Market Indexes:

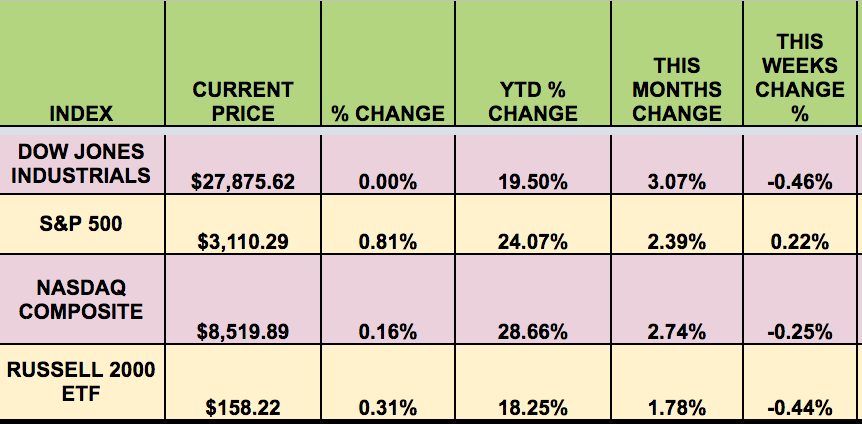

“The S&P 500 and the Dow showed their biggest daily gains on Friday, in a lackluster week marked by uncertainty, with a report suggesting the delay of a trade truce to 2020 and U.S. lawmakers passing two bills supporting protesters in Hong Kong, which could complicate U.S.-China talks.” (Reuters)

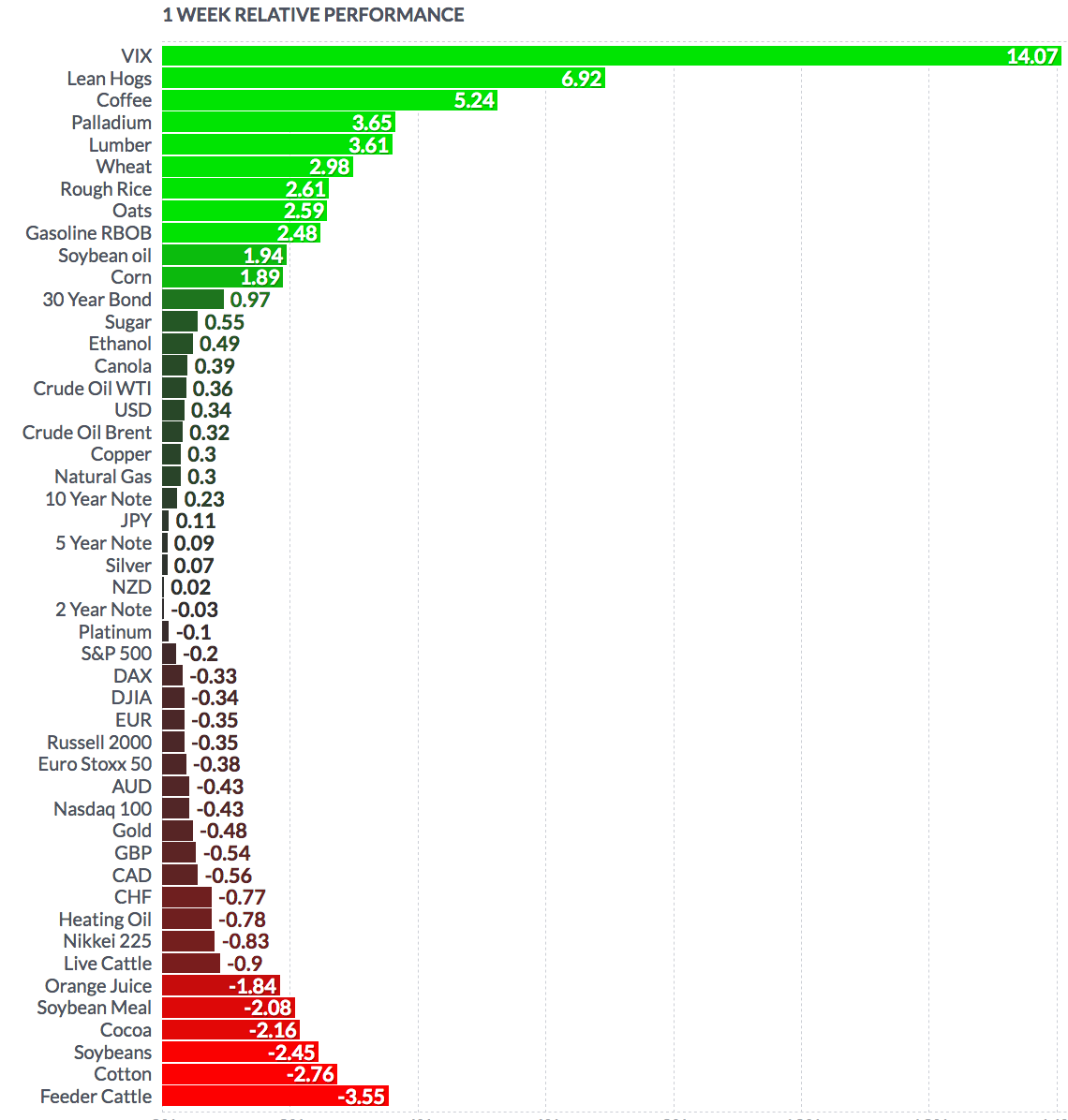

Volatility: The VIX fell 2.45% this week, ending the week at $12.34.

High Dividend Stocks: These high yield stocks go ex-dividend next week: RVI, ABDC, AY, BPR, BPY, CLDT, NGG, PEI, SPKE.

Market Breadth: 13 out of 30 DOW stocks rose this week, vs. 26 last week. 42% of the S&P 500 rose, vs. 66% last week.

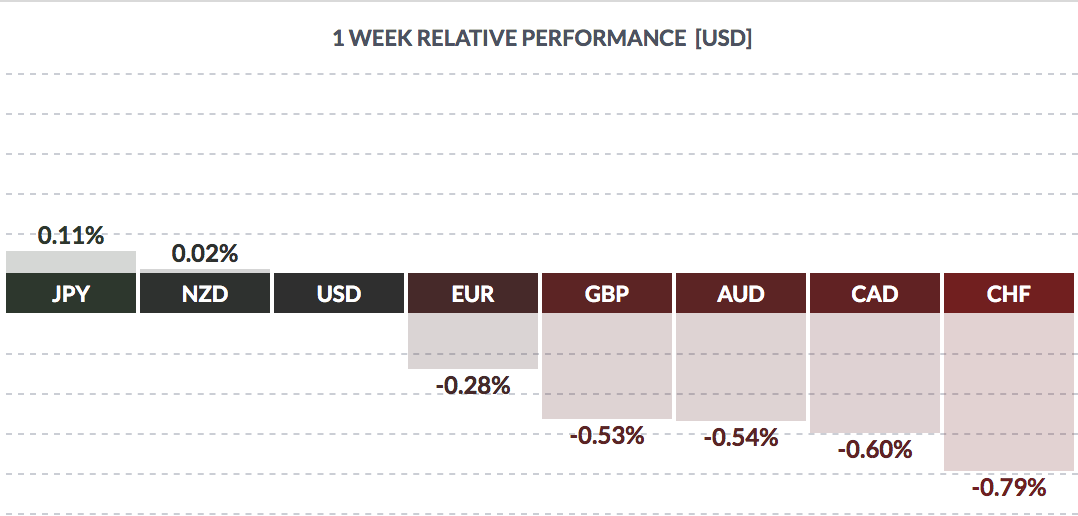

FOREX: The USD rose vs. most major currencies this week, except the Yen and the NZ$.

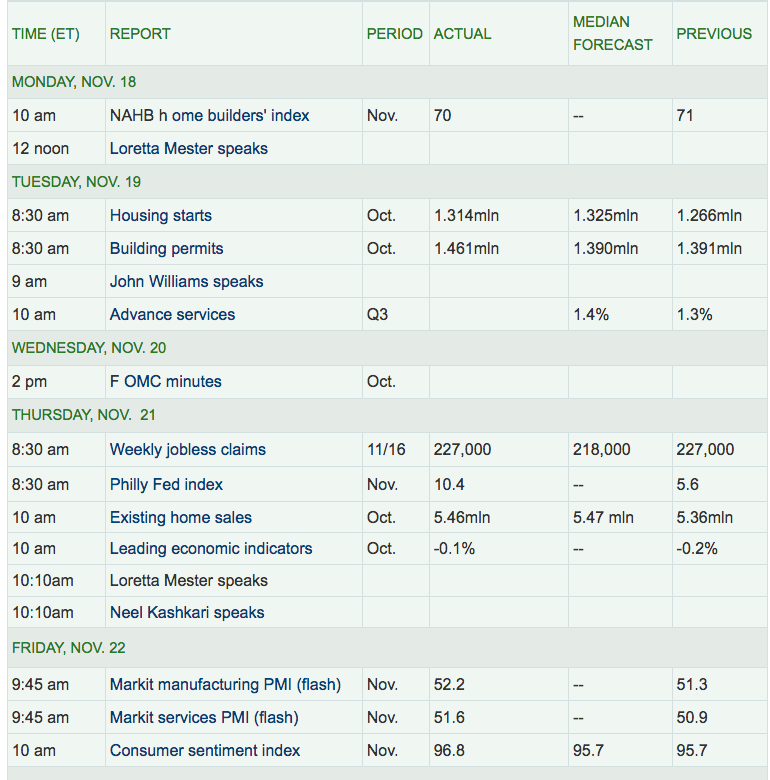

This Week’s Economic Reports:

“The world is getting windier at the same time that developers are installing more turbines to generate electricity from breezes. Average wind speeds rose about 7% since 2010 in northern mid-latitude regions, reversing a trend of slowing winds in the decades prior, according to a group of researchers from institutions including Princeton University. The findings, published Monday in Nature Climate Change, forecast that wind farms will produce significantly more energy than anticipated as a result of the shift in the coming years.

Wind had been slowing down since the late 1970s, data analyzed in the study showed. That all changed in 2010, when wind speeds started to pick up. If the trend continues, wind power generation could increase 37%, according to the study.” (Bloomberg)

Consumer sentiment came in at 96.8 in November, above the expected 95.7

“The U.S. is set to post the smallest agricultural trade surplus since 2006, with costlier imports shrinking the difference between the value of exports and inbound shipments. The trade surplus is projected to total $5.2 billion in the fiscal year that ended in September, according to a government report updated Wednesday. Imported fruits and vegetables were more expensive than expected, and exports of corn and soybeans were lower than earlier projections, the U.S. Department of Agriculture said.

In general, while overseas shipments of agriculture have been increasing in value since 2016, inbound crops have been getting costlier more quickly. Agriculture exports in the 2019 fiscal are expected to total $134.5 billion, with imports at $129.3 billion, according to the USDA.” (Bloomberg)

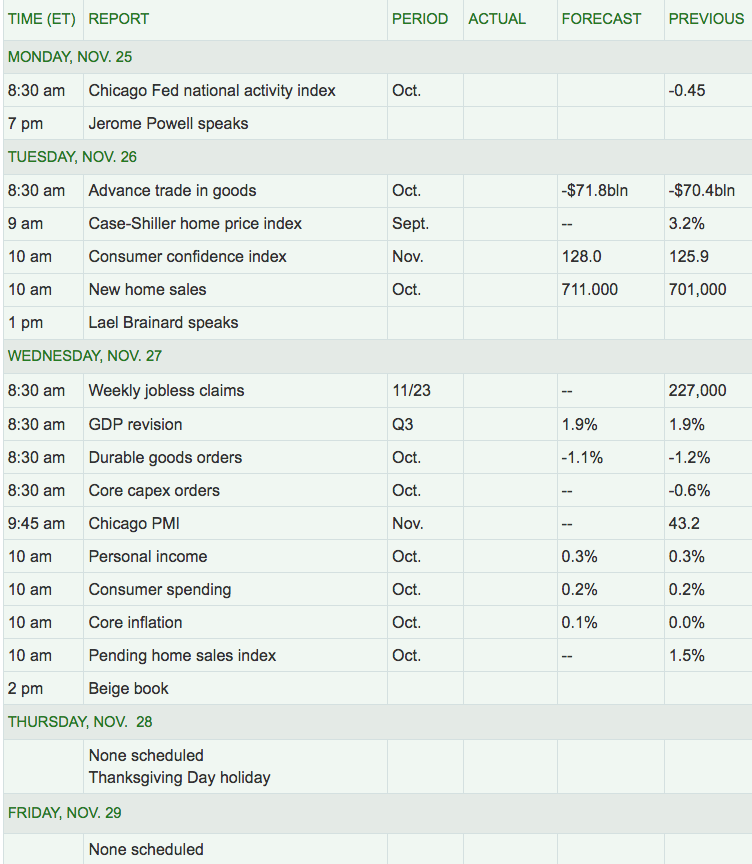

Week Ahead Highlights: Earnings season starts to wind down as 95% of the S&P 500 companies have already reported. The US markets will be closed on Thursday, for Thanksgiving.

Next Week’s US Economic Reports:

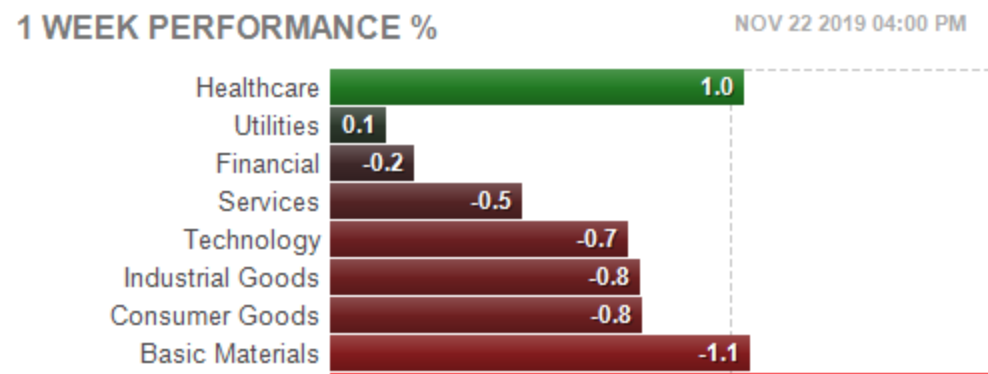

Sectors: Healthcare led again this week, with Basic Materials lagging.

Futures: WTI Crude rose .36% this week, finishing at $57.93, while Natural Gas rose .3%.