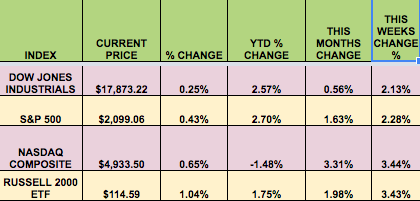

Markets: The S&P had its best week since March 4th, and is now only 1.5% below its all-time high, reached in May 2015. Strong Housing data helped push markets higher, with small caps and the NASDAQ leading the way.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Gaming & Leisure Properties (NASDAQ:GLPI), Whitestone REIT (NYSE:WSR), Evolving Systems Inc (NASDAQ:EVOL), Navient Cor (NASDAQ:NAVI), Golub Capital BDC Inc (NASDAQ:GBDC), PDL BioPharma Inc (NASDAQ:PDLI), Quad Graphics Inc (NYSE:QUAD)

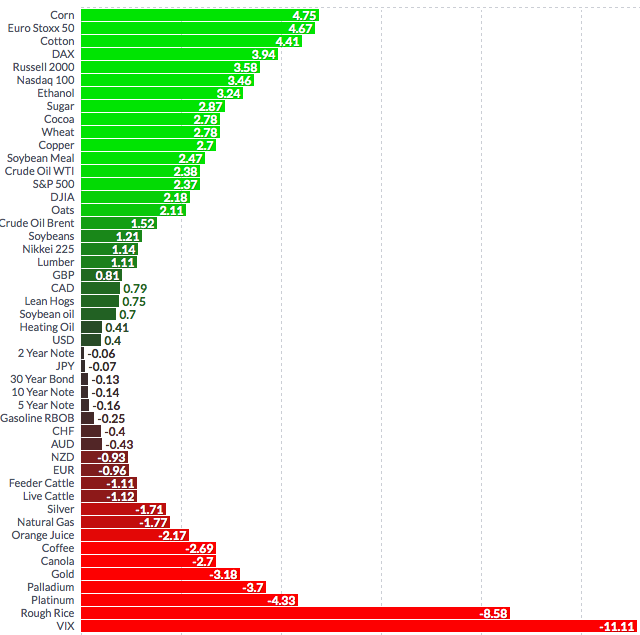

Volatility: The VIX fell 11% this week, finishing at $15.40.

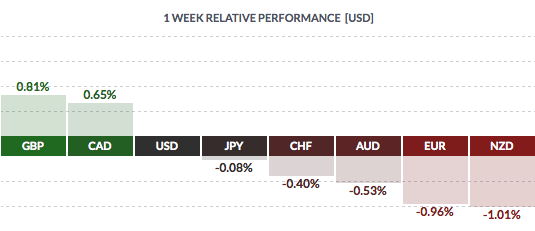

Currency: The dollar rose vs. most major currencies, as several Fed officials and Chief Yellen reiterated that a rate hike would be appropriate in the coming months.

Market Breadth: The strongest market breadth week in 2016: 29 of the Dow 30 stocks rose this week, vs. 12 last week. 92% of the S&P 500 rose this week, vs. 55% last week.

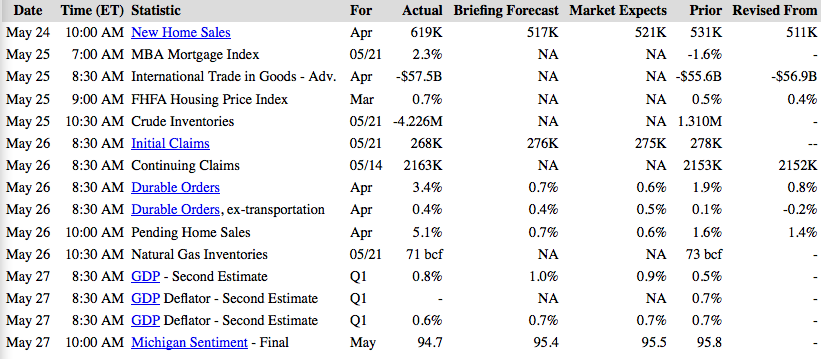

US Economic News: April New and Pending Home Sales both crushed forecasts. New Home sales were the highest since 2008. Q1 GDP was also revised upward.

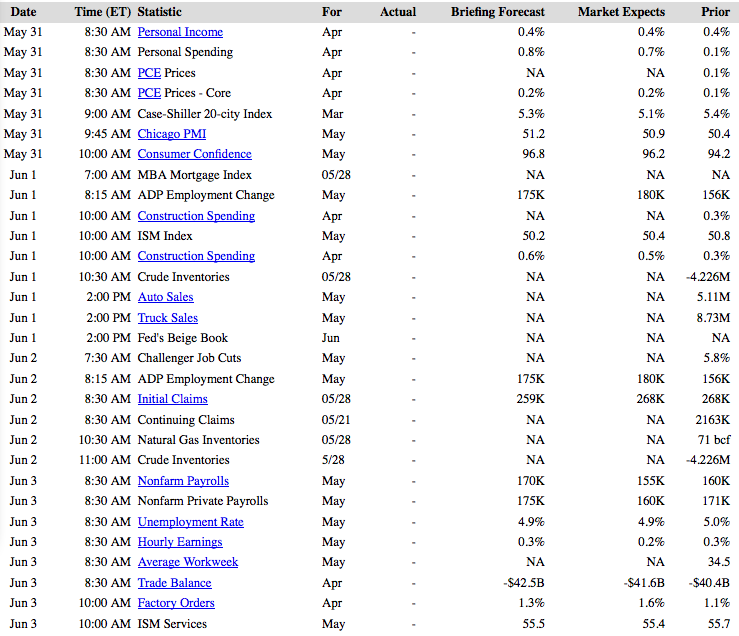

Week Ahead Highlights: US markets will be closed Monday, for the Memorial Day holiday. Next Friday’s payrolls report takes on more than normal significance, in light of recent Fed rate hike comments – if the report is strong, it will shift the probability of a June rate hike higher. Futures markets are now giving a June hike a 34% chance of happening, a bit higher than last week.

There’s also an OPEC meeting on Thursday, which could roil crude prices.

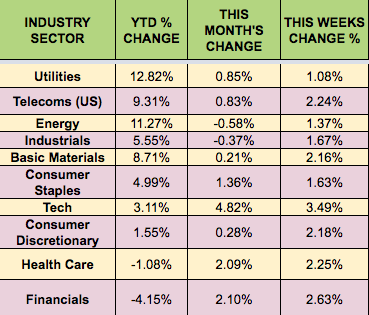

Sectors and Futures:

Tech led this week, as Utilities trailed.

Corn led this week, with Rice trailing: