Does Your Portfolio Need More Protection In This Volatile Market?

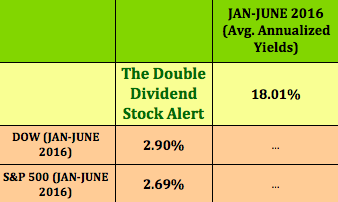

Check out our returns in 2016:

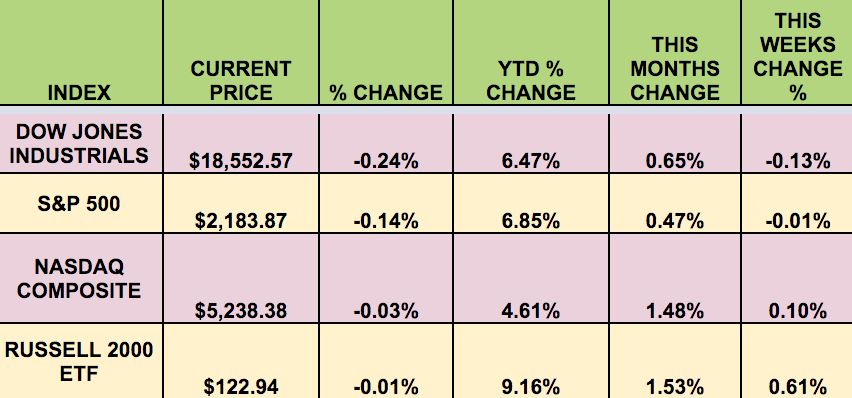

Markets: The Dow, S&P, and NASDAQ indexes all rallied for 3 days this week, reaching new highs, but then subsided, ending the week mostly flat. Small caps leed the pack for the week, and still lead for the month.

The hawkish Fed minutes and various Fed member speeches served to dampen investors spirits. The market is looking ahead to this week’s annual Fed conference in Jackson Hole, and the next Fed meeting in Sept., which Fed members are indicating still has the possibility of a rate hike.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: NYSE:DHT, NYSE:MCC, NASDAQ:SPKE.

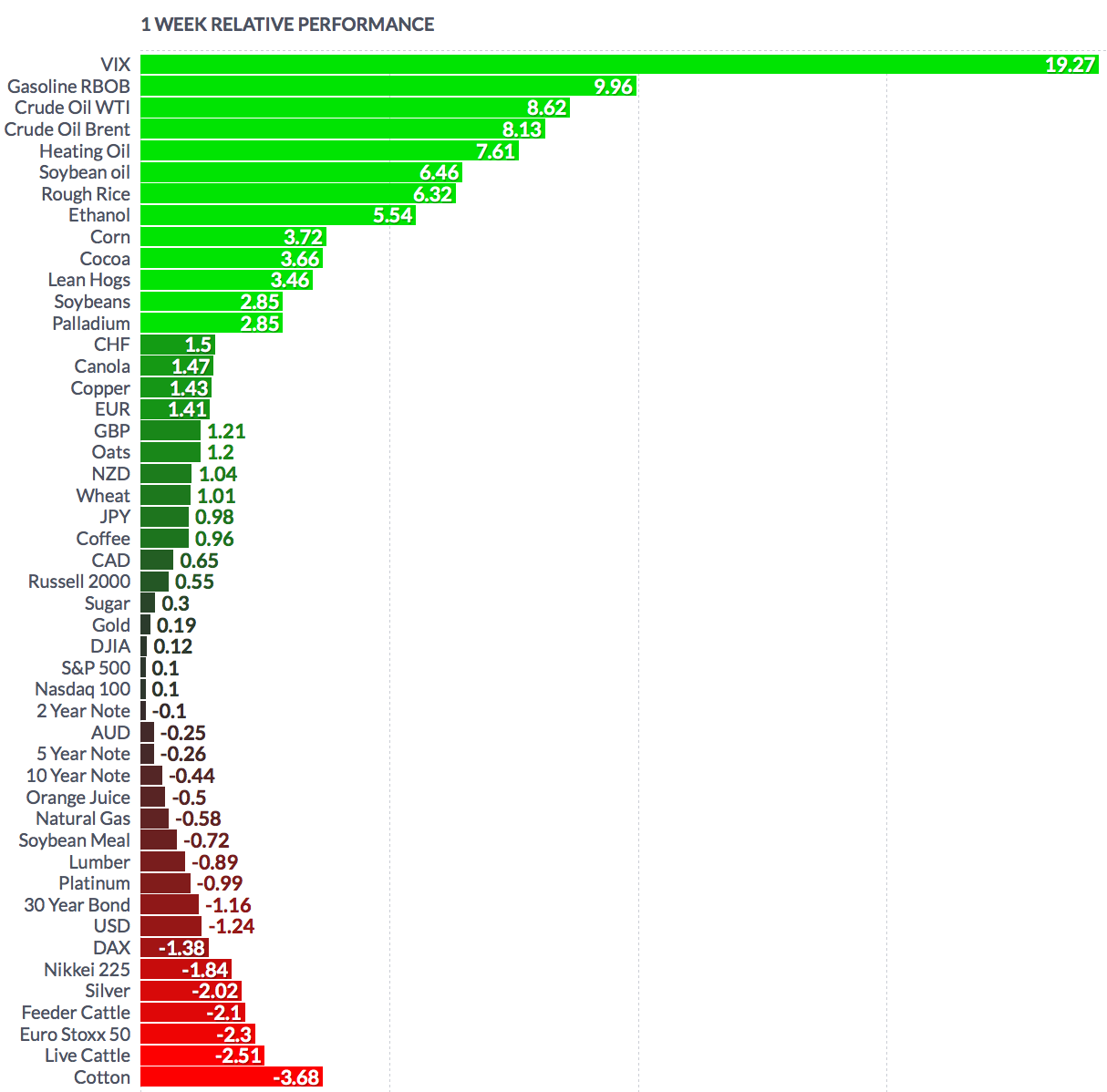

Volatility: The VIX rose 17% this week, finishing at $14.70.

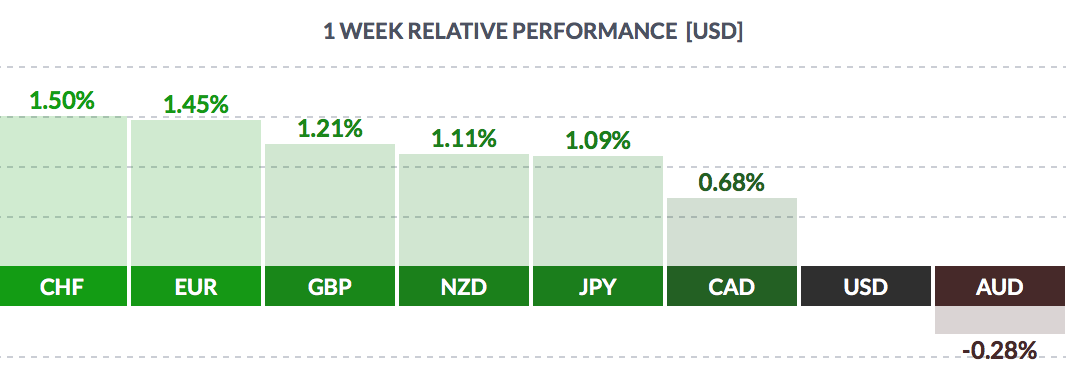

Currency: The US $ fell vs. most major currencies, except the Aussie $, as Fed minutes and speeches fanned rate hike fears.

Market Breadth: 18 of the DOW 30 stocks rose this week, vs. 15 last week. 55% of the S&P 500 rose this week, vs. 51% last week.

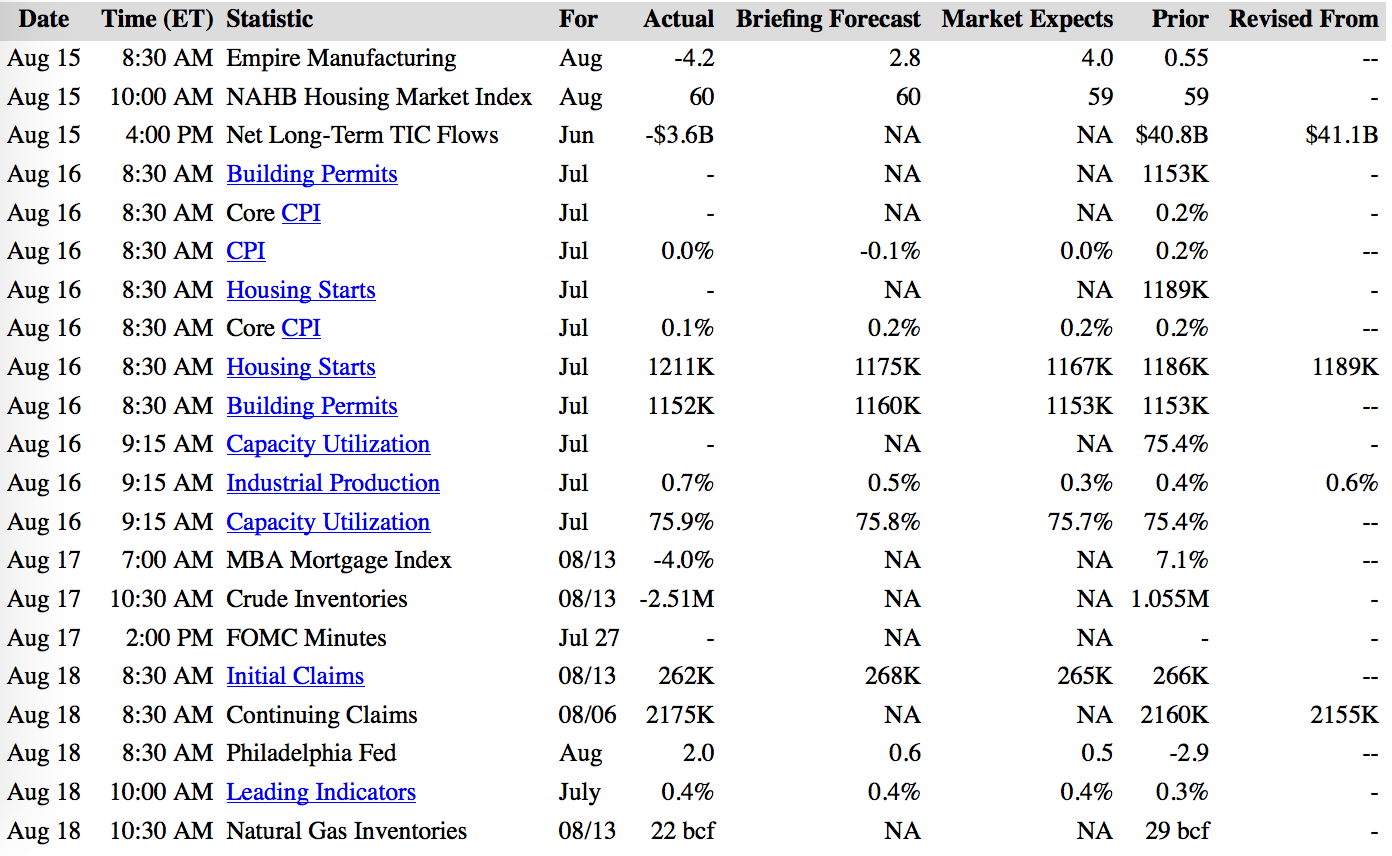

US Economic News: The NY State Empire Mfg. Index contracted in Aug., vs. a +6 gain in July. Housing Starts surprised to the upside, and Initial Claims were lower than expected. Inflation still looks tame – Core CPI actually fell to 0.1% in July, vs. 0.2% in June.

Our latest Seeking Alpha articles: “High Dividend Stock Yields 11%, Pays Monthly, Goes Ex-Dividend This Week” (SATURDAY)

“High Dividend Stock Yields 9%, 9 Straight Dividend Hikes, Ex-Dividend This Week” (SUNDAY)

Our latest Dividend Stocks Blog article: (JULY) “2 Low Beta Utility Dividend Stocks Beating The Market”

(You can read our latest articles on our Dividend Stocks Blog)

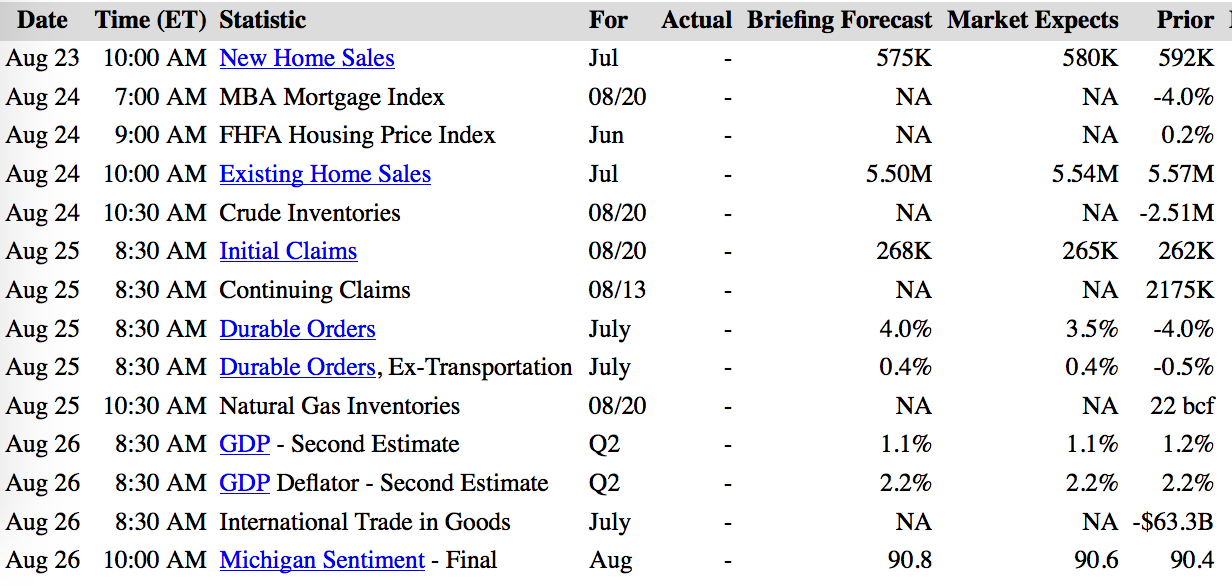

Week Ahead Highlights: Fed Chief Yellen speaks at the Jackson Hole Conference on Friday, Aug. 26th. This annual speech has become a heavily-anticipated event in the post-crisis era, as it has been used to announce new Fed programs or shifts in policy.

We’ll get another estimate for Q2 GDP, which the market expects to be just 1.1%.

Oil Rebound? “The commodity strategists at Bank of America Merrill Lynch expect the price of oil to rise to $54 by the end of 2016, and to $69 by next June. That was a big reason the investment bank upgraded the energy sector to Overweight last week.” (Source: Barrons)

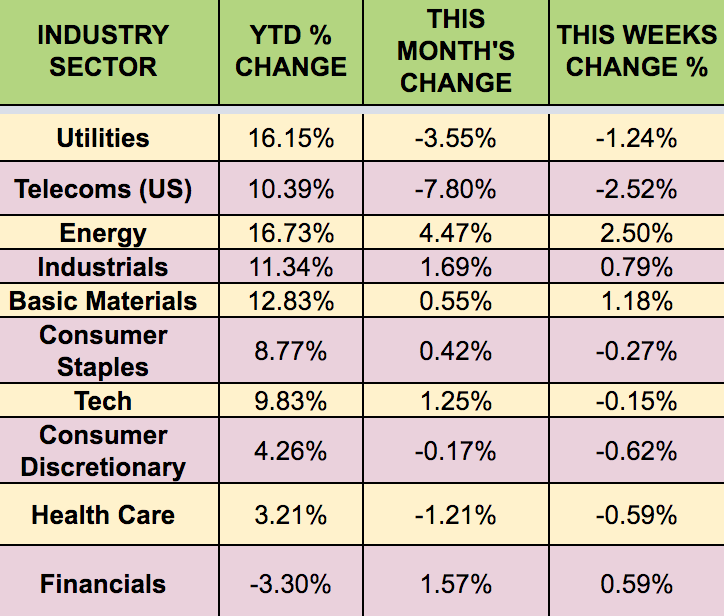

Sectors & Futures:

The Energy sector led this week, fueled by rising Crude prices, while defensive Telecoms and Utilities lagged, due to rate hike fears.

Gasoline and crude surged this week, while cotton lagged: