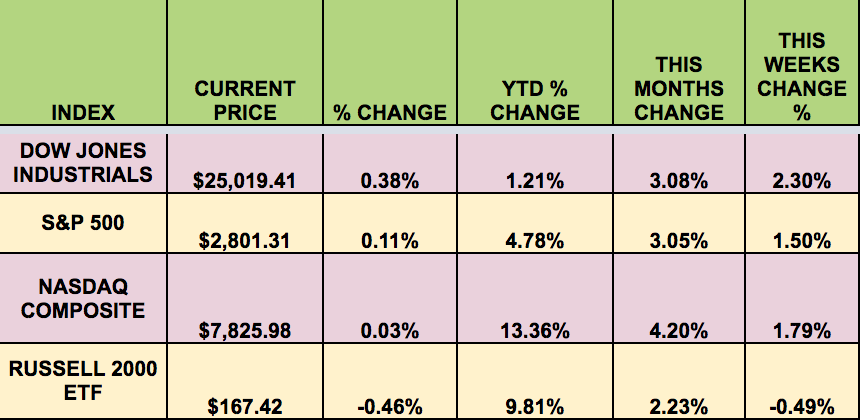

Markets: It was an up week for the market, with investors shaking off trade war developments. Oddly, the Russell Small Caps fell, lagging the Dow, the S&P 500, and the NASDAQ. The megacap Dow led the way, climbing above the 25,000 level for the 1st time in almost a month, while technology stocks pushed the Nasdaq to a record high.

A record $1.45 trillion of US syndicated lending to companies for acquisitions, leveraged buyouts, dividends and refinancing in the first half of the year has propelled bank fees from arranging the loans to all-time highs. The $8.1 billion earned in the first half of this year slightly topped the prior record $8 billion taken in during the second half of last year, setting a new peak, according to Freeman Consulting Services.

The lending pace escalated in the second quarter and is seen staying heated through year-end, encouraged by lower US corporate tax rates and a federal judge’s June endorsement of the long-pursued mega-merger between AT&T (NYSE:T) and Time Warner.

Bankers eagerly awaited the outcome of the AT&T/Time Warner ruling, long after the deal was first announced in October 2016, and now expect the decision to keep the chute wide open for similar mergers and acquisitions (M&A) in coming months. For lower-rated borrowers, there is less onerous enforcement under this administration of leveraged lending guidelines put in place five years ago to rein in high-risk practices.” (Bloomberg)

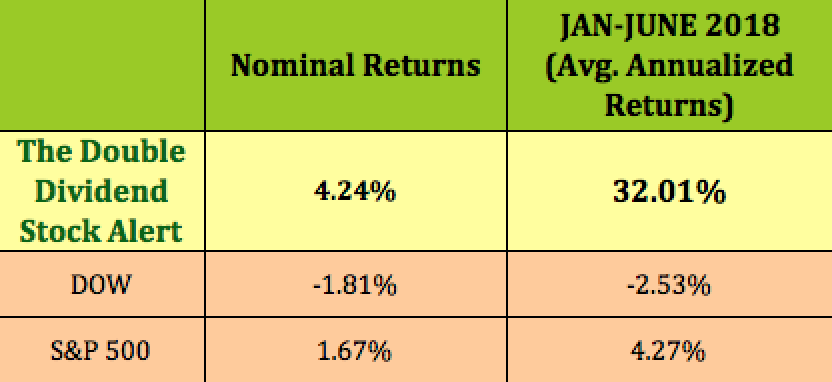

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: CODI, PFLT, SUNS, ACSF.

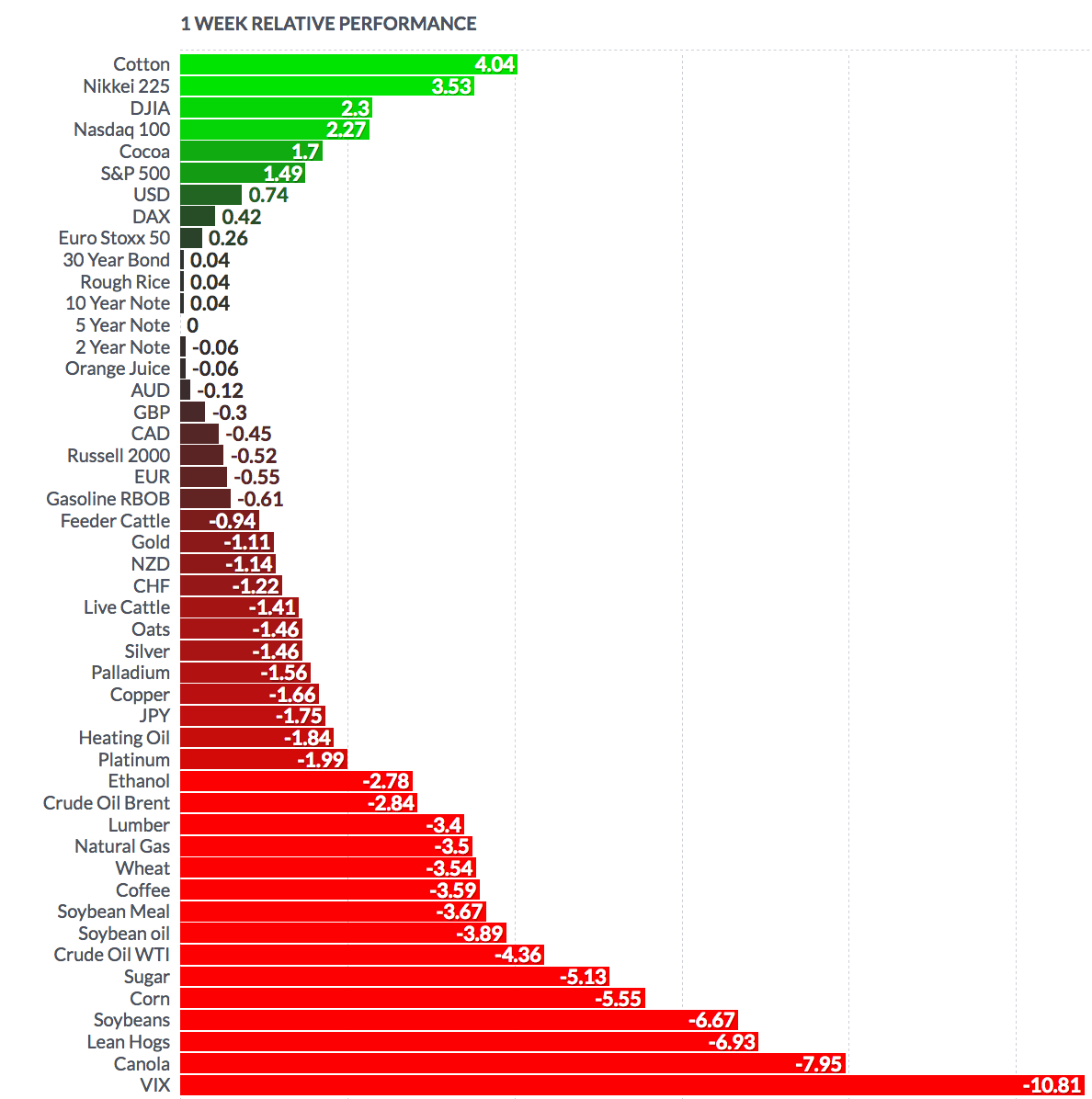

Volatility: The VIX fell 8.9% this week, ending the week at $12.18.

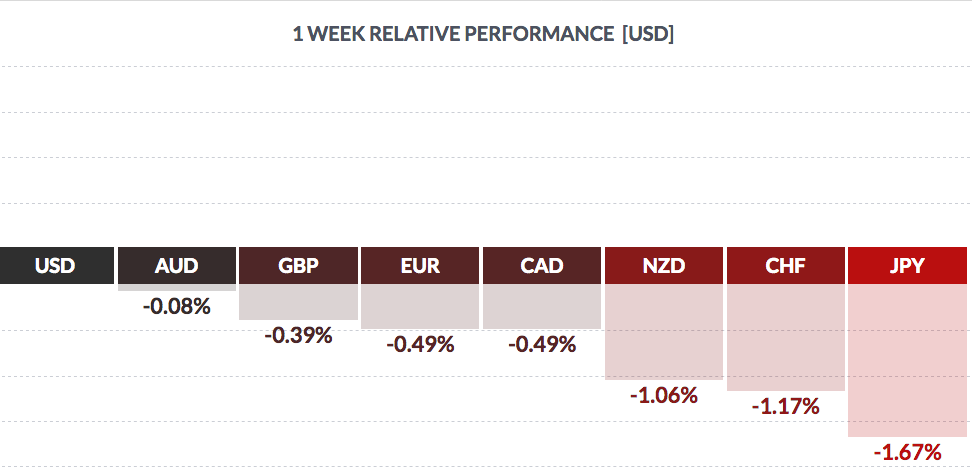

Currency: The US dollar bounced back this week, rising vs. other major currencies.

Market Breadth: 26 of the Dow 30 stocks rose this week, vs. 21 last week. 64% of the S&P 500 rose this week, vs. 79% last week.

Economic News: “US loan applications to refinance an existing home fell to their lowest level in over 17-1/2 years even as most 30-year home borrowing costs decreased last week, data from the Mortgage Bankers Association released on Wednesday showed.” (Reuters) Consumer Sentiment fell to 97.1, below the forecast 98.9 figure. The Producer Price Index and the Consumer Price Index both also fell, but Core CPI was steady. There wasn’t much of a sign of inflation from these 2 reports.

Week Ahead Highlights: The market revs up the Q2 earnings season next week, with 8 Dow stocks reporting, including Microsoft, Goldman Sachs, and IBM. There will be 13% of the S&P 500 stocks reporting, including Bank of America, Netflix, United Health, and Johnson & Johnson.

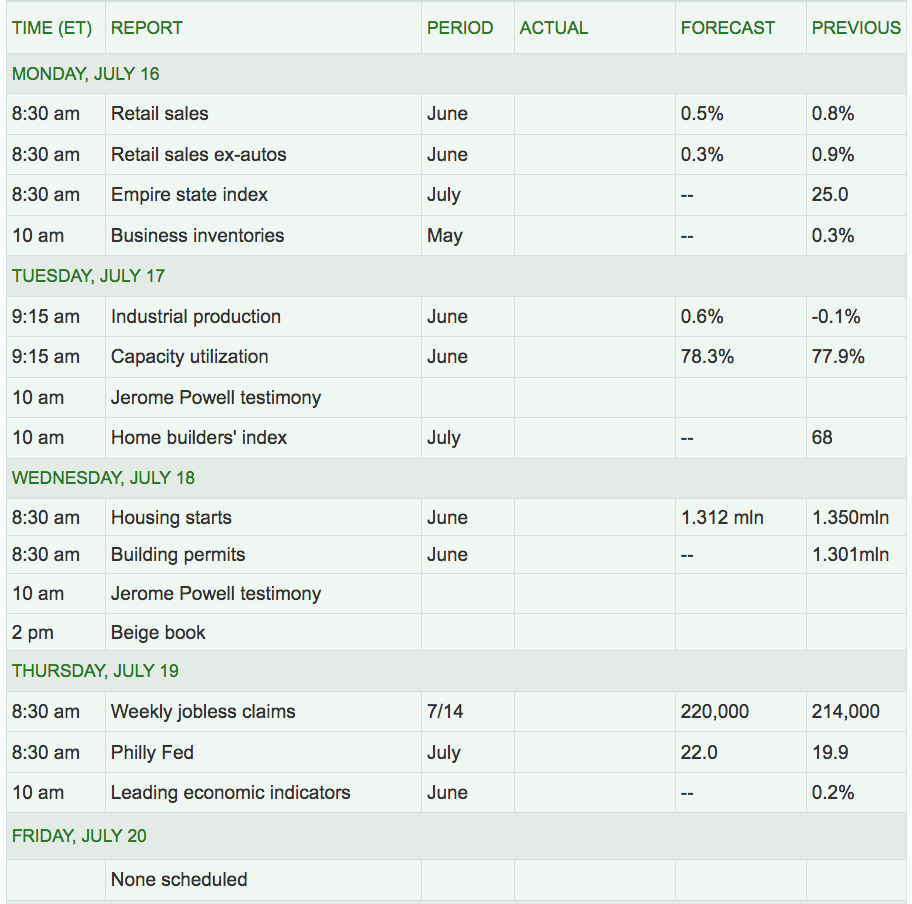

Next Week’s US Economic Reports:

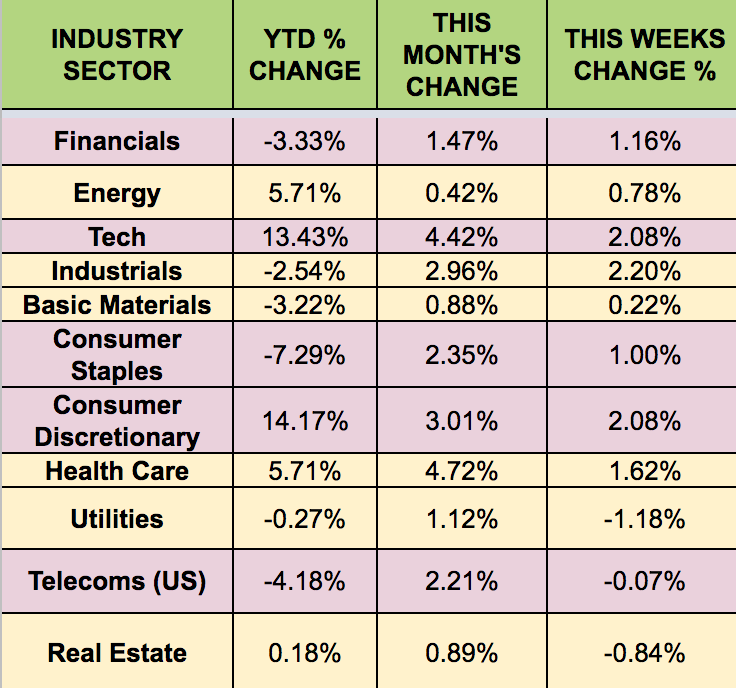

Sectors: The industrial sector led this week, for the 1st time in a while, as investors shook off trade war jitters. Utilities trailed.

Futures:

Global benchmark Brent crude oil plummeted on Wednesday, dropping more than 5 percent a barrel as trade tensions escalated between the United States and China and expectations of growing supplies mounted on news that Libya would reopen ports. (Reuters)

WTI Crude finished the week at $70.58, with Crude Oil WTI Futures Down -4.36%. Natural Gas Futures fell -3.5%: