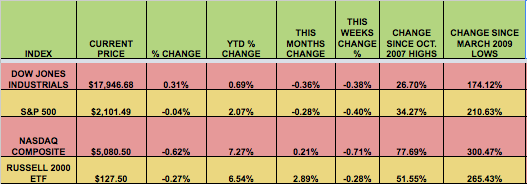

Markets: It was a down week for the market, in spite of strong US Consumer Spending, Consumer Sentiment, and Housing data. The culprit? You guessed it – the ongoing Greek drama. How fitting that the country that gave the world the art of drama millenia ago hasn’t lost its flair for it in the 21st century. There’s yet another round of meetings this weekend to try and stave off a default on the looming June 30th payment due date.

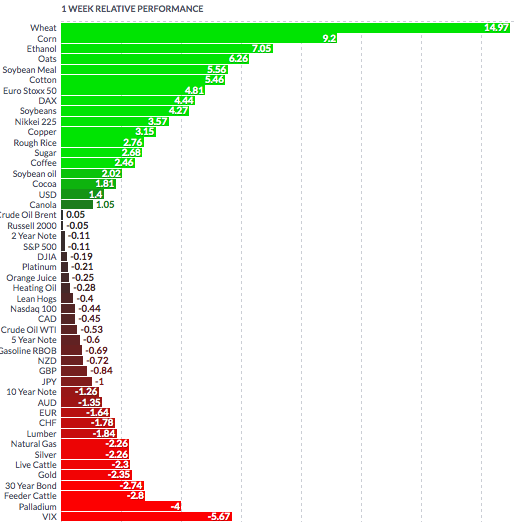

Volatility: In spite of the down week, the VIX barely budged, finishing at 14.02 vs. last week’s 13.96 close.

Market Breadth: 10 DOW stocks rose this week, vs. 20 last week. 38% S&P 500 stocks rose this week, vs. 66% last week.

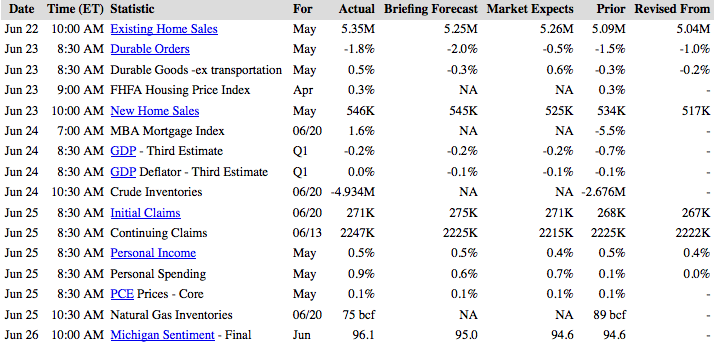

US Economic News: Consumer Spending had its biggest monthly jump in over 6 years, rising .9% in May. Initial Claims have now been under 300K for 16 weeks. Existing Home Sales jumped 5.1% to 5.33M, best since 2009. New Home Sales also surprised to the upside, at 546K. Consumer Sentiment hit a 5-month high.

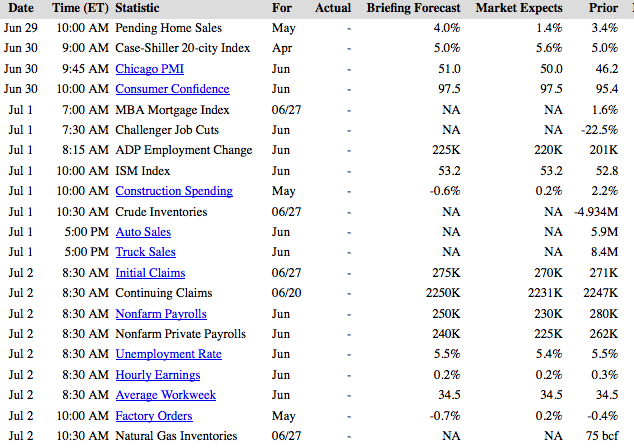

Week Ahead Highlights: Greece Debt Payment is due on Tuesday. Markets will be closed on Friday, for the July 4th holiday. Non-Farm Payrolls come out a day earlier, on Thursday, due to the holiday – consensus is for 232K jobs added in June, and the Unemployment Rate to edge down to 5.4%.

Next Week’s US Economic Reports:

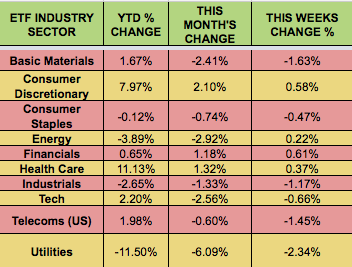

Sectors and Futures:

Financials led this week, while Utilities trailed.