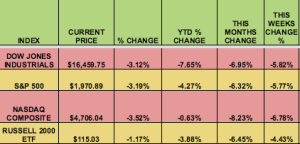

Markets: Weak data from China, more oil declines, emerging market worries, (i.e. Brazil), and ongoing FED rate hike worries all combined to send markets tumbling Friday in the worst weekly rout of the year. The Dow lost 531 points Friday (its worst week since 2011), after a Friday morning report from China showed manufacturing there had hit a 6-year low. The S&P 500 had its worst weekly decline since 2011.

Markets throughout the world also fell steeply this week.

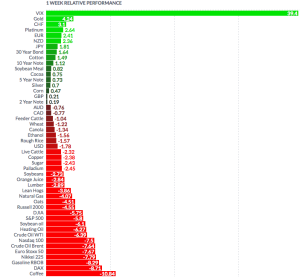

Volatility: The VX had its biggest 1-week rally ever, surging 118%, as investors plowed into S&P 500 options to hedge their positions. Options values soared, as the VIX hit a 4-year high, ending at 28.03.

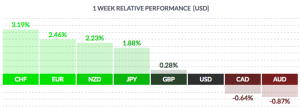

Currency: The US dollar fell vs. most major currencies, except the Loonie, and the Aussie dollar – 2 commodity-rich country’s currencies, thanks to weak Chinese economic data.

Market Breadth: All 30 DOW stocks fell this week – anywhere from -2.16%, (McDonalds (NYSE:MCD)), to -10.79%, (Chevron (NYSE:CVX)). Only 15 out of S&P 500 stocks rose, with Netflix (NASDAQ:NFLX) being the biggest loser at 15.75%.

US Economic News: Existing Home Sales hit their highest point in 8 years, since early 2007, as US mortgage rates continued to hit multi-month lows, down to an avg. 4.11%.

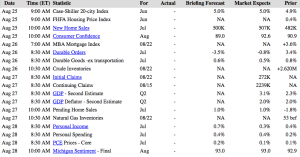

Week Ahead Highlights: (Reuters): “The Federal Reserve begins its annual meeting in Jackson Hole, Wyoming, next week. Investors will be looking for any signs that the central bank is increasingly worried about global issues or whether it is going ahead with what had been a widely-expected interest rate hike in September.”

The Fed has said its decision to raise rates will depend on data, such as an improving jobs market and housing market. Should the Fed signal that it plans to raise rates, investor sentiment towards the United States and emerging markets may further diverge.

Minutes released Wednesday of the central bank’s most recent meeting revealed Fed officials were concerned about “recent decreases in oil prices and the possibility of adverse spillovers from slower economic growth in China,” a detail which helped spark the selling this week.

Next Week’s US Economic Reports:

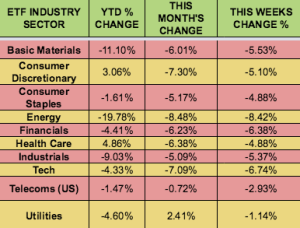

Sectors and Futures:

All sectors fell this week, but Utilities fell the least, while Energy stocks fell the most:

Gold led, while coffee lagged. VIX futures surged:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.