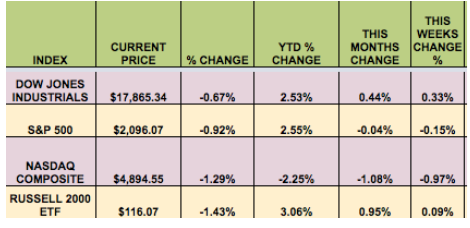

Markets: It was a mixed week for US and global markets – even after Fed chief Yellen’s more dovish comments on Monday, concerns about US and global growth served to depress investors’ enthusiasm for S&P and NASDAQ stocks. However, the DOW and the RUSSELL small caps both had a positive week.

With the S&P only around 1.5% below its all-time high, some market observers note that many stocks look fully valued – particularly in defensive sectors, such as Utilities. Never the less, that sector continues to roll on, and was one of the leaders this week, and still leads by a wide margin in 2016.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Frontier Communications Corporation (NASDAQ:FTR), ARMOUR Residential REIT Inc Pa Pref (NYSE:ARR_pa), Fifth Street Finance Corp (NASDAQ:FSC), Monroe Capital Corp (NASDAQ:MRCC), Harvest Capital Credit Corporation (NASDAQ:HCAP), Medical Properties Trust Inc (NYSE:MPW), New Mountain Finance Corporation (NYSE:NMFC), OFS Capital Corp (NASDAQ:OFS), Redwood Trust Inc (NYSE:RWT), TICC Capital Corp (NASDAQ:TICC), BlackRock Kelso Capital Corporation (NASDAQ:BKCC), Cm Finance Inc (NASDAQ:CMFN), Gladstone Investment Corporation (NASDAQ:GAIN), Gladstone Capital Corporation (NASDAQ:GLAD), Gladstone Commercial Corporation (NASDAQ:GOOD), Oxbridge Re Holdings Ltd (NASDAQ:OXBR), PennantPark Floating Rate Capital Ltd (NASDAQ:PFLT), Apollo Investment Corporation (NASDAQ:AINV), Capitala Fi (NASDAQ:CPTA).

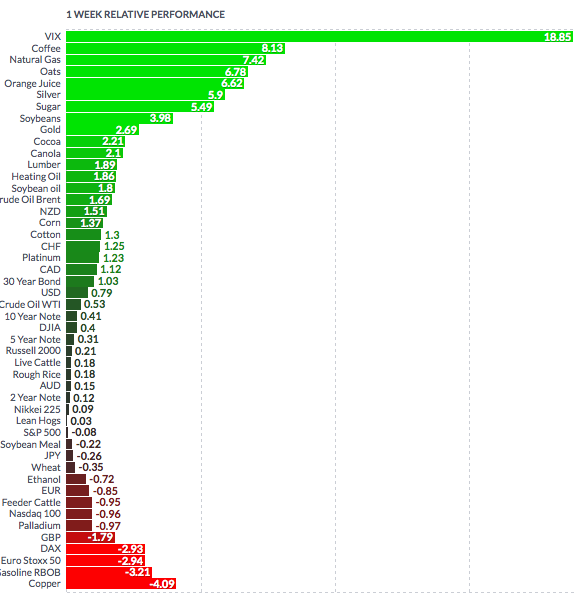

Volatility: The VIX rose 15% this week, finishing at $17.03 – its highest close since March 10th.

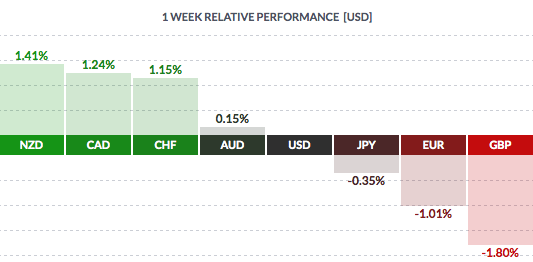

Currency: The dollar rose vs. the yen, the euro, and the pound, but fell vs. Swiss franc, the loonie, and the NZ and Aussie dollars.

Market Breadth: 20 of the DOW 30 stocks rose this week. 49% of the S&P 500 rose this week.

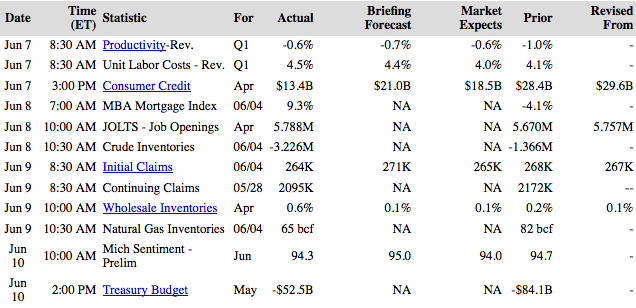

US Economic News: April Job Openings rose to 5.79M, tying the record set in July 2015, Construction Spending was revised up 1.5% from 0.3%, Mortgage apps rose 11% – best since October.

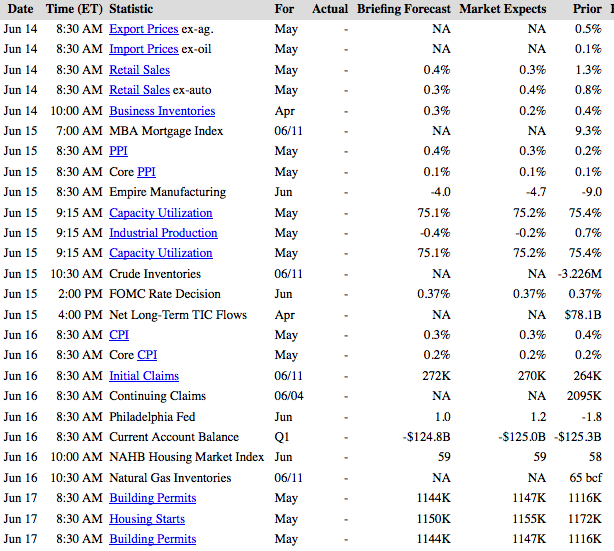

Week Ahead Highlights: The Fed holds its rate meeting on Tues-Wed. – “the futures market is now putting only even money on a single boost in 2016, and not until December”.(Source: Barrons). China releases data on retail sales, industrial production on Sunday, which may move markets Monday. 2 weeks ahead – on Thursday June 23rd, the UK votes on whether to leave or stay in the European Union.

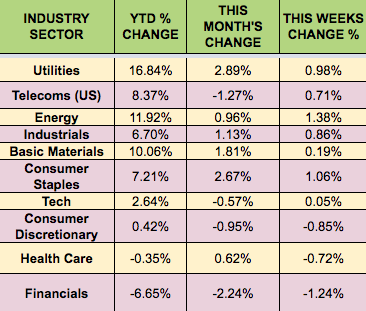

Sectors and Futures:

Energy and Consumer Staples led this week, as Financials trailed. The Financial sector is the worst-performing sector year to date.

Coffee futures led this week, with copper trailing: