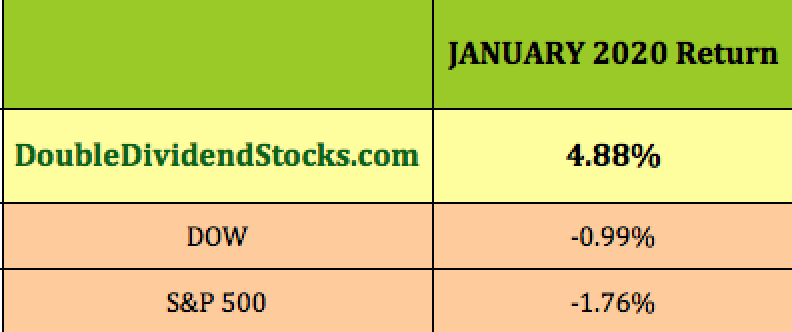

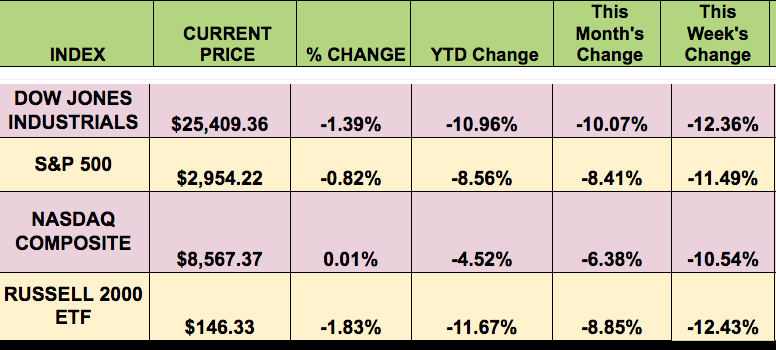

Market Indexes: The market had its worst week since the 2008 financial crisis, with no DJIA stocks rising, and only two stocks rising in the S&P 500. The DOW and the Russell small caps fared the worst, and the NASDAQ held up the best, but all 4 indexes had double-digit losses.

“The Dow Jones Industrial Average extended its biggest weekly point drop in its history, and biggest percentage selloff since the financial crisis, but market internals suggest NYSE investors are acting relatively calmly, with those buying Nasdaq stocks on dips are more aggressive than sellers.” (MarketPulse)

This Week’s Options Trades: Looking for high yield covered call hedging trades and high yield put-selling trades?

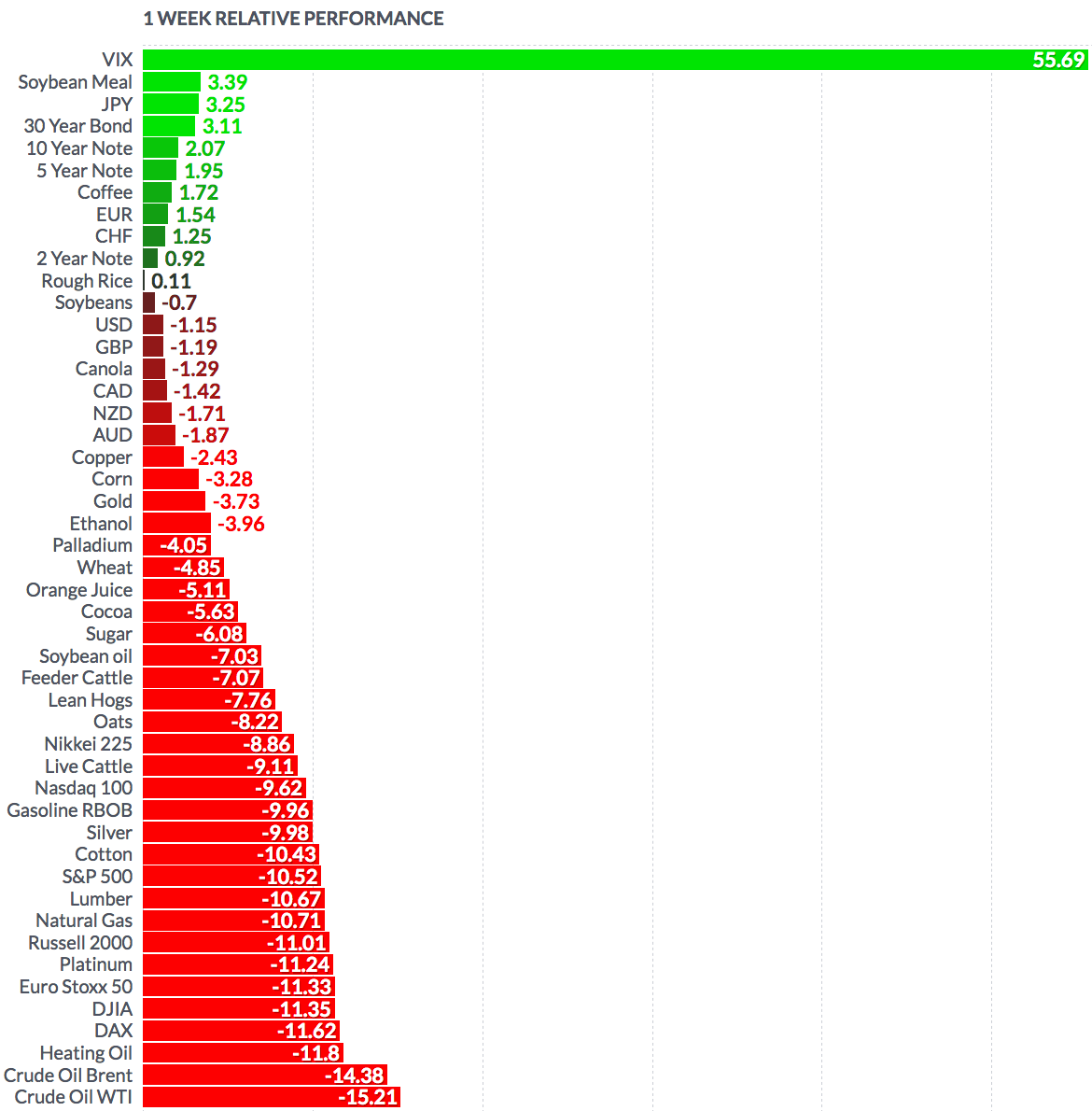

Volatility: The VIX rose 135% this week, ending the week at $40.11. This was its highest closing value since the financial crisis in 2008,

High Dividend Stocks: These high yield stocks go ex-dividend next week: KRO, NCMI, RTLR, WSR, FUN, BBL, WHG, AFIN.

Market Breadth: 0 out of 30 DOW stocks rose this week, vs. 7 last week. 4% of the S&P 500 rose, vs. 35% last week. This was the worst market breadth we’ve seen in many years.

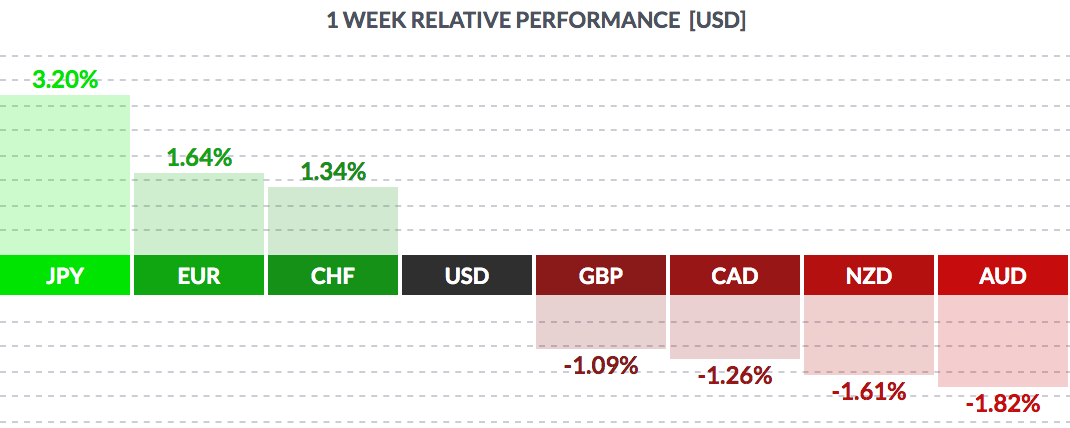

FOREX: The US $ fell vs. the Yen, the Euro, and the Swiss Franc; and rose vs. the Pound, the Loonie, and the NZ and Aussie $.

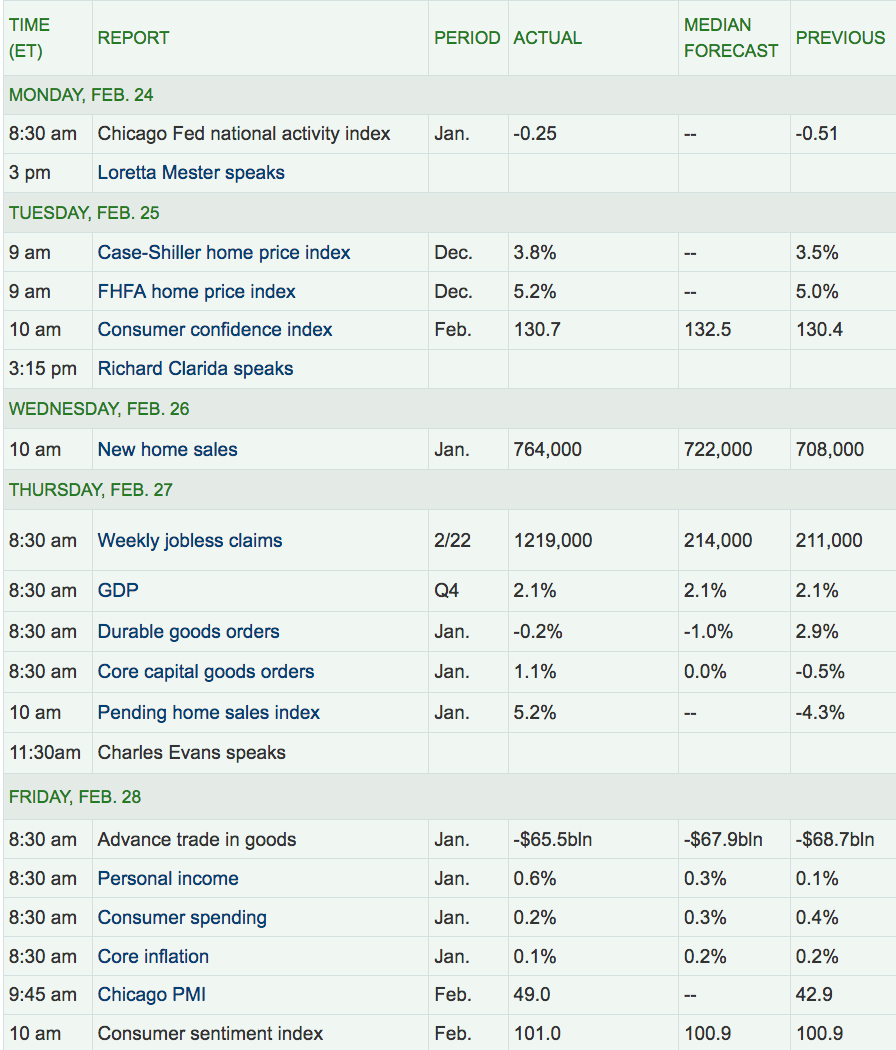

Economic News: New Home sales surprised to the upside in January, aided by the mild weather and very low interest rates. Q4 GDP growth was flat, at 2.1%, the same as Q3.

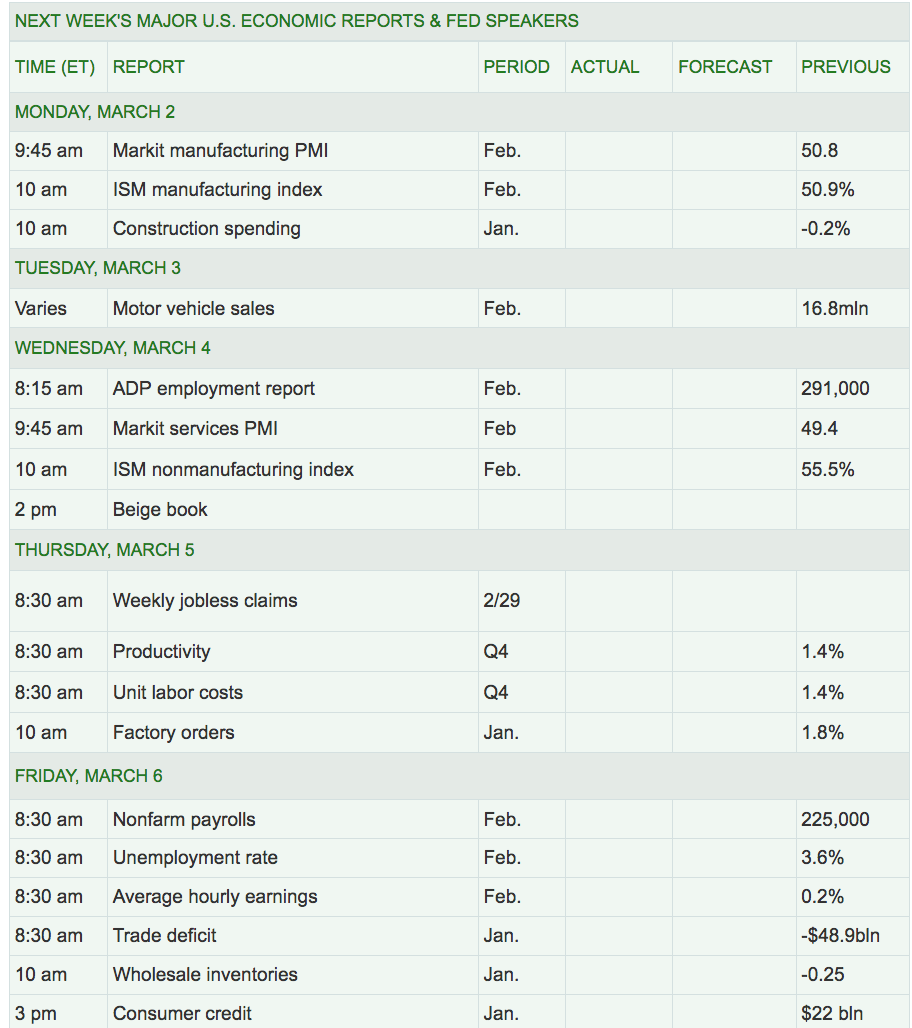

Week Ahead Highlights: February’s Non-Farm Payroll report will come out on Friday.

“The spread of the corona virus epidemic from China around the world poses a unique challenge for the Organization of the Petroleum Exporting Countries and their allies, as the major oil producers prepare for talks next week aimed at supporting prices and balancing global supply and demand. OPEC and its allies, collectively known as OPEC+, will gather in Vienna for official meetings on March 5 and 6. The oil market expects the producers to extend the expiration of existing production cuts, and many analysts see the likelihood of an additional output reduction. The main obstacle to a new agreement on production cuts is that there’s still a high degree of uncertainty surrounding the impact of the corona virus,” which causes COVID-19, says Cailin Birch, global economist at The Economist Intelligence Unit. It is still difficult to ascertain what the final impact on oil consumption will be in 2020, and some partners to the agreement, most notably Russia, may want to avoid a scenario where OPEC continues to cut indefinitely,” Birch says.” (MarketWatch)

Next Week’s US Economic Reports:

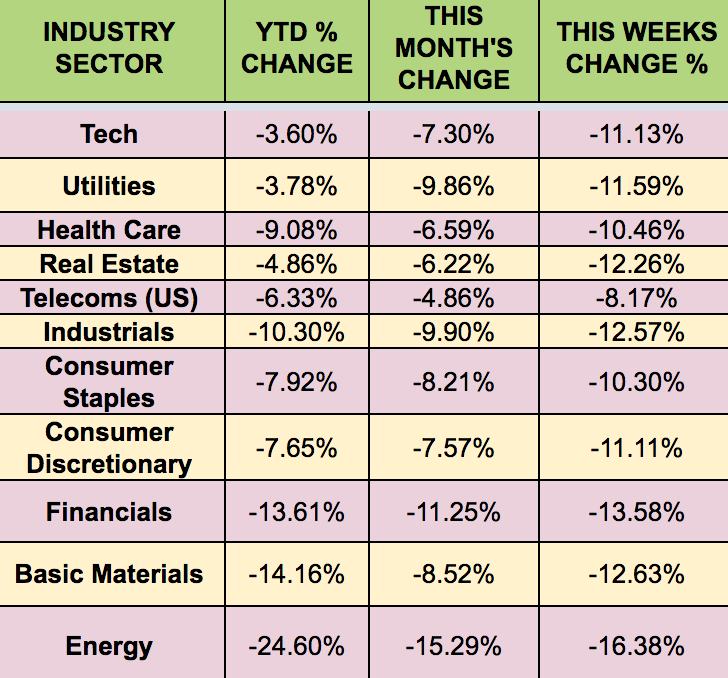

Sectors: There was no truly safe sector in the market this week, as they all declined significantly. Telecoms held up the best, but still lost -8.17%, while Energy lost -16.38%.

Futures: WTI Crude plunged this week, down -15%, finishing at $45.26.

“Oil prices slumped on Friday to their lowest in more than a year, set for their steepest weekly fall since 2008 as the global spread of the coronavirus stokes demand fears. Oil was not the only market to drop. Coronavirus panic also sent global stock markets tumbling, compounding their worst week since the 2008 global financial crisis with losses amounting to $5 trillion.” (Reuters)