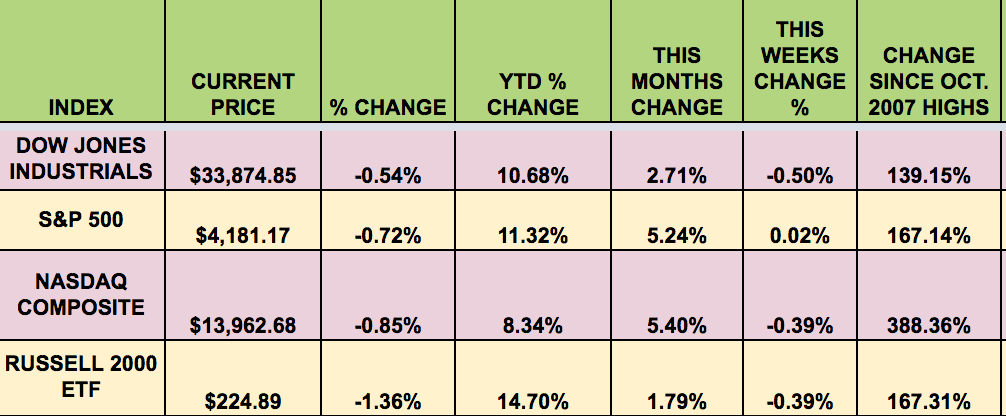

Market Indexes

Indexes ended lower on Friday, with Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOGL) and other tech-related companies weighing on the S&P 500 and NASDAQ despite recent strong quarterly earnings reports. Still, there were good gains for the month, led by the NASDAQ and S&P, which both were up over 5%. The Russell small caps still lead year to date.

Volatility

The VIX rose 8% last week, ending at $18.61.

High Dividend Stocks

These high dividend stocks go ex-dividend this week: Crossamerica Partners LP (NYSE:CAPL), Landmark Infrastructure Part (NASDAQ:LMRK), Shell Midstream Partners LP (NYSE:SHLX), Sprague Resources LP (NYSE:SRLP), Suburban Propane Partners LP (NYSE:SPH), Equitrans Midstream Corp (NYSE:ETRN), Teekay LNG Partners LP (NYSE:TGP), USD Partners LP (NYSE:USDP), Cheniere Energy Partners LP (NYSE:CQP), Hoegh LNG Partners LP (NYSE:HMLP), MPLX (NYSE:MPLX), Archrock Inc (NYSE:AROC), Delek Logistics Partners LP (NYSE:DKL), Global Partners LP (NYSE:GLP), and NuStar Energy LP (NYSE:NS).

Market Breadth

12 out of 30 DOW stocks rose last week, vs. 9 the previous week. 52% of the S&P 500 rose, vs. 50% the previous week.

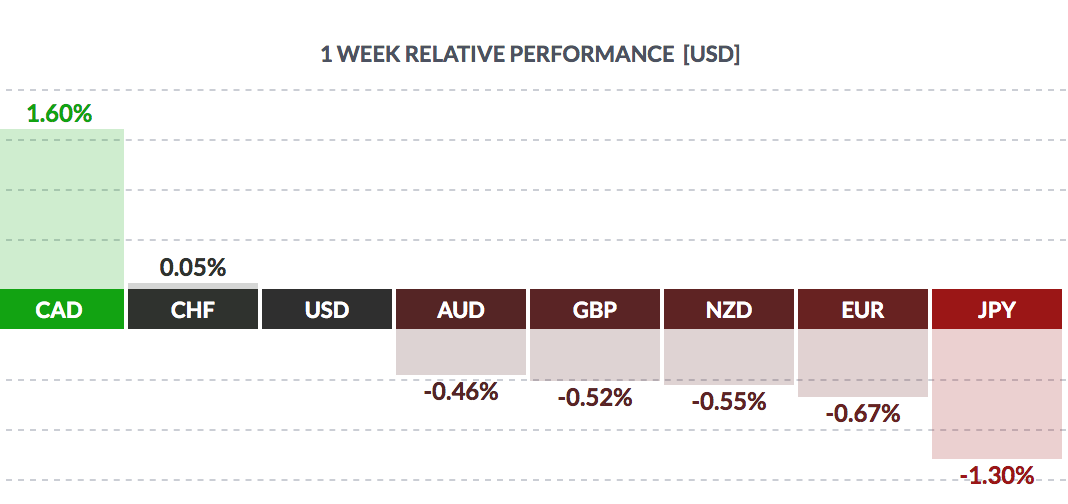

Forex

The US dollar gained vs. most major currencies last week, except for the Loonie.

Binay Chandgothia, managing director and portfolio manager at Principal Global Investors in Singapore, told the Reuters Global Markets Forum on Wednesday:

“The U.S. dollar is expected to continue declining, pressured by rising trade and fiscal deficits along with recovering growth that is being powered by a rise in commodities prices, a fund manager and two economists said. However, a rise in real yields in the United States backed by a strong recovery in the economy will keep the dollar from falling drastically.

“My sense is that the dollar weakens a tad more, (by about) 2%-5%, from here.”

Chandgothia, whose firm manages nearly $545 billion in assets, added that the dollar could get a lift from the U.S. Federal Reserve changing its stance as this will start pushing up real yields at the short-to-medium end. The dollar index has fallen 2.6% from its 2021 high hit on Mar. 31, and is now trading at 91.004.” (Reuters)

Economic News

After its latest meeting on Wednesday, the Federal Open Market Committee confirmed it will seek to achieve the twin objectives of maximum employment and inflation at the rate of 2% over the longer run. The committee noted price rises have been running persistently below target, so it aims to achieve inflation moderately above 2% for some time to make up the shortfall and anchor expectations at around the 2% level.

But if the Fed leaves rates low to target the slackest part of the economy—the labor market—it must intensify pressure on capacity and prices in other parts of the economy, including manufacturing and raw materials. With the Fed focused on maximum employment creation, it is almost inevitable global supply chains and manufacturing systems will remain stretched, generating upward pressure on goods prices and raw materials.

Not since the 1960s has the Fed been so intensely focused on employment, when there was strong growth in output, but which eventually ended with a sharp acceleration in inflation at the end of the decade and in the 1970s.

For the central bank, the hope is that running the economy hot will encourage investment in additional capacity in the manufacturing and commodities sectors, creating jobs and dampening price increases over time.” (Reuters)

“Data Friday showed U.S. personal incomes soared in March by the most in monthly records back to 1946, powered by a third round of pandemic-relief checks. A key measure of consumer prices, the PCE, known as the personal consumption expenditure price index, that the Federal Reserve officially uses for its target rose 2.3% in March from a year earlier, the biggest gain since 2018. Meanwhile, a gauge of consumer sentiment continued to strengthen in late April.”

“The Commerce Department reported Thursday that the economy expanded 1.6% in the first three months of 2021, compared with 1.1% in the final quarter last year. On an annualized basis, the Q1 ’21 growth rate was 6.4%, bringing GDP back to nearly pre-pandemic levels." (Bloomberg)

Looking ahead, economists said they expected to see even better numbers this quarter. “It’s good news, but the better news is coming,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics. “There’s nothing in this report that makes me think the economy won’t grow at a gangbusters pace in the second and third quarter.”

The expansion last quarter was spurred by stimulus checks, he said, which quickly translated into purchases of durable goods like cars and household appliances.

“This demonstrates the value of government intervention when the economy is on its knees from COVID,” he added. “But in the coming quarters, the economy will be much less dependent on stimulus as individuals use the savings they’ve accumulated during the pandemic.”

Overall economic activity should return to pre-pandemic levels in the current quarter, Mr. Anderson said, while cautioning that it will take until late 2022 for employment to regain the ground it lost as a result of the pandemic. Still, the labor market does seem to be catching up. Last month, employers added 916,000 jobs, and the unemployment rate fell to 6%, while initial claims for unemployment benefits have dropped sharply in recent weeks.

Tom Gimbel, chief executive of LaSalle Network, a recruiting and staffing firm in Chicago, said: “It’s the best job market I’ve seen in 25 years. We have 50% more openings now than we did pre-COVID.”

Hiring is stronger for junior to mid-level positions, he said, with strong demand for professionals in accounting, financing, marketing and sales, among other areas. “Companies are building up their back-office support and supply chains,” he said. “I think we’re good for at least 18 months to two years.”

