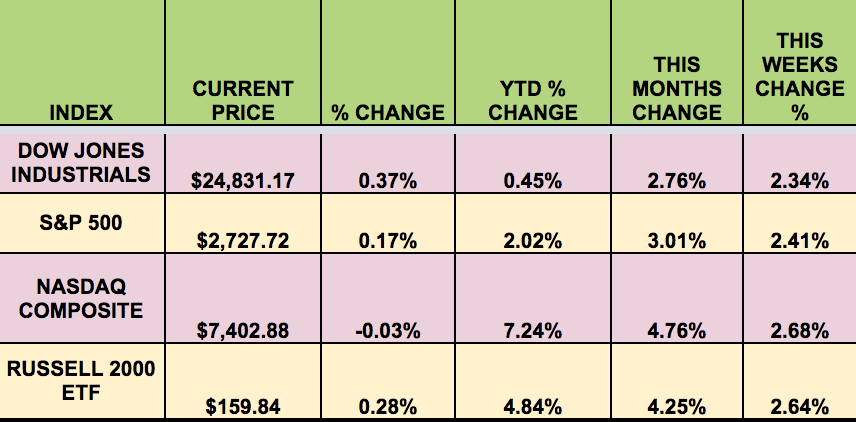

Markets: It was a strong week for the market – with all 4 indexes up over 2%. The Dow had its 7th straight up day – its longest win streak since November 2017. On Friday, the Dow rose above its 100-day moving average for the first time since April 18, following the S&P 500’s similar move on Thursday. This week’s rally brought the Dow and the S&P back into positive territory year-to-date.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: ARR, EENB, OAKS, SXCP, APAM, CORR, NRT, MAIN.

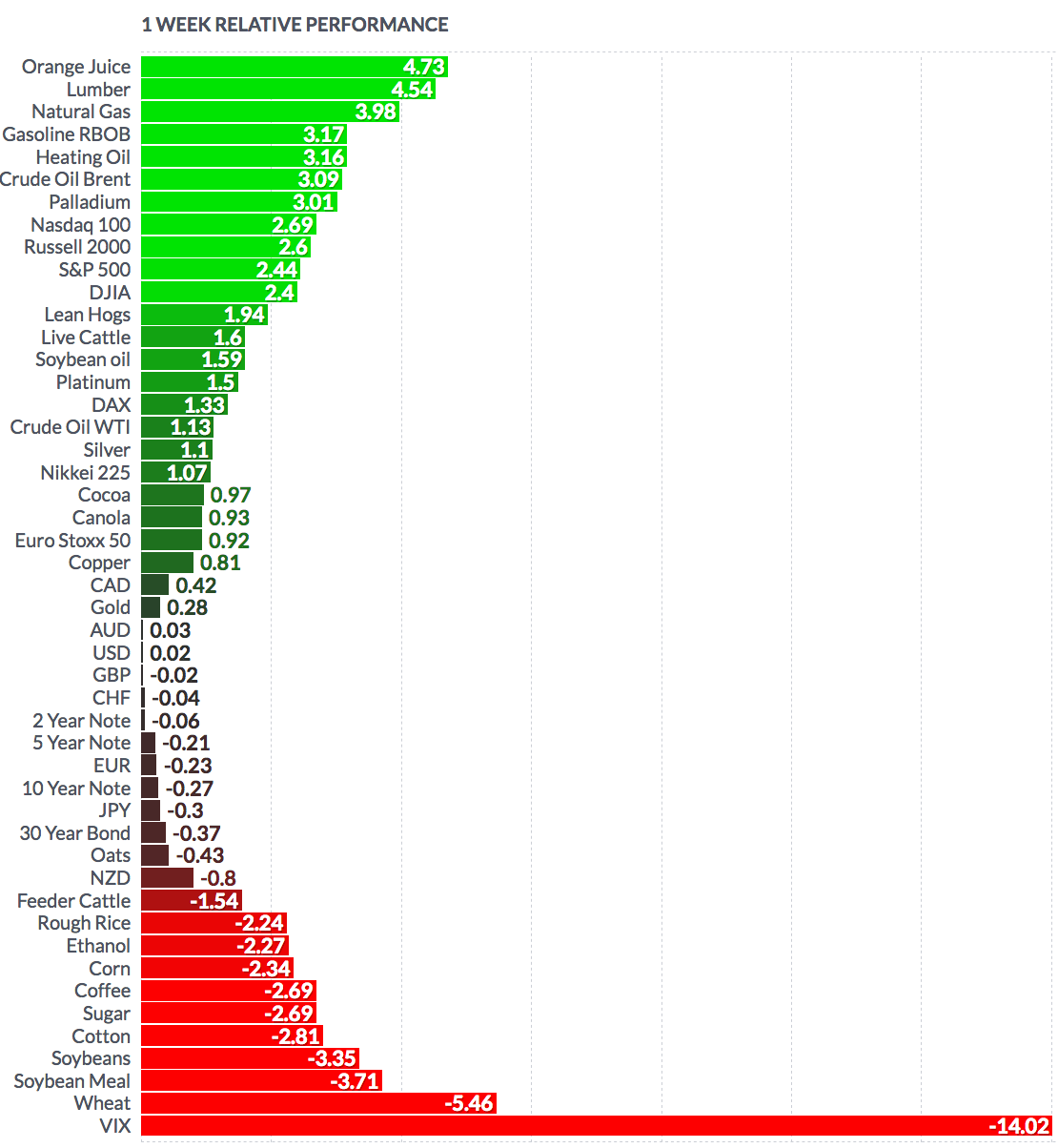

Volatility: The VIX fell -14.4% this week, ending the week at $12.65

The U.S. stock market has seen volatility rear up in 2018, with major indexes experiencing wild swings on a nearly daily basis. There have been a number of causes often cited for the recent bout of turbulence, including concerns over inflation, geopolitical uncertainty, and the first-quarter earnings season, but one of Wall Street’s most prominent investment banks fingers one key culprit: Main Street.

Citing both their outsize ownership of stocks and a surge in recent trading activity, Goldman attributed the recent whipsawing trading in the equity market to average investors, writing that retail investors—as opposed to institutional ones—“appear to have driven much of the U.S. equity market turbulence in late March and April.”

While retail investors individually control small amounts of money relative to portfolio managers or other professional market participants, their collective influence in the market is sizable. Per Goldman’s data, households directly own 36% of the $46 trillion U.S. equity market, more than any other type of owner, and their share rises to more than 50% if you include indirect ownership through mutual funds and exchange-traded funds. (Mutual funds own 24% of U.S. stocks, while ETFs own 6%. (Source: MarketWatch)

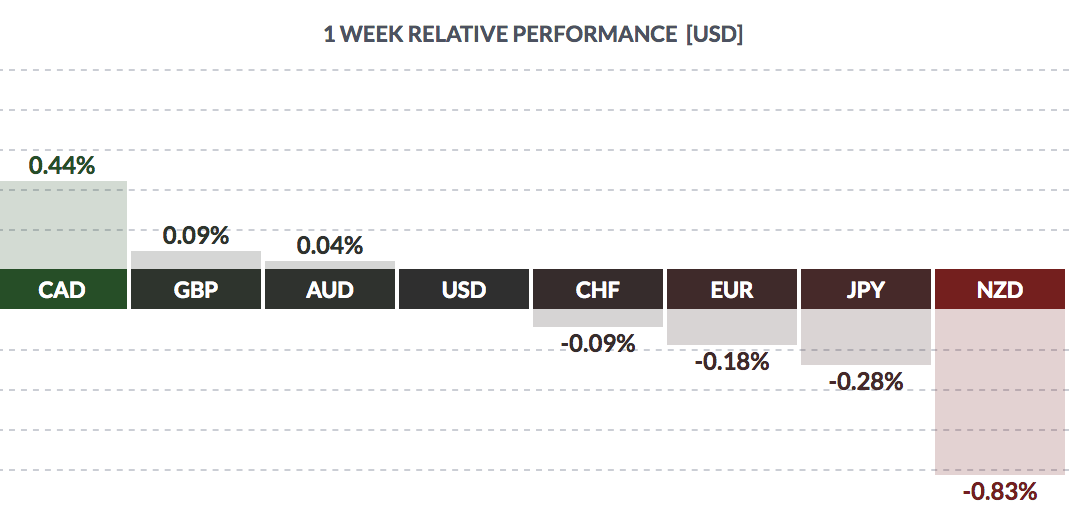

Currency: The US dollar rose vs. the Swiss franc, the euro, the yen, and the NZD, but fell vs. the Loonie, the pound, and the Aussie.

Market Breadth: In much stronger market breadth, 28 of the Dow 30 stocks rose this week vs. 10 last week. 78% of the S&P 500 rose this week, vs. 38% last week.

Economic News: Job openings hit a high of 6.6M in March – the best since the study began in 2000. Producer Prices were lower than forecast, up only 0.1%, as were Consumer Prices, with the Core CPI also rising only 0.1%

Week Ahead Highlights: Q1 ’18 earnings season continues, with Dow components Home Depot (NYSE:HD), Cisco (NASDAQ:CSCO), and Walmart (NYSE:WMT) all reporting. 10% of the S&P 500 will report next week, including more retailers, such as TJX, KSS, and TGT.

“Nearly 80 percent of the companies in the Standard & Poor’s 500-stock index that have reported so far have outstripped the expectations of Wall Street — 16 percentage points higher than the average number of companies that beat expectations.” (Reuters)

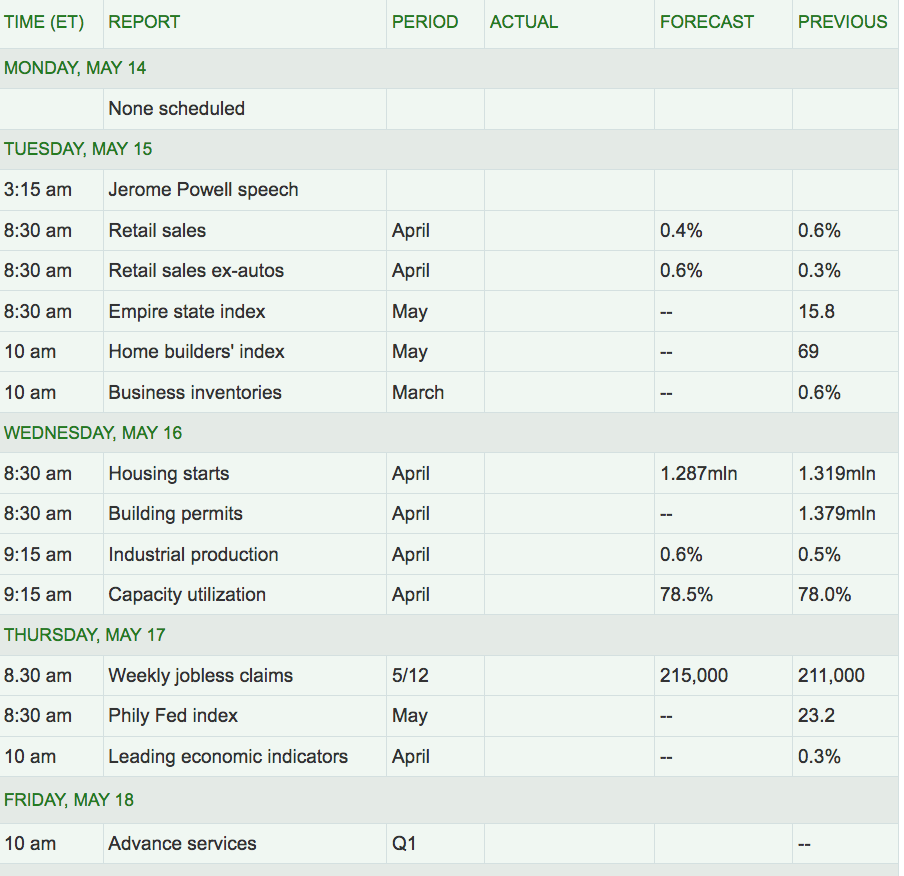

Next Week’s US Economic Reports: Fed chief Powell gives a speech on Tuesday – Wall St. will be parsing it for hints on the pace of future rate hikes. We’ll also get some Housing industry data on Tuesday and Wednesday.

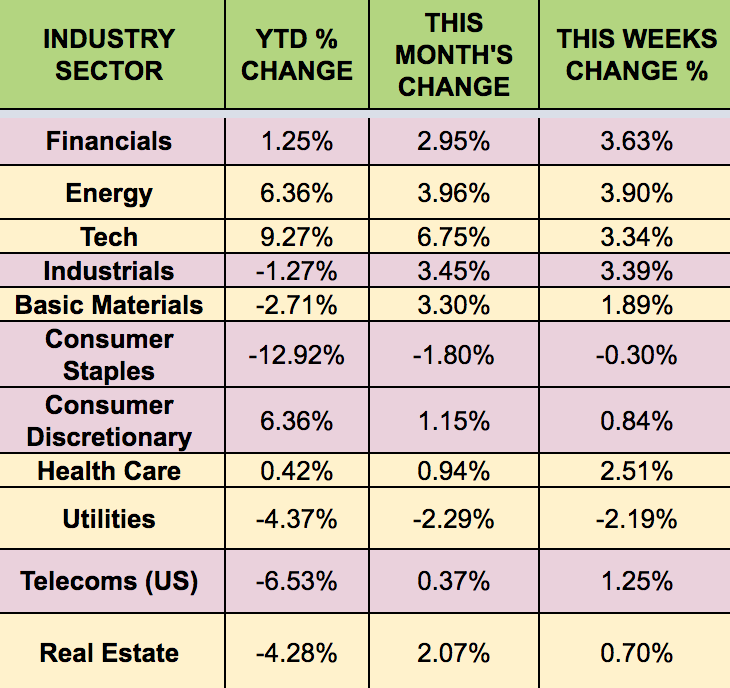

Sectors: The Energy Sector) led this week, powered by resurgent Crude Oil prices, and Utilities trailed.

Futures:

WTI Crude futures rose again this week, up 1.13%, while Natural Gas futures rose 3.98%.

Benchmark prices for American crude oil broke $70 a barrel on Monday, the 1st time they’ve been that high since 2014, as investors factored in the prospect of a US exit from the Iran nuclear deal.

Since Iran is the world’s 5th largest oil producer, global supplies could face a shortage, if sanctions on Iran’s oil are reintroduced.

WTI Crude finished the week above $70, at $70.51/barrel.