Market Indexes

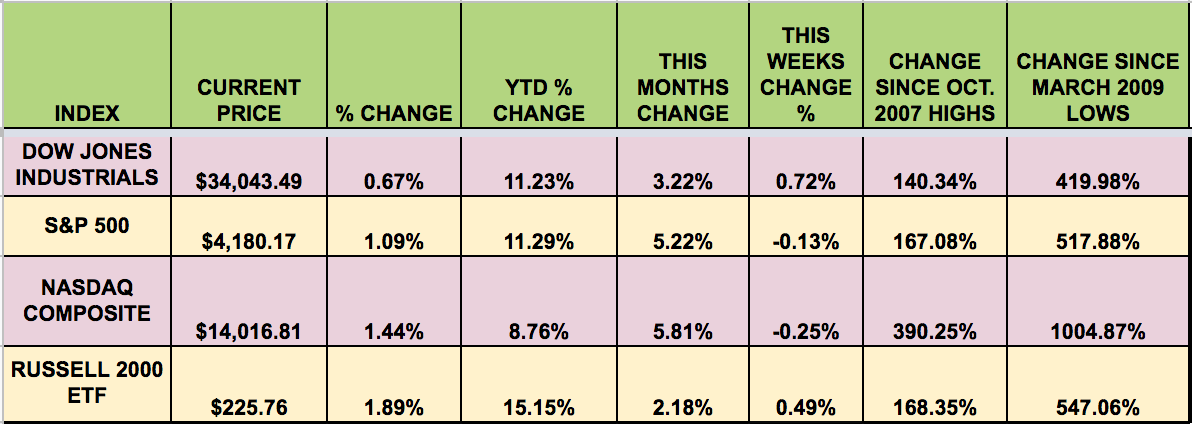

It was a split decision last week, as 2 of 4 indexes—the DOW and the Russell 2000, registered gains, while the S&P 500 and the NASDAQ were slightly in the red. A big bounce back on Friday averted a totally negative week for the market.

Stocks erased earlier gains to trade sharply lower Thursday, after Bloomberg reported that President Joe Biden would propose increasing the capital gains tax rate on wealthy individuals. The Dow dropped more than 250 points, or 0.7%, immediately following the report, after trading just slightly lower earlier. The S&P 500 and NASDAQ erased gains to trade at session lows.

Biden’s plan would involve increasing the capital gains tax rate on the wealthy to 39.6%. This would apply to those earning at least $1 million. The current base capital gains tax rate is 20%.

Stocks churned in recent sessions as investors digested a bevy of corporate earnings results and await additional reports, more economic data and more commentary from Federal Reserve officials in the coming weeks.

Number crunchers were quick to point out an important fact about changes in the capital-gains tax rate: history shows they don’t have much, if any, effect on stock-market returns.

In the most recent example, capital-gains tax rates jumped by nearly 9 percentage points in 2013 but stocks rose 30% that year, noted Mark Haefele, chief investment officer for global wealth management at UBS, in a note. Haefele wrote:

“In addition, we find no correlation between capital-gains tax rates and equity market valuations.

“Price-to-earnings multiples have been as low as 10x when the capital-gains tax rate was 20%, and as high as 18x when it was 35%. Ultimately, other factors such as the outlook for economic growth, monetary policy, and interest rates are much more powerful drivers of equity market returns and

valuations.” (MarketWatch)"Corporate earnings have so far exceeded Wall Street’s even lofty expectations, as companies benefited from both a pick-up in revenue as demand recovered, and as cost-cutting measures implemented during the pandemic boosted their bottom lines.” (YahooFinance)

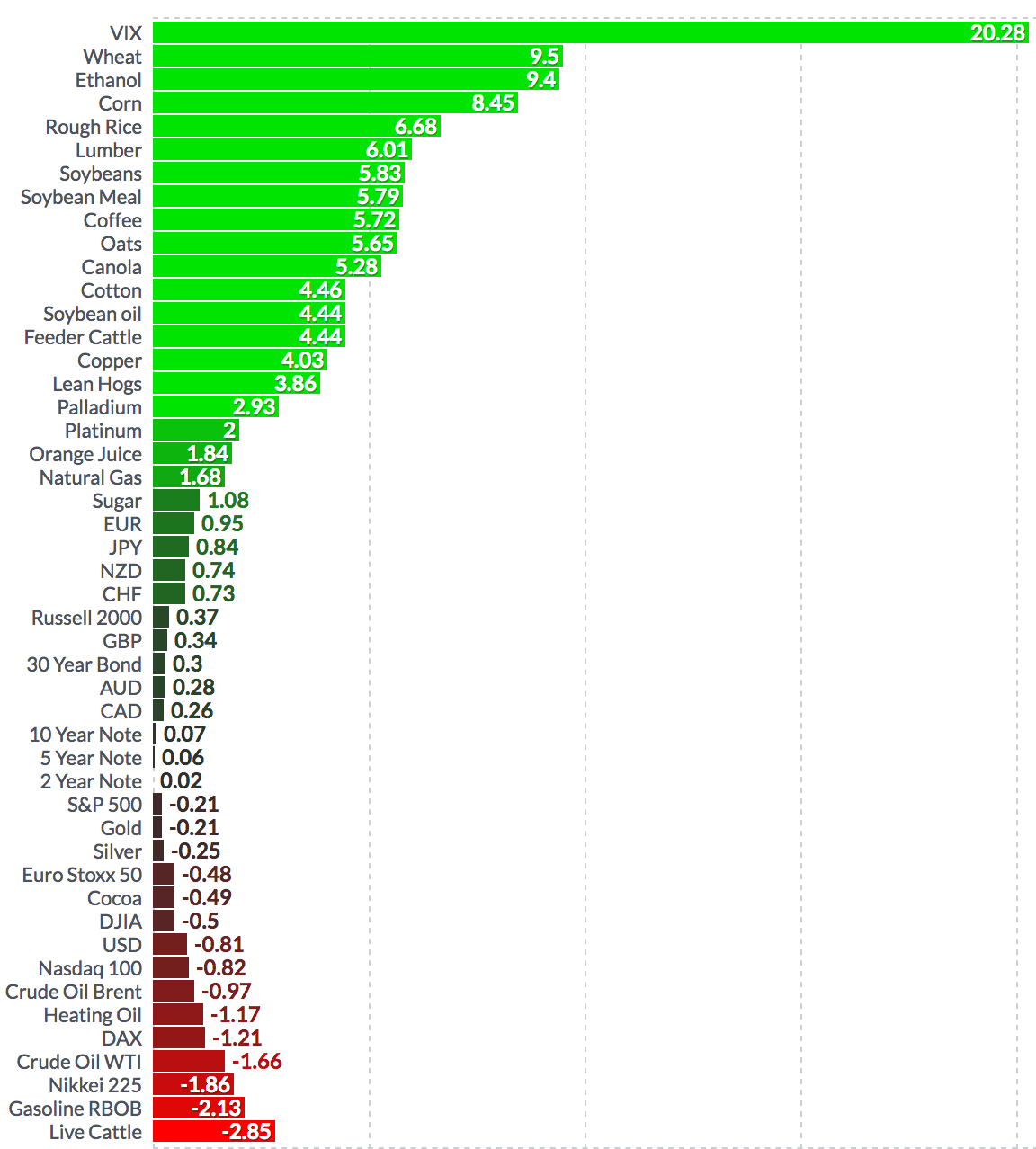

Volatility: The VIX rose 6% this week, ending at $17.21.

High Dividend Stocks: These high dividend stocks go ex-dividend this week: QIWI (NASDAQ:QIWI), Bank of America Corp (NYSE:BAC), BP Midstream Partners LP (NYSE:BPMP), KNOT Offshore Partners LP (NYSE:KNOP), Main Street Capital Corporation (NYSE:MAIN), AGNC Investment Corp (NASDAQ:AGNC), Broadmark Realty Capital Inc (NYSE:BRMK), Ceres Global Ag Corp (TSX:CRP), DCP Midstream LP (NYSE:DCP), Ellington Financial LLC (NYSE:EFC), EnLink Midstream LLC (NYSE:ENLC), Enterprise Products Partners LP (NYSE:EPD), Kinder Morgan Inc (NYSE:KMI), Orchid Isla (NYSE:ORC), Phillips 66 Partners LP (NYSE:PSXP), Plains All American Pipeline LP (NYSE:PAA), Prospect Capital Corporation (NASDAQ:PSEC), Stellus Capital Investment (NYSE:SCM), VOC Energy Trust (NYSE:VOC), and Western Gas Equity Partners LP Unit (NYSE:WES).

Market Breadth: 9 out of 30 DOW stocks rose last week, vs. 20 the previous week. 50% of the S&P 500 rose last week, vs. 80% the previous week.

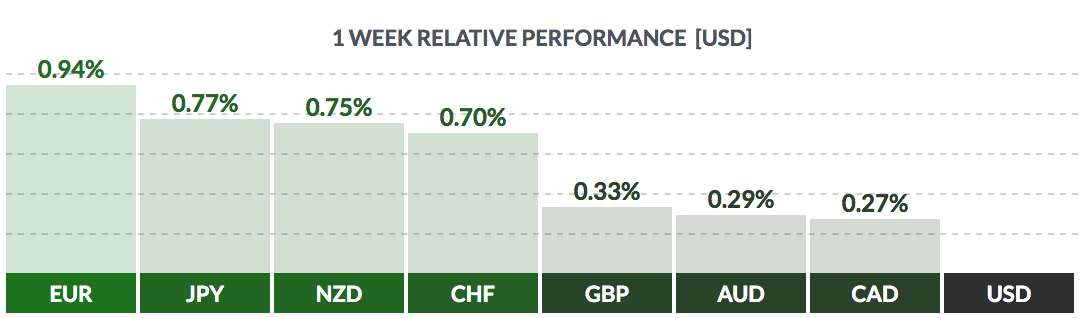

Forex: The US dollar fell vs. most major currencies again this week.

Economic News

On Thursday, the Equipment Leasing and Finance Association (ELFA) said:

“U.S. companies’ borrowings for capital investments rose 4% in March from a year earlier. The companies signed up for $9.3 billion in new loans, leases and lines of credit last month, up from $8.9 billion a year earlier. However, borrowings in March rose 26% from the previous month.

“The equipment finance industry appears poised to take advantage of an economic tailwind that is manifesting itself in an improving labor market, a continued low interest-rate environment, a strong corporate earnings season, and high business confidence that is creating demand for investment in commercial equipment,” said ELFA Chief Executive Officer Ralph Petta.” (Reuters)

A key measure of the perceived risk in low-rated corporate bonds is hovering around its lowest level in more than a decade, highlighting investors’ mounting confidence in the economic outlook.

The average extra yield, or spread, investors demand to hold in speculative-grade corporate bonds over U.S. Treasuries dropped below 3 percentage points this month to as low as 2.90 percentage points for the first time since 2007, when it set a record of 2.33 percentage points, according to Bloomberg Barclays data.

Yields on low-rated corporate bonds already hit a record low of 3.89% in February. That data point is especially important for businesses, because it signals how cheaply they can borrow when they issue new bonds.

The spread relative to Treasuries, however, is arguably an even better measure of investors’ outlook for the economy, since it shows how much investors feel they need to be compensated for the risk that companies may default on their debt. (Wall St. Journal)

Week Ahead Highlights

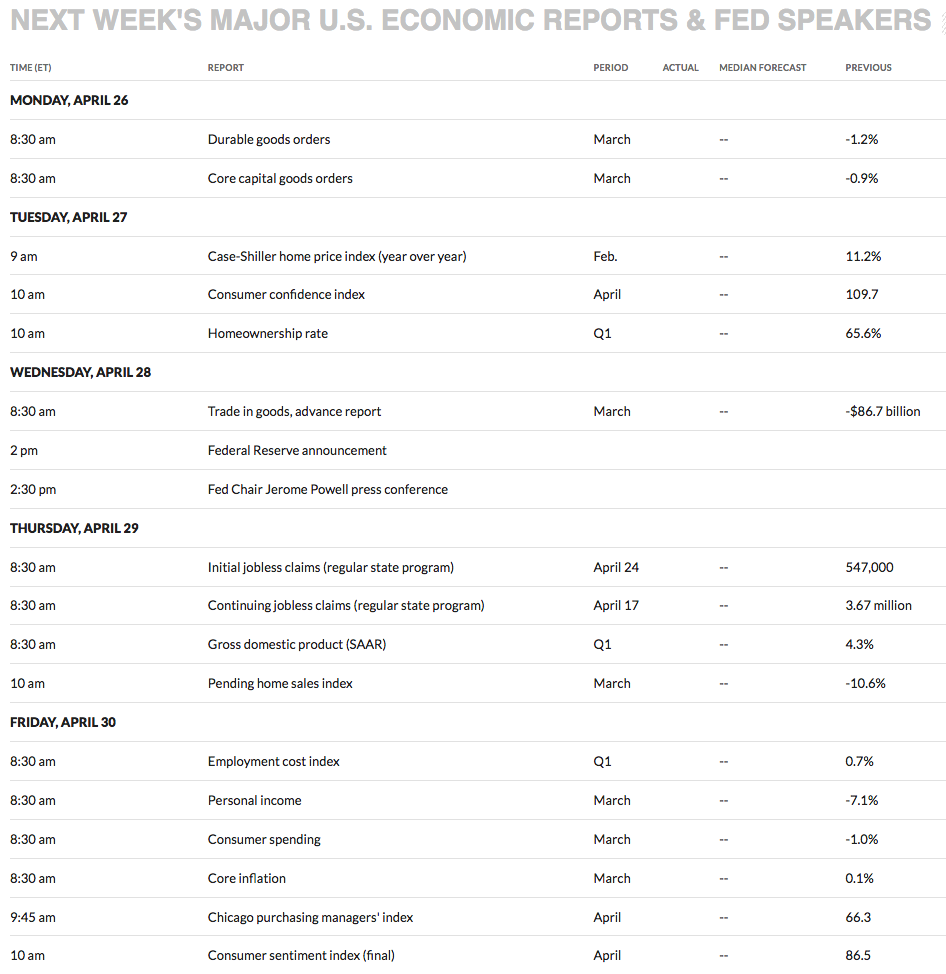

Q1 2021 earnings season continues, with 10 DOW stocks reporting, including MRK, AAPL, MSFT, MMM, V, and others. 30% of the S&P 500 will report this week.

The Fed makes its rate announcement, and Fed Chief Powell holds a press conference, on Wednesday. An estimate for Q1 GDP comes out on Thursday. Consumer Spending and Personal Income reports are due out on Friday.

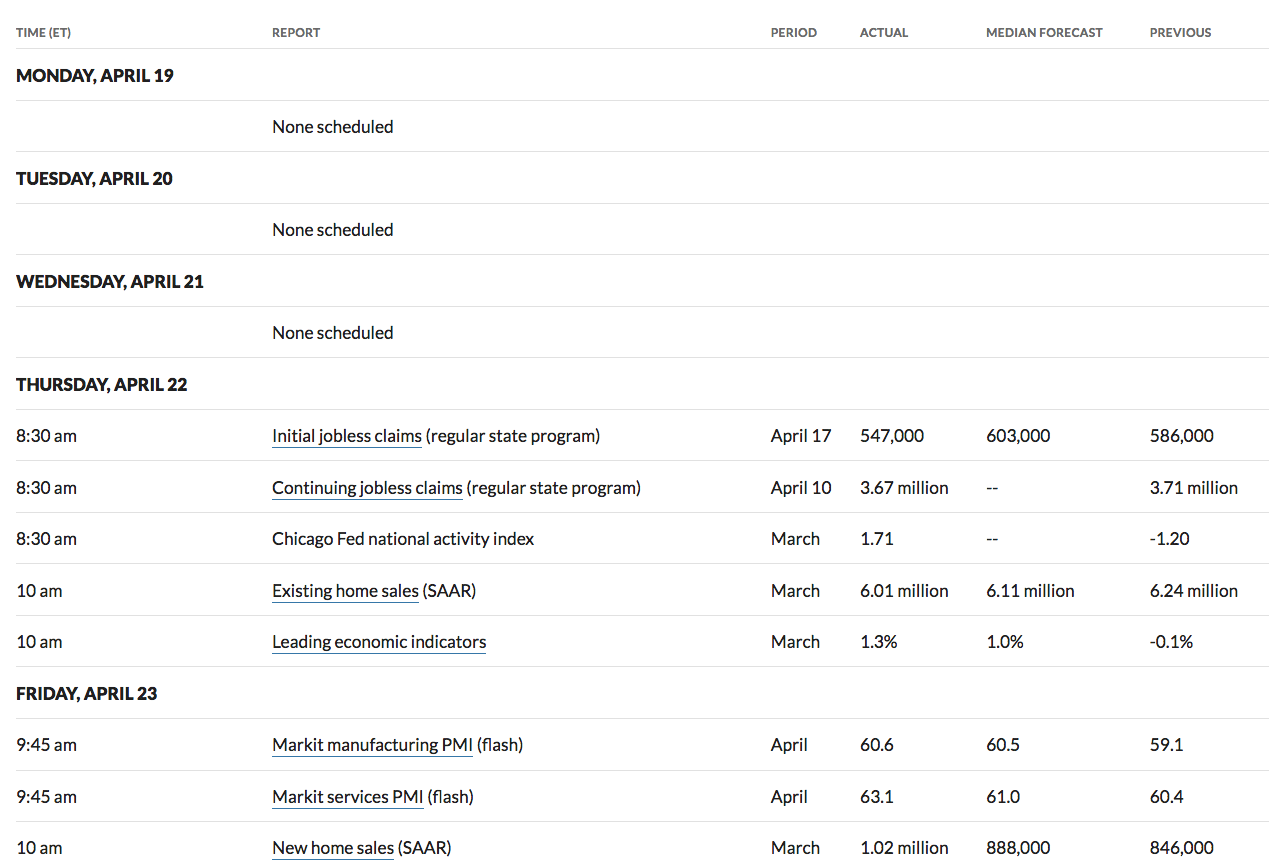

US Economic Reports

Sectors

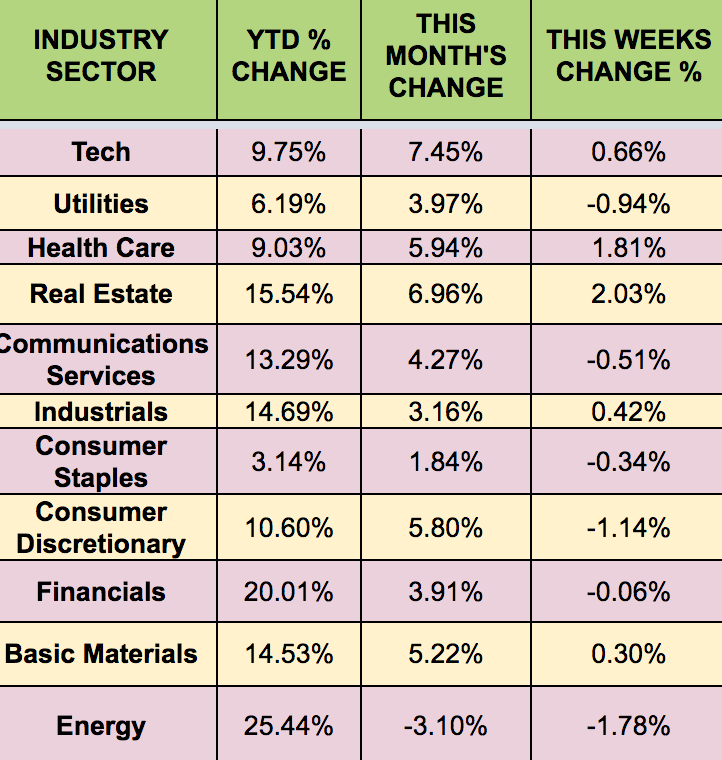

The Real Estate and Health Care sectors led last week, while the Energy sector lagged. Energy and Financials) lead year-to-date.

Futures

WTI Crude fell -1.66%, ending the week at $62.15.