Spending on goods like automobiles led the way in the first quarter, but demand for services like dining out should revive in the second quarter, said Rubeela Farooqi, chief U.S. economist at High Frequency Economics. “I think we will see a surge in services spending,” she said.” (NY Times)

“The U.S. trade deficit in goods jumped to a record high in March, suggesting trade was a drag on economic growth in the first quarter, but that was likely offset by robust domestic demand amid massive government aid and easing pandemic stress. Economic activity in the United States has rebounded more quickly compared to its global rivals.

The pent-up demand is drawing in imports, eclipsing a recovery in exports and keeping the overall trade deficit elevated. The report from the Commerce Department on Wednesday also showed inventories at retailers fell sharply in March, underscoring the strong domestic demand.

The goods trade deficit surged 4.0% to $90.6 billion last month, the highest in the history of the series. Exports of goods accelerated 8.7% to $142.0 billion. They were boosted by shipments of motor vehicles, industrial supplies, consumer and capital goods, and food.

The jump in exports was offset by a 6.8% advance in imports to $232.6 billion. Imports rose across the board. There were large gains in imports of motor vehicles, industrial supplies, consumer goods and food. Capital goods imports also rose solidly.” (Reuters)

Week Ahead Highlights

Q1 2021 earnings season continues, with 23% of the S&P 500 reporting this week, including Pfizer (NYSE:PFE), CVS Health Corp (NYSE:CVS), and General Motors Company (NYSE:GM).

The Non-farm Payrolls report for April and the Unemployment Rate are due out on Friday morning.

"Earnings are rebounding from last year’s pandemic-fueled lows. With results in from more than half of the S&P 500 companies, earnings are now expected to have risen 46% in the first quarter from the previous year, compared with forecasts of 24% growth at the start of the month, according to IBES data from Refinitiv.

"Investors will be watching reports in the weeks ahead to see if the trend continues. Results are expected next week from a wide range of companies including Activision Blizzard (NASDAQ:ATVI), Cummins Inc (NYSE:CMI), ConocoPhillips (NYSE:COP) and Pfizer.

"Technology-related companies as well as banks—value trade favorites—have had the largest percentage point contribution to estimated first-quarter S&P 500 earnings, with JPMorgan Chase & Co (NYSE:JPM) and Apple Inc (NASDAQ:AAPL) at the top of the list, based on Refinitiv’s data.

"Tech is also among the strongest sectors for year-over-year sales growth for the quarter.” (Reuters)

About 87% of reports have come in ahead of analysts’ estimates for EPS, putting the quarter on track to have the highest beat rate on record going back to 1994, when Refinitiv began tracking the data.

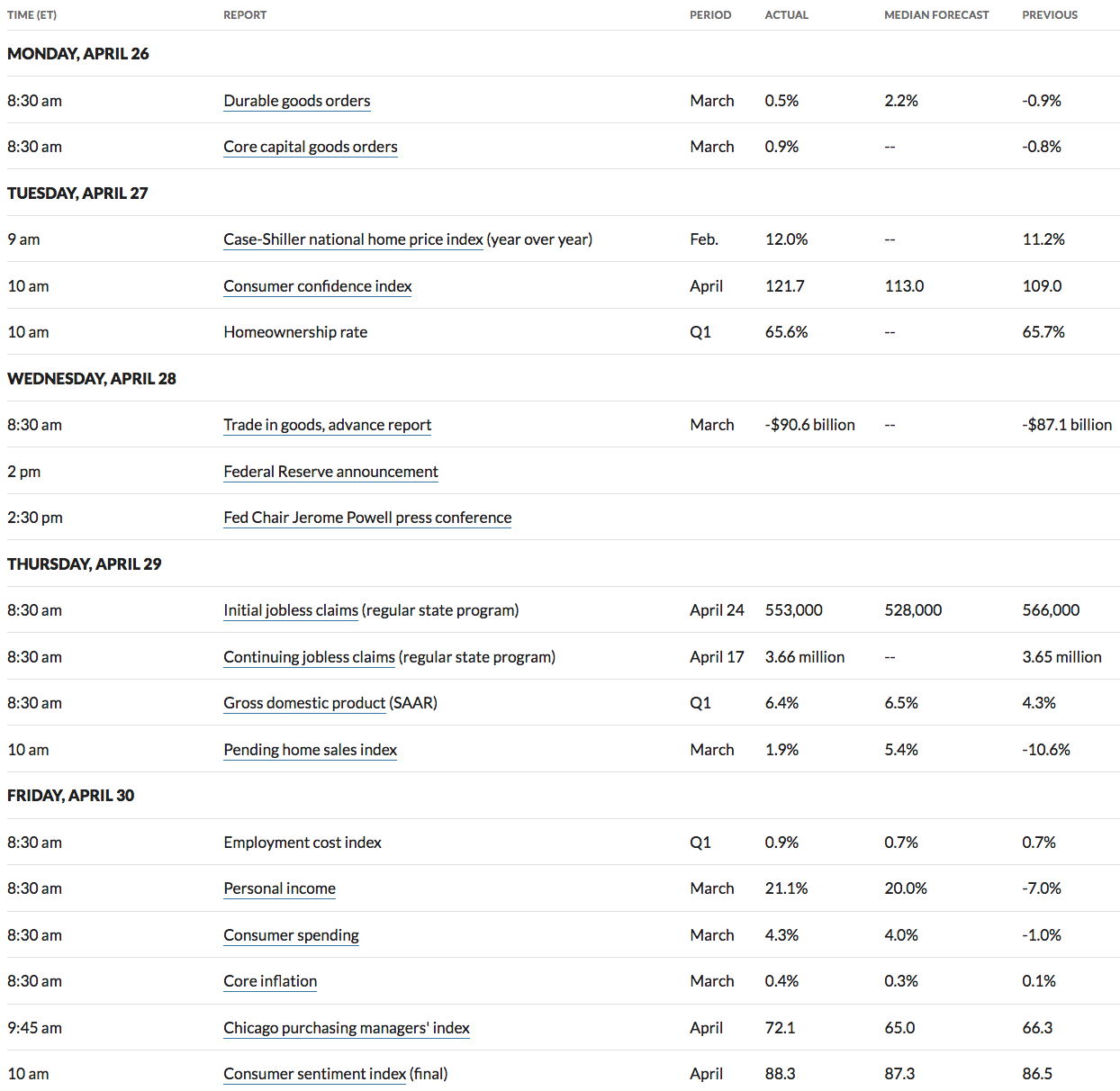

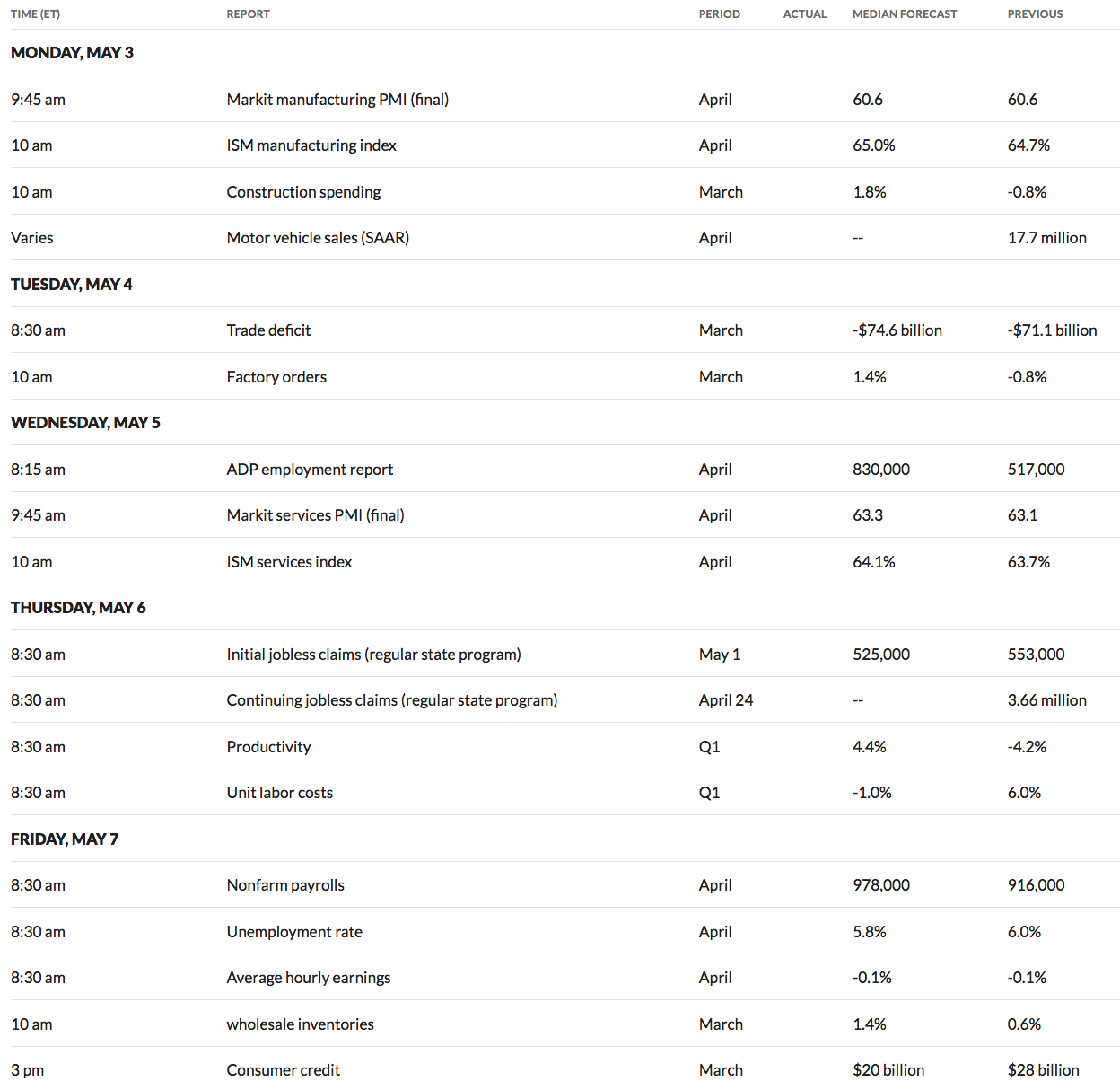

US Economic Reports

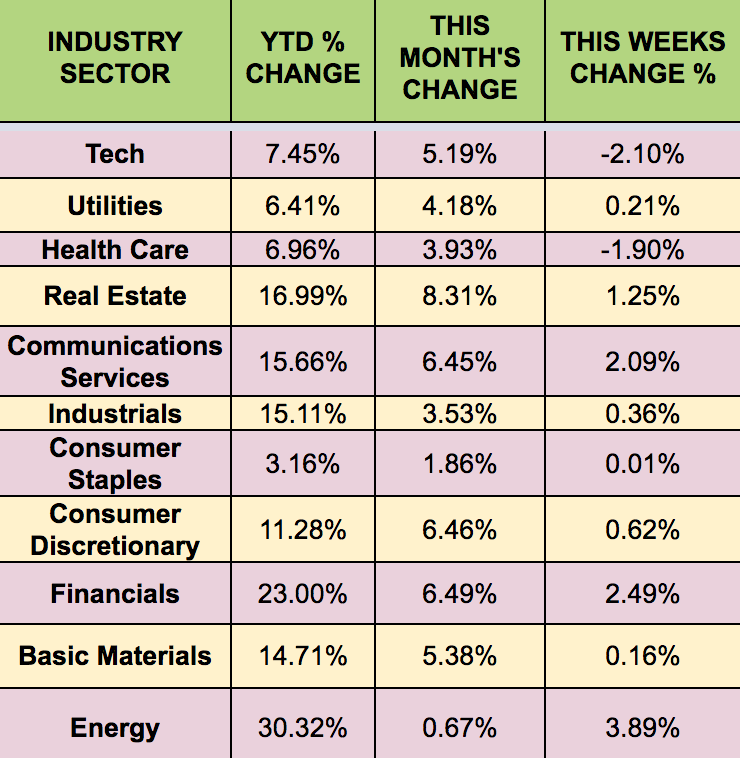

Sectors

The Energy sector led this week, while the Tech, sector lagged. Real Estate led for the month. Energy and Financials lead year-to-date.

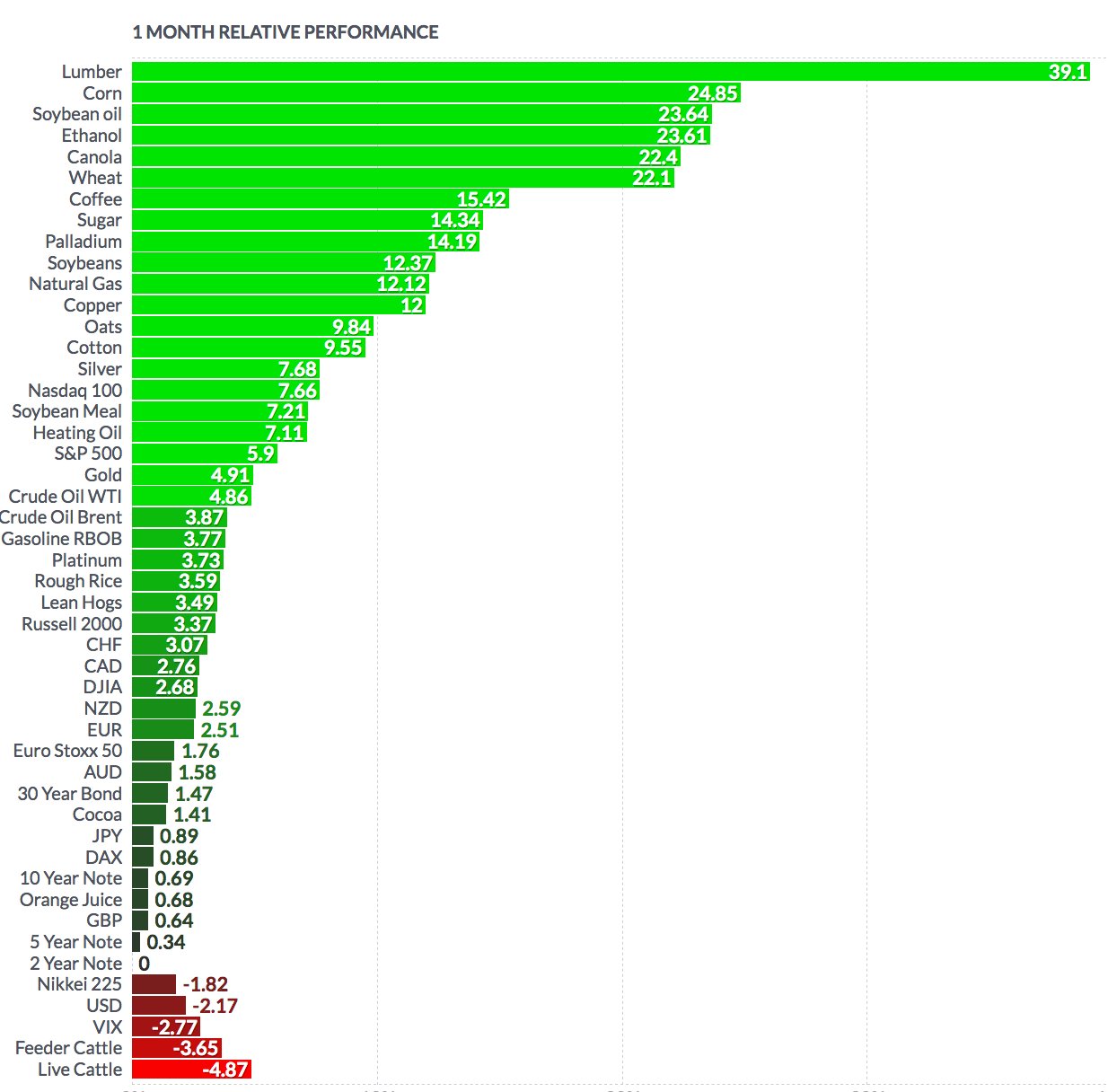

Futures

WTI crude rose 4.86% in April, ending at $63.49.