Investing.com’s stocks of the week

Market Indexes:

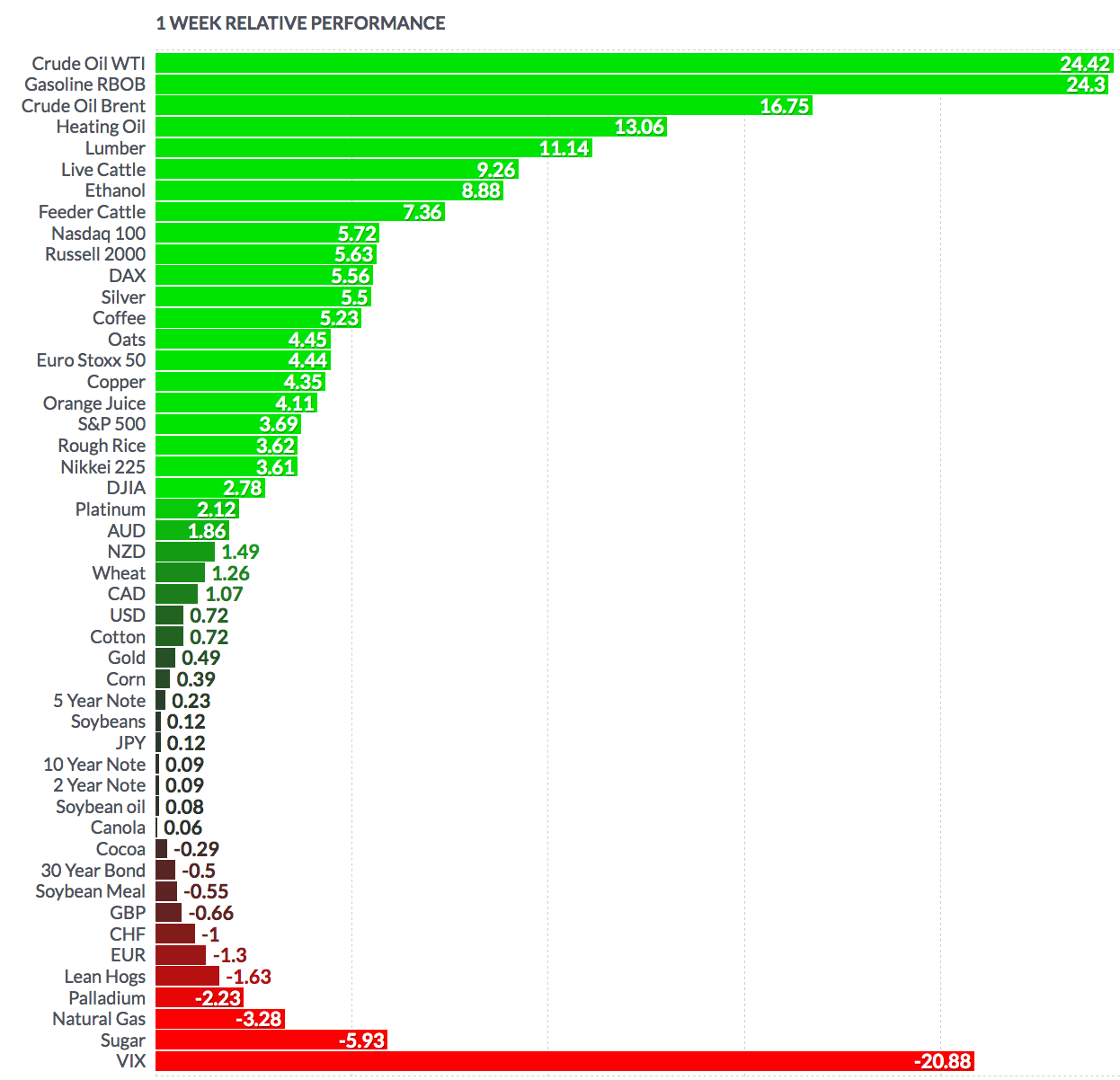

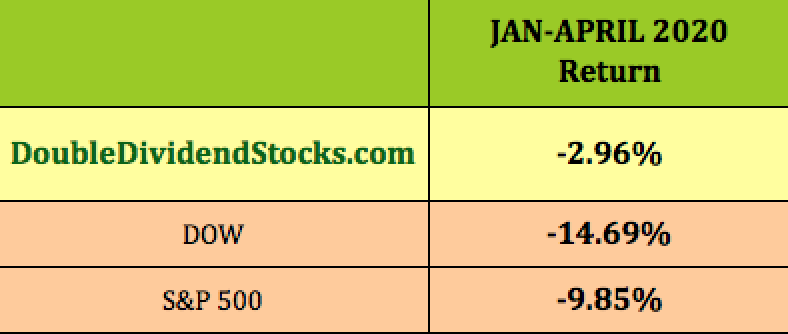

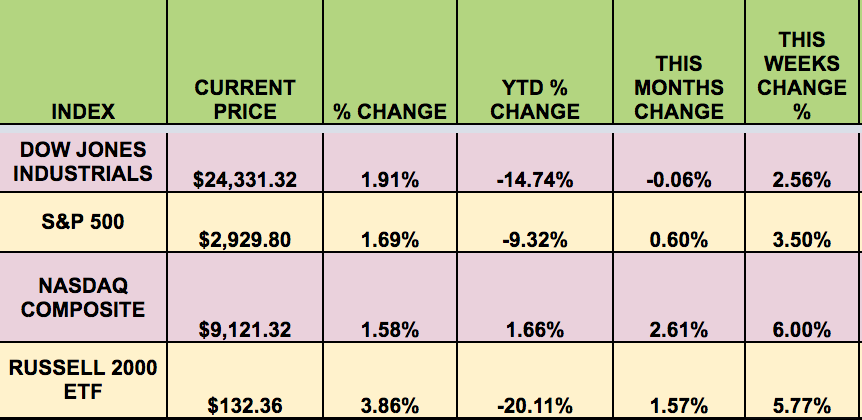

The NASDAQ and the Russell small caps surged 6% and 5.8% this week, with the S&P (NYSE:SPY) up 3.5% and the DOW up 2.56%, as investors cheered imminent reopening plans for 30 US states in the next few weeks. The indexes were also buoyed by resurgent crude oil prices, as WTI crude gained over 24% this week; and a better-than-expected Chines export figure.

“Financial markets on Thursday began pricing in a negative U.S. interest rate environment for the first time, as investors grappled with the economic consequences of the new coronavirus outbreak.

Stocks have staged a sharp rebound since late March from the coronavirus-fueled sell-off, helped by massive monetary and fiscal stimulus. The tech-heavy Nasdaq on Thursday erased its 2020 declines and turned positive for the year.” (Reuters)

“World shares rose on Thursday after China’s exports came in far stronger than expected, suggesting an economic recovery was under way, but the dollar fell from two-week highs as U.S. data showed millions more Americans joined the ranks of the unemployed.

Stocks globally were bolstered after Beijing reported a 3.5% rise in exports in April from a year earlier, confounding expectations of a 15.7% fall and outweighing a 14.2% drop in imports.The strong showing boosted speculation China could recover from its coronavirus lockdown more quickly than expected and support global growth in the process.” (Reuters)

Volatility: The VIX fell 24.76% this week, ending at $27.98, vs. $37.19, last week.

High Dividend Stocks: These high yield stocks go ex-dividend next week: ANH, ETRN, GLPI, SWT, CC, GSK.

Market Breadth: 7 out of 30 DOW stocks rose this week, vs. 5 last week. 30% of the S&P 500 rose, vs. 55% last week.

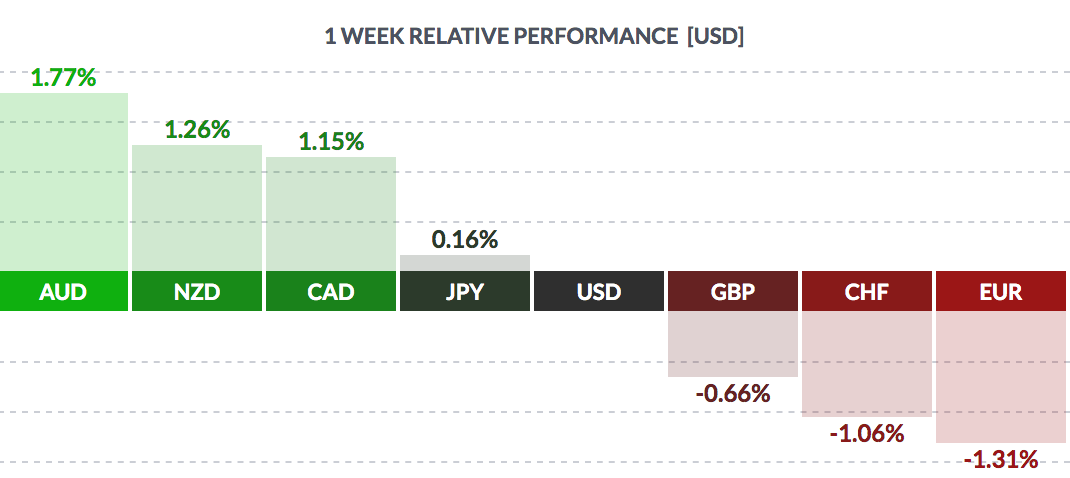

FOREX: The US Dollar fell vs. the Aussie, New Zealand dollar, and Canadian dollar this week, and rose vs. the pound, the Swiss franc and the euro.

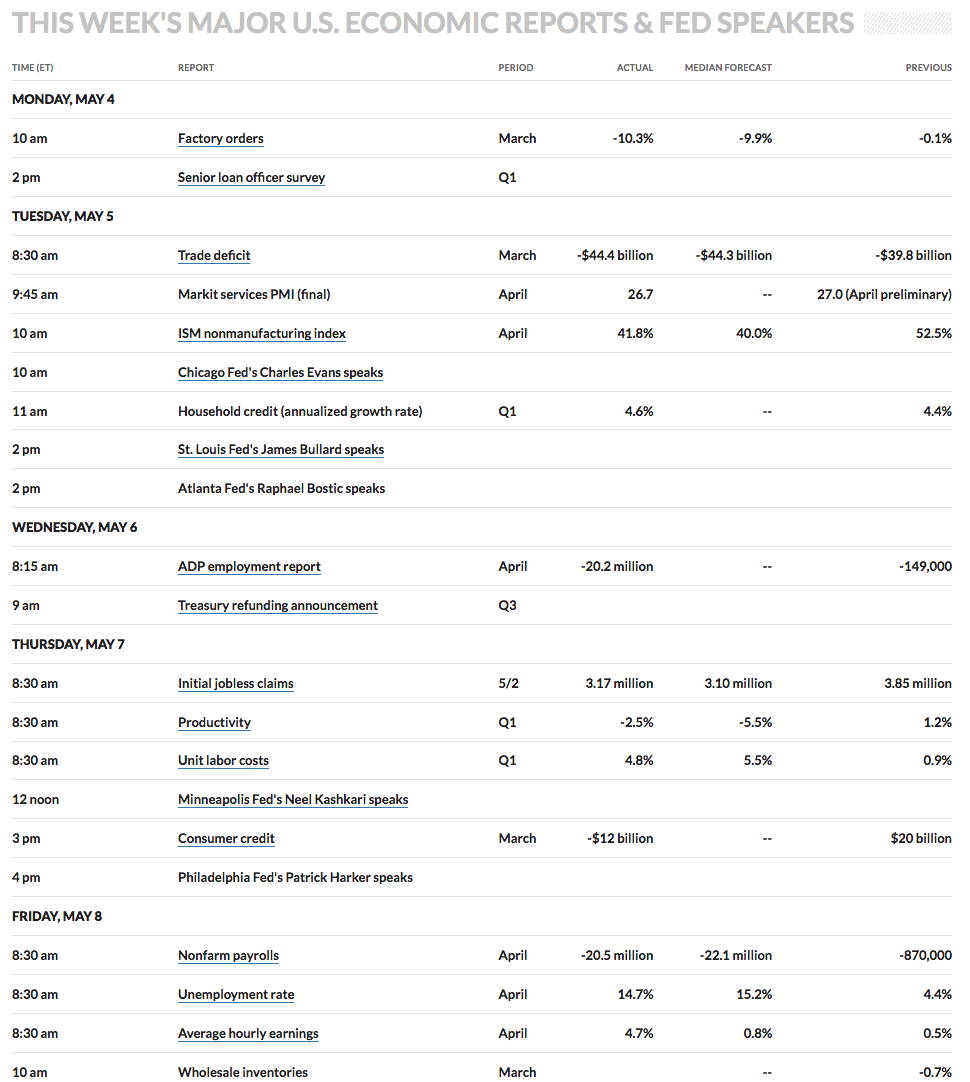

Economic News:

“The U.S. economy lost 20.5 million jobs in April, the Labor Department reported. Economists polled by Reuters had forecast payrolls diving by 22 million, but the decline still marked the steepest plunge since the Great Depression. Layoffs last month were across small, medium and large enterprises. The leisure and hospitality industry shed 8.6 million jobs in April, accounting for more than 40% of the private sector job losses. Manufacturing lost 1.7 million jobs, while 2.5 million construction workers were laid off.

The staggering numbers were widely anticipated, since 30.3 million people had filed claims for unemployment benefits since March 21, equivalent to nearly one out of every five workers losing their job in just over a month.

The change in total non-farm payroll employment for February was revised down by 45,000 from +275,000 to +230,000, and the change for March was revised down by 169,000 from -701,000 to -870,000. With these revisions, employment changes in February and March combined were 214,000 lower than previously reported.

The Unemployment rate shot up to 14.7% in April, the highest rate since the 1930’s.

“Initial jobless claims for state unemployment benefits totaled a seasonally adjusted 3.169 million for the week ended May 2. Data for the prior week was revised to show 7,000 more applications received than previously reported, taking the tally for that period to 3.846 million. Economists polled by Reuters had forecast 3.0 million claims for the latest week.

It was the fifth straight weekly decrease in applications since the record 6.867 million in the week ended March 28. Still, the latest numbers lifted to about 33.5 million the number of people who have filed claims for unemployment benefits since March 21, roughly 22.1% of the working-age population.” (Reuters)

“American households added $155 billion of debt in the first quarter and overall debt levels rose to a new record at $14.30 trillion, the Federal Reserve Bank of New York said on Tuesday in a report that provides a snapshot of where household balance sheets stood before the coronavirus pandemic brought much of the economy to a halt.

Mortgage balances rose by $156 billion from the fourth quarter to $9.71 trillion. But access to credit overall tightened slightly in the first quarter and other types of debt declined. The report provides a snapshot of consumer data as of March 31. But since credit accounts are updated once a month, the data may not fully reflect the effects of the pandemic, which led to widespread shutdowns and job losses in the second half of March.” (Reuters)

Week Ahead Highlights:

“Federal Reserve Chairman Jerome Powell will talk about the economic outlook next week, the central bank announced Friday. Powell will talk to the Peterson Institute for International Economics via webcast on Wednesday at 9 a.m. Eastern.” (MarketWatch)

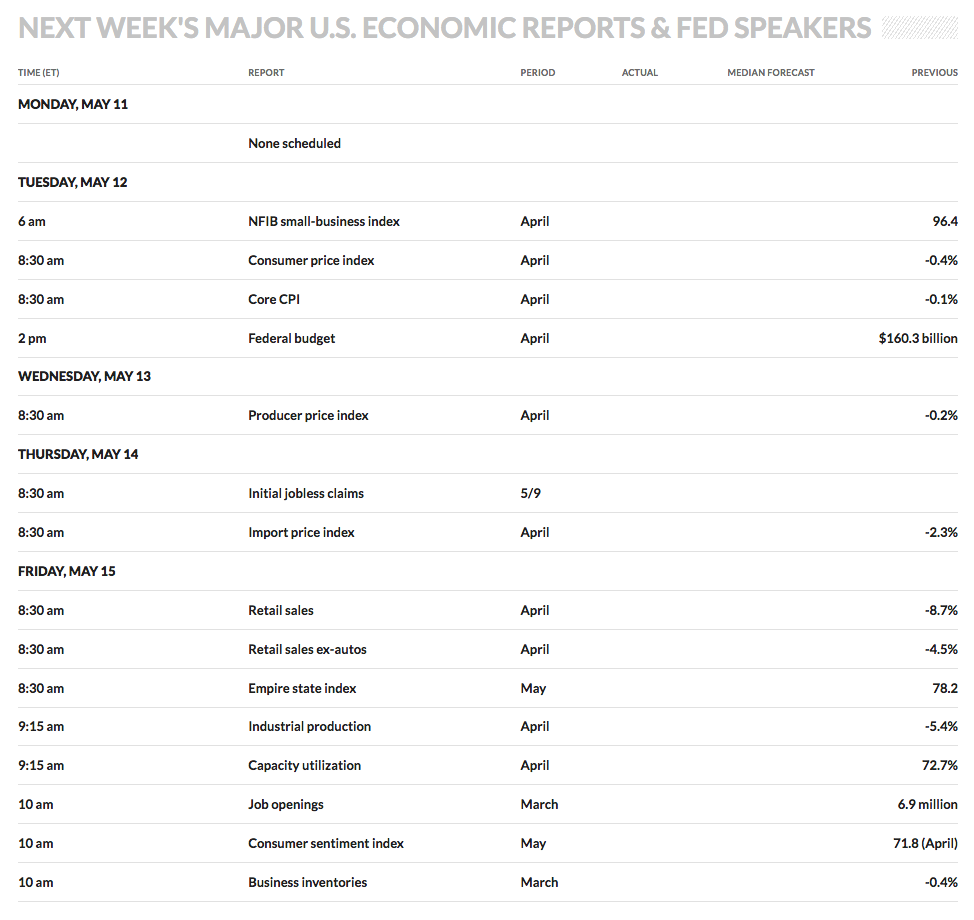

There will be several consumer-based reports due out.

Next Week’s US Economic Reports:

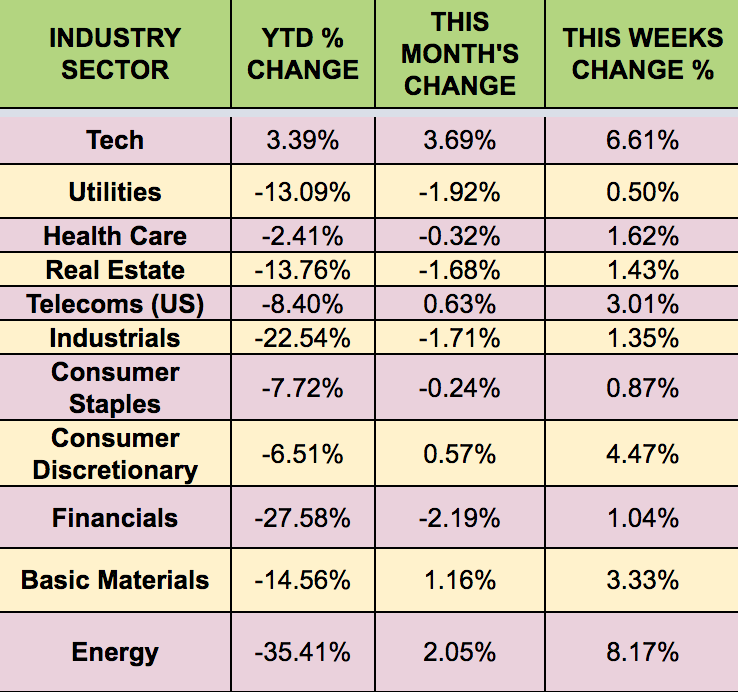

Sectors: Energy and Tech led this week, with Utilities lagging again.

Futures:

WTI Crude rose 24.42% this week, on lower production output and production cuts by oil majors. It ended the week at $24.77.

WTI Crude jumped 18% on Tuesday, to over $24.00, and pushed market indexes higher, ending a 3-day losing streak for the market. Tentative reopening plans abroad and for 30 US states turned investors bullish, due to the chance for higher oil consumption.