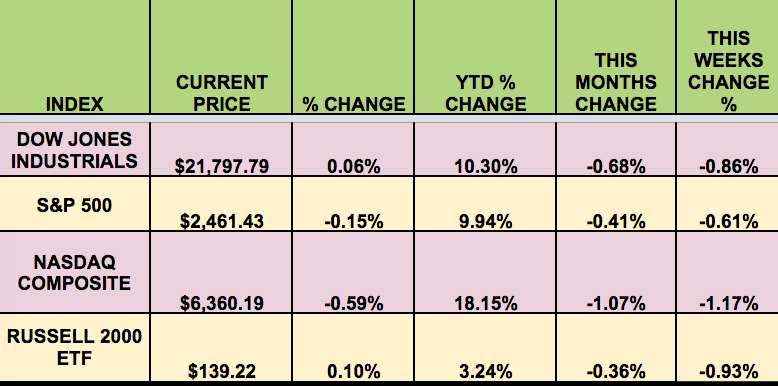

Markets: The market fell this week, with the YTD-leading NASDAQ pulling back -1.17%, as investors pulled back over geopolitical tensions and hurricane-related damage concerns. All 4 indexes fell, with the small caps being the most resilient.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: GHL (NYSE:GHL), TLRD (NYSE:TLRD), MPW (NYSE:MPW), ARR (NYSE:ARR), ARCC (NASDAQ:ARCC), CSWC (NASDAQ:CSWC), FSC (NASDAQ:FSC), M (NYSE:M), NMFC (NYSE:NMFC), OAKS (NYSE:OAKS), OXLC (NASDAQ:OXLC), RWT (NYSE:RWT), SAR (NYSE:SAR), SAR (NYSE:SFL), SAR (NASDAQ:SOHO), TCPC (NASDAQ:TCPC), TICC (NASDAQ:TICC), TSLX (NYSE:TSLX).

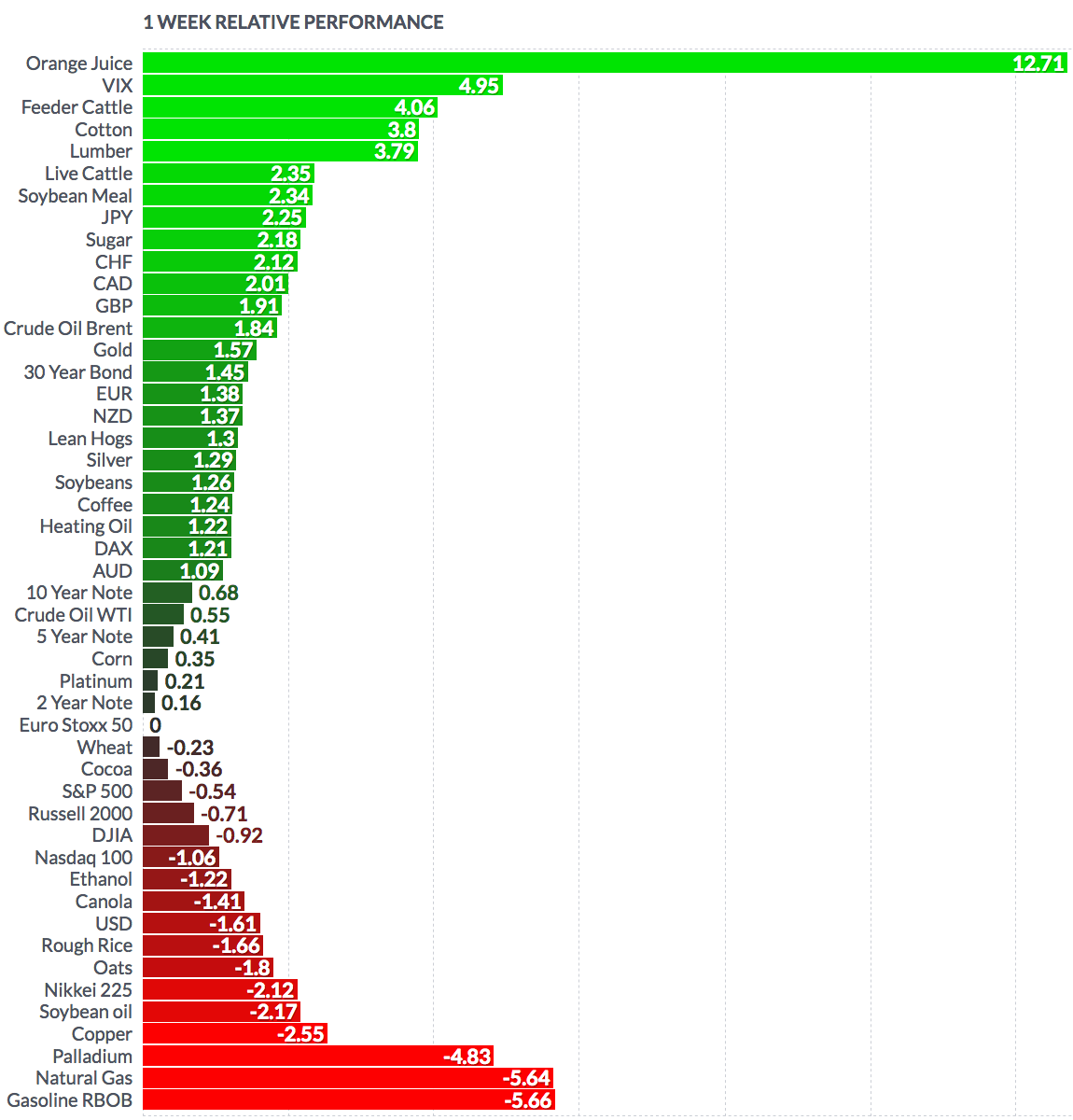

Volatility: The VIX rose 19.6% this week, and finished at $12.12.

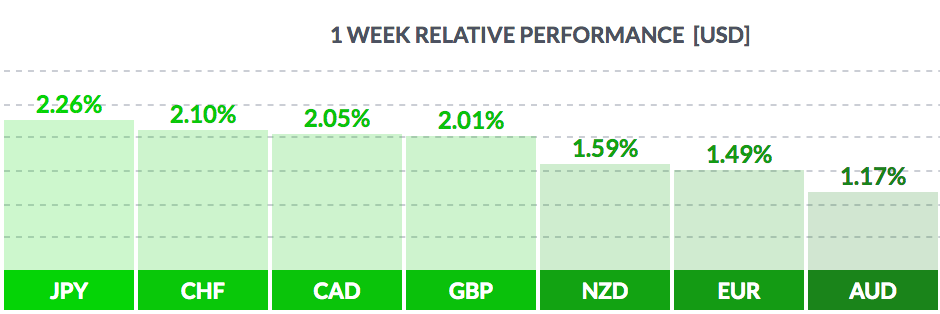

Currency: The dollar fell across the board vs. other major currencies this week, in the wake of dovish Fed commentary.

Market Breadth: 12 of the DOW 30 stocks rose this week, vs. 22 last week. 55% of the S&P 500 rose, vs. 73% last week.

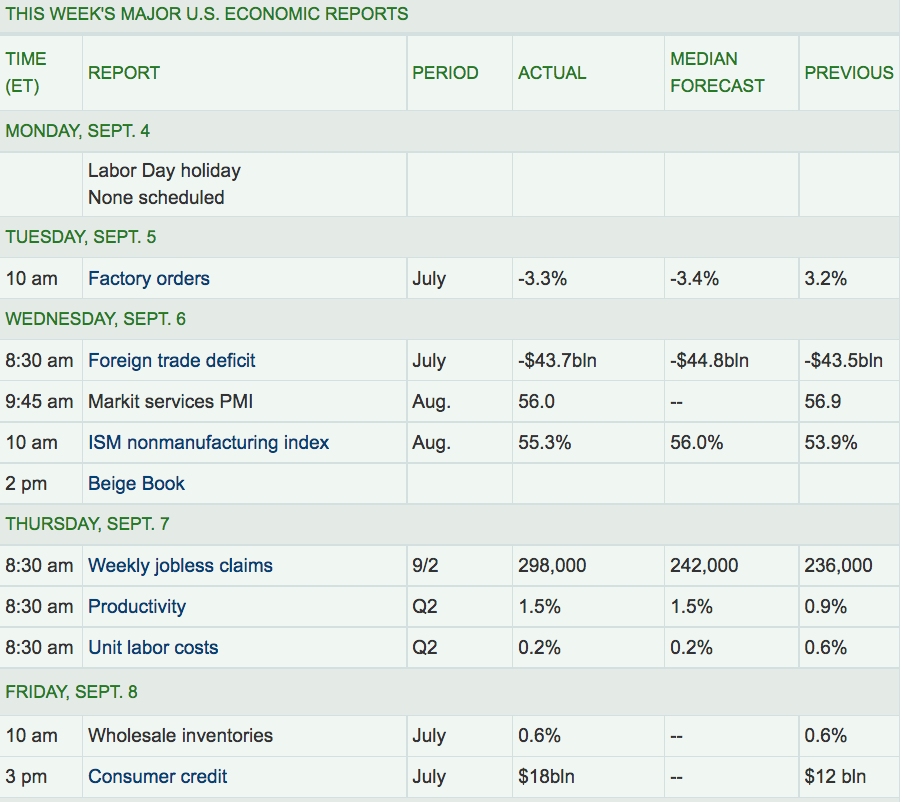

Economic News: A potential standoff over the U.S. federal debt ceiling has been avoided for the next few months, as a deal was cut in DC, to delay the decision until December. Weekly Jobless claims surpassed estimates, jumping from 236K to 298K. Q2 Productivity strengthened, to 1.5%.

Week Ahead Highlights: As Hurricane Irma continues, we’ll start seeing damage assessments filter in. JP Morgan analyst team wrote on Friday that “the price tag from Hurricane Harvey and Hurricane Irma seen potentially exceeding more than 50% of the total hurricane damage tally seen over the last 50 years in 2017 dollars, and stock and sub-industry moves are likely to be even bigger than usual.

Insurance, Telecoms, Leisure, and Industrials are likely to be the hardest hit, while outperformers are likely to be industries tied to replacing and/or repairing existing capital stock (e.g. Energy Equipment & Services, Communication Equipment, Autos), transportation and logistics (e.g. Distribution, Air Freight, Trading Companies), and construction (Basic Materials and Engineering)”. (Source: MarketWatch)

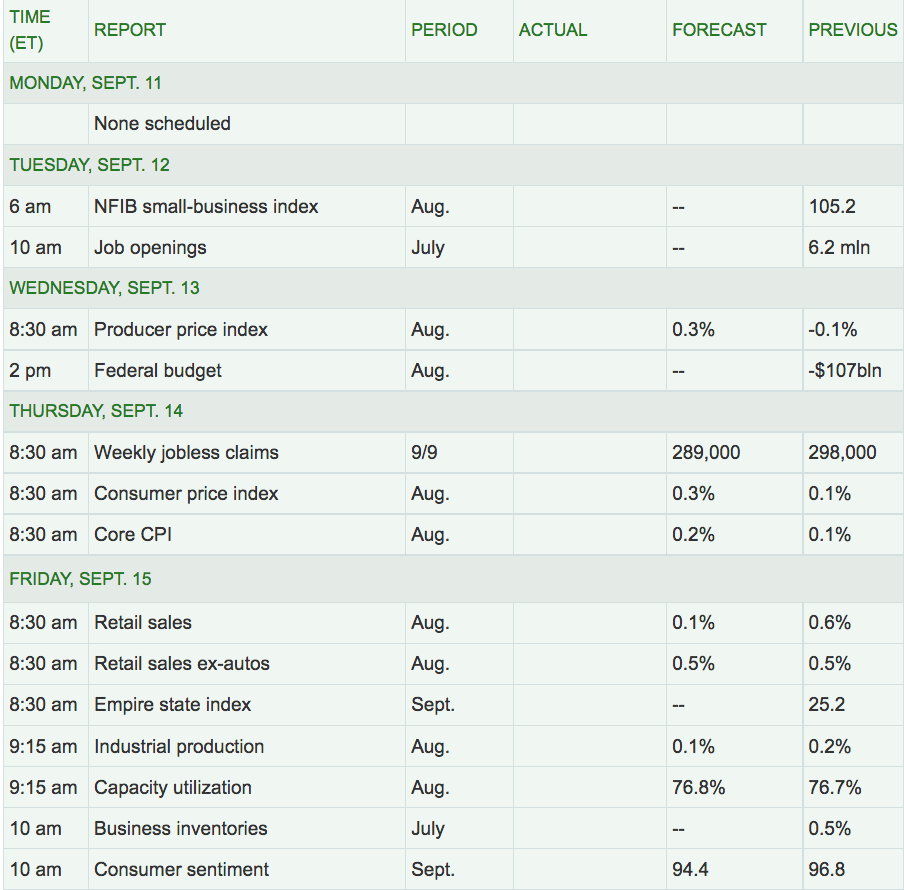

Next Week’s US Economic Reports: A look at inflation, via the Producer Price Index, comes out on Wed. Retails Auto sales, and the Consumer Price Indexes, plus the Consumer Sentiment report are also due out next week.

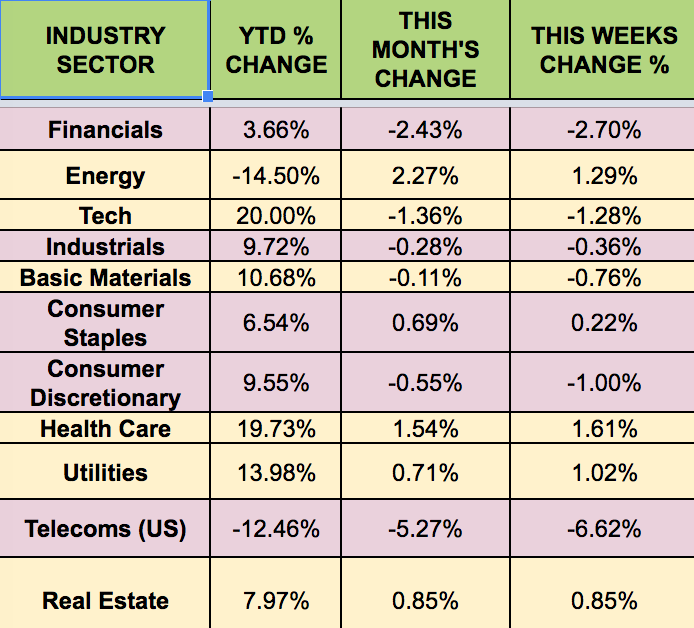

Sectors: The Energy sector led this week, with Telecoms and Financials trailing.

Futures: Natural Gas futures fell -5.6% this week, while Crude Oil rose .55%.