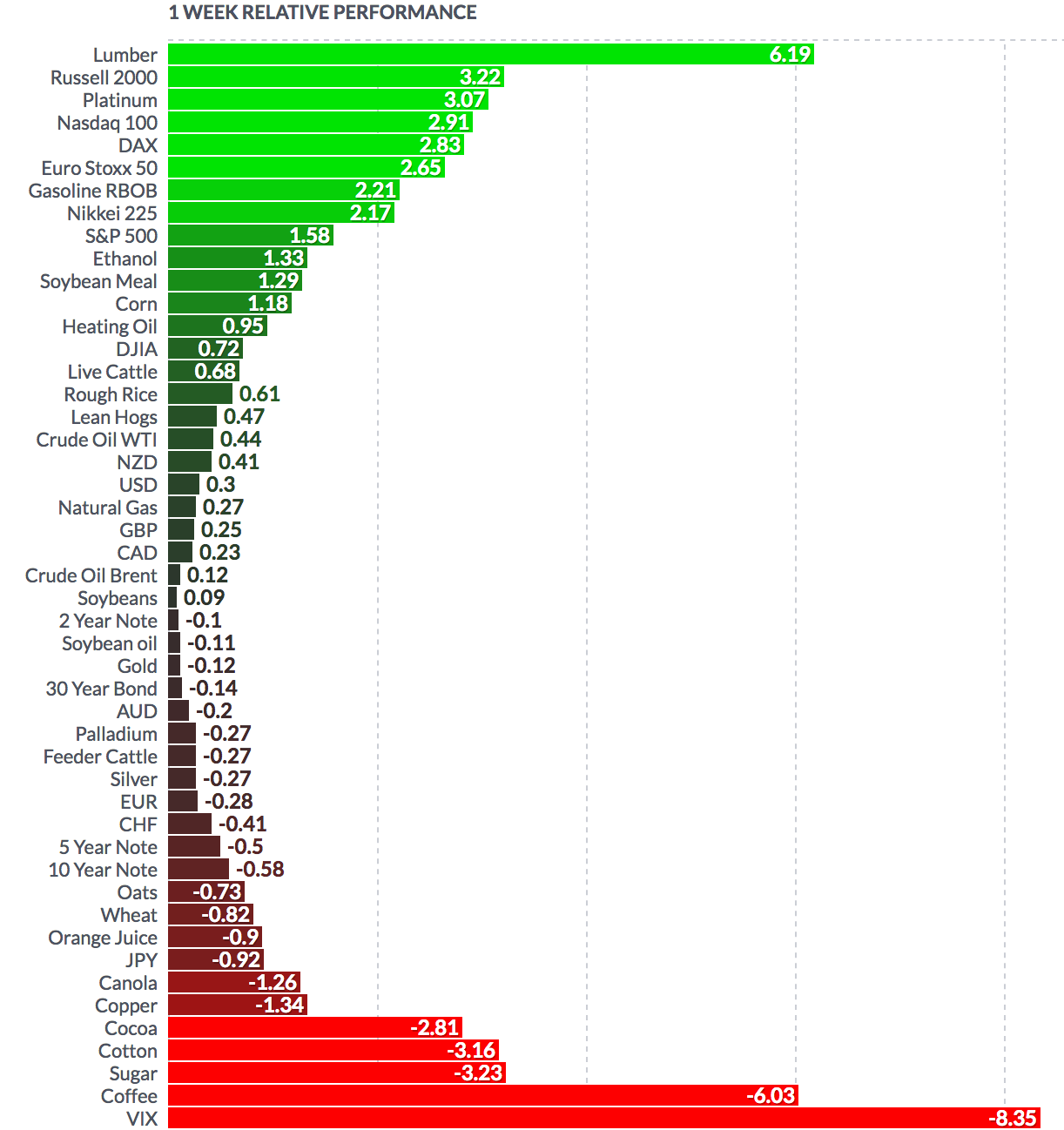

Volatility: The VIX fell 8% this week, ending at $17.33.

High Dividend Stocks: These high dividend stocks go ex-dividend next week: United Security Bancshares (NASDAQ:UBFO), Brandywine Realty Trust (NYSE:BDN), Saratoga Investment Corp (NYSE:SAR), AT&T (NYSE:T), Invesco Mortgage Capital (NYSE:IVR), Manhattan Bridge Capital (NASDAQ:LOAN), Universal Corporation (NYSE:UVV).

Market Breadth: 26 out of 30 Dow stocks rose this week, vs. 22 last week. 85% of the S&P 500 rose, vs. 74% last week.

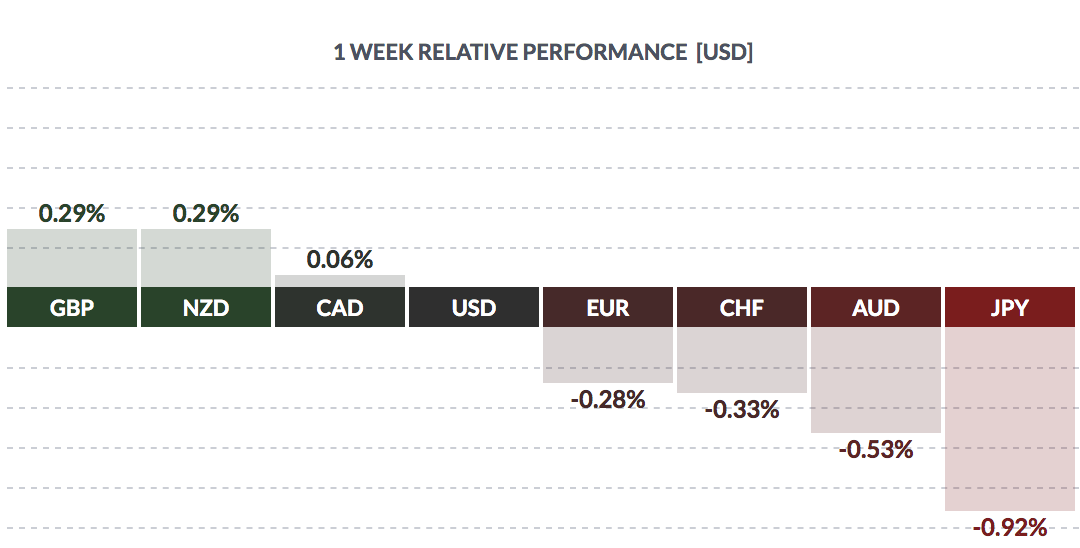

FOREX: The US dollar rose vs. the yen, Aussie, Swiss franc, and the euro, and fell vs. the pound, the Loonie, and the NZD this week.

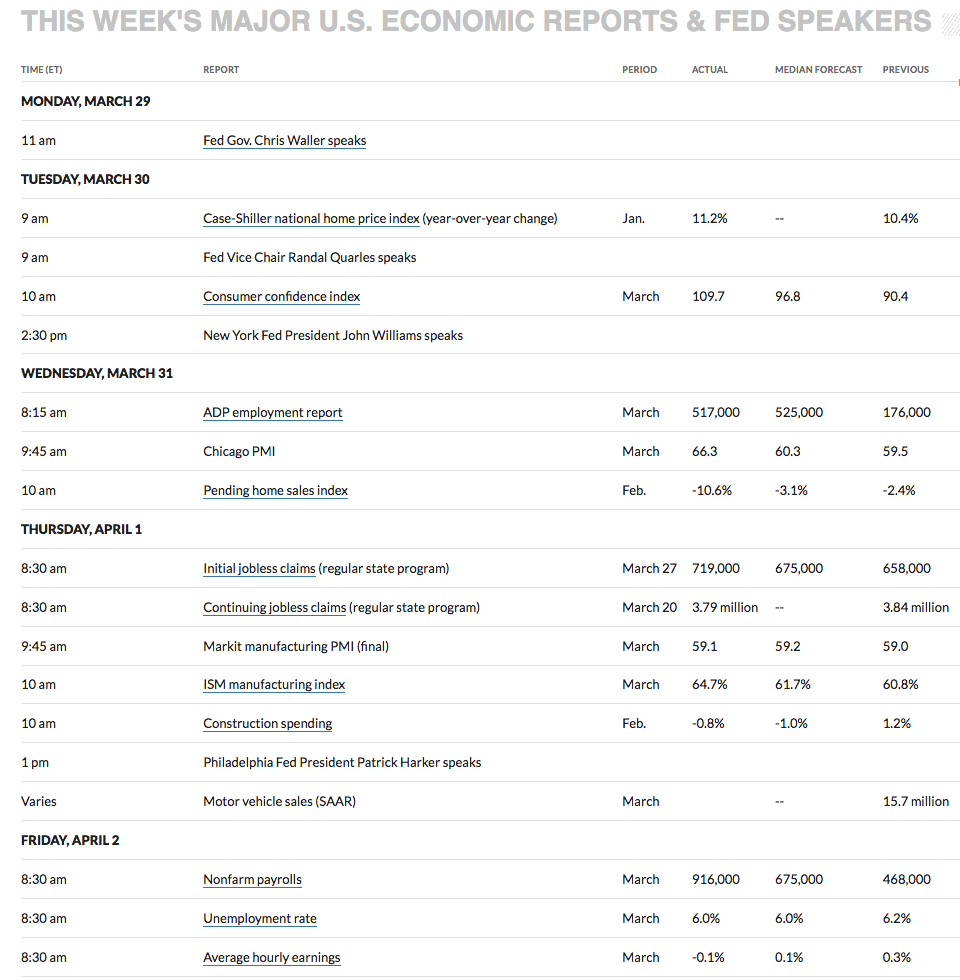

Economic News:

“”The U.S. jobs rebound picked up steam last month, fueled by the accelerating pace of vaccinations and a new injection of federal aid.

Employers added 916,000 jobs in March, up from 416,000 in February and the most since August, the Labor Department said Friday. It was 241,000 more than predicted by economists. February’s gains were revised higher by 89,000 as well, to 468,000.

The leisure and hospitality sector led the way, adding 280,000 jobs as Americans returned to restaurants and resorts in greater numbers. Construction firms added 110,000 jobs as the housing market stayed strong and activity resumed following winter storms in February.

The unemployment rate fell to 6%, down from 6.2% in February.

Economists said the latest data marked a turning point. Last month was the third straight month of accelerating hiring, and even bigger gains are likely in the months ahead. The March data was collected early in the month, before most states broadened vaccine access and before most Americans began receiving $1400.00 checks from the federal government as part of the most recent relief package.

“The tide is turning,” said Michelle Meyer, chief U.S. economist for Bank of America (NYSE:BAC). The report, she said, “reaffirms this idea that the economy is accelerating meaningfully in the spring.”

The United States still has 8.4 million fewer jobs than it did before the pandemic. Even if employers kept hiring at the pace they did in March, it would take months to fill the gap. More than four million people have been out of work for more than six months, a number that continued rising in March.

Few economists expect a repeat of the winter, when a spike in Covid-19 cases pushed the recovery into reverse. More than a quarter of U.S. adults have received at least 1 dose of a coronavirus vaccine, and more than two million people a day are being inoculated. That should allow economic activity to continue to rebound.” (NY Times)

Week Ahead Highlights: The Q1 ’21 earnings report season will start in mid-April, with overall S&P 500 earnings are expected to jump 24.2% from a year ago.

“One near-term market focus is likely to be whether Congress will pass the infrastructure plan Biden formally introduced this week. It includes $2 trillion in spending but also higher corporate taxes that investors fear could undermine profits. Economists at Jefferies (NYSE:JEF) estimate Biden’s infrastructure plan overall could add 0.5 to 1 percentage points to their estimate of 5.2% growth in U.S. gross domestic product in 2022.” (Reuters)

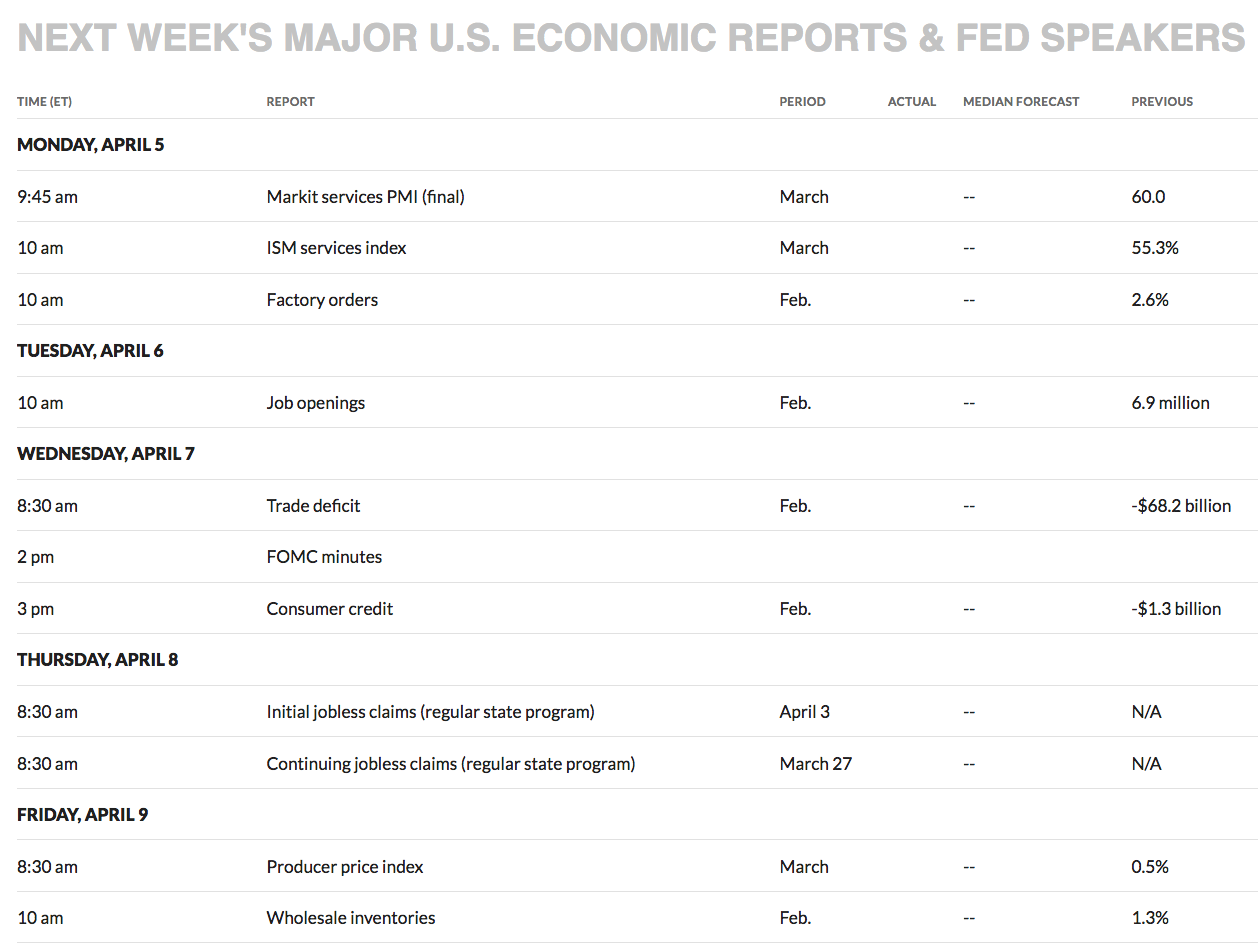

Next Week’s US Economic Reports:

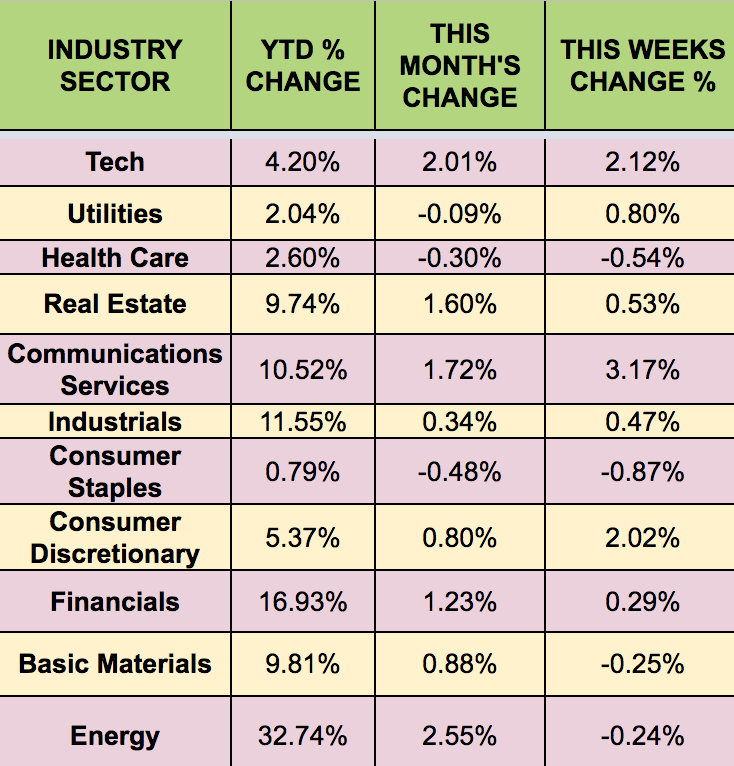

Sectors: The Communications Services sector led this week, while the Consumer Staples sector lagged.

Futures: WTI Crude rose .44% this week, after sliding earlier, ending the week at $61.24.

“Oil prices slid on Tuesday as the Suez Canal reopened to traffic and the dollar rallied, while focus turned to an OPEC+ meeting this week, where analysts expect an extension to supply curbs to offset dim demand prospects. Ships were moving through the Suez Canal again a day after tugs refloated the Ever Given container carrier, which had blocked the passage for almost a week. The backlog of 422 ships could be cleared in 3 -1/2 days, the canal’s chairman said.

Saudi Arabia is prepared to accept an extension of production cuts through June and to prolong its own additional cuts amid the latest wave of coronavirus lockdowns, a source briefed on the matter said on Monday.” (Reuters